Program Report: Economic Fluctuations and Growth, 2003

The NBER's Research Program on Economic Fluctuations and Growth marks its 25thanniversary this year. During the long U.S. economic expansion of the 1990s -- the longest in the chronology maintained by the NBER -- topics related to growth played a large role in the Program's activities. With the onset of a recession in early 2001, research on economic fluctuations has gained additional attention.

The Business Cycle Dating Committee

The EFG Program hosts the Business Cycle Dating Committee which carries out a long-standing function of the NBER, the maintenance of a chronology of the U.S. business cycle. The Bureau began compiling the chronology in the early 1920s; it now covers almost a century and a half of business-cycle history. I chair the committee, which also includes Martin Feldstein, Jeffrey A. Frankel, Robert J. Gordon, Christina D. Romer, David H. Romer, and Victor Zarnowitz.

On November 26, 2001, the committee announced that a recession had begun in the U.S. economy in March 2001. That is, a peak in economic activity occurred during March and the economy began to contract. A recession is a significant decline in activity spread across the economy, lasting more than a few months, visible in real gross domestic product, employment, and other indicators of activity. The committee determined in November 2001 that these conditions had been met.

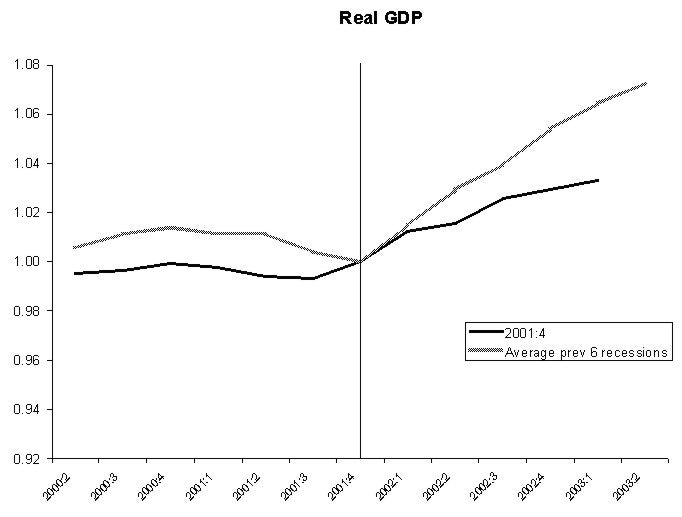

On July 17, 2003, the committee announced that the recession had ended in November of 2001. The trough marked the end of the recession that began in March 2001 and the beginning of an expansion. The recession lasted eight months, which is slightly less than average for recessions since World War II. Real GDP has grown since the trough, as shown in the figure below.

Quarterly Real GDP

The dark line shows the movement of quarterly real GDP in 2000-2003 and the shaded line the average over the previous 6 recessions. Source: Bureau of Economic Analysis, U.S. Department of Commerce (https://www.bea.gov/).

The current recovery has not seen as high a growth rate of real GDP as in the average recovery. In addition, productivity has grown unusually rapidly during the recession and recovery. As a result, employment has continued to decline slightly during the recovery. In dating the trough, the committee relied on the tradition of the Bureau's business-cycle dating procedure that emphasized output as the measure of economic activity, rather than employment.

Research Meetings

Research Groups

Much of the activity of the EFG program occurs in its research groups. The groups meet during the NBER's Summer Institute in July in Cambridge and occasionally at other times and locations as well.

Economic Growth - Charles I. Jones and Peter J. Klenow, Leaders

This group conducts research on a range of subjects related to long-run economic performance. Its meetings focus on such topics as differences in income across countries, firm-level productivity growth, and technical progress over time, as illustrated by the following papers:

Based on a study of immigrants, Lutz Hendricks1 presents new evidence on the sources of cross-country income differences. His estimates suggest that, for countries whose output per worker is below 40 percent of U.S. output per worker, less than half of that relative output gap can be attributed to human and physical capital.

