Program Report: International Trade and Investment, 2023

The International Trade and Investment (ITI) Program holds three regular meetings annually, in winter, spring, and at the NBER Summer Institute. The ITI Program has 85 research associates, 11 faculty research fellows, two research economists, and 34 members with primary affiliations in other NBER programs, making a total of 132 members. Research within the group covers a wide range of topics, such as explaining patterns of international trade and foreign direct investment, understanding the impact of trade policies, and examining the spatial distribution of economic activity within countries.

The regular meetings are often complemented with specialized conferences. In recent years, these have included “International Fragmentation, Supply Chains, and Financial Frictions” (2023), organized by Pol Antràs, Sofía Bauducco, Linda S. Goldberg, and Ṣebnem Kalemli-Özcan; “Trade and Trade Policy in the 21st Century” (2022), “The Future of Globalization” (2021), and “International Trade Policy and Institutions” (2020), all organized by Robert W. Staiger and myself; “The Rise of Global Supply Chains” (2021), organized by Laura Alfaro and Chad Syverson); “Risks in Agricultural Supply Chains” (2021), organized by Antràs and David Zilberman; “Agricultural Markets and Trade Policy” (2020), organized by Dave Donaldson; “Economic Consequences of Trade” (2019), organized by Redding; “Firms and Networks” (2018), organized by Alfaro, Antràs, and Redding; and “Trade and Geography” (2017), organized by Redding and Esteban Rossi-Hansberg.

This report focuses on research during 2016–22 period; the last ITI program report was in 2016. During this period, two ITI program members — Donaldson in 2017 and Oleg Itskhoki in 2022 — received the John Bates Clark Medal, awarded by the American Economic Association to American economists under the age of 40 who have made significant contributions to economic thought and knowledge.

Trade Policy

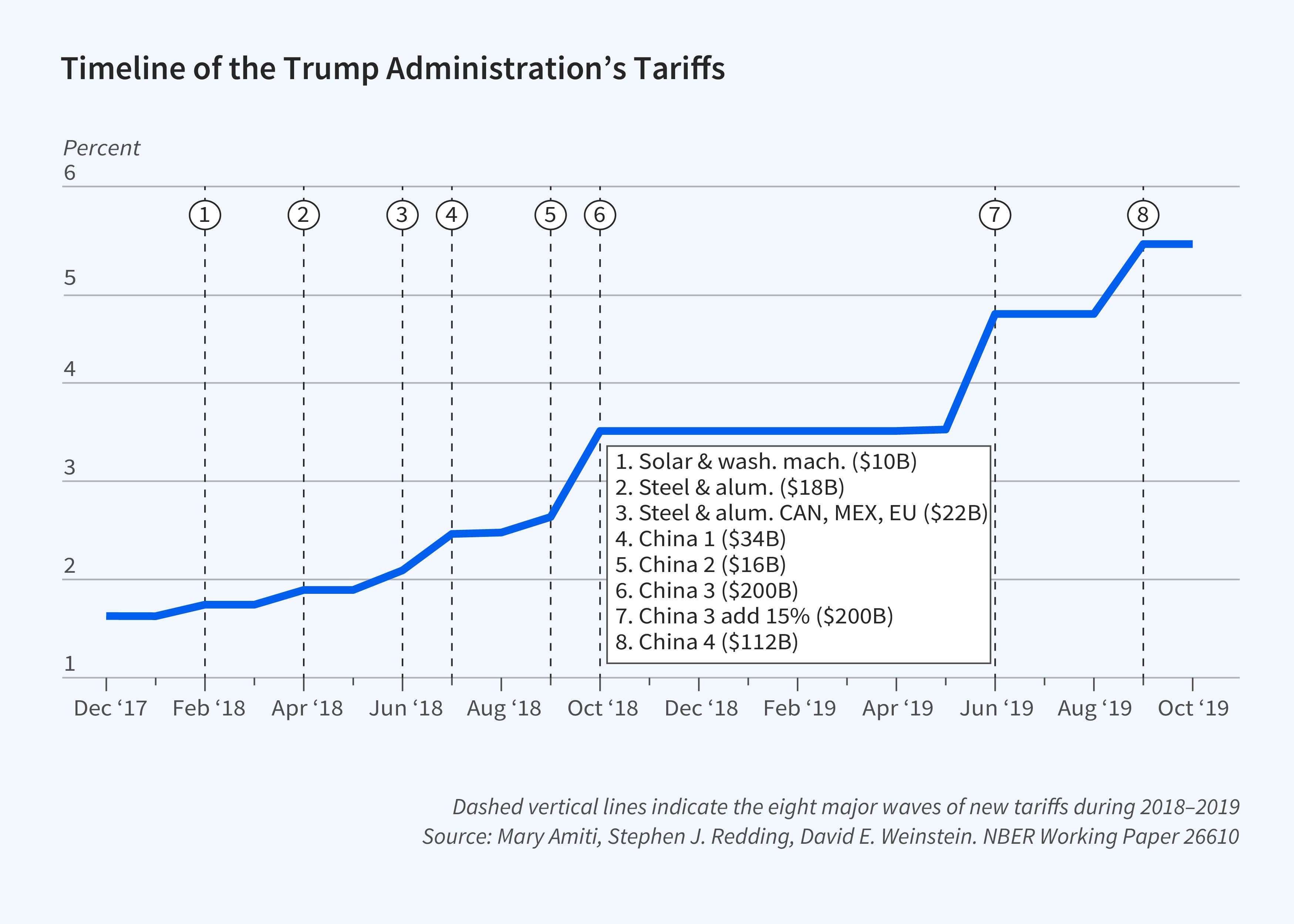

The last six years have witnessed a resurgence in protectionist policies and an accompanying renaissance in research on trade policy. Although several previous US presidents have introduced protectionist measures early in their first terms, the Trump administration followed this historical precedent with more breadth and force than hitherto observed, and these policies have largely remained in place in the Biden administration. During 2018, six waves of tariffs were introduced on $283 billion of US imports, with further waves of tariffs introduced in 2019. As illustrated in Figure 1, the average US import-weighted tariff rose sharply from less than 2 percent to more than 5 percent, with a marked increase in the number of US tariffs of more than 10 percent. In response, China, the European Union, Russia, Canada, Turkey, Mexico, Switzerland, Norway, India, and Korea all filed disputes with the United States at the World Trade Organization (WTO). Many countries retaliated against the US actions by applying tariffs of their own.1

