Government Support and Corporate Debt Restructuring

Since the global financial crisis of 2008, policymakers have increasingly turned to unconventional stabilization policies when confronting large macroeconomic shocks. When the COVID-19 shock hit in 2020 and capital flows retrenched, such tools took center stage, especially across emerging markets with limited fiscal space.

In Firm Financing During Sudden Stops: Can Governments Substitute Markets? (NBER Working Paper 33283), Miguel Acosta-Henao, Andrés Fernández, Patricia Gomez-Gonzalez, and Şebnem Kalemli-Özcan study the effectiveness of new central bank credit lines and government-backed credit guarantees on commercial loans to firms in Chile when the pandemic triggered a large sudden stop event — the abrupt withdrawal of international capital. They do so through the empirical analysis of a unique micro dataset of Chilean firms and by exploiting size-based eligibility thresholds on these policies that allow for clean identification of policy effects through regression discontinuity.

Government credit guarantees in Chile mitigate sudden stops in international capital flows by enabling firms to increase their domestic borrowing.

The government’s policies took two forms: a new credit line facility at the Banco Central de Chile for commercial banks that were expanding credit to firms below a given size threshold, and government guarantees on commercial bank loans for the same firms.

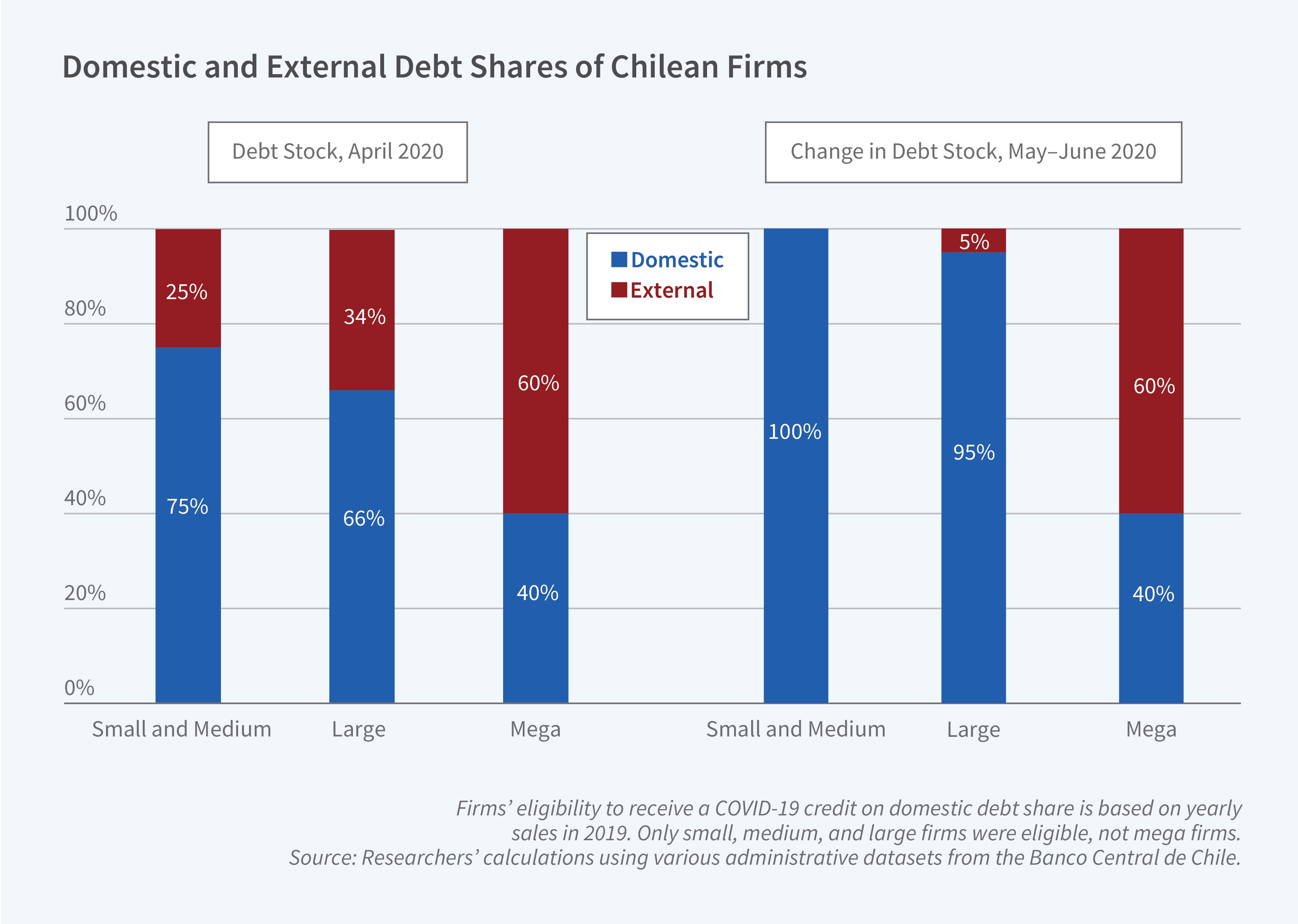

The researchers’ analysis shows that eligibility for government guarantees caused firms to increase their domestic debt share. They also find that the mechanism underlying the increase in domestic debt is the pricing of credit risk. Analysis of loan-level data reveals that, during normal times, Chilean firms face a domestic uncovered interest parity premium on loans in local currency from domestic lenders of about 3 percent. This premium rose to 7 percent between March and May 2020, at the height of the pandemic-induced sudden stop, and then dropped below pre-pandemic levels after the policy interventions were implemented.

The researchers attribute their findings to the complementarity of the government’s policies, which effectively reduced the cost of domestic currency debt relative to foreign currency debt during the sudden stop. By lowering risk aversion among domestic financial intermediaries and boosting domestic credit supply, the government credit guarantees helped compensate for the reduced availability of international capital. Banks, motivated by the new credit line facility, were incentivized to extend loans to smaller firms.

The unconventional policies pursued in Chile effectively lowered the relative cost of domestic capital in the short term, which suggests more generally that it is possible to incentivize domestic lenders to replace disappearing foreign capital flows during short-term stress events.

— Lauri Scherer