Simon Djankov, Rafael La Porta, Florencio Lopez de Silanes, and Andrei Shleifer2 present new data on the regulation of entry of start-up firms in 85 countries containing information on the number of procedures, official time, and official cost that a start-up must bear before it can operate legally. The official costs of entry are high in most countries, and could explain a portion of the sizable income differences across countries.

Daron Acemoglu, Simon Johnson, and James Robinson3 study the interplay between growth and institutions. They show that the rise of Europe between 1500 and 1850 was driven primarily by cities along the Atlantic coast, especially by those engaged in colonialism and long-distance oceanic trade. The economic benefits from this trade strengthened the commercial class, leading to improvements in property rights and institutions that furthered Western European growth and the emergence of the modern world.

One widely held view is that competitive pressure can boost firm productivity, but the evidence to support this view is not plentiful. Jose Galdon-Sanchez and James Schmitz4 therefore study the U.S. and Canadian iron-ore industries in the early 1980s. They find that an increase in domestic and international competition did lead to large gains in labor productivity at continuing mines producing the same products with the same technology. Tor Jakob Klette and Samuel Kortum5 also study firm productivity, but they emphasize R and D rather than competition. Their research explains why R and D as a fraction of revenues is related strongly to firm productivity yet largely unrelated to firm size or growth.

Rodolfo Manuelli and Ananth Seshadri6 study the lag between the introduction of technology and its adoption. According to the conventional wisdom, slow technology diffusion suggests some sort of friction, for example vintage physical capital, vintage human capital, or local informational externalities. Their work, based on the diffusion of tractors in the United States between 1910 and 1960, shows otherwise.

Consumption - Orazio Attanasio, Christopher D. Carroll, and Jose Victor Rios-Rull, Leaders

This research ranges from purely empirical studies using microeconomic data to purely theoretical analyses of dynamic stochastic general equilibrium models with uninsurable idiosyncratic risk.

Nicholas Souleles and his co-authors7 use microeconomic data to show that the timing of a household's receipt of a tax rebate check has a very strong effect on the timing of household spending, contrary to the predictions of standard consumption theory.

Jonathan Heathcote, Kjetil Storesletten, and Gianluca Violante8 explore the macroeconomic and welfare implications of the sharp rise in U. S. wage inequality over the last several decades. They show that if a substantial component of the increased wage variation is transitory but persistent, a standard optimizing model can reconcile the widening income distribution with a stable distribution of consumption across families.

Over the last few years several papers have examined why households in the uppermost part of the permanent income distribution save so much more than the typical household. Among the potential explanations explored have been: imperfect capital markets that require business ventures to be self-financed9,10; the risk of medical expenses that will not be covered by insurance11; and preferences that embody habit formation rather than the usual intertemporal separability12.

Another persistent recent thread has been the importance of spending on durable goods. Brian Peterson13 develops a theoretical model that generates strong cyclicality of spending on housing via an interaction between cyclical variations in uncertainty and the effect of uncertainty on spending when there are durable goods that can't be resold. Burcu Duygan14 presents complementary microeconomic empirical work, showing that, controlling for the fall in income during the 1994 Turkish financial crisis, those consumers whose unemployment risk increased more cut their spending on durable goods by more. In previous years, Antonia Diaz and María José Luengo-Prado15 argued that understanding the dynamics of durable goods ownership can substantially modify the interpretation of wealth inequality in microeconomic data. Also, Dirk Krueger and Jesus Fernandez-Villaverde16 suggested that when the concentration of durable goods expenditures in the early years of the life cycle is taken into account, life-cycle patterns of total consumption of services are less steeply sloped than appears when only spending on nondurables and services are considered together.