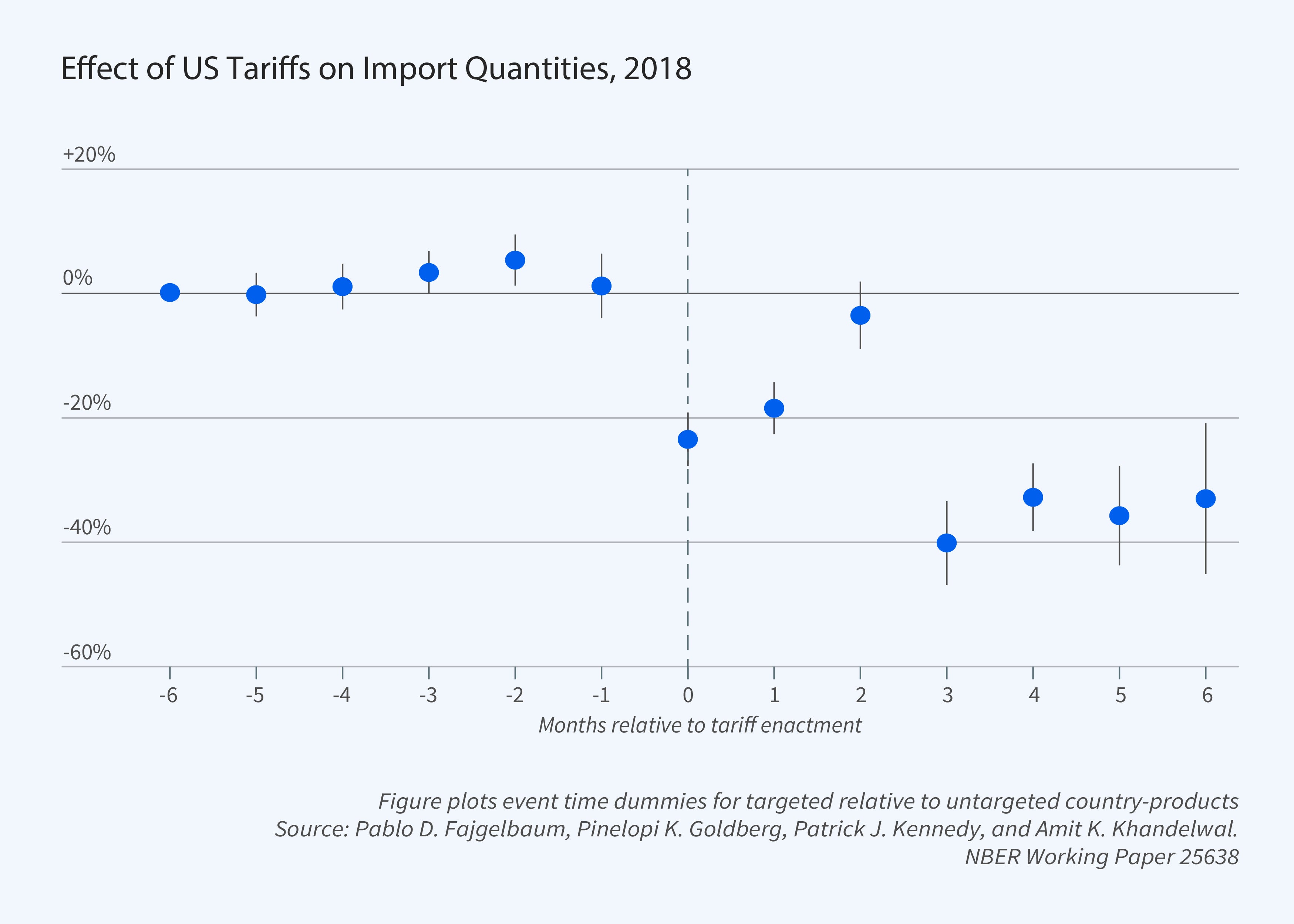

A growing body of research has estimated the economic impact of the US-China trade war. Two early empirical studies — one by Mary Amiti, David Weinstein, and me, and one by Pablo Fajgelbaum, Pinelopi Goldberg, Patrick Kennedy, and Amit Khandelwal — estimated aggregate real income losses for the United States of $8.2 billion and $7.2 billion, respectively. While these real income losses correspond to less than 1 percent of GDP, they are comparable to estimates of US welfare gains from tariff reductions under the North American Free Trade Agreement (NAFTA).2 Figure 2 shows event-study estimates in which imposition of the US tariffs is followed by sharp reductions in import values.3 One surprising finding of these and other empirical studies is that the US tariffs were largely passed through into higher prices for US firms or consumers, with little evidence of reductions in the prices received by Chinese exporters. In contrast, neoclassical trade theory would predict incomplete pass-through for a country that is large relative to world markets, such as the US. These high rates of pass-through into import prices remain somewhat of a puzzle for ongoing research.

Whether the US tariffs were passed on fully into US consumer prices is harder to discern because of the challenges of developing comprehensive mappings from Harmonized Tariff Schedule (HTS) products to final consumer expenditure categories. Using product-level data from several large retailers, Alberto Cavallo, Gita Gopinath, Brent Neiman, and Jenny Tang find more limited movements in consumer prices, suggesting that these tariffs were mainly absorbed in retail and wholesale margins within the United States.4 In a detailed study of washing machines, Aaron Flaaen, Ali Hortaçsu, and Felix Tintelnot find that the 2018 tariffs increased the US consumer price of washing machines by nearly 12 percent. Notably, even though dryers were not themselves subject to tariffs, the price of dryers increased by an equivalent amount, suggesting a role for complementarities in demand between goods.5

A distinctive feature of US tariffs on imports from China was that the initial waves mainly concentrated on intermediate and capital goods. Later waves expanded to include consumer goods as the administration began to run out of intermediate and capital goods to target. Gene M. Grossman and Elhanan Helpman analyze the reorganization of firm supply chains in response to such tariffs on intermediate goods in a setting with costly supplier search and bargaining.6 Kyle Handley, Fariha Kamal, and Ryan Monarch analyze the impact of these tariffs on intermediate goods on the ability of US firms to export, and find a resulting decline in US export growth equivalent to an ad valorem tax on US exports of 2 percent for the typical product and up to 4 percent for products with higher than average exposure.7

Although most research has focused on the impact of the US-China trade war on the United States, Davin Chor and Bingjing Li use high-frequency night-lights data across latitude and longitude grid cells to provide evidence on the impact on China.8 While grid cells with negligible direct exposure to the US tariffs account for up to 70 percent of China’s population, the 2.5 percent of the population located in grid cells with the largest US tariff shocks saw a 2.52 percent decrease in predicted income per capita and a 1.62 percent predicted drop in manufacturing employment. More broadly, Fajgelbaum, Goldberg, Kennedy, Khandelwal, and Daria Taglioni examine the reallocation of global trade patterns and find that a number of third countries, such as Vietnam, benefited from the US tariffs, experiencing increased exports to the United States and the rest of the world.9 Fajgelbaum and Khandelwal survey the burgeoning empirical literature on the impact of the US-China trade war,10 while Lorenzo Caliendo and Fernando Parro provide a broader review of the theoretical and empirical literature on the normative and positive aspects of trade policy.11

The decades leading up to the US-China trade war were a time of ongoing multilateral and preferential trade liberalization. A number of studies have argued that the recent change in the direction of US trade policy, alongside other retreats from trade liberalization such as the United Kingdom’s Brexit decision to leave the European Union, have substantially increased trade policy uncertainty. This increase in uncertainty by itself can depress trade and investment, as firms adopt a “wait-and-see” strategy before engaging in large investments such as in overseas plant and machinery. Using data on movements in stock prices around the dates of US-China tariff announcements, Amiti, Sang Hoon Kong, and Weinstein estimate that these changes in trade policy lowered the investment growth rate of listed US companies by 1.9 percentage points, and reduced aggregate US welfare through all channels including uncertainty by 4.9 percentage points.12 More broadly, Andrew Greenland, Mihai Ion, John Lopresti, and Peter Schott use movements in stock prices around trade policy announcements to develop an overall measure of trade liberalization.13

A growing number of studies examine the relationship between international trade flows and trade policy uncertainty. Alejandro Graziano, Handley, and Nuno Limão find that increases in the probability of Brexit in prediction markets reduced both bilateral export values and the extensive margin of firm trade participation.14 Saad Ahmad, Limão, Sarah Oliver, and Serge Shikher show that these increases in the predicted probability of Brexit had a pronounced impact on services trade, with reductions in services exports from Britain to the European Union of around 20 log points.15 Using data on Chinese firms, Felipe Benguria, Jaerim Choi, Deborah L. Swenson, and Mingzhi Xu find that increases in both US tariffs and Chinese retaliatory tariffs raised measures of trade policy uncertainty (TPU), with a one standard deviation increase in TPU reducing firm-level investment, research and development (R&D), and profits by 1.4, 2.7, and 8.9 percent, respectively.16 Isaac Baley, Laura Veldkamp, and Michael E. Waugh demonstrate that the effects of greater uncertainty are in fact uncertain. They provide conditions under which increased uncertainty can promote trade.17 Handley and Limão survey this growing literature on trade policy uncertainty.18

