Real-Time Charging Data Could Accelerate Electric Vehicle Adoption

Charging infrastructure reliability and accessibility remain significant impediments in the transition to electric vehicles (EVs). While the Bipartisan Infrastructure Law included substantial investments to expand the charging network, potential EV buyers often struggle to determine whether chargers are functioning and available when needed. In Charging Uncertainty: Real-Time Charging Data and Electric Vehicle Adoption (NBER Working Paper 33342), researchers Omar Isaac Asensio, Elaine Buckberg, Cassandra Cole, Luke Heeney, Christopher R. Knittel, and James H. Stock examine how improving real-time charging data availability could affect EV adoption rates.

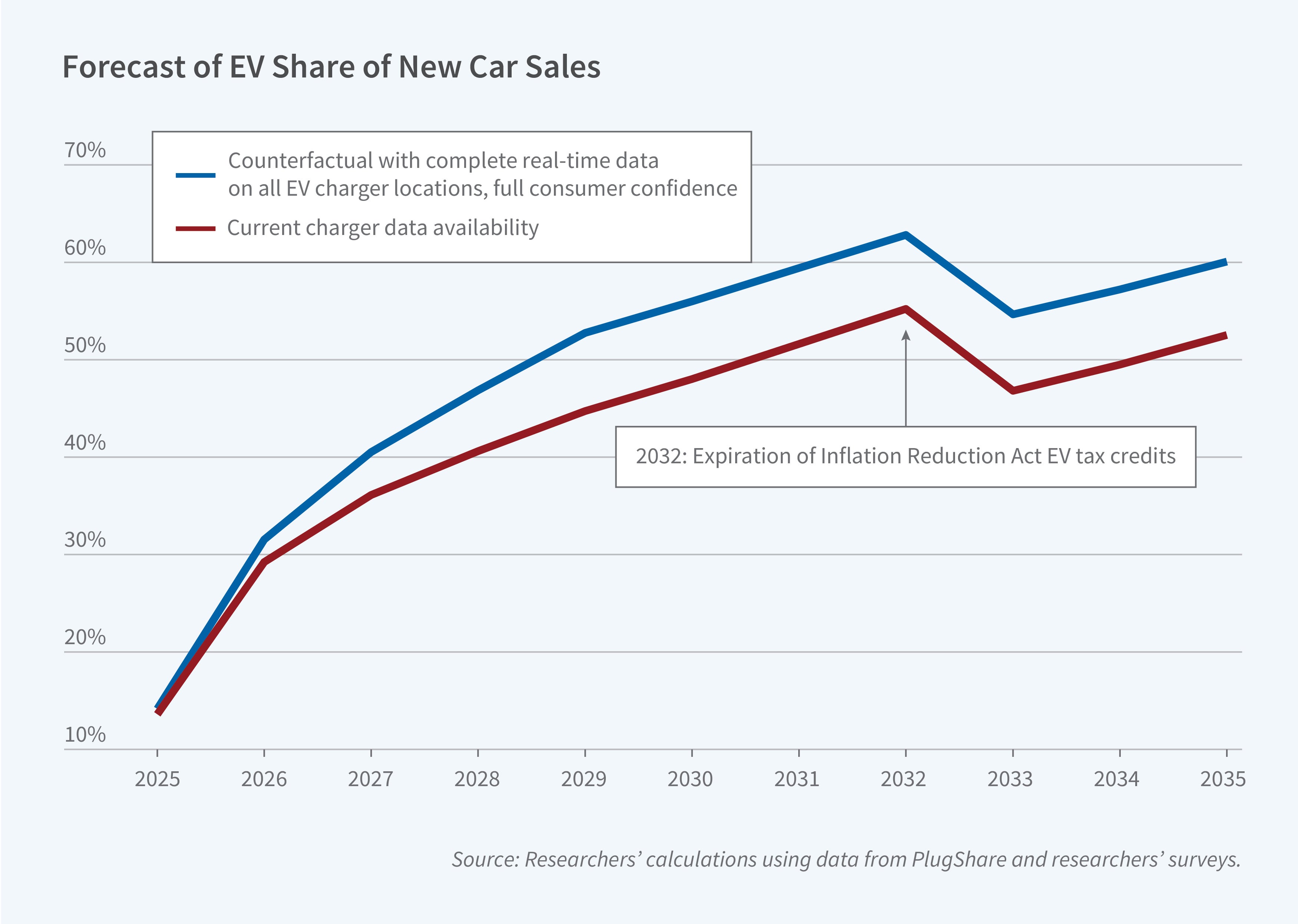

Universal real-time charging data availability combined with improved reliability could increase EV market share by up to 8 percentage points by 2030.

The researchers analyzed real-time charging data from fast chargers along six major US interstates between March and August 2024. These highways represent 27.7 percent of the interstate system. The researchers found that only 32.9 percent of charging stations provided real-time status information through PlugShare, a major charger-finding application. Data deserts exacerbate the problem, with stretches of up to 1,308 miles without status information. Tesla and Electrify America, the two largest fast charging providers, do not share real-time data to central apps, though they operate approximately half of the charging stations along the studied highways.

To assess consumer attitudes, the researchers surveyed current EV owners and prospective buyers about their confidence in charger reliability. Even when real-time data indicated a charger was working and available, prospective EV buyers assigned only a 65 percent probability of successful charging. Current EV owners, who probably had more experience with visiting charging stations that were supposed to be available, were more pessimistic at 59 percent. Both groups expressed even lower confidence in chargers without real-time status information: 52 percent for prospective buyers and 41 percent for EV owners.

Using these findings, the researchers modeled three scenarios for universal real-time data implementation, which could be achieved by charging providers posting status data either voluntarily or through policy mandates. With 100 percent real-time data availability by 2029 but no other changes, they forecast that the EV share of new vehicle sales would increase by 1.1 percentage points in 2030. If universal real-time data reporting improves charger uptime to 97 percent, the EV sales share could rise by 2.7 percentage points. If universal real-time data and improved reliability raise consumer confidence in chargers, the EV sales share could increase by 8.0 percentage points, the researchers forecast. This would expand the total EV fleet by 13.2 percent.

Accelerating EV adoption has important implications for carbon emissions. In the high scenario, the researchers project a reduction of 22.5 million metric tons in 2030, compared to the emissions if the status quo level of information on charger availability persisted through that year. This reduction amounts to more than one-quarter of the emissions reductions expected from the EV provisions in the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, yet at zero fiscal cost.

The researchers are grateful to the Harvard Salata Institute for Climate and Sustainability and MIT CEEPR for funding this project.