Program Report: International Trade and Investment, 2016

The International Trade and Investment (ITI) Program holds three regular meetings annually, in winter, spring, and at the NBER Summer Institute. The ITI Program has about 60 research associates and 20 faculty research fellows with primary affiliation to the group, and another 20 individuals with secondary affiliation. Research within the group covers a wide range of topics, such as explaining patterns of international trade as well as foreign direct investment, and understanding the impact of trade policies. This is in addition to topics covered by specialized conferences, the most recent of which was on "Globalization in an Age of Crisis: Multilateral Economic Cooperation in the Twenty-First Century," held at the Bank of England September 15–16, 2011, proceedings published in R. C. Feenstra and A. M. Taylor, eds., Globalization in an Age of Crisis, Chicago, IL: University of Chicago Press, 2014. That volume dealt with the aftermath of the global financial crisis and its lessons for multilateral cooperation. The last NBER Reporter article on the ITI program was in 2011; this article's focus is on research during 2012–15.

The rise in exports from China has been one of the most significant events in international trade in recent decades. This trend has accelerated since that country's entry into the World Trade Organization (WTO) in 2001. Even before that date, by a vote of the U.S. Congress China received the low-tariff, most-favored-nation status associated with WTO membership each year. But with WTO membership, Chinese firms experienced a reduction in the uncertainty associated with the outcome of that vote. This contributed importantly to the surge in exports to the United States, according to studies by Justin Pierce and Peter Schott and by Kyle Handley and Nuno Limão; their hypothesis is supported by empirical work by Ling Feng, Zhiyuan Li, and Deborah Swenson.1 Pierce and Schott observe that the surge in Chinese exports to the United States coincides with a substantial decline in U.S. manufacturing employment. Handley and Limão find that the welfare gain for consumers due to this increase in Chinese imports is of the same order of magnitude as the U.S. gain from new imports in the preceding decade. These initial findings highlight the dual role that Chinese imports play for the United States: on the one hand, they create import competition with associated labor-market dislocation; on the other, they benefit U.S. consumers.

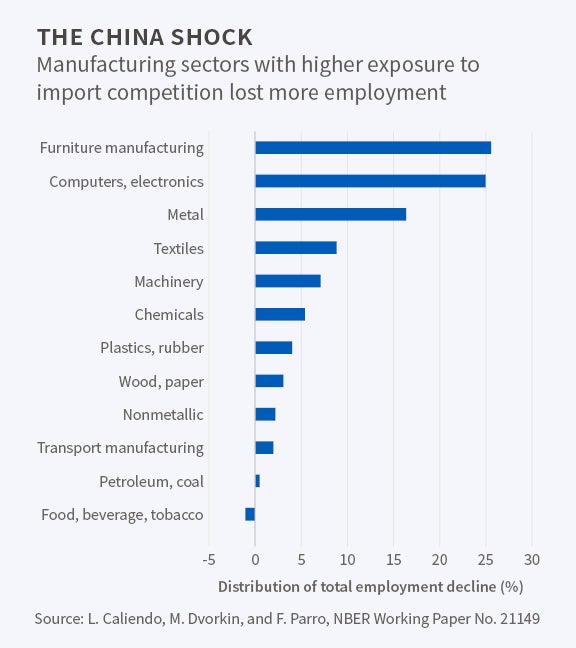

The first of these roles is explored in a series of papers by David Autor, David Dorn, and Gordon Hanson.2 They analyze the impact of Chinese import competition between 1990 and 2007 on local U.S. labor markets, exploiting geographic differences in import exposure that are due to initial differences in industry specialization. Higher exposure increases unemployment, lowers labor force participation, and reduces wages. [See Figure 1] At the aggregate level, a conservative estimate is that the import surge accounts for one-quarter of the decline in U.S. manufacturing employment. The regional concentration in the decline in manufacturing employment is inconsistent with some alternative explanations of this phenomenon, notably the possibility of a systemic technology shock.3 The trade effects on unemployment are confirmed by examining worker-level evidence.4 Most recently, in joint work with Daron Acemoglu and Brendan Price, these authors find that the import surge from China also contributed to unusually slow employment growth in the United States following the global financial crisis and the Great Recession.5

While these papers have explored the impact of import competition from China, they do not incorporate the consumer gains or the export opportunities created by expanded Chinese exports. The first attempt to put the surge in Chinese exports into a general equilibrium context is that of Lorenzo Caliendo, Maximiliano Dvorkin, and Fernando Parro.6 Their computable general equilibrium model incorporates labor mobility frictions and dislocation costs. They find that growing Chinese import competition resulted in a 0.6 percentage point reduction in manufacturing's share of total employment, or approximately one million jobs lost, which is about 60 percent of the change in manufacturing employment not explained by a secular trend. At the same time, the China shock increased U.S. welfare by 0.2 percent in the short run and 6.7 percent in the long run, with very heterogeneous effects across labor markets. Despite the fact that employment impacts and labor market dislocation are much stronger in some areas, the consumer gains and export opportunities mean that nearly all regions experience net benefits from rising Chinese imports.