The recent resurgence of protection in the United States and elsewhere has led to renewed debate about the future of the WTO and the multilateral rules-based trading system that has characterized the period since the Second World War. Staiger reviews recent research on the economic rationale for the WTO and its underlying principles of reciprocity and nondiscrimination, as captured in the so-called most-favored-nation (MFN) rule. These principles can be rationalized as a mechanism for countries to overcome the externality from each nation having an incentive to introduce protection in order to improve its terms of trade.19 Kyle Bagwell, Staiger, and Ali Yurukoglu develop a quantitative model of tariff negotiations between countries to study the design of the institutional rules of the General Agreement on Tariffs and Trade and the WTO. Abandoning the MFN principle in bilateral tariff negotiations is found to reduce world welfare as a whole, although some individual countries, such as Japan and the United States, experience welfare gains.20

Recent years have seen a proliferation of so-called “new trade agreements” which not only constrain governments’ choices of tariffs, but also restrict their domestic regulatory policies. Grossman, Phillip McCalman, and Staiger study the rationale for these new agreements in a setting in which firms design products to cater to local tastes.21 If government choices of tariffs are constrained by international trade agreements, but domestic regulatory policies are not restricted, these domestic regulations can be used as a form of protection that benefits domestic consumers and producers at the cost of exerting a negative externality on foreign consumers and producers.

Global Value Chains (GVCs) and Networks

One of the distinctive features of globalization in recent decades has been global value chains (GVCs). Sometimes called slicing the value-added chain, fragmentation, vertical specialization, trade in tasks, or the unbundling of production, this refers to the spreading of stages of production across national borders. In contrast, international trade in earlier episodes of globalization, such as the late-nineteenth century, was concentrated on the exchange of raw materials and final goods.22

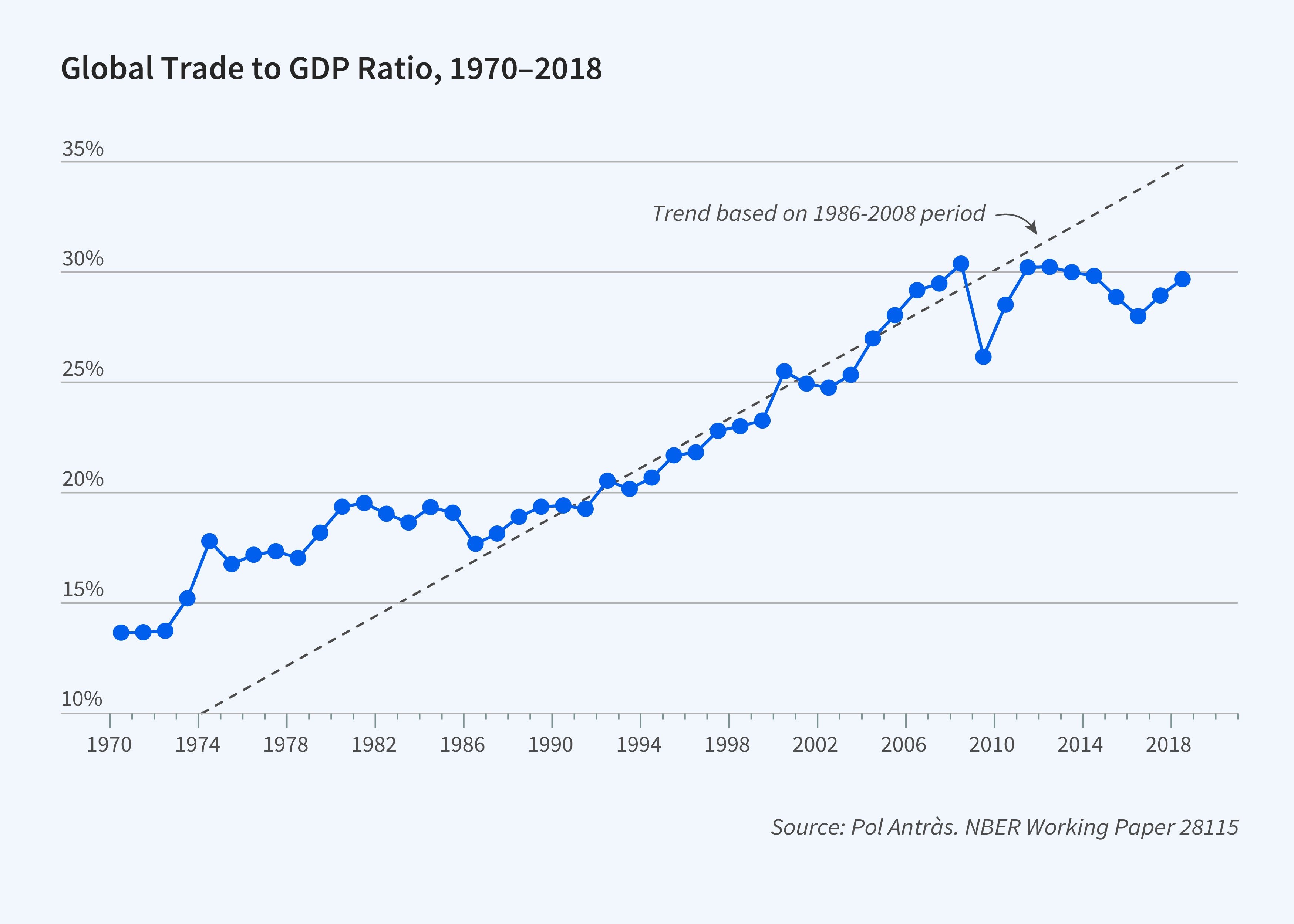

Antràs and Richard Baldwin provide recent reviews of the evolution of globalization and the emergence of GVCs.23 As shown in Figure 3, world trade grew substantially more rapidly than world production from the end of the Second World War to the 2008 financial crisis, after which it stagnated. Measuring GVC trade is more complicated than measuring overall trade, but a natural measure is the share of a country’s exports that flow through at least two national borders — for example, a semiconductor chip that is shipped from Japan to China, where it is put into an iPhone which is then shipped to the United States. GVC trade based on this measure grew substantially more rapidly than overall trade over the same period, again before stagnating after the 2008 financial crisis.

This stagnation of both overall trade and GVC trade since the 2008 crisis has led to much debate about the extent to which the world economy will experience “deglobalization.” It is important to keep in mind that 1986–2008 was a period of especially rapid trade integration — sometimes called “hyper-globalization” — as shown by the dashed gray linear time trend for this period in Figure 3. This was driven by the confluence of three sets of forces: (1) multilateral and regional trade policy integration; (2) technological innovations such as the computer, satellite phone, and internet that reduced the cost of international communication; and (3) geopolitical and institutional changes, such as domestic reform in China, Eastern Europe, and India and their emergence into world markets. Against this backdrop of especially rapid trade integration, some slowdown in the pace of globalization might be expected, which has led a number of authors to refer to “slowbalization” rather than deglobalization. Nevertheless, the recent resurgence of protectionism and increased geopolitical tensions, such as the potential decoupling of China and the United States and the Russia-Ukraine War, provide considerable headwinds that could stall or reverse the increasing economic integration of the last few decades.