Income Distribution and Macroeconomics - Roland Benabou, Steven N. Durlauf, and Oded Galor, Leaders

The marked rise in inequality in most developed countries over the past 20 years again has brought income distribution to the forefront of economists' and policymakers' concerns. NBER researchers have explored a wide range of issues related to the sources and consequences of inequality at both the national and international levels. This research group is notable for its combination of empiricists, theorists, and econometricians. The interactions across their research orientations have led to valuable cross-fertilization in individual research programs and to general progress on the broad issues that lie at the core of the group's interests.

The group devoted significant attention to three fundamental research avenues: 1) the identification of channels through which the distributions of income, human capital, and financial assets affect aggregate performance in the medium and long run, within and across countries; 2) the determinants of inequality itself, in terms of both exogenous shocks and sources of persistence; and 3) the role of political institutions and social conflict in the determination of cross-country growth differences, including the use of history in understanding contemporaneous economic issues.

For instance, Dilip Mookherjee and Debraj Ray17 focus on credit market frictions and related principal-agent contractual imperfections. The authors identify general conditions under which poverty traps, resulting in persistent inequality and suboptimal output, can appear. On the empirical side, the often-nonlinear implications of credit-constraint models for the relationship between inequality and growth have motivated research by Abhijit Banerjee and Esther Duflo.18 They critically re-examine previous econometric studies of this relationship, particularly those using panel data. Francesco Casselli and Nicola Gennaioli19 present a model of occupational choice with contractual imperfections. It attributes a significant fraction of the income gap between less developed, countries (LDCs) and advanced countries to a misallocation of talents, taking the form of a much higher share of family-owned firms in LDCs.

Mathias Thoenig and Thierry Verdier20 present a model of how firms in developed countries respond to competition from low-wage countries with defensive skill-biased technological innovations that further exacerbate wage inequality. Michael Kremer and Eric Maskin21 show how international trade and outsourcing lead to a rematching of workers of different skill levels across countries into different production structures or teams, thus explaining the simultaneous rise in earnings inequality in both the developed and the developing world. Taking a longer, historical perspective, Oded Galor and Andrew Mountford22 show how the emergence of international trade in the nineteenth century, leading countries like India to specialize away from skill-intensive goods, delayed these countries' demographic transition by skewing fertility choices towards quantity rather than "quality" of children, and how this causes divergent growth performances.

There also has been work on social interactions and the macroeconomic implications of sorting, including a paper by Raquel Fernandez, Nazih Guner, and John Knowles,23 that presents a model of marital sorting among men and women with different education levels. William Brock and Steven N. Durlauf24 develop methods for studying neighborhood and peer effects. Among the empirical studies are a paper by William Easterly25 on the dynamics of racial segregation in U.S. cities, and one by Jeffrey B. Liebman, Jeffrey R. Kling, and Lawrence F. Katz26 on studying the effects of the Moving to Opportunity housing voucher program on the educational and labor market outcomes of children and adults in poor households.

On the political-economy side of macroeconomics work, the work includes a paper by Olivier J. Blanchard and Francesco Giavazzi27 that examines how deregulation in goods and labor markets will affect unemployment and wage dynamics, in particular explaining recent movements in the labor share. Together with Thomas Philippon, Blanchard28 also presents a study of how the dismantling of barriers to entry and capital mobility has eroded rents, with a positive effect on efficiency in the long run, but a possible adverse effect in the medium run in countries where learning by unions is slowest. Gilles-Saint Paul29 develops a model of job creation and job destruction in a growing economy with embodied technical progress, and uses it to analyze the political support for employment protection legislations.

Another important line of inquiry -- by John Hassler, Jose Rodriguez Mora, Kjetil Storesletten, and Fabrizio Zilibotti30 -- is why the welfare state is so different in Europe compared to the United States. Alberto Alesina and Eliana LaFerrara31 use individual data to show how a person's support for redistributive policies is affected negatively by her perceived likelihood of moving up in the income distribution and by the extent to which she believes that American society offers equal opportunities to all.