This work has inspired much additional research on the China shock. In the United States, Avraham Ebenstein, Ann Harrison, and Margaret McMillan analyze the impact of globalization at the occupational level and find that offshoring to low-wage countries and imports are both associated with wage declines for U.S. workers, though imports from China have a greater impact than does offshoring.7 In France, analysis by James Harrigan, Ariell Reshef, and Farid Toubal concludes that increased polarization of the labor market is associated more with technological change than with imports from China.8 In Denmark, Wolfgang Keller and Hâle Utar find that import competition from China is an important cause of job polarization, with about four times the impact of offshoring.9 They confirm a strong role for technical change and computerization in leading to polarization, but find that these factors cannot explain the rise in low-wage employment up to the early 2000s.

Global Supply Chains and Wage Inequality

A great deal of work in the International Trade and Investment Program deals with multinational firms, their global sourcing decisions, and wage inequality. Understanding which countries a company chooses to use for offshoring is a challenging theoretical problem. In the presence of fixed costs of procurement, that problem is inherently discrete in nature, since the firm must choose zero, one, two or more countries to which to outsource. Pol Antràs, Teresa Fort, and Felix Tintelnot develop a method to analyze the outsourcing problem as though firms were choosing a continuous rather than a discrete outcome, and they apply it to firm-level U.S. data.10 They study the implications of a hypothetical 100 percent increase in China's sourcing potential, such as could be produced by a reduction in bilateral trade costs between the U.S. and China. They find that such a shock tends to create gains by decreasing the equilibrium industry-level U.S. price index, even while some U.S. final goods producers exit the market. Other U.S. firms choose to source from China as a result of the shock, and these firms on average also increase their input purchases from the U.S. and other countries. Greater sourcing by U.S. firms from China can lead to enhanced demand for local inputs, too, as these firms grow.

In other work, Antràs and Davin Chor analyze offshoring using a property-rights model of the firm.11 They consider a continuum of production stages, where at each stage a final goods producer contracts with a distinct supplier for a customized, stage-specific component. They show that the incentive to integrate suppliers varies systematically with the relative position—upstream versus downstream—at which the supplier enters the production process and that the nature of the relationship between integration and "downstreamness" depends crucially on the elasticity of demand faced by the final goods producer. Using the U.S. Census Bureau's Related Party Trade database, they find empirical evidence broadly supportive of these predictions. In work with coauthors Laura Alfaro and Paola Conconi, they provide further evidence supporting this theory of offshoring using data on the production activities of firms operating in more than 100 countries.12 These papers build on work by Antràs and Chor with coauthors Thibault Fally and Russell Hillberry which measures the "upstreamness" of production and trade flows.13 Fally and Hillberry further build on these insights to provide their own Coasian model of international production chains.14

The linkage of wage inequality to global supply chains is studied in a theoretical model by Arnaud Costinot, Jonathan Vogel, and Su Wang, who find that the emergence of these chains has opposite effects on wage inequality for workers employed at the bottom and the top of the chains, thereby generating wage inequality across sectors.15 A more detailed, empirical examination of inequality in the United States, which focuses on inequality between groups of workers, such as those of high and low skill, is done by Ariel Burstein, Eduardo Morales, and Vogel using an assignment framework with many labor groups, equipment types, and occupations.16 Elhanan Helpman, Oleg Itskhoki, Marc-Andreas Muendler, and Stephen Redding drill down further to examine inequality across firms within sector and occupation for workers with similar observable characteristics.17 Their model allows for heterogeneity across firms in the cost of screening workers and in the fixed cost of exporting. They show, using Brazilian data, that residual wage dispersion between firms is related to firm employment size and to participation in trade. Other work linking the regional skill-premium in Brazil to trade liberalization is provided by Rafael Dix-Carneiro and Brian Kovak.18

These papers rely on matching models between heterogeneous firms or managers and heterogeneous workers with complementary abilities. This type of model is developed by Gene Grossman individually and in work with Helpman and Philipp Kircher.19 To study the implications for income distribution, Grossman and Helpman develop a dynamic growth model with heterogeneous firms and workers.20 They find that a country with greater innovation capacity grows faster in autarky, but experiences greater income inequality, than one with less innovation capacity. Globalization raises growth rates in all countries, but it worsens the income distribution because the more-able workers benefit relatively more from the improved matching with new technologies.

Sources of the Gains from Trade

The entry of China into the WTO in 2001 is but one example—albeit a very important one—of a reduction in the trade costs between countries. But surprisingly, the paper by Caliendo, Dvorkin, and Parro cited previously models the export surge from China as arising from a positive technology shock in that country rather than from an effective U.S. tariff cut. That is also the case for the research of Chang-Tai Hsieh and Ralph Ossa dealing with the impact of China's export growth on the rest of the world.21 The reason that an effective tariff cut is not used in the models is twofold. First, as noted, the U.S. tariff cut received by China when it entered the WTO in 2001 was actually a reduction in the risk of having non-WTO tariffs applied, since most-favored-nation tariffs had been approved in previous years.