Recent research has examined the implications of the emergence of GVCs for our understanding of international trade. This is part of a broader and growing wave of research in economics on networks domestic and foreign. Viewing international trade as a network of buyers and sellers has a number of implications for our understanding of the causes and consequences of such trade.24 A first set of implications relates to the international propagation of shocks, an issue which has received renewed prominence in the wake of the large-scale shocks from the US-China trade war, the COVID-19 pandemic, and the Russia-Ukraine War. From a theoretical perspective, a classic insight from the closed-economy macroeconomics literature is Hulten’s theorem: for efficient economies and under minimal assumptions, the first-order impact of a technology shock to a firm or industry is equal to that industry’s or firm’s sales as a share of output. David Baqaee and Emmanuel Farhi show how to generalize this result to open economies in order to characterize the response of the aggregate economy to productivity shocks, tariffs, and iceberg trade costs.25 Emmanuel Dhyne, Ken Kikkawa, Magne Mogstad, and Tintelnot show that although relatively few firms directly import, many firms are indirectly affected by foreign shocks because they are connected through production networks to direct importers.26 Zhen Huo, Andrei A. Levchenko, and Nitya Pandalai-Nayar show that the network transmission of shocks is quantitatively relevant for the international comovement of GDP, although most comovement is explained by the correlation of the underlying national shocks.27

The aftermath of the COVID-19 pandemic saw large-scale disruptions to supply chains, shortages of critical components such as semiconductors, growing transportation delays, and record transportation rates on key shipping routes, such as from Shanghai to the West Coast of the United States. Additionally, the US-China trade war and growing geopolitical tensions have raised concerns about the national security implications of GVCs. In response, there is a growing debate about the resiliency of supply chains and the extent to which these large-scale shocks will lead to onshoring, reshoring, friend-shoring, and/or diversification. Grossman, Helpman, and Hugo Lhuillier develop a theoretical framework to analyze optimal policy in the face of supply chain disruptions. In general, a government needs at least two policy instruments, such as subsidizing or taxing diversification while subsidizing or taxing offshoring, to achieve efficient sourcing. When a government is limited to one policy instrument, either policies towards diversification or those towards onshoring or offshoring can dominate.28

National security concerns in particular have led to a renewed debate about the potential scope for industrial policy. Dominick G. Bartelme, Arnaud Costinot, Donaldson, and Andrés Rodríguez-Clare study the rationale for industrial policy in the presence of external economies of scale in some sectors. Although they find evidence of significant and heterogeneous economies of scale across manufacturing sectors, the implied welfare gains from industrial policy are relatively modest, and equal to less than 1 percent of GDP on average.29 Jaedo Choi and Levchenko examine the impact of South Korea’s industrial policy in the form of its Heavy and Chemical Industry (HCI) Drive. Combining historical data on the universe of firm-level subsidies with a theoretical model of trade and development, they find that the HCI Drive was overall welfare improving for South Korea, in part because of an externality from firms’ learning by doing. Ernest Liu and Song Ma study the cross-sector allocation of R&D in a multisector growth model with an innovation network in which each sector can benefit from other sectors’ innovations. A social planner that values long-term growth should allocate more R&D to central sectors in the innovation network, but this incentive is muted in open economies that benefit more from foreign knowledge spillovers.30

A second set of implications of a network perspective relates to the sources of firm success in international markets. Andrew B. Bernard, Dhyne, Glenn Magerman, Kalina Manova, and Andreas Moxnes develop a theoretical framework in which larger firm size can come from high production capability, more or better buyers and suppliers, and/or better matches between buyers and suppliers.31 They find that the production network, in the form of access to buyers and suppliers, can account for more than half the cross-sectional dispersion in firm size. Ezra Oberfield and Johannes Boehm find that the cost of contract enforcement influences firms’ sourcing of intermediate inputs in production networks.32 In Indian states with more congested courts, plants in industries that rely more heavily on relationship-specific intermediate inputs shift their expenditures away from intermediate inputs and adopt more vertically integrated production structures. Jonathan Eaton, Marcela Eslava, David Jinkins, C. J. Krizan, and James R. Tybout develop a model of firm-level export dynamics with costly consumer search, in which a firm’s customer base is a valuable intangible asset.33 Costly consumer search shapes the dynamic response of firm exports to foreign demand shocks, with the five-year response of total export sales to an exchange rate shock exceeding the one-year response by about 40 percent. Jonathan Eaton, Samuel S. Kortum, and Francis Kramarz develop a model of firm-to-firm matching in which domestic and imported intermediate inputs compete directly with labor in performing production tasks.34 Applying this framework to the 2004 expansion of the European Union, they find that workers benefited overall, but those competing most directly with imports gained less, even losing in some countries entering the EU.

More generally, ITI researchers have explored the determinants of GVCs and their aggregate economic implications. Antràs and Alonso de Gortari develop a multistage general equilibrium model of GVCs in which the optimal location of production of a given stage in a GVC is not only a function of its own marginal cost in each location, but also depends on the proximity of that location to those of the preceding and subsequent stages of production.35 Reductions in trade frictions generate somewhat larger welfare gains than in models without multistage production, in part because the lower trade costs accrue at each of the stages of production. Antràs develops a model of multistage production in which the time length of each stage is endogenously determined.36 Letting the production process mature for a longer period of time increases labor productivity, but comes at the cost of higher working capital needs. A worldwide decline in interest rates lowers the cost of working capital and raises the share of GVC trade in world trade.

Multistage production can be organized either within firm boundaries — foreign direct investment (FDI) — or in separate firms — outsourcing. Antràs, Evgenii Fadeev, Teresa C. Fort, and Tintelnot combine Census Bureau and Bureau of Economic Analysis data to provide new evidence on the role of multinational enterprises (MNEs) in the US economy.37 MNEs comprise only 0.23 percent of all firms in the United States, yet employ one-quarter of the workforce and account for 44 percent of aggregate sales, 69 percent of US imports, and 72 percent of US exports. Other related ITI research provides evidence of spillovers from MNEs to domestic firms, including work by Brian McCaig, Nina Pavcnik, and Woan Foong Wong for Vietnam, and by Bradley Setzler and Tintelnot for the United States.38

COVID-19

Antràs, Rossi-Hansberg, and I develop a theoretical framework for analyzing the two-way interaction between globalization and pandemics.39 In this framework, business travel facilitates trade, and travel leads to human interactions that transmit disease. This trade-motivated travel generates an epidemiological externality across countries, such that whether a global pandemic occurs depends on domestic disease transmission in the country with the worst domestic disease environment. If agents internalize the threat of infection, social distancing leads to a reduction in travel that is larger for higher-trade-cost locations, which generates an initial sharp decline and a subsequent rapid recovery in the ratio of trade to output, as observed during the COVID-19 pandemic. The outbreak of the COVID-19 pandemic triggered an explosion of research by economists on the spread of the disease.

Barthélémy Bonadio, Zhen Huo, Levchenko, and Pandalai-Nayar study the role of global supply chains in shaping the impact of the COVID-19 pandemic on GDP growth using a multisector quantitative model and data on 64 countries.40 One-quarter of the total model-implied real GDP decline is explained by cross-country transmission through global supply chains. However, “renationalization” of global supply chains does not in general make countries more resilient against pandemic-induced contractions in labor supply because reducing reliance on foreign inputs increases reliance on domestic inputs, which are also disrupted by lockdowns. Gaurav Khanna, Nicolas Morales, and Pandalai-Nayer use Indian data to identify firms with larger supplier risk following COVID-19 lockdowns.41 They find that firms that buy more complex products with fewer available suppliers are less likely to break buyer-supplier relationships in response to lockdowns. Alfaro, Anusha Chari, Greenland, and Schott use stock market returns and an event-study approach to show that COVID-19–related losses in firm value were larger in industries with higher capital intensity, greater leverage, and greater scope for disease transmission.42

Fajgelbaum, Khandelwal, Wookun Kim, Cristiano Mantovani, and Edouard Schaal examine optimal dynamic lockdowns against COVID-19 within a model of a commuting network.43 Applying this framework to Seoul, Daegu, and New York City, which differ substantially in terms of initial disease diffusion, they find that spatial lockdowns achieve substantially smaller income losses than uniform lockdowns. Actual commuting reductions were too weak relative to this optimal policy in central locations in Daegu and New York City, and too strong in Seoul.

