Wage Insurance for Displaced Workers

Wage insurance (WI) aims to mitigate the negative impacts of job loss and to encourage reentry into the labor market by providing partial income replacement to displaced workers who are reemployed at a new wage that is lower than their prior wage. Whether it achieves this goal in practice, however, remains unclear; it could also result in worse job matches and persistently low wages after benefits expire.

In Wage Insurance for Displaced Workers (NBER Working Paper 32464), Benjamin G. Hyman, Brian K. Kovak, and Adam Leive study the impacts of wage insurance in the context of the US Trade Adjustment Assistance (TAA) Program, which compensates workers who become unemployed as a result of international trade.

Workers must be 50 or older to qualify for TAA wage insurance, which pays up to half of the difference between their pre- and post-separation wages for up to two years. The researchers use administrative data on TAA petitions combined with linked employer-employee Census Bureau data to compare outcomes for workers just above and just below the age eligibility cutoff. To account for the possibility that other public programs may also be differentially available to those over the age of 50, they also compare workers above and below age 50 whose petitions for TAA were denied.

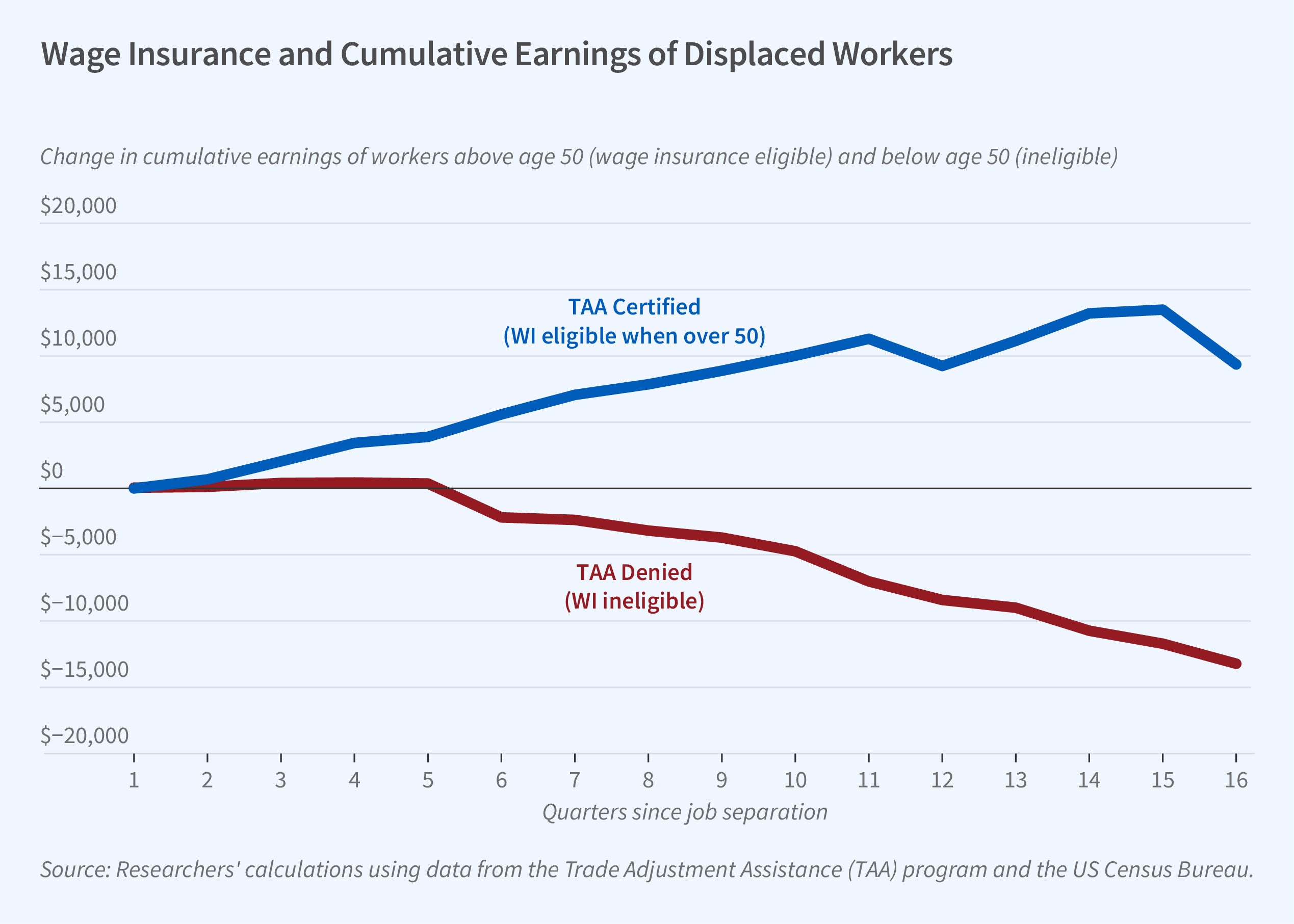

Eligibility for wage insurance through the US Trade Adjustment Assistance Program increases displaced workers’ earnings by $18,000 (26 percent) over the four years following displacement.

The researchers estimate that during the two years following displacement, wage insurance eligibility increases the likelihood that a worker will be employed by between 8 and 17 percentage points. They do not find any effect on employment four years after an unemployment spell begins. Program eligibility also increases the proportion of displaced workers’ prior earnings that are replaced by income from a new job by 10 percentage points. On average, cumulative earnings rise by over $18,000 (26 percent) during the four years following displacement.

These effects are driven by shorter unemployment durations among workers who are eligible for wage insurance. Compared to WI-ineligible workers, eligible workers experience initial nonemployment spells that are about one calendar quarter shorter, and total time out of employment in the four years after separation that is about 1.26 quarters shorter.

The researchers estimate that the reduced outlays on unemployment insurance as a result of quicker job finding and the long-term revenue gain from taxing a worker’s increased earnings more than cover the cost of wage insurance benefits and administrative program costs.

—Abigail Hiller

This research was supported by the National Science Foundation under Grant No. SES-1851679. The researchers acknowledge support from the UVA Bankard Fund for Political Economy and the Block Center for Technology and Society at Carnegie Mellon University. This paper was made possible (in part) by a grant from the Carnegie Corporation of New York. This research uses data from the Census Bureau’s Longitudinal Employer-Household Dynamics Program, which was partially supported by National Science Foundation Grants SES-9978093, SES-0339191 and ITR-0427889; National Institute on Aging Grant AG018854; and grants from the Alfred P. Sloan Foundation. This research was performed at a Federal Statistical Research Data Center under FSRDC Project Number 1762. (CBDRB-FY23-P1762-R10162, CBDRB-FY23-P1762-R10429, CBDRB-FY23-P1762-R10845, CBDRB-FY24-P1762-R11193).