Highway Construction Costs During the Great Recession: Evidence from Texas

In 2009, responding to the so-called Great Recession, the federal government initiated a stimulus program, the American Recovery and Reinvestment Act (ARRA), that included infrastructure spending. The state of Texas used this funding to improve highways. It reaped a double benefit: the spending helped buoy its economy and the state completed projects more efficiently and at lower cost than in pre-recession times. In 2009, ARRA funding accounted for 38 percent of the total value of highway contracts awarded in Texas.

In Highway Procurement During the Great Recession and Stimulus (NBER Working Paper 33299), researchers Dakshina G. De Silva and Benjamin Rosa find that the recession reduced not only direct costs, such as the price of building materials, but also contractors’ opportunity costs in bidding for public highway projects. The researchers explain that “the dearth of private construction projects likely reduced contractor opportunity costs, which then contributed to the budget-efficient nature of projects procured during this period.” With fewer private-sector projects in the pipeline, contractors had more incentive to bid for public-sector opportunities, and they put in lower bids than in non-recession years.

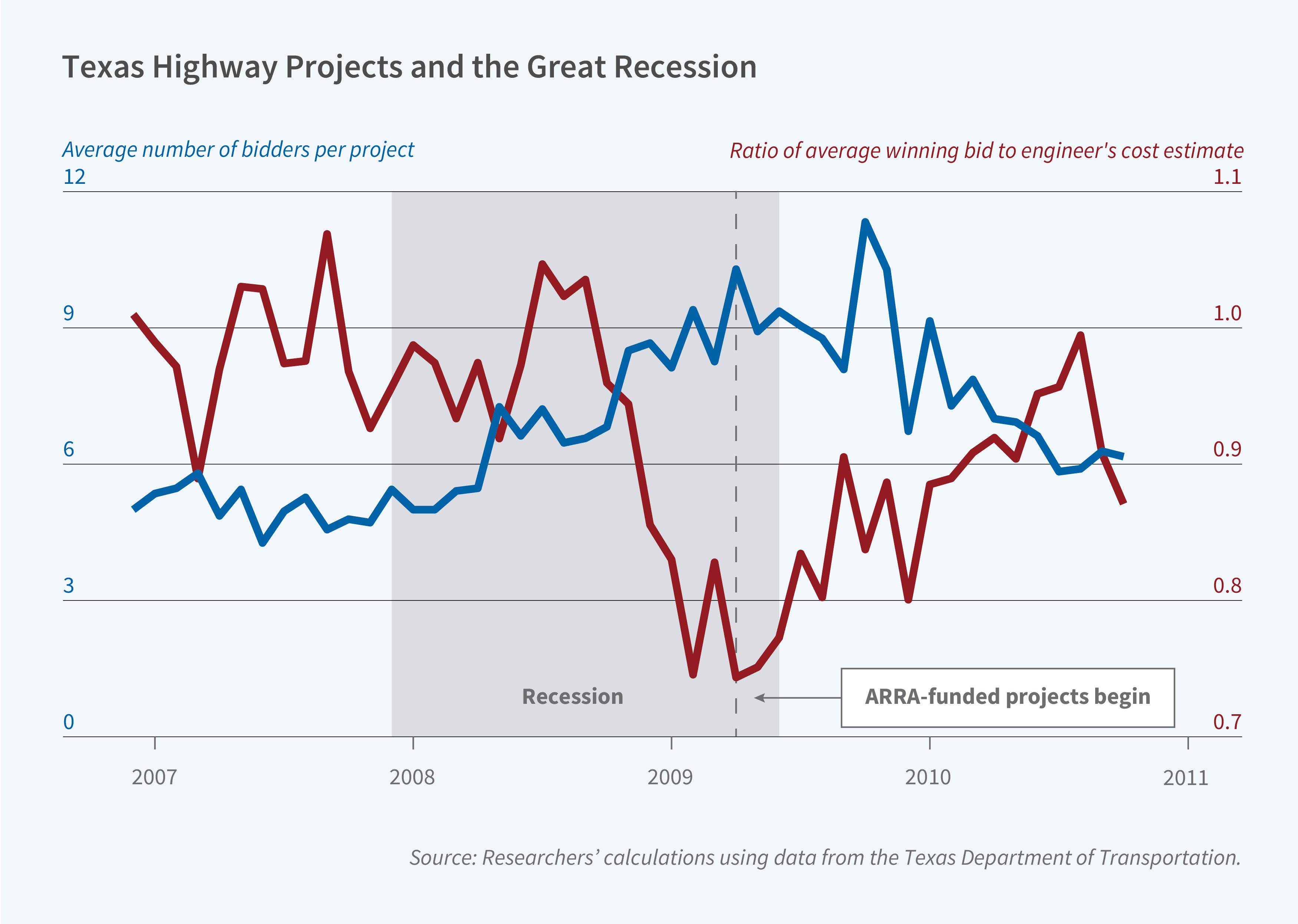

The 2009 recession drove down contractor bids and increased competition for highway projects, resulting in cost savings and improved efficiency.

The study looks at four years of contracts let by the Texas Department of Transportation (TxDOT) for highway structures — typically bridges and overpasses. That includes 242 projects in the year before the recession and 626 projects during the recession, which overlaps with the enactment of the ARRA of 2009. Before the recession, the average bid was about $4.26 million; when the recession-era ARRA stimulus was in place, it fell to $3.44 million. A significant portion of the $789 billion of ARRA spending went towards boosting government purchases through public procurement, including $27.5 billion for highway construction.

In Texas, recession-era highway procurement attracted an average of two additional bidders for each project. The researchers estimate that contractors’ opportunity costs of carrying out a public project, which affect their bids, declined by about 2.5 percent of project cost. TxDOT engineers’ cost estimates fell during the recession, but the bids fell even more. Pre-recession, the average bid was 105 percent of the engineers’ estimate; during the recession, it was only 93 percent. The researchers also find that the efficiency of the contracting process during the recession increased relative to contracting before the Great Recession.

— Laurent Belsie