The Inflation Reduction Act and the Electric Vehicle Market

The Inflation Reduction Act (IRA) relied heavily on electric vehicle (EV) subsidies to advance its goal of decarbonizing the US transportation sector. In The Effects of “Buy American”: Electric Vehicles and the Inflation Reduction Act (NBER Working Paper 33032), Hunt Allcott, Reigner Kane, Maximilian S. Maydanchik, Joseph S. Shapiro, and Felix Tintelnot find that the net social benefits of these subsidies were moderate compared with their costs.

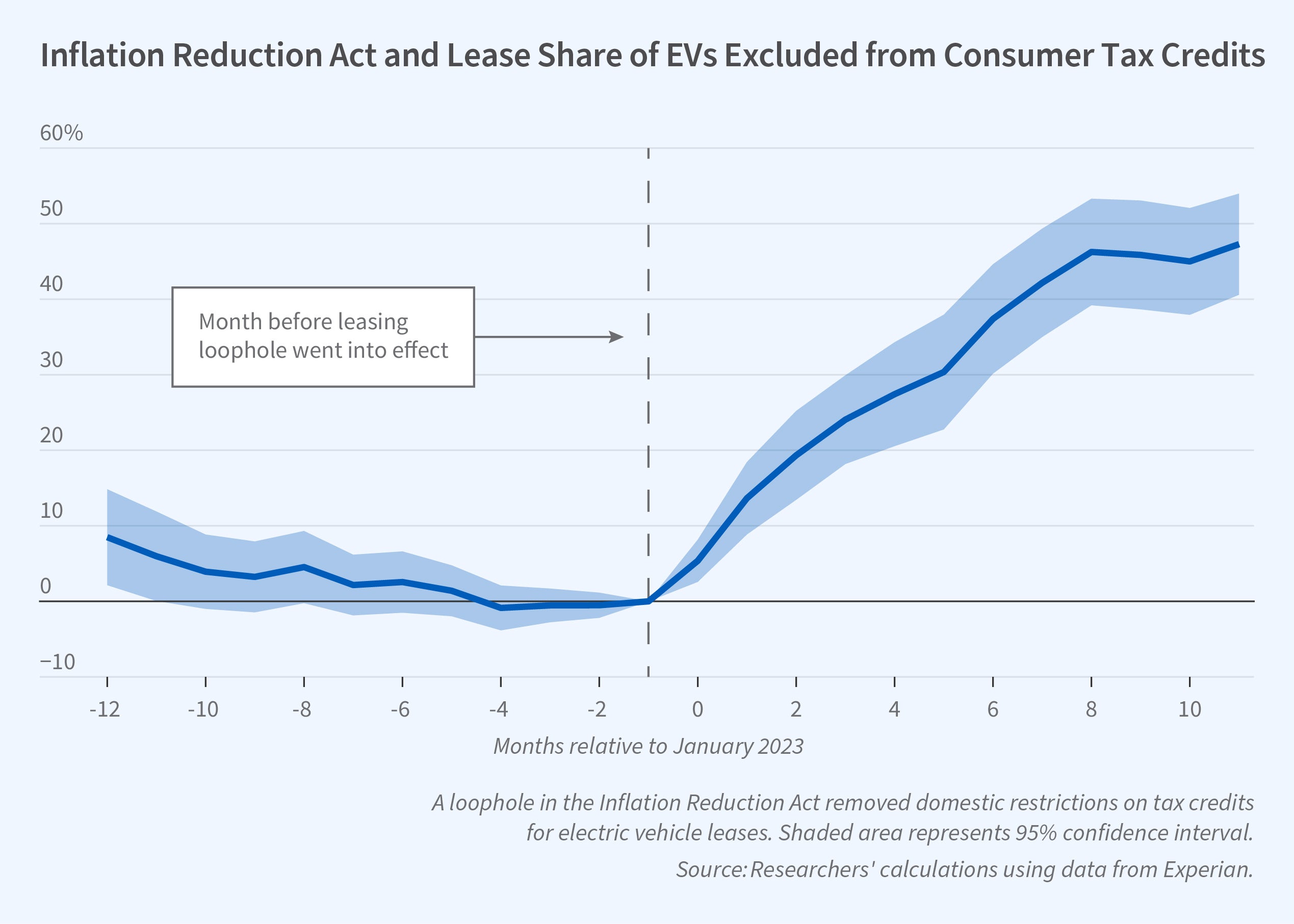

A leasing provision in the IRA that allowed foreign-made EVs to qualify for a tax subsidy resulted in a sharp increase in EV leasing but reduced the bill’s benefits relative to its cost.

The researchers estimate that the EV incentive program generated $1.87 of US benefits per dollar spent in 2023 when they compare this program with the pre-IRA structure of incentives, but only $1.02 when compared with a no-subsidy baseline. They calculate the benefits by estimating CO2 and local air pollution emissions from manufacturing and driving various electric and gasoline-powered cars, the number of fatal accidents associated with driving, and the fiscal externalities from explicit or implicit taxes on gasoline and electricity.

The benefits would have been larger if the IRA had not allowed tax breaks to US companies that lease EVs, even those that do not meet the domestic-content requirements. This drove down the cost of leasing an EV relative to owning one. Leasing surged, especially for foreign models that no longer qualified for purchase subsidies. The share of leased EVs jumped from 15 to 30 percent between December 2022 and December 2023.

The market and welfare effects of replacing the EV incentive program are complex. The researchers estimate that if the US scrapped the IRA credits and offered no subsidies for EV purchases, the number of new EV registrations would have fallen by 27 percent. Reverting to the pre-IRA subsidy regime would reduce registrations by only 8 percent, and a much higher share of new EVs would be produced abroad. Because the researchers assign benefits to domestic vehicle production, the IRA’s incentive structure generates larger benefits. Their analysis suggests that many of those who leased foreign EVs to claim IRA incentives would have either bought a domestic EV or an unsubsidized foreign EV instead if the leasing option had not been allowed.

The total government cost of encouraging one additional EV purchase is between $23,000 and $32,000, even though the buyer receives only $7,500.

The researchers indicate that the most cost-effective policy would be a tax on all vehicles, including gasoline-powered ones, because they generate externalities, including harmful emissions and fatal accidents. But if gasoline-powered vehicles cannot be taxed, subsidies to EVs can provide incentives for a shift away from gasoline-powered cars, which have substantial negative externalities.

The researchers estimate that, ignoring the distortionary costs of raising revenue to pay for the subsidies, the optimal one-size-fits-all EV subsidy would be $6,355 — not far from the current $7,500 credit. If the costs of taxation were included, the optimal subsidy would be much lower.

Vehicle-specific subsidies would allow a higher ratio of benefits to costs. The net social benefits of a small EV, for example, are estimated to be greater than those for heavier models. Subsidizing more efficient EVs more than less efficient ones could increase the net benefits from the EV subsidy policy by as much as $2.5 billion annually.

— Laurent Belsie

The researchers are grateful to the Becker Friedman Institute at the University of Chicago and NSF grant SES-2117158 and SES-2214949 for research support.