The role of institutions in promoting or hindering growth has also been studied theoretically and empirically from a historical perspective. Daron Acemoglu, Simon Johnson, and James Robinson32 provide evidence that among countries colonized by European powers, those that were relatively rich in 1500 are now relatively poor. They argue that this reversal of fortune reflects the introduction of institutions encouraging investment in regions that were previously poor. Oded Galor, Omer Moav, and Dietrich Vollrath33 present a theory of the development process in which complementarity between human and physical capital leads powerful landlords to switch from opposing public education to supporting it.

Forecasting and Empirical Methods in Macroeconomics and Finance - Mark W. Watson and Kenneth D. West, Leaders

This group focuses on the development and assessment of econometric methods for use in empirical macroeconomics and finance, placing special emphasis on problems of prediction. It meets jointly with a group on forecasting, under the Committee on Econometrics and Mathematical Economics umbrella, with support from the National Science Foundation.

Recent meetings have discussed: methods and applications of factor models for macroeconomic forecasting and structural analysis; nonlinear forecasting models and methods; inference issues in models with persistent regressors; evaluating models using out-of-sample predictive accuracy tests; instrumental variable and GMM methods; and empirical asset pricing.

These papers use panel datasets with large cross-section and time dimensions. Ben Bernanke, Jean Boivin, and Piotr Eliasz34 and Domenico Giannone, Lucrezia Reichlin, and Luca Sala35 use factor models to study monetary policy in the United States. Policymakers at the Federal Reserve set interest rates after studying hundreds or even thousands of time series for clues about the current and future behavior of inflation and real activity. This means that the small vector autoregressions often used to study monetary policy may suffer from important omitted variables bias and thus yield misleading results about monetary policy.

The usual VAR methods cannot be used when the number of time series is large because the number of parameters in the VAR is proportional to the square of the number of series. Factor models can solve this problem. In these models, latent or unobserved factors are used to explain the co-movement of a set of time series. These factors can be used to summarize the information in a large number of time series. The empirical analysis in the two papers just described is complementary. The first studies the effects of monetary policy shocks, and the second studies technology and aggregate demand shocks. The results suggest that during the Greenspan era, the Federal Reserve has raised interest rates in response to aggregate demand shocks, but has changed rates far less in response to technology shocks.

Jushan Bai36 provides some important statistical foundations for the use of principal components. He shows that when the cross section is sufficiently large, the sampling error in the estimated factors can be ignored when carrying out many of the usual kinds of statistical inference, such as constructing confidence intervals for forecasts or standard errors on VAR impulse responses. Bai's work along with the work of others in this group set the stage for a much broader use of structural factor models in macroeconometrics.

The Labor Market in Macroeconomics - Richard Rogerson, Robert Shimer, and Randall Wright, Leaders

The labor market is central to many issues in macroeconomics, including business cycles, unemployment, inequality, and growth. This group's research ranges from foundational work on model building, to quantitative evaluation of models, substantive policy evaluation, and data description.

The idea that trading frictions play an important role in shaping aggregate labor market outcomes has become increasingly standard over the past years. The early work of Peter A. Diamond, Dale Mortensen, and Christoper Pissarides has spawned a class of models that have become the standard in formalizing these trading frictions. Many of the papers presented in this group add to this overall research effort, albeit along very different dimensions.

In the context of these models, frictions can help us to understand why the steady state unemployment rate is as high as it is in a country like the United States. But another key issue is to what extent these frictions help us to understand cyclical fluctuations in unemployment. Robert Shimer37 argues that in the standard matching model the frictions can account for only a small fraction of cyclical fluctuations in the labor market. An important driving force behind this result is that the standard model assumes that wages are determined by Nash bargaining, which in turn implies that wages increase during good times and thus seriously dampen the incentives of firms to create new jobs. In a more recent paper, I38 build on these insights by showing that a particular formulation of wage setting is consistent with both no unrealized bilateral gains to trade and wages that are relatively unresponsive to shocks to the value of a match. As a result, I provide an internally consistent model of labor market fluctuations that can replicate the main stylized facts.