A growing body of research has begun to examine the long-run implications of the COVID-19 pandemic in terms of a shift to remote and hybrid working. Jonathan I. Dingel and Brent Neiman provide evidence on the feasibility of working from home (WFH) for workers in different occupations. Overall 37 percent of jobs in the United States can be performed entirely at home, with substantial variation across occupations. Examples of occupational roles in which workers are largely able to work from home are managers, educators, and those working in computers, finance, and law. In contrast, examples of occupations in which workers are largely unable to work from home are farming, construction, and production.

Spatial Economics

One area of particularly active ITI research in recent years is spatial economics, namely the study of the distribution of economic activity across locations within countries.44 Many of the same issues involved in studying international trade also apply to internal trade within countries, with a key difference being that labor mobility is typically much higher within countries than across national borders.45

Three factors have contributed to this growth of research in spatial economics. First, new theoretical techniques have been developed that enable researchers to analyze spatial interactions in settings with many heterogeneous locations connected by a rich network of trade and migration costs. Second, data from geographic information systems that encode latitude and longitude have dramatically improved our ability to measure the distribution of economic activity within countries at a fine spatial scale. Third, new sources of data have expanded the range of economic activities that can be measured at this fine level, including ride-hailing data, GPS data from smartphones, firm-to-firm shipments data, credit-card data, barcode-scanner data, and satellite-imaging data. An exciting aspect of this research on spatial economics in the ITI Program is the connections that it makes with related research in other NBER programs, including Development Economics, Industrial Organization, Labor Studies, and Public Economics.

Another active area of research has been on the economy’s response to local labor demand shocks from, for example, changes in technology or international trade. Building on their own previous research, David Autor, David Dorn, and Gordon Hanson show that the China trade shock had persistent effects on US local labor markets out to 2019, despite the fact that this trade shock plateaued in 2010.46 Rodríguez-Clare, Mauricio Ulate, and José Vásquez show that incorporating nominal rigidities is important in accounting for the estimated impacts of the China trade shock on unemployment and labor force participation across local labor markets.47 Rodrigo Adão, Michal Kolesár, and Eduardo Morales, and Adão, Costas Arkolakis, and Federico Esposito, develop improved methods for estimating the effects of these local labor demand shocks which take into account the spatial correlation of these shocks across locations and spillover effects to proximate locations.48

Robert C. Feenstra and Akira Sasahara highlight the importance of taking into account both exports and imports in understanding the impact of international trade shocks on US employment across sectors.49 Dingel and Tintelnot argue that granularity, in which the idiosyncratic decisions of individual agents affect equilibrium outcomes, can be important at small spatial scales.50 Rafael Dix-Carneiro, João Paulo Pessoa, Ricardo M. Reyes-Heroles, and Sharon Traiberman provide theory and evidence that aggregate trade imbalances shaped the impact of the China shock on the US manufacturing sector.51

In general, the economy’s response to local labor demand shocks can be gradual because of migration frictions for mobile factors such as labor, and the gradual accumulation of immobile factors such as plant and equipment. Benny Kleinman, Liu, and I show that capital and labor dynamics interact to shape the economy’s speed of convergence to steady state.52 When the gaps of both capital and labor from steady state are positively correlated across locations, this reduces the economy’s speed of convergence because of the interdependence between factors’ marginal products in the production technology. A high capital stock relative to steady state raises labor’s marginal product, which retards its downward adjustment, and vice versa. Using data on US states between 1965 and 2015, we find this interaction between capital and labor dynamics plays a central role in explaining the observed decline in the rate of income convergence across states and the persistent and heterogeneous impact of local shocks.

Treb Allen and Donaldson investigate the role of history in shaping the current distribution of economic activity through either persistence — the long-lived dependence of current outcomes on temporary events — or path dependence where temporary events can permanently affect long-run outcomes. The analysis incorporates agglomeration externalities, forward-looking agents, and many heterogeneous locations which are connected through costly goods trade and migration. Despite this rich economic environment, the analysis yields sharp conditions on model parameters under which there are unique dynamics that nevertheless feature substantial persistence and path dependence. Estimating the model using data on US counties from 1800 to 2000, they find that small historical shocks leave a sizable trace for several centuries, and can cause large and permanent differences in long-run aggregate welfare.53

Related research has explored the implications of the sorting of heterogeneous agents across geographic space. Cecile Gaubert examines the role of the sorting of firms of heterogeneous productivity in explaining the productivity advantages of large cities.54 Victor Couture, Gaubert, Jessie Handbury, and Erik Hurst study the implications of the sorting of workers of heterogeneous skill for gentrification and changes in real income inequality.55 Such sorting of heterogeneous agents across geographic space has important implications for the rationale for so-called place-based policies that target particular regions, as analyzed by Fajgelbaum and Gaubert; Gaubert, Patrick Kline, and Danny Yagan; and Rossi-Hansberg, Pierre-Daniel Sarte, and Felipe Schwartzman.56