Setting aside this issue, there is a deeper reason why these papers do not use a tariff cut to explain China's export surge. Suppose that we model the Chinese economy and the rest of world as being composed of heterogeneous firms with a Pareto distribution of productivities competing under monopolistic competition, as in the widely used Melitz-Chaney model.22 Then, let us introduce an iceberg trade cost—the assumption that trade costs rise with the distance between as a proxy for border costs. It turns out that a reduction in the iceberg trade cost has no impact on the entry of firms into the monopolistically competitive sector. For this reason, it would be difficult to calibrate the large export surge from China as arising from a reduction in trade costs alone. Furthermore, in this setting, the gains from trade resulting from a reduction in trade costs are much the same as in an Armington model, where the number of firms is fixed by assumption, or as in a monopolistic competition model with homogeneous firms. For these reasons, Costas Arkolakis, Costinot, and Andrés Rodríguez-Clare conclude that new models such as these have not contributed much, at least so far, to measuring the welfare gains from trade.23 That conclusion led to a strong response to the contrary by Marc Melitz and Redding in "New Trade Models, New Trade Implications."24

This debate has led to ongoing research dealing with the gains from trade. Melitz and Redding explore how gains are affected when the distribution of firms' productivities takes on a truncated Pareto distribution, with an upper bound to the highest productivity available. In that case, a change in trade costs indeed leads to entries and exits by firms that influence the gains from trade. Melitz and Redding, and also Thomas Chaney and Ossa, further consider a model of sequential production, whereby a reduction in trade costs feeds back into domestic productivity, leading to greater gains from trade.25 Ana Fernandes, Peter Klenow, Sergii Meleshchuk, Martha Denisse Pierola, and Rodríguez-Clare use data from the World Bank's Exporter Dynamics Database and conclude that the productivity distribution cannot be an unbounded Pareto.26

My own work extends the discussion of truncated Pareto by allowing for a wide range of preference beyond the constant elasticity of substitution, called the "quadratic mean of order r" preferences.27 Again, entry by firms responds to changes in trade costs. The average markup charged by firms and the variety of goods available to consumers also change. Therefore, increased trade has positive pro-competitive and variety effects. Using a truncated Pareto distribution in this way avoids the result of Arkolakis, Costinot, Dave Donaldson, and Rodríguez-Clare, who also allow for quite general preferences, but do not find any positive, pro-competitive effect of trade.28 David Weinstein and I have measured the pro-competitive effect and the positive impact of import variety for the U.S. economy; we assume translog preferences but do not restrict the distribution of productivities.29 An entirely new specification of preferences that allows for strong pro-competitive and variety effects is proposed by Paolo Bertoletti, Federico Etro, and Ina Simonovska.30

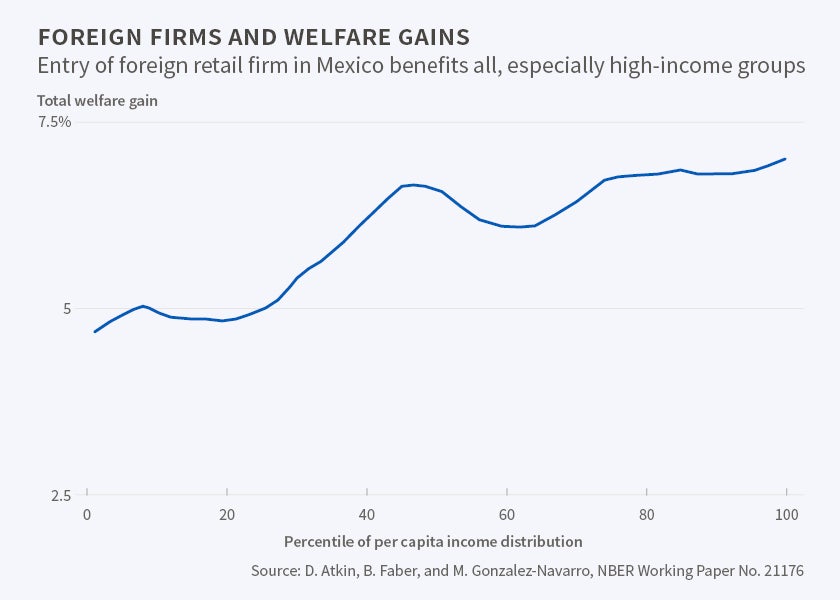

The welfare effects of changing markups and variety must take into account the impact on domestic firms, too. Colin Hottman, Redding, and Weinstein document how markups differ in the United States across firms of various sizes, with only the largest firms showing evidence of variable markups.31 For Mexico, David Atkin, Benjamin Faber, and Marco Gonzalez-Navarro document how the arrival of foreign firms in the retail sector created gains for consumers by creating more competition and lowering markups, as well as expanding variety.32 [See Figure 2.] They also find evidence of store exit. Despite this, the gains are on average positive for all income groups but regressive, benefitting those with higher income more. A different view of how the gains from trade are distributed across consumers and countries of differing incomes is presented by Pablo Fajgelbaum and Amit Khandelwal, who use an Almost-Ideal Demand system.33 They find that trade typically favors the poor, because they spend more in traded sectors.