I show too that matching models have a large set of equilibrium wages that are consistent with no unrealized bilateral gains to trade. In that setting, empirical understanding of wage determination is central. Mortensen39 uses matched worker-firm data from Denmark to compare Nash bargaining to unilateral wage-setting by workers, with employment then determined by the firm. He finds that the Nash bargaining mechanism does a better job of matching the data.

One issue that has seen ongoing attention in this group is the effect of labor market institutions on labor market outcomes. The topics covered include: the implications of fixed-term labor contracts in the European context; the short-run effects of labor market flexibilization in Argentina; the role of taxes on labor market outcomes in Europe compared to the United States; the effects of firing costs and wage compression on unemployment durations; and the effect of labor market regulations on measured productivity.

Empirical work on labor market dynamics stresses the large magnitude of labor market flows. Many of these flows consist of workers making job-to-job transitions. Gadi Barlevy40 demonstrates that the reallocation of workers to better matches associated with the job-to-job flows is reduced in recessions. This effect opposes the cleansing effect of recessions that has been widely cited. Ken Burdett, Ryoichi Imai, and Randall Wright41 show that a model with on-the-job search (and hence job-to-job transitions) will lead quite naturally to multiple equilibriums that can be ranked in terms of the overall level of turnover.

Capital Markets and the Economy - Janice C. Eberly and Deborah J. Lucas, Leaders

This group brings together researchers working on capital markets from a variety of perspectives, including corporate finance, asset pricing, macro and monetary economics, international economics, and consumption/investment. Their common goal is a better understanding of the determinants and interactions of real and financial investments, and their effect on individual welfare and the macroeconomy. Recent work in this group centers on the effect of regulation on real investment; determinants of individual portfolio choice; the impact of financing constraints and irreversibility on firm-level investment; and the role of institutions, information, and beliefs in financial markets.

Alberto Alesina, Silvia Ardagna, Giuseppe Nicoletti, and Fabio Schiantarelli42 find that various measures of regulation are negatively related to investment in physical capital. The authors use a new dataset on product market regulation of communications, utilities, and transportation in a set of OECD countries. Their results indicate that entry barriers have a particularly strong negative effect on new investment.

Simon Gilchrist and Marc Rysman43 develop and study a new dataset on Chilean manufacturing plants to estimate a model of discrete investment useful for policy analysis. Joao Gomes, Amir Yaron, and Lu Zhang44 specify and estimate a model of investment with adjustment costs and costly external financing. Using both aggregate measures, such as the default premium, and firm-specific measures, such as leverage, they find no significant role for a financing premium in investment returns.

Andrea Caggese45 studies the behavior in industry equilibrium of firms facing both a borrowing constraint and a non-negativity constraint on investment. His results suggest that the two constraints are mutually reinforcing, even though the financing constraint binds when the firm is growing, while the irreversibility constraint binds when the firm would prefer to shrink. The second constraint amplifies the effect of either alone, and leads to inventory behavior consistent with what is found empirically.

Stephen Bond's paper on physical investment46 takes a more theoretical perspective on such investment and financing constraints, examining its sensitivity to cash flow. He analyzes the effect of cash flow on investment when a control for fundamentals is included in an investment regression. His results indicate that firms with a greater sensitivity of investment to cash flow will have a larger external financing premium. Thus, in this sense, cash flow sensitivity can be interpreted as a measure of the severity of financing constraints.

Turning to the role of financial institutions in credit markets, Joseph Peek and Eric S. Rosengren47 use firm- and bank-level evidence from Japan to examine the allocation of credit in the Japanese banking system. Their results suggest that additional credit is channeled to firms in poor financial condition, and that these firms continue to perform poorly even after the extension of credit. Refet Gurkaynak48 considers whether the capital structure of bank intermediaries can exacerbate economic shocks through a credit channel.