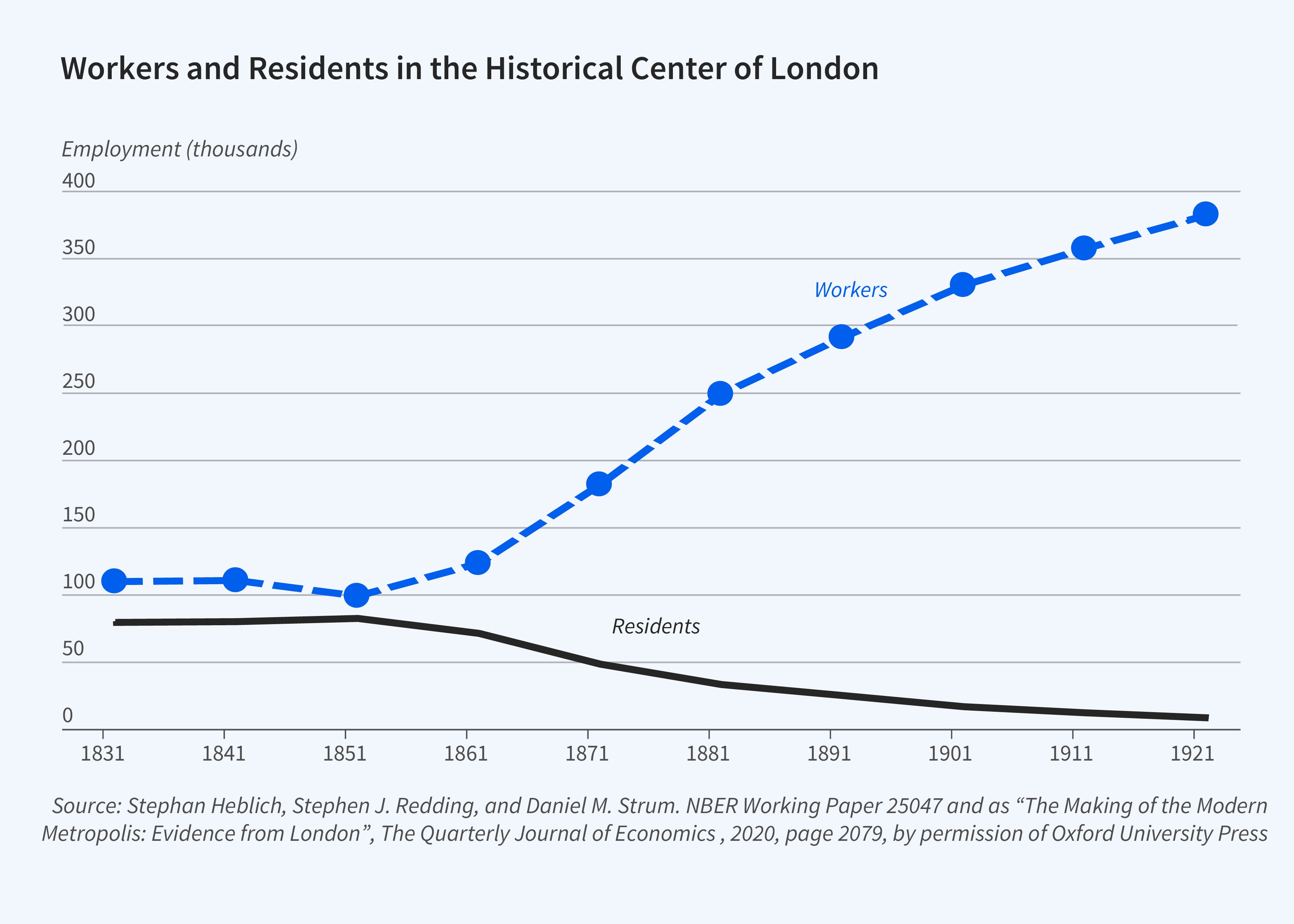

There is also a growing body of empirical research on the impact of transport infrastructure investments on the location of economic activity.57 Stephan Heblich, Daniel Sturm, and I use the natural experiment of the mid-nineteenth-century invention of steam railways to provide evidence on the role of transport networks in shaping the spatial organization of economic activity.58 Their key finding is that this new transport technology dramatically reduced travel times, thereby lowering commuting costs and permitting large-scale separation of workplace and residence. A quantitative urban model is shown to be remarkably successful at capturing the sharp divergence between nighttime and daytime population observed in the historical center of London from the mid-nineteenth century onwards, as shown in Figure 4. Although this historical center experiences the largest absolute increase in employment as it specializes as workplace rather than residence, the highest percentage rates of growth in employment and population occur in the outlying suburbs, as these are transformed from open fields. These findings suggest that present-day technological changes that further reduce commuting costs, such as innovations in remote working and autonomous vehicles, have the potential to further decentralize economic activity.

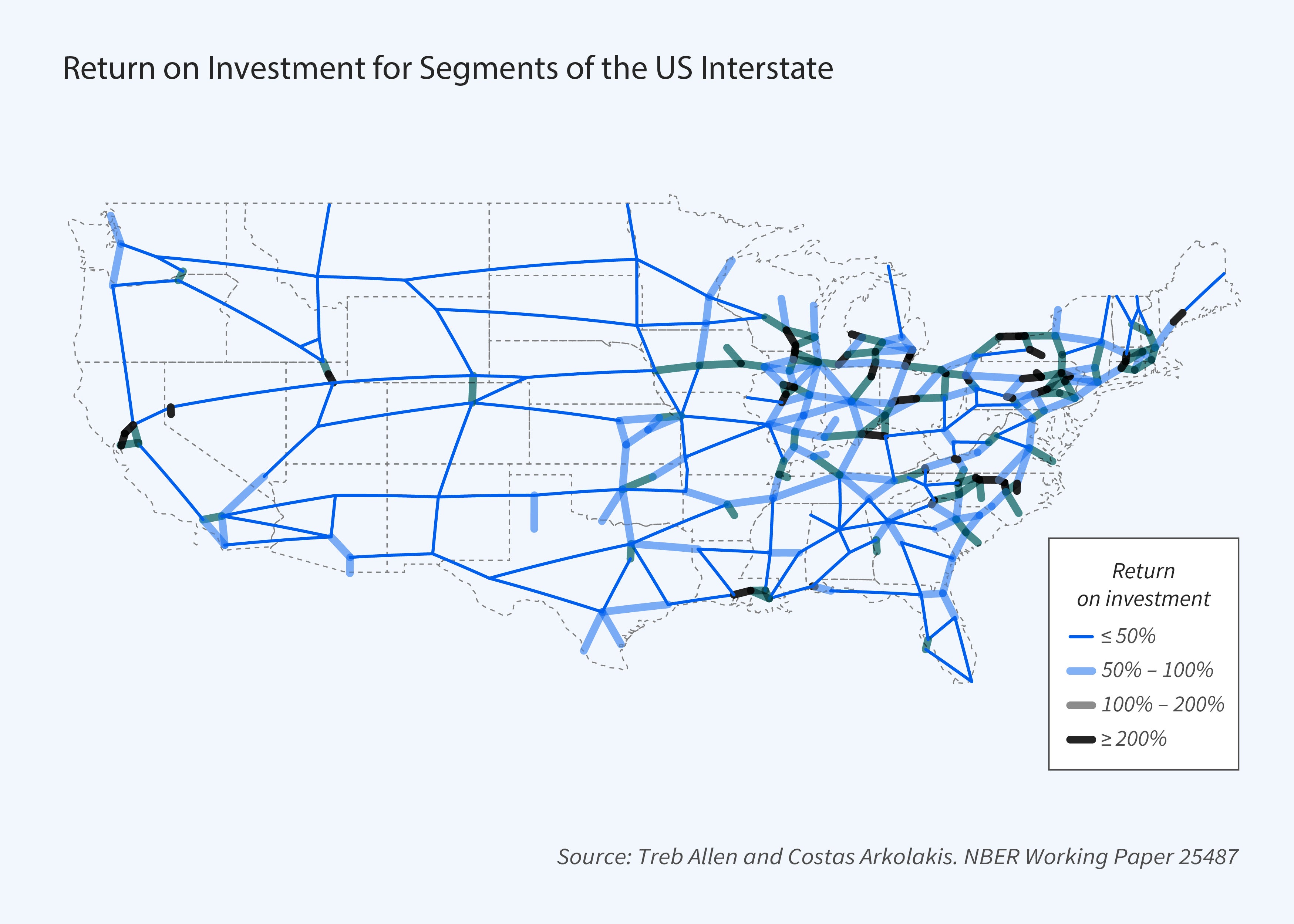

Policymakers are often interested in comparing possible alternative transport investments, such as which links in a railway or highway network to improve. To develop a theoretical framework to address this question, Allen and Arkolakis embed a specification of endogenous route choice in a quantitative spatial model.59 In their approach, individuals consider travel costs and choose the least-costly route. A key implication of this framework is that the welfare effects of a small improvement in a transport link are equal to the percentage cost saving multiplied by the initial value of travel along that link. Applying this framework to both the US highway network and the Seattle road network, they find that the returns to investment are highly variable across different links in the transport network, as shown in Figure 5 for the US highway network, highlighting the importance of well-targeted infrastructure investment.

More generally, Fajgelbaum and Schaal develop a framework for characterizing optimal transport networks in spatial equilibrium.60 They show that the problem of finding the optimal transport network can be transformed into the problem of finding the optimal flow in a network, which has been studied in the operations research literature. The planner chooses the optimal amount to invest in each link in the transport link, where the trade costs for each link are assumed to be increasing with the volume of traffic. Applying this framework to road networks in European countries, they find that road misallocation from the actual network deviating from the optimal network reduces real consumption by around 2 percent.