These papers refer to general sources of gains from trade. Returning to the specific case of tariffs, recent research has shown that changes in tariffs—in striking contrast to the conclusion in models with iceberg transport costs—can indeed induce firm entry and exit. This point was recognized by Costinot and Rodríguez-Clare in their survey; they allow for potential changes in the entry of firms in their treatment of tariffs.34 But because they focus on tariffs that are charged on the variable costs of firms, the only difference between tariffs and iceberg transport costs is that tariffs generate revenue that is redistributed to consumers. In contrast, Caliendo, John Romalis, Alan Taylor, and I allow tariffs to be applied to total import revenue, inclusive of the markup earned by the exporting firm.35 A tariff is then equivalent to a tax on costs and on profits. We find a quite pronounced impact of the Uruguay Round on firm entry, and therefore also on welfare, due to the component of the tariff that functions as an implicit tax on profits.

The link between tariffs and the profits of exporters is also apparent from the empirical work of Jan De Loecker, Pinelopi Goldberg, Khandelwal, and Nina Pavcnik, who focus on trade liberalization in India.36 They find that a reduction in output tariffs has the expected pro-competitive effects, with firms lowering their net-of-tariff prices. However, a reduction in input tariffs leads to a sizable increase in markups as firms absorb the fall in marginal costs with little change in prices.

We conclude this section by noting that historical data remains a rich source for exploration of the effects of tariff changes. Examining the change in U.S. sugar duties from 1890 to 1930, Douglas Irwin finds a striking asymmetry: a tariff reduction is immediately passed through to consumer prices with no impact on the import price, whereas about 40 percent of a tariff increase is passed through to consumer prices and 60 percent is borne by foreign exporters.37 A comprehensive examination of historical tariff negotiations that will give rise to new data is being undertaken by Kyle Bagwell, Robert Staiger, and Ali Yurukoglu.38 They have access to recently declassified data from rounds of GATT/WTO tariff bargaining. These data give us an unprecedented opportunity to examine the motivations for and results of GATT/WTO rules, such as most-favored-nation status and reciprocity.

The Gravity Equation and Intranational Trade

An ongoing topic of research in the ITI program is the gravity equation, which explains trade between countries based on their size and the distance between them, as well as other variables. The foundations of this equation and its estimation are constantly being expanded. Chaney shows how this equation can arise from stable networks of firms with their suppliers and customers.39 Treb Allen, Arkolakis, and Yuta Takahashi nest alternative models to provide a very general treatment of this equation in what they call "Universal Gravity."40 The estimation of the gravity equation using moment inequalities is discussed by Morales, Gloria Sheu, and Andrés Zahler, who also examine "extended gravity," whereby a firm's entry into one country makes entry into neighboring countries easier.41 On the other hand, the difficulty of entering markets means that many country-pairs have zero trade between them in specific products. While it can be difficult to account for zero trade flows in standard models, a new approach is proposed and implemented by Jonathan Eaton, Samuel Kortum, and Sebastian Sotelo.42

One goal when estimating the gravity equation is to obtain estimates of the elasticity of trade flows with respect to trade costs. Simonovska and Michael Waugh show the elasticity obtained is very sensitive to the underlying model for the gravity equation.43 Their work informs the trade elasticity that is used in computational models. In addition to the micro-elasticity between foreign countries, Philip Luck, Maurice Obstfeld, Katheryn Russ, and I extend the estimation of the gravity equation to incorporate a macro-elasticity between foreign and home variety. We find that the micro-elasticity is typically larger than the macro-elasticity, and quite often conforms to the "rule of two" by being twice as large.44

ITI program members have also used the insights of the gravity equation to inform research on intranational as opposed to international trade. Delina Agnosteva, James Anderson, and Yoto Yotov develop a procedure to flexibly estimate both intranational border barriers and intraregional trade costs.45 A more detailed examination of intraregional costs is undertaken by Ferdinando Monte, Redding, and Esteban Rossi-Hansberg.46 They examine spatial linkages between goods markets through trade and between factor markets through commuting and migration. The latter are subject to heterogeneous moving costs between regions. They find that without these costs, commuting flows cannot be explained by only considering conventional variables such as the difference between regions in their size or wages.

