Lessons from the Federal Bank Holiday of 1933

To reassure depositors during banking crises, policymakers sometimes extend guarantees that go beyond legal requirements. After the failure of Lehman Brothers in 2008, regulators provided assistance to a broad range of financial institutions, even lightly regulated money market mutual funds. When Silicon Valley Bank and Signature Bank failed earlier this year, federal regulators bailed out all depositors, including those whose balances vastly exceeded federal deposit insurance limits.

Such actions can incentivize riskier bank behavior if managers and depositors believe that the government will insure them against losses. Policymakers sometimes justify such moves, incentive effects notwithstanding, by arguing that the stigma of targeted government assistance would further weaken the least solvent banks, leading to a reallocation of funds to stronger financial institutions and a slowdown in economic recovery. In a new study of the bank holiday at the nadir of the Great Depression, Signals and Stigmas from Banking Interventions: Lessons from the Bank Holiday in 1933 (NBER Working Paper 31088), Matthew S. Jaremski, Gary Richardson, and Angela Vossmeyer find that discriminating interventions can stigmatize banks perceived as weak and push deposits elsewhere. However, they find little if any effect on economic growth.

Sweeping government interventions to stem financial sector weakness can stigmatize banks perceived by the public to be weak and shift deposits towards banks believed to be healthier.

The financial panic in the winter of 1932/33 was among the most severe in American history. Within a few months, customers withdrew more than 20 percent of all deposits from the nation’s financial system. Bank runs caused so many financial institutions to close that the Roosevelt administration had to intervene to a degree never seen before from the federal government.

After the Federal Reserve Bank of New York announced on March 3 it would not open the next day because its gold reserves had fallen to their legal limit, President Roosevelt declared a nationwide bank holiday beginning March 6. In his first fireside chat, on March 12, he outlined his plan to reopen sound banks supported by the government, and he emphasized that a “bank that opens on one of the subsequent days is in exactly the same status as the bank that opens tomorrow.” As the plan was announced, some worried about the stigma of government assistance.

Roosevelt’s reassurances worked to some degree. Deposits flowed back immediately. Inflows by mid-March exceeded the withdrawals associated with previous bank runs, and they continued through the end of March. But the gradual reopening of banks did generate stigma: the researchers found that the public used early reopening as a signal of a bank’s strength and showered those institutions with their money.

To a large extent, depositors were correct in drawing inferences from when a bank reopened. The biggest and best-capitalized banks did reopen first. In all, 11,793 of the 16,790 commercial banks operating right before the bank holiday had fully reopened by the end of March. In some cases, government officials were working so fast that they opened objectively weaker banks sooner than stronger ones. These weaker institutions also saw a big rebound in deposits while the laggards, even those with strong balance sheets, saw much less deposit growth. For some banks, the time to reopening was longer and nearly 4,000 banks never reopened.

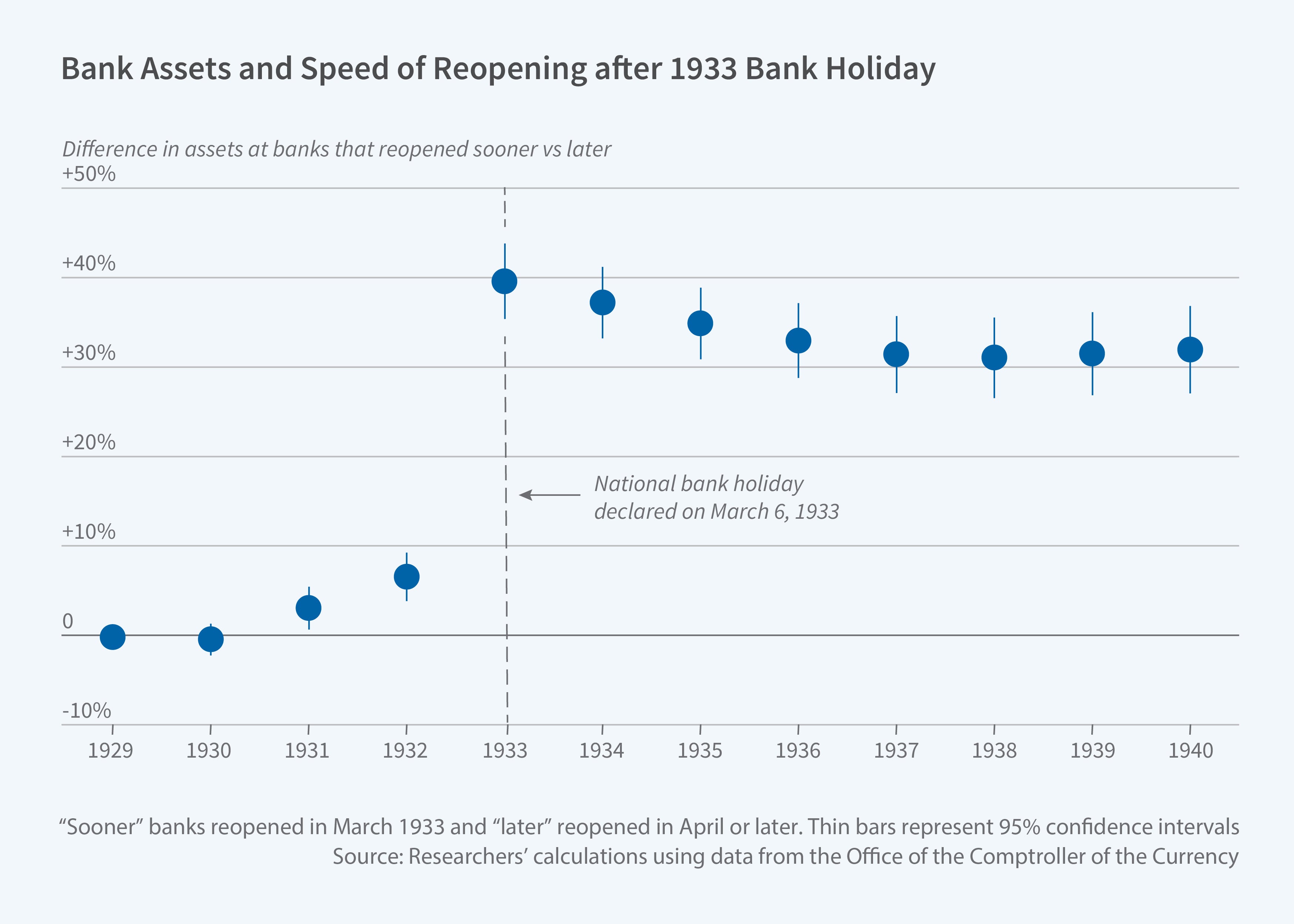

The researchers found that banks that fully reopened in March had 15 percent more assets by July, relative to their pre-bank-holiday position, than those that reopened in April, May, or June. The quick-to-reopen banks also were able to operate with lower capital and reserve ratios. These effects were long-lived, persisting at least through 1940 and, in the case of deposits, through the early 1950s. The findings suggest that the timing of reopening had a substantial and persistent influence on perceived bank soundness, despite government guarantees that all reopened banks were sound.

—Laurent Belsie