Trade and the Environment

The ITI Program has also contributed to research on the economics of climate change and the clean energy transition as a leading issue of contemporary debate.61 Joseph S. Shapiro examines the role of international trade policy in shaping global carbon dioxide (CO2) emissions patterns.62 In most countries, import tariffs and non-tariff barriers are substantially lower on “dirty industries” — those with high CO2 emissions per dollar of output — than on “clean industries,” thereby providing an implicit subsidy to CO2 emissions. Using a quantitative trade model to undertake a counterfactual in which similar trade policies are applied in clean and dirty industries, researchers find that global CO2 emissions fall substantially, with little cost in terms of global real income.63

A central feature of climate change is its uneven impact across locations, depending on initial climatic conditions, temperature, and proximity to the coast. Klaus Desmet, Robert E. Kopp, Scott A. Kulp, Dávid Krisztián Nagy, Michael Oppenheimer, Rossi-Hansberg, and Benjamin H. Strauss use a dynamic model of the world economy that features migration, trade, and innovation to evaluate the economic cost of coastal flooding.64 Under an intermediate greenhouse gas concentration trajectory, permanent flooding is projected to reduce global real GDP in 2200 by 0.11 percent. Adaptation mechanisms are important in mitigating these real income costs of climate change. When the adaptation mechanisms of migration and investment are shut down, the loss in real GDP in 2200 increases to 4.5 percent. José-Luis Cruz and Rossi-Hansberg study the economic geography of global warming in a setting in which temperature directly affects both productivity and amenities, and the economy can adjust through goods trade, migration, innovation, and natality.65 Welfare losses from global warming are as large as 15 percent in parts of Africa and Latin America, but also highly heterogeneous across locations, with northern regions in Siberia, Canada, and Alaska experiencing gains. Carbon taxes delay consumption of fossil fuels and help flatten the temperature curve but are much more effective when an abatement technology is forthcoming.

An important challenge in tackling environmental externalities that are global in scope is the so-called problem of leakage: when climate policies vary across countries, energy-intensive industries have an incentive to relocate to places with few or no emissions restrictions. David Weisbach, Kortum, Michael Wang, and Yujia Yao characterize optimal policy in such a setting with leakage and show it involves taxing both the supply of and demand for fossil fuels.66 Bruno Conte, Desmet, and Rossi-Hansberg examine the economic impact of local carbon taxes in an economic geography model with agglomeration and congestion forces, in which regions are linked through both trade and migration.67 In the presence of agglomeration and congestion forces, the market equilibrium need not be efficient. A unilateral carbon tax can be welfare improving, even in the short run when its effects on temperature have not been fully realized, with the effects of this policy depending importantly on how the revenue from the unilateral carbon tax is rebated.

Endnotes

“US Trade Policy in Historical Perspective,” Irwin DA. NBER Working Paper 26256, September 2019. “Trade Policy,” Caliendo L, Parro F. NBER Working Paper 29051, September 2021.

“The Impact of the 2018 Trade War on US Prices and Welfare,” Amiti M, Redding SJ, Weinstein D. NBER Working Paper 25672, March 2019. “The Return to Protectionism,” Fajgelbaum PD, Goldberg PK, Kennedy PJ, Khandelwal AK. NBER Working Paper 25638, October 2019.

"The Return to Protectionism,” Fajgelbaum PD, Goldberg PK, Kennedy PJ, Khandelwal AK. NBER Working Paper 25638, October 2019. Even extending the sample period through into 2019, the same pattern of results continues to hold, as shown in “Who’s Paying for the US Tariffs? A Longer-Term Perspective,” Amiti M, Redding SJ, Weinstein DE. NBER Working Paper 26610, January 2020.

“Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy,” Cavallo A, Gopinath G, Neiman B, Tang J. NBER Working Paper 26396, October 2019.

“The Production Relocation and Price Effects of US Trade Policy: The Case of Washing Machines,” Flaaen AB, Hortaçsu A, Tintelnot F. NBER Working Paper 25767, April 2019.

“When Tariffs Disturb Global Supply Chains,” Grossman GM, Helpman E. NBER Working Paper 27722, August 2020.

"Rising Import Tariffs, Falling Export Growth: When Modern Supply Chains Meet Old-Style Protectionism,” Handley K, Kamal F, Monarch R. NBER Working Paper 26611, August 2020.

“Illuminating the Effects of the US-China Tariff War on China’s Economy,” Chor D, Li B. NBER Working Paper 29349, October 2021.

“Illuminating the Effects of the US-China Tariff War on China’s Economy,” Chor D, Li B. NBER Working Paper 29349, October 2021.

“The Economic Impacts of the US-China Trade War,” Fajgelbaum PD, Khandelwal A. NBER Working Paper 29315, December 2021.

Return to Text

“Trade Policy,” Caliendo L, Parro F. NBER Working Paper 29051, September 2021.

“The Effect of the US-China Trade War on US Investment,” Amiti M, Kong SH, Weinstein D. NBER Working Paper 27114, May 2020. “Trade Protection, Stock-Market Returns, and Welfare,” Amiti M, Kong SH, Weinstein D. NBER Working Paper 28758, August 2022.

Return to Text

“The Effect of the US-China Trade War on US Investment,” Amiti M, Kong SH, Weinstein D. NBER Working Paper 27114, May 2020. “Trade Protection, Stock-Market Returns, and Welfare,” Amiti M, Kong SH, Weinstein D. NBER Working Paper 28758, August 2022.

“Brexit Uncertainty and Trade Disintegration,” Graziano A, Handley K, Limão N. NBER Working Paper 25334, December 2018.

“Brexit Uncertainty and Its (Dis)Service Effects,” Ahmad S, Limão N, Oliver S, Shikher S. NBER Working Paper 28053, November 2020.

“Anxiety or Pain? The Impact of Tariffs and Uncertainty on Chinese Firms in the Trade War,” Benguria F, Choi J, Swenson DL, Xu M. NBER Working Paper 27920, October 2020.

Return to Text

Might Global Uncertainty Promote International Trade?” Baley I, Veldkamp L, Waugh ME. NBER Working Paper 25606, February 2019.

“Trade Policy Uncertainty,” Handley K, Limão N. NBER Working Paper 29672, January 2022.

“A World Trading System for the Twenty-First Century,” Staiger RW. NBER Working Paper 28947, June 2021.

“Quantitative Analysis of Multi-Party Tariff Negotiations,” Bagwell K, Staiger RW, Yurukoglu A. NBER Working Paper 24273, February 2018.

“The “New” Economics of Trade Agreements: From Trade Liberalization to Regulatory Convergence?” Grossman GM, McCalman P, Staiger RW. NBER Working Paper 26132, August 2019.

“Economic History and Contemporary Challenges to Globalization,” O’Rourke KH. NBER Working Paper 25364, December 2018.

“De-Globalisation? Global Value Chains in the Post-COVID-19 Age,” Antràs P. NBER Working Paper 28115, November 2020. “The Great Convergence: Information Technology and the New Globalization,” Baldwin R. Cambridge, MA: Harvard University Press, 2016. “The Globotics Upheaval: Globalization, Robotics, and the Future of Work,” Baldwin R. Oxford: Oxford University Press, 2019.

“Networks and Trade,” Bernard AB, Moxnes A. NBER Working Paper 24556, April 2018. “Micro Propagation and Macro Aggregation,” Baqaee D, Rubbo E. NBER Working Paper 30538, May 2023.

“Networks, Barriers, and Trade,” Baqaee D, Farhi E. NBER Working Paper 26108, July 2022.

“Networks, Barriers, and Trade,” Baqaee D, Farhi E. NBER Working Paper 26108, July 2022

“International Comovement in the Global Production Network,” Huo Z, Levchenko AA, Pandalai-Nayar N. NBER Working Paper 25978, March 2023.

“Supply Chain Resilience: Should Policy Promote Diversification or Reshoring?” Grossman GM, Helpman E, Lhuillier H. NBER Working Paper 29330, October 2021.

“The Textbook Case for Industrial Policy: Theory Meets Data,” Bartelme DG, Costinot A, Donaldson D, Rodríguez-Clare A. NBER Working Paper 26193, August 2019.

“Innovation Networks and R&D Allocation,” Liu E, Ma S. NBER Working Paper 29607, January 2023.