There are many "natural experiments" that can be used to test spatial models. Andrew Bernard, Andreas Moxnes, and Yukiko Saito use the opening in Japan of a high-speed bullet train (Shinkansen) line that lowered the cost of passenger travel but left shipping costs unchanged. 47 They find significant improvements in firm performance as well as creation of new buyer-seller links, consistent with their model. Allen and Arkolakis apply a quite general theoretical framework to the construction of the interstate highway system in the United States and find that this system increased U.S. welfare by 3.5 percent, which is roughly twice its cost.48 In another natural experiment, Gabriel Ahlfeldt, Redding, Daniel Sturm, and Nikolaus Wolf study the changes to city structure in Berlin due to the fall of the Berlin Wall.49 The general relationship between transportation costs and the spatial distribution of economic activity is surveyed by Redding and Matthew Turner.50 Finally, a new model of cities is proposed by Donald Davis and Jonathan Dingel, who test it using data on U.S. metropolitan areas.51

The tools of the gravity equation also can be used to study optimal policies at the state level. Fajgelbaum, Morales, Juan Carlos Suárez Serrato, and Owen Zidar analyze the potential spatial misallocation arising from differing state taxes in the United States.52 They find that revenue-neutral tax harmonization leads to aggregate real-GDP and welfare gains of 0.7 percent. Ossa studies how the difference in state taxes can arise from welfare-enhancing subsidy competition between them.53 He finds that subsidy competition can create large distortions, so that the gains from cooperative setting of state taxes and subsidies are substantial. Caliendo, Parro, Rossi-Hansberg, and Pierre-Daniel Sarte abstract from taxes to study how productivity shocks within U.S. regions spill over to the entire economy.54

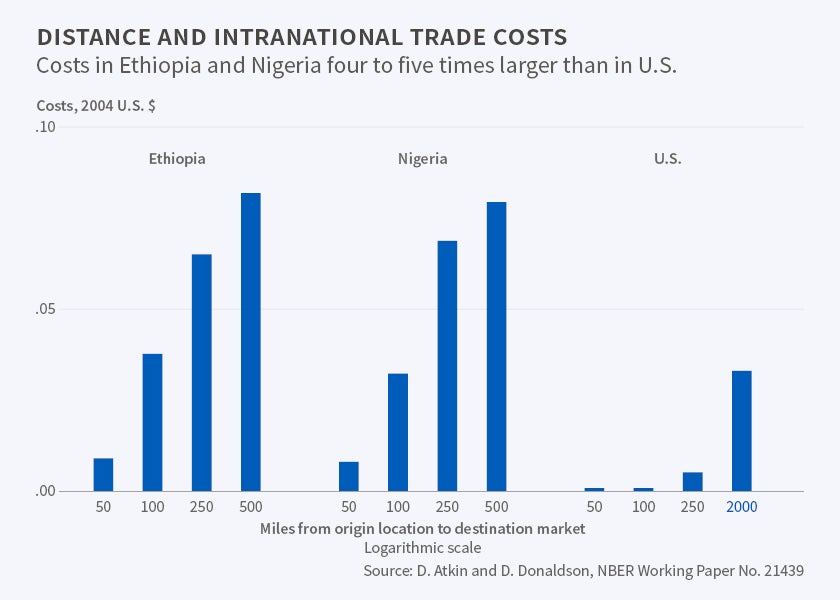

Internal transportation costs can have a significant impact on international trade, too. Atkin and Donaldson use newly collected CPI microdata from Ethiopia and Nigeria to assess the impact of internal distance on the prices at the port of exit.55 They find that the effect of distance on trade costs within Ethiopia or Nigeria is four to five times larger than in the U.S. [See Figure 3.]

In addition, they find that intermediaries capture the majority of welfare benefits from international trade, and that their share is even higher in distant locations, suggesting that remote consumers receive only a small share of the gains from falling international trade barriers. Kerem Coçar and Fajgelbaum also study the connections between internal geography, regional specialization, and international trade, using data from Chinese prefectures.56

Conclusions

Research on all four of the topics covered in this review—the rise of China's exports, global supply chains and wage inequality, the sources of gains from trade, and the gravity equation and intranational trade—is motivated by observations about trade between countries (or regions) and how it has changed. Nearly all of the papers reviewed use a general equilibrium model and estimation techniques appropriate to that setting, which is an important distinguishing feature of research in the ITI program. Another unifying theme in all trade research is the concern for social welfare—accounting for the well-being of consumers and the profits earned by firms.

Other important topics, such as immigration57 and the evaluation of policies to promote growth in developing countries,58 are studied in the ITI program but have not been described here. Still, it would be remiss to conclude without mentioning one area on which there is likely to be a substantial volume of future research: the impact of global climate change. Donaldson, Costinot, and Cory Smith examine the implications of climate change for a variety of crops and locations around the world.59 They fully incorporate the alternatives to current crop patterns as global temperature rises. With this costless substitution of crops and allowing trade to adjust, they find that the impact of climate change on the agricultural markets in their study would amount to a rather modest 0.26 percent reduction in global GDP.