Two papers address aspects of portfolio choice. Francisco Gomes, Alexander Michaelides, and Valery Polkovnichenko49 look at the optimal allocation of tax-deductible assets between tax sheltered and non-sheltered accounts, in a calibrated life-cycle model with labor income shocks. The model implies segregation of assets bearing high tax rates in tax deferred accounts. Many investors appear to contradict this advice, holding taxable investments such as dividend paying stocks and bonds outside of sheltered accounts. Entrepreneurs make financial investment decisions that interact with their ability to invest in entrepreneurial activity. Hugo Hopenhayn and Galina Vereshchagina50 show that capital constraints can induce risk-preferring behavior by entrepreneurs, especially early in their careers. This might help to explain the apparently high risk-to-reward ratio many entrepreneurs seem to choose.

Understanding the relationship between financial market prices and fundamental value is the topic of the final two papers. I51 derive the relationship between earnings and prices in a model with adjustment costs. Robert Chirinko and Huntley Schaller52 find some evidence that financial market valuations overly influence the level of real investments, by looking at the success of future investments as a function of past financial returns.

Impulses and Propagation Mechanisms - Martin S. Eichenbaum and Lawrence J. Christiano, Leaders

This group considers two key issues: 1) what are the major sources of fluctuations in economic activity? and 2) what are the key mechanisms by which these shocks are propagated across sectors of the economy, over countries and over time? In exploring these questions, group members focus on three related activities: empirically identifying the effects of exogenous shocks on the economy; constructing empirical general equilibrium models of economic fluctuations; and exploring the efficacy of alternative policy responses to different shocks.

Jordi Gali, David Lopez-Salido, and Javier Valles;53 Lawrence Christiano, Martin Eichenbaum, and Robert Vigfusson;54 and David Altig, Christiano, Eichenbaum, and Jesper Linde55 all work on isolating the effects of technology shocks on the U.S. economy. The key issues here are: how we can reliably identify aggregate technology shocks to the economy, including their effects on key macro variables like employment, and what role has monetary policy played in the transmission of these shocks? The previous papers argue that technology shocks generate expansions in employment. But the reason the U.S. economy responds to technology shocks the way it does has to do with monetary policy. The models developed in these papers suggest that if the Fed had not been accommodative in response to a positive technology shock, employment initially would have fallen rather than expanded in the wake of technology shocks.

Other members of this group focus on measuring the effects of fiscal shocks. For example, Craig Burnside, Eichenbaum, and Jonas Fisher56 investigate the response of hours worked and real wages to changes in military purchases. A military shock causes a persistent increase in government purchases and a rise in tax rates, plus a persistent rise in aggregate hours worked and a decline in real wages. Susantu Basu and Miles Kimball57 argue that models embodying nominal rigidities provide a more convincing account of this evidence. Using different identifying assumptions, Gali, Lopez-Salido, and Valles58 show that shocks to government purchases do not lead to expansions in aggregate employment and output but to a rise in real wages. This leads them to explore non-neoclassical mechanisms to account for the effects of shocks to government purchases.

Christiano, Eichenbaum, and Charles Evans59 construct and estimate a dynamic general equilibrium model embodying nominal wage rigidities as well as frictions to the real side of the economy. Michelle Alexopoulos60 argues that efficiency wages and segmented financial markets play a key role in the monetary transmission mechanism. Consistent with this emphasis on labor market frictions, Gali, Mark Gertler, and Lopez-Salido61 develop a theory-based measure of the variations in aggregate economic efficiency associated with business fluctuations. They decompose this indicator, which they refer to as "the gap," into two constituent parts: a price markup and a wage markup. They show that the latter accounts for the bulk of the fluctuations in their gap measure.