“The Origins of Firm Heterogeneity: A Production Network Approach,” Bernard AB, Dhyne E, Magerman G, Manova K, Moxnes A. NBER Working Paper 25441, January 2019.

“Misallocation in the Market for Inputs: Enforcement and the Organization of Production,” Boehm J, Oberfield E. NBER Working Paper 24937, August 2018.

“A Search and Learning Model of Export Dynamics,” Eaton J, Eslava M, Jinkins D, Krizan CJ, Tybout JR. NBER Working Paper 29100, July 2021.

“Firm-to-Firm Trade: Imports, Exports, and the Labor Market,” Eaton J, Kortum SS, Kramarz F. NBER Working Paper 29685, January 2022.

“On the Geography of Global Value Chains,” Antràs P, de Gortari A. NBER Working Paper 23456, May 2017. “Global Value Chains,” Antràs P, Chor D. NBER Working Paper 28549, March 2021

“An ‘Austrian’ Model of Global Value Chains,” Antràs P. NBER Working Paper 30901, January 2023.

“Global Sourcing and Multinational Activity: A Unified Approach,” Antràs P, Fadeev E, Fort TC, Tintelnot F. NBER Working Paper 30450, September 2022.

“FDI Inflows and Domestic Firms: Adjustments to New Export Opportunities,” McCaig B, Pavcnik N, Wong WF. NBER Working Paper 30729, December 2022. “The Effects of Foreign Multinationals on Workers and Firms in the United States,” Setzler B, Tintelnot F. NBER Working Paper 26149, March 2021.

“Globalization and Pandemics,” Antràs P, Redding SJ, Rossi-Hansberg E. NBER Working Paper 27840, November 2022.

“Global Supply Chains in the Pandemic,” Bonadio B, Huo Z, Levchenko AA, Pandalai-Nayar N. NBER Working Paper 27224, April 2021.

"Supply Chain Resilience: Evidence from Indian Firms,” Khanna G, Morales N, Pandalai-Nayar N. NBER Working Paper 30689, November 2022.

"Aggregate and Firm-Level Stock Returns during Pandemics, in Real Time,” Alfaro L, Chari A, Greenland AN, Schott PK. NBER Working Paper 26950, May 2020.

“Optimal Lockdown in a Commuting Network,” Fajgelbaum PD, Khandelwal A, Kim W, Mantovani C, Schaal E. NBER Working Paper 27441, November 2020.

“The Economies of Cities: From Theory to Data,” Redding SJ. NBER Working Paper 30875, January 2023. “Economic Activity across Space: A Supply and Demand Approach,” Allen T, Arkolakis C. NBER Working Paper 30598, March 2023. “Trade and Geography,” Redding SJ. NBER Working Paper 27821, September 2020. “Quantitative Spatial Economics,” Redding SJ, Rossi-Hansberg E. NBER Working Paper 22655, September 2016.

“Goods and Factor Market Integration: A Quantitative Assessment of the EU Enlargement,” Caliendo L, Opromolla LD, Parro F, Sforza A. NBER Working Paper 23695, August 2017. “Tradability and the Labor-Market Impact of Immigration: Theory and Evidence from the US,” Burstein A, Hanson GH, Tian L, Vogel J. NBER Working Paper 23330, September 2017. “Migration Costs and Observational Returns to Migration in the Developing World,” Lagakos D, Marshall S, Mobarak AM, Vernot C, Waugh ME. NBER Working Paper 26868, March 2020.

“On the Persistence of the China Shock,” Autor D, Dorn D, Hanson GH. NBER Working Paper 29401, October 2021.

“Trade with Nominal Rigidities: Understanding the Unemployment and Welfare Effects of the China Shock,” Rodríguez-Clare A, Ulate M, Vásquez JP. NBER Working Paper 27905, March 2022.

“Shift-Share Designs: Theory and Inference,” Adão R, Kolesár M, Morales E. NBER Working Paper 24944, August 2018. “General Equilibrium Effects in Space: Theory and Measurement,” Adão R, Arkolakis C, Esposito F. NBER Working Paper 25544, June 2020.

“The ‘China Shock,’ Exports and US Employment: A Global Input-Output Analysis,” Feenstra RC, Sasahara A. NBER Working Paper 24022, November 2017.

"Spatial Economics for Granular Settings,” Dingel JI, Tintelnot F. NBER Working Paper 27287, January 2021.

“Globalization, Trade Imbalances, and Labor Market Adjustment,” Dix-Carneiro R, Pessoa JP, Reyes-Heroles RM, Traiberman S. NBER Working Paper 28315, April 2022.

“Dynamic Spatial General Equilibrium,” Kleinman B, Liu E, Redding SJ. NBER Working Paper 29101, December 2022.

“Persistence and Path Dependence in the Spatial Economy,” Allen T, Donaldson D. NBER Working Paper 28059, November 2022.

“Firm Sorting and Agglomeration,” Gaubert C. NBER Working Paper 24478, April 2018.

“Income Growth and the Distributional Effects of Urban Spatial Sorting,” Couture V, Gaubert C, Handbury J, Hurst E. NBER Working Paper 26142, January 2020. “Where Is Standard of Living the Highest? Local Prices and the Geography of Consumption,” Diamond R, Moretti E. NBER Working Paper 29533, January 2023.

“Optimal Spatial Policies, Geography, and Sorting,” Fajgelbaum PD, Gaubert C. NBER Working Paper 24632, November 2019. “Place-Based Redistribution,” Gaubert C, Kline PM, Yagan D. NBER Working Paper 28337, January 2021. “Cognitive Hubs and Spatial Redistribution,” Rossi-Hansberg E, Sarte P-D, Schwartzman F. NBER Working Paper 26267, September 2019.

“Does the US Have an Infrastructure Cost Problem? Evidence from the Interstate Highway System,” Turner MA, Mehrotra N, Uribe JP. NBER Working Paper 30989, February 2023. “Transportation Infrastructure in the US,” Duranton G, Nagpal G, Turner MA. NBER Working Paper 27254, June 2020. “Does Investment in National Highways Help or Hurt Hinterland City Growth?” Baum-Snow N, Henderson JV, Turner MA, Zhang Q, Brandt L. NBER Working Paper 24596, May 2018.

The Making of the Modern Metropolis: Evidence from London,” Heblich S, Redding SJ, Sturm DM. NBER Working Paper 25047, April 2020.

“The Welfare Effects of Transportation Infrastructure Improvements,” Allen T, Arkolakis C. NBER Working Paper 25487, December 2020.

“Optimal Transport Networks in Spatial Equilibrium,” Fajgelbaum PD, Schaal E. NBER Working Paper 23200, July 2019.

“Globalization and the Environment,” Copeland BR, Shapiro JS, Taylor MS. NBER Working Paper 28797, May 2021.

“Globalization and the Environment,” Copeland BR, Shapiro JS, Taylor MS. NBER Working Paper 28797, May 2021.

“Trade Policy and Global Sourcing: An Efficiency Rationale for Tariff Escalation,” Antràs P, Fort TC, Gutiérrez A, Tintelnot F. NBER Working Paper 30225, July 2022.

“Evaluating the Economic Cost of Coastal Flooding,” Desmet K, Kopp RE, Kulp SA, Nagy DK, Oppenheimer M, Rossi-Hansberg E, Strauss BH. NBER Working Paper 24918, August 2018.

“The Economic Geography of Global Warming,” Cruz J-L, Rossi-Hansberg E. NBER Working Paper 28466, February 2021.

“Trade, Leakage, and the Design of a Carbon Tax,” Weisbach D, Kortum SS, Wang M, Yao Y. NBER Working Paper 30244, July 2022.

“On the Geographic Implications of Carbon Taxes,” Conte B, Desmet K, Rossi-Hansberg E. NBER Working Paper 30678, November 2022.