Klaus Desmet and Rossi-Hansberg use a less-detailed model of agriculture along with a manufacturing sector, both of which are impacted by global warming.60 They assume that trade is subject to iceberg transport costs, like Donaldson, Costinot, and Smith, but allow for free labor migration either worldwide or within a northern and southern region. They find that the adverse effects of global climate change are much more pronounced when migration is limited. The actual response of migrants to changes in temperature across a large number of countries is studied by Cristina Cattaneo and Giovanni Peri.61 They find that in middle-income countries, migration represents an important margin of adjustment, with migrants moving towards cities or other countries as temperature warms. This mechanism does not seem to work in poor economies, where higher temperatures reduce the probability of emigration to cities or to other countries, consistent with the presence of severe liquidity constraints.

This research suggests that the results from multi-country general equilibrium models may be very sensitive to the efficacy with which different margins of substitution operate—substitution between crops, between regions, and between countries. Understanding those margins of substitution and the costs associated with them is an important ongoing direction of research in the ITI program, and one on which further research, allowing for realistic adjustment through trade, migration and other margins, is likely to be forthcoming.

Endnotes

J. R. Pierce and P. K. Schott, "The Surprisingly Swift Decline of U.S. Manufacturing Employment," NBER Working Paper 18655, December 2012; K. Handley and N. Limão, "Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the U.S.," NBER Working Paper 19376, January 2012; L. Feng, Z. Li, and D. Swenson, "Trade Policy Uncertainty and Exports: Evidence from China's WTO Accession," NBER Working Paper 21985, February 2016.

D. H. Autor, D. Dorn, and G. H. Hanson, "The China Syndrome: Local Labor Market Effects of Import Competition in the United States," NBER Working Paper 18054, May 2012, and the American Economic Review, 103(6), 2013, pp. 2121–68; D. H. Autor, D. Dorn, and G. H. Hanson, "Untangling Trade and Technology: Evidence from Local Labor Markets," NBER Working Paper 18938, April 2013, and the Economic Journal, 125(584), May 2015, pp. 621–46.

D. H. Autor, D. Dorn, and G. H. Hanson, "The Geography of Trade and Technology Shocks in the United States," NBER Working Paper 18940, April 2013, and the American Economic Review, 103(3), May 2013, pp. 220–25.

D. H. Autor, D. Dorn, and G. H. Hanson, "Trade Adjustment: Worker Level Evidence," NBER Working Paper 19226, July 2013.

D. Acemoglu, D. H. Autor, D. Dorn, G. H. Hanson, and B. Price, "Import Competition and the Great U.S. Employment Sag of the 2000s," NBER Working Paper 20395, August 2014.

L. Caliendo, M. Dvorkin, F. Parro, "The Impact of Trade on Labor Market Dynamics," NBER Working Paper 21149, May 2015.

A. Ebenstein, A. E. Harrison, and M. S. McMillan, "Why are American Workers getting Poorer? China, Trade and Offshoring," NBER Working Paper 21027, March 2015.

J. Harrigan, A. Reshef, F. Toubal, "The March of the Techies: Technology, Trade, and Job Polarization in France, 1994–2007," NBER Working Paper 22110, March 2016.

W. Keller and H. Utar, "International Trade and Job Polarization: Evidence at the Worker Level," NBER Working Paper 22315, June 2016.

P. Antràs, T. C. Fort, and F. Tintelnot, "The Margins of Global Sourcing: Theory and Evidence from U.S. Firms," NBER Working Paper 20772, December 2014.

P. Antràs and D. Chor, "Organizing the Global Value Chain," NBER Working Paper 18163, June 2012, and Econometrica, 81(6), 2013, pp. 2127–2204.

L. Alfaro, P. Antràs, D. Chor, and P. Conconi, "Internalizing Global Value Chains: A Firm-Level Analysis," NBER Working Paper 21582, September 2015.

P. Antràs, D. Chor, T. Fally, and R. Hillberry, "Measuring the Upstreamness of Production and Trade Flows," NBER Working Paper 17819, February 2012, and the American Economic Review, 102(3), May 2012, pp. 412–16.

T. Fally and R. Hillberry, "A Coasian Model of International Production Chains," NBER Working Paper 21520, September 2015.

A. Costinot, J. Vogel, and S. Wang, "Global Supply Chains and Wage Inequality," NBER Working Paper 17976, April 2012.

A. Burstein, E. Morales, and J. Vogel, "Accounting for Changes in Between-Group Inequality," NBER Working Paper 20855, January 2015.

E. Helpman, O. Itskhoki, M.-A. Muendler, and S. J. Redding, "Trade and Inequality: From Theory to Estimation," NBER Working Paper 17991, April 2012.