Jess Benhabib, Stephanie Schmitt-Grohe, and Martin Uribe62 explore the nature of optimal monetary policy once the zero bound on nominal interest rates is taken into account. They argue that Taylor-type interest-rate feedback rules give rise to unintended self-fulfilling decelerating inflation paths and aggregate fluctuations driven by arbitrary revisions in expectations. They then propose several fiscal and monetary policies that preserve the appealing features of Taylor rules, such as local uniqueness of equilibrium near the inflation target, and at the same time rule out the deflationary expectations that can lead an economy into a liquidity trap. Finally, Gauti Eggertsson and Michael Woodford63 study optimal monetary policy in a New Keynesian model when real disturbances cause the natural interest rate to be temporarily negative.

Endnotes

L. Hendricks, "How Important is Human Capital for Development? Evidence from Immigrant Earnings," American Economic Review, 92 (March 2002), pp. 198-219.

S. Djankov, R. La Porta, F. Lopez de Silanes, and A. Shleifer, "The Regulation of Entry," NBER Working Paper 7892, September 2000, and Quarterly Journal of Economics, 117 (February 2002), pp. 1-37.

D. Acemoglu, S. Johnson, and J. Robinson, "The Rise of Europe: Atlantic Trade, Institutional Change and Economic Growth," NBER Working Paper 9378, December 2002.

J. Galdon-Sanchez and J. Schmitz, "Competitive Pressure and Labor Productivity: World Iron-Ore Markets in the 1980s," American Economic Review, 92 (September 2002), pp. 1222-35.

T. Klette and S. Kortum, "Innovating Firms and Aggregate Innovation," NBER Working Paper 8819, February 2002.

R. Manuelli and A. Seshadri, "Frictionless Technology Diffusion: The Case of Tractors," NBER Working Paper 9604, April 2003.

N. Souleles, S. Agarwal, C. Liu, D. Johnson, and J. Parker, "The Response of Consumer Spending and Debt to Tax Rebates: Evidence from the CEX and the Household Credit Accounts," manuscript, 2003.

J. Heathcote, K. Storesletten, and G. Violante, "The Macroeconomic Implications of Rising Wage Inequality in the U.S.," manuscript, 2003.

E. French and J. Jones, "On the Distribution and Dynamics of Health Care Costs," manuscript, 2003.

B. Peterson, "Aggregate Uncertainty, Individual Uncertainty, and the Housing Market," manuscript, 2003.

B. Duygan, "Analyzing Durable Goods Purchases and Idiosyncratic Income Uncertainty," manuscript, 2003.

A. Diaz and M. Luengo-Prado, "Precautionary Savings and Wealth Distribution with Durable Goods," manuscript, 2003.

D. Krueger and J. Fernandez-Villaverde, "Consumption over the Life Cycle: Facts from Consumer Expenditure Survey Data," NBER Working Paper 9382, December 2002.

D. Mookherjee and D. Ray, "Persistent Inequality," Review of Economic Studies, 70 (April 2003), pp. 369-93.

A. Banerjee and E. Duflo "Inequality and Growth: What can the Data Say?" Journal of Economic Growth, 8 (September 2003).

F. Caselli and N. Gennaioli, "Dynastic Management," NBER Working Paper 9442, January 2003.

M. Thoenig and T. Verdier, "A Theory of Defensive Skill-Biased Innovation and Globalization", American Economic Review, 93 (June 2003), pp. 709-28.

O. Galor and A. Mountford, "Trade, Demographic Transition, and the Great Divergence," Brown University manuscript, 2003.

R. Fernandez, N. Guner, and J. Knowles, "Inequality, Education, and Marital Sorting," NBER Working Paper 8580, November 2001.

W. Brock and S. Durlauf, "Multinomial Choice with Social Interactions," NBER Technical Working Paper 288, March 2003.

W. Easterly, "The Racial Tipping Point in American Neighborhoods: Unstable Equilibrium or Urban Legend," New York University manuscript, 2003.

J.B. Liebman, J. R. Kling, and L.F. Katz, "What Randomized Experiments Can Teach Us About Social Interactions," Harvard University manuscript, 2003.

