Comparing Retail Electricity Pricing Programs

Most retail electricity customers face constant electricity prices even though the hourly costs of electricity production vary substantially. In The Efficiency of Dynamic Electricity Prices (NBER Working Paper 32995), Andrew J. Hinchberger, Mark R. Jacobsen, Christopher R. Knittel, James M. Sallee, and Arthur A. van Benthem examine how closely the retail charges associated with time-of-use rate plans, critical-peak pricing plans, and real-time retail pricing with price ceilings match wholesale electricity prices, which vary at high frequency and reflect volatile production costs.

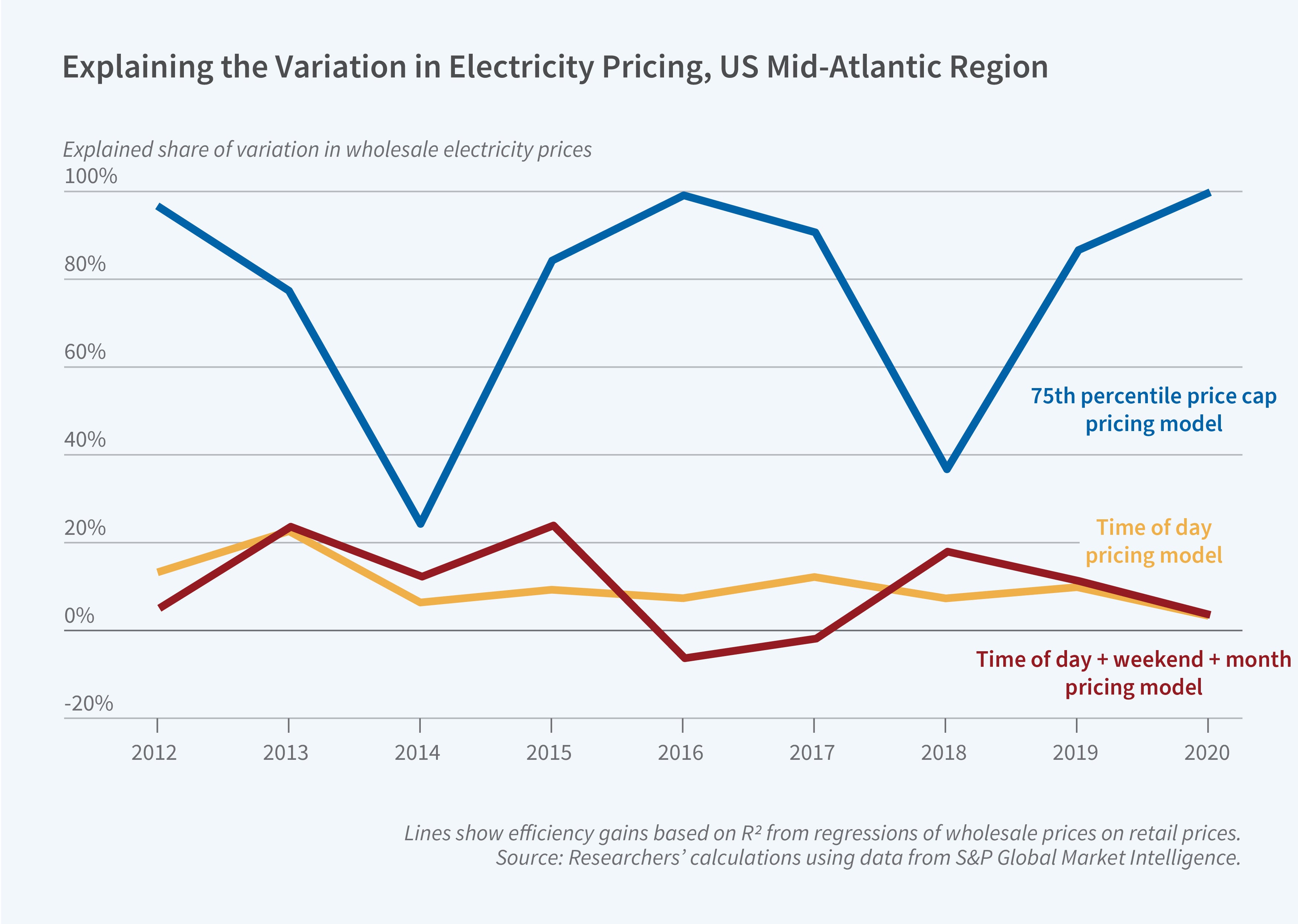

Time-of-use and critical-peak electricity pricing models are jointly 20 percent better than flat-rate pricing at matching the variation in wholesale electricity prices but fall far short of real-time pricing with price ceilings.

Two of the most common variable retail pricing structures are time-of-use (TOU) and critical peak pricing (CPP). TOU prices specify rates based on the time of day, day of the week, or season, and are calibrated using historical data. CPP rates add a cost premium during time periods called “events,” when the grid is expected to be near capacity. Although events are announced only hours in advance, the rates that apply when an event is in progress are often held constant for years.

To construct a time series on wholesale electricity prices, the researchers use data on real-time and day-ahead locational marginal prices from the hourly auctions in the seven US wholesale electricity markets from 2000 through 2020. They use these data to fit alternative rate schedules onto historical wholesale prices using standard regression tools, accounting for out-of-sample fit and the fact that alternative policies change equilibrium wholesale-market prices.

The researchers consider several simulated TOU price schedules for each year using data from the three previous years. These schedules layer on three different types of price variation: peak hours of the day, peak hours and whether it is the weekend, and peak hours and whether it is the weekend and which month it is, respectively. To compare the retail price from each schedule with the wholesale price, they use three years of historical data and calculate the average wholesale price within each period. They define peak periods for wholesale prices as those time periods with the highest expected prices, and they use their estimates of average wholesale prices in each period to calibrate the TOU prices for the next year.

TOU pricing schedules calibrated from the previous three years of data are poor predictors of wholesale prices in the next year. They explain only about 10 percent more of the variation in wholesale prices than a flat-rate electricity pricing schedule. However even a 10 percent efficiency gain generates about $200 million per year in cost savings, which may pass a cost-benefit test. A similar approach to calibrating CPP schedules, using contemporary day-ahead prices to call events and the three previous years of data to calibrate event prices, also has only modest success in tracking wholesale prices. Even when utilities can call events in real time, the pricing algorithm only explains about 10 percent of the wholesale price variation. TOU and CPP together yield a 16–20 percent efficiency gain on average.

In contrast to the TOU and CPP algorithms, real-time price variation with price caps allows the retail price to track the wholesale prices very well. Even when the price cap is set modestly, at the 75th percentile of the price distribution, the retail price tracks most of the movement in wholesale prices and achieves a much larger efficiency gain than any of the TOU schedules studied. Automation may relieve an otherwise larger burden on consumers’ ability to follow a complex and irregular price schedule.

— Whitney Zhang

Van Benthem thanks the Kleinman Center for Energy Policy, Analytics at Wharton, the Mack Institute, the National Science Foundation (SES-2117158), and the Wharton Dean’s Research Fund for generous support.