R. Dix-Carneiro and B. K. Kovak, "Trade Liberalization and the Skill Premium: A Local Labor Markets Approach," NBER Working Paper 20912, January 2015; R. Dix-Carneiro and B. K. Kovak, "Trade Reform and Regional Dynamics: Evidence From 25 Years of Brazilian Matched Employer-Employee Data," NBER Working Paper 20908, January 2015.

G. M. Grossman, "Heterogeneous Workers and International Trade," NBER Working Paper 18788, February 2013, and the Review of World Economics (Weltwirtschaftliches Archiv), 149(2), 2013, pp. 211–45; G. M. Grossman, E. Helpman, and P. Kircher, "Matching and Sorting in a Global Economy," NBER Working Paper 19513, October 2013.

G. M. Grossman and E. Helpman, "Growth, Trade, and Inequality," NBER Working Paper 20502, September 2014.

C.-T. Hsieh and R. Ossa, "A Global View of Productivity Growth in China," NBER Working Paper 16778, February 2011.

T. Chaney, "Distorted Gravity: the Intensive and Extensive Margins of International Trade," American Economic Review, 98(4), 2008, pp. 1707–21; M. J. Melitz, "The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity," Econometrica, 71(6), 2003, pp. 1695-1725.

C. Arkolakis, A. Costinot, and A. Rodríguez-Clare, "New Trade Models, Same Old Gains?" American Economic Review, 102(1), 2012, pp. 94-130.

M. J. Melitz and S. J. Redding, "New Trade Models, New Trade Implications," NBER Working Paper 18919, March 2013, and the American Economic Review, 105(3), 2015, pp. 1105–46; see also M. J. Melitz and S. J. Redding, "Heterogeneous Firms and Trade," NBER Working Paper 18652, December 2012, and in G. Gopinath, E. Helpman, and K. Rogoff, eds., Handbook of International Economics, Volume 4, Amsterdam, The Netherlands: North-Holland, 2014, pp. 1-54.

M. J. Melitz and S. J. Redding, "Missing Gains from Trade?" NBER Working Paper 19810, January 2014, and the American Economic Review, 104(5), May 2014, pp. 317–21; T. Chaney and R. Ossa, "Market Size, Division of Labor, and Firm Productivity," NBER Working Paper 18243, July 2012, and the Journal of International Economics, 90(1), 2013, pp. 177–80.

A. M. Fernandes, P. J. Klenow, S. Meleshchuk, M. D. Pierola, and A. Rodríguez-Clare, "The Intensive Margin in Trade: Moving Beyond Pareto," NBER Working Paper w25195, October 2018

R. C. Feenstra, "Restoring the Product Variety and Pro-competitive Gains from Trade with Heterogeneous Firms and Bounded Productivity," NBER Working Paper 19833, January 2014.

C. Arkolakis, A. Costinot, D. Donaldson, and A. Rodríguez-Clare, "The Elusive Pro-Competitive Effects of Trade," NBER Working Paper 21370, July 2015.

R. C. Feenstra and D. E. Weinstein, "Globalization, Markups, and U.S. Welfare," NBER Working Paper 15749, February 2010, and forthcoming in the Journal of Political Economy.

P. Bertoletti, F. Etro, and I. Simonovska, “International Trade with Indirect Additivity,” NBER Working Paper 21984, December 2016

C. Hottman, S. J. Redding, and D. E. Weinstein, “Quantifying the Sources of Firm Heterogeneity,” NBER Working Paper 20436, August 2014.

D. Atkin, B. Faber, and M. Gonzalez-Navarro, “Retail Globalization and Household Welfare: Evidence from Mexico,” NBER Working Paper 21176, May 2015.

P. D. Fajgelbaum and A. K. Khandelwal, “Measuring the Unequal Gains from Trade,” NBER Working Paper 20331, July 2014.

A. Costinot and A. Rodríguez-Clare, “Trade Theory with Numbers: Q uantifying the Consequences of Globalization,” NBER Working Paper 18896, March 2013, and in G. Gopinath, E. Helpman, and K. Rogoff, eds., Handbook of International Economics, Volume 4, Amsterdam, The Netherlands: North-Holland, Elsevier, 2014, pp. 197–262.

L. Caliendo, R. C. Feenstra, J. Romalis, and A. M. Taylor, “Tariff Reductions, Entry, and Welfare: Theory and Evidence for the Last Two Decades,” NBER Working Paper 21768, December 2015.

J. De Loecker, P. K. Goldberg, A. K. Khandelwal, and N. Pavcnik, “Prices, Markups and Trade Reform,” NBER

Working Paper 17925, March 2012.

D. A. Irwin, “Tariff Incidence: Evidence from U.S. Sugar Duties, 1890–1930,” NBER Working Paper 20635,

October 2014.

K. Bagwell, R. W. Staiger, and A. Yurukoglu, “Multilateral Trade Bargaining: A First Look at the GATT Bargaining Records,” NBER Working Paper 21488, August 2015.

T. Chaney, “The Gravity Equation in International Trade: An Explanation,” NBER Working Paper 19285, August

2013.