O. J. Blanchard and F. Giavazzi, "Macroeconomic Effects of Regulation and Deregulation in Goods and Labor Markets" Quarterly Journal of Economics, 118 (August 2003).

G. Saint-Paul, "The Political Economy of Employment Protection," Journal of Political Economy, 110 (June 2002), pp. 672-701.

J. Hassler, J. Rodriguez Mora, K. Storesletten, and F. Zilibotti, "The Survival of the Welfare State," American Economic Review, 93 (March 2003), pp. 87-112.

A. Alesina and E. LaFerrara, "Preferences for Redistribution in the Land of Opportunities," NBER Working Paper 8267, May 2001.

O. Galor, O. Moav, and D. Vollrath, "Land Inequality and the Origin of Divergence and Overtaking in the Growth Process: Theory and Evidence," Brown University manuscript, 2002.

B. Bernanke, J. Boivin, and P. Eliasz, "Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Auto-Regressive (FAVAR) Approach," manuscript, 2003.

D. Giannone, L. Reichlin, and L. Sala, "Tracking Greenspan: Systematic and Unsystematic Monetary Policy Revisited," CEPR Discussion Paper 3550, 2002.

R. Shimer, "The Cyclical Behavior of Equilibrium Unemployment and Vacancies: Evidence and Theory," NBER Working Paper 9536, March 2003.

G. Barlevy, "The Sullying Effects of Recessions," Review of Economic Studies, (January 2002), pp. 65-96.

K. Burdett, R. Imai, and R. Wright, "Unstable Relationships," PIER Working Paper No. 02-037, 2002.

A. Alesina, S. Ardagna, G. Nicoletti, and F. Schiantarelli, "Regulation and Investment," NBER Working Paper 9560, March 2003.

S. Gilchrist and M. Rysman, "Trade Liberalization and Lumpy Investment: Evidence from Chilean Plant-level Data," manuscript, 2003.

J. Gomes, A. Yaron, and L. Zhang, "Investment and Returns with Financing Constraints: Evidence Using Firm Data," manuscript, 2003.

A. Caggese, "Financing Constraints, Irreversibility, and Investment Dynamics," manuscript, 2003.

J. Peek and E.S. Rosengren, "Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan," NBER Working Paper 9643, April 2003.

F. Gomes, A. Michaelides, and V. Polkovnichenko, "Life Cycle Portfolio Choice with Taxable and Tax Deferred Accounts," manuscript, 2003.

J. Gali, J. Lopez-Salido, and J. Valles, "Technology Shocks and Monetary Policy: Assessing the Fed's Performance," NBER Working Paper 8768, February 2002.

L.J. Christiano, M.S. Eichenbaum, and R. Vigfusson, "What Happens after a Technology Shock," NBER Working Paper 9819, July 2003.

D. Altig, L.J. Christiano, M.S. Eichenbaum, and J. Linde, "Technology Shocks and Aggregate Fluctuations," manuscript, 2003.

C. Burnside, M.S. Eichenbaum, and J. Fisher, "Fiscal Shocks and Their Consequences," NBER Working Paper 9772, June 2003.

S. Basu and M. Kimball, "Investment Planning Costs and the Effects of Fiscal and Monetary Policy," manuscript, 2003.

J. Gali, D. Lopez-Salido, and J. Valles, "Technology Shocks and Monetary Policy: Assessing the Fed's Performance," NBER Working Paper 8768, February 2002.

L.J. Christiano, M.S. Eichenbaum, and C. Evans, "Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy," NBER Working Paper 8403, July 2001.

J. Gali, M. Gertler, and D. Lopez-Salido, "Markups, Gaps, and the Welfare Costs of Business Fluctuations," NBER Working Paper 8850, March 2002.

J. Benhabib, S. Schmitt-Grohe, and M. Uribe, "Backward-Looking Interest-Rate Rules, Interest-Rate Smoothing, and Macroeconomic Instability," NBER Working Paper 9558, March 2003.