Cancellation of Student Loans Led to a General Deleveraging

Debt cancellation for borrowers who were in default on their student loans resulted in more rapid repayment of other outstanding debts and subsequent increase in average income.

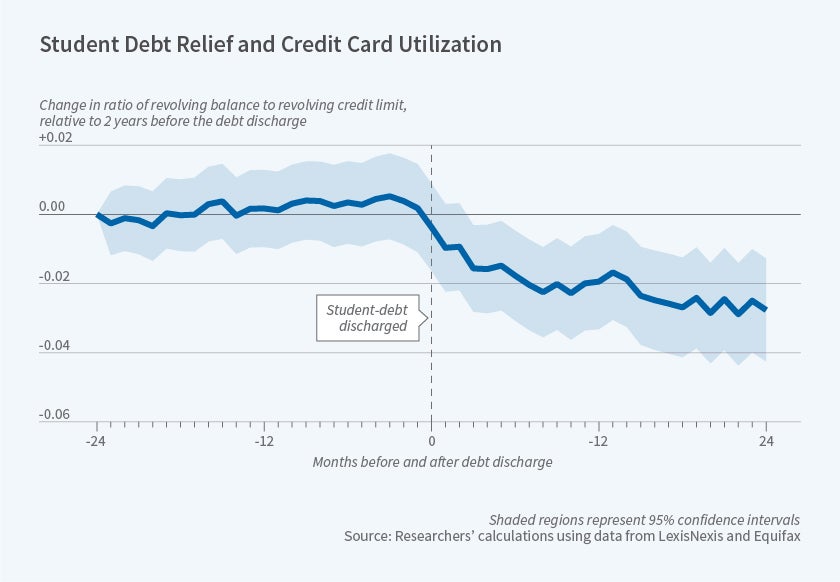

In the first quarter of 2018, outstanding student debt in the United States reached $1.5 trillion. Student debt is now the second-largest type of consumer debt, ahead of auto loans, credit card debt, and home-equity lines of credit. In recent years, economists and policymakers have asked whether this debt may have consequences for individual students' prospects and for overall economic growth. In Second Chance: Life without Student Debt (NBER Working Paper 25810), Marco Di Maggio, Ankit Kalda and Vincent Yao, explore how student debt relief affects credit and labor market outcomes. The researchers study a natural experiment: debt relief that occurred when National Collegiate, the country's largest holder of private student loan debt, was forced, in court cases, to discharge thousands of student loans in default because it could not prove that it owned these loans in the first place. The researchers matched the affected borrowers to their credit bureau data; they then compared outcomes for these borrowers to a control group of similar borrowers who were also behind on their loan payments but did not benefit from the debt relief shock. The researchers find that borrowers who benefited from the debt relief significantly reduced their borrowing across different types of debt, including credit cards, auto loans, and home loans. They reduced both the total number of other accounts they held and their total debt by about 25 percent, or $4,000. The lower account balances were the result of both reduced credit demand and higher repayments.

Borrowers who benefited from the debt relief shock were 12 percent less likely to default on other types of debt later on, largely due to a reduced likelihood of falling behind on credit card payments. "Overall, these results provide evidence that one of the effects of relieving borrowers from their student loans is to allow them to better manage their finances and start significantly deleveraging, which is likely to make them more resilient to negative shocks," the researchers conclude.

They also study the effects of debt relief on mobility and income. Borrowers whose loans were discharged were 4 percent more likely to move to a different state. These borrowers were also more likely to change jobs and to land higher-paying jobs in new industries, resulting in over $4,000 in additional earnings, on average, over a three-year period. Although the discharge does not result in additional disposable income for the borrowers, because most delinquent borrowers were not repaying their loans, debt overhang might be responsible for distorting their labor market choices.

While the researchers did not have access to detailed information on consumption decisions after debt relief, they were able to impute car purchases as a proxy for durable consumption and found that borrowers are more likely to purchase a car following debt relief. The researchers conclude that the findings "strongly suggest that the increase in student loans burden for young borrowers might be an important drag on their economic outcomes by limiting their ability to pursue better opportunities."

--Dwyer Gunn