T. Allen, C. Arkolakis, and Y. Takahashi, “Universal Gravity,” NBER Working Paper 20787, December 2014.

E. Morales, G. Sheu, and A. Zahler, “Gravity and Extended Gravity: UsingMoment Inequalities to Estimate a Model of Export Entry,” NBER Working Paper 19916, February 2014.

J. Eaton, S. S. Kortum, and S. Sotelo, “International Trade: Linking Micro and Macro,” NBER Working Paper 17864, February 2012.

I. Simonovska and M. E. Waugh, “Trade Models, Trade Elasticities, and the Gains from Trade,” NBER Working Paper 20495, September 2014.

R. C. Feenstra, P. A. Luck, M. Obstfeld, and K. Russ, “In Search of the Armington Elasticity,” NBER Working Paper 20063, April 2014.

D. E. Agnosteva, J. E. Anderson, and Y. V. Yotov, “Intra-national Trade Costs: Measurement and Aggregation,” NBER Working Paper 19872, January 2014.

F. Monte, S. J. Redding, and E. Rossi-Hansberg, “Commuting, Migration, and Local Employment Elasticities,” NBER Working Paper 21706, November 2015.

A. B. Bernard, A. Moxnes, and Y. U. Saito, “Production Networks, Geography and Firm Performance,” NBER Working Paper 21082, April 2015.

T. Allen and C. Arkolakis, “Trade and Topography of the Spatial Economy,” NBER Working Paper 19181, June 2013.

G. M. Ahlfeldt, S. J. Redding, D. M. Sturm, and N. Wolf, “The Economics of Density: Evidence from the Berlin

Wall,” NBER Working Paper 20354, July 2014.

S. J. Redding and M. Turner, “Transportation Costs and the Spatial Organization of Economic Activity,” NBER

Working Paper 20235, June 2014.

D. R. Davis and J. I. Dingel, “A Spatial Knowledge Economy,” NBER Working Paper 18188, June 2012;

D. R. Davis and J. I. Dingel, “The Comparative Advantage of Cities,” NBER Working Paper 20602, October 2014.

P. D. Fajgelbaum, E. Morales, J. C. S. Serrato, and O. M. Zidar, “State Taxes and Spatial Misallocation,” NBER

Working Paper 21760, November 2015.

R. Ossa, “A Quantitative Analysis of Subsidy Competition in the U.S.,” NBER Working Paper 20975, February 2015.

L. Caliendo, F. Parro, E. Rossi-Hansberg, and P.-D. Sarte, “The Impact of Regional and Sectoral Productivity

Changes on the U.S. Economy,” NBER Working Paper 20168, May 2014.

D. Atkin and D. Donaldson, “Who’s Getting Globalized? The Size and Implications of Intra-national Trade Costs,” NBER Working Paper 21439, July 2015.

A. K. Coşar and P. D. Fajgelbaum, “Internal Geography, International Trade, and Regional Specialization,”

NBER Working Paper 19697, December 2013.

See for example G. Peri, K. Shih, and C. Sparber, “Foreign and Native Skilled Workers: What Can We Learn from H-1B Lotteries?” NBER Working Paper 21175, May 2015; G.I.P. Ottaviano, G. Peri, and G. C. Wright,

“Immigration, Trade and Productivity in Services: Evidence from U.K. Firms,” NBER Working Paper 21200, May

2015; G. Peri and V. Yasenov, “The Labor Market Effects of a Refugee Wave: Applying the Synthetic Control Method to the Mariel Boatlift,” NBER Working Paper 21801, December 2015.

See for example A. E. Harrison, J. Y. Lin, and L. C. Xu, “Explaining Africa’s (Dis)advantage,” NBER Working Paper 18683, January 2013, and in World Development, 63(C), 2014, pp. 59–77; M. S. McMillan and K. Harttgen, “What is Driving the ‘African Growth Miracle’?” NBER Working Paper 20077, April 2014; D. Rodrik, “An African Growth Miracle?” NBER Working Paper 20188, June 2014; D. Atkin, A. Chaudhry, S. Chaudry, A. K. Khandelwal, and E. Verhoogen, “Organizational Barriers to Technology Adoption: Evidence from Soccer-Ball Producers in Pakistan,” NBER Working Paper 21417, July 2015.

D. Donaldson, A. Costinot, and C. B. Smith, “Evolving Comparative Advantage and the Impact of Climate Change in Agricultural Markets: Evidence from 1.7 Million Fields around the World,” NBER Working Paper 20079, April 2014.

K. Desmet and E. Rossi-Hansberg, “On the Spatial Economic Impact of Global Warming,” NBER Working Paper 18546, November 2012, and the Journal of Urban Economics, 88, July 2015, pp. 16–37.

C. Cattaneo and G. Peri, “The Migration Response to Increasing Temperatures,” NBER Working Paper 21622, October 2015