Could the IRS Prepopulate Income Tax Returns?

Americans spend an average of $200 and 12.5 hours per year filing individual income tax returns. More than 40 percent of filers, particularly filers with lower incomes, could save that money and time if the Internal Revenue Service (IRS) prefilled their tax returns, Lucas Goodman, Katherine Lim, Bruc(e Sacerdote, and Andrew Whitten find in Automatic Tax Filing: Simulating a Prepopulated Form 1040 (NBER Working Paper 30008).

Using a random, representative sample of 344,400 anonymized individual federal returns filed in 2019, the researchers prepopulate tax returns with income data reported directly to the IRS. This includes information on wages (Form W-2); unemployment compensation (Form 1099-G); interest, dividends, and capital gains (Forms 1099-B and 1099-DIV); nonemployee compensation (Form 1099-MISC or 1099-NEC); and income from partnerships and S corporations (Forms 1065 and 1120S, Schedule K-1). The researchers then compare their prepopulated tax returns with the actual returns that taxpayers filed.

Prepopulation would be most accurate for taxpayers who are single, lack dependents, have no credits or deductions, and whose only income is wages under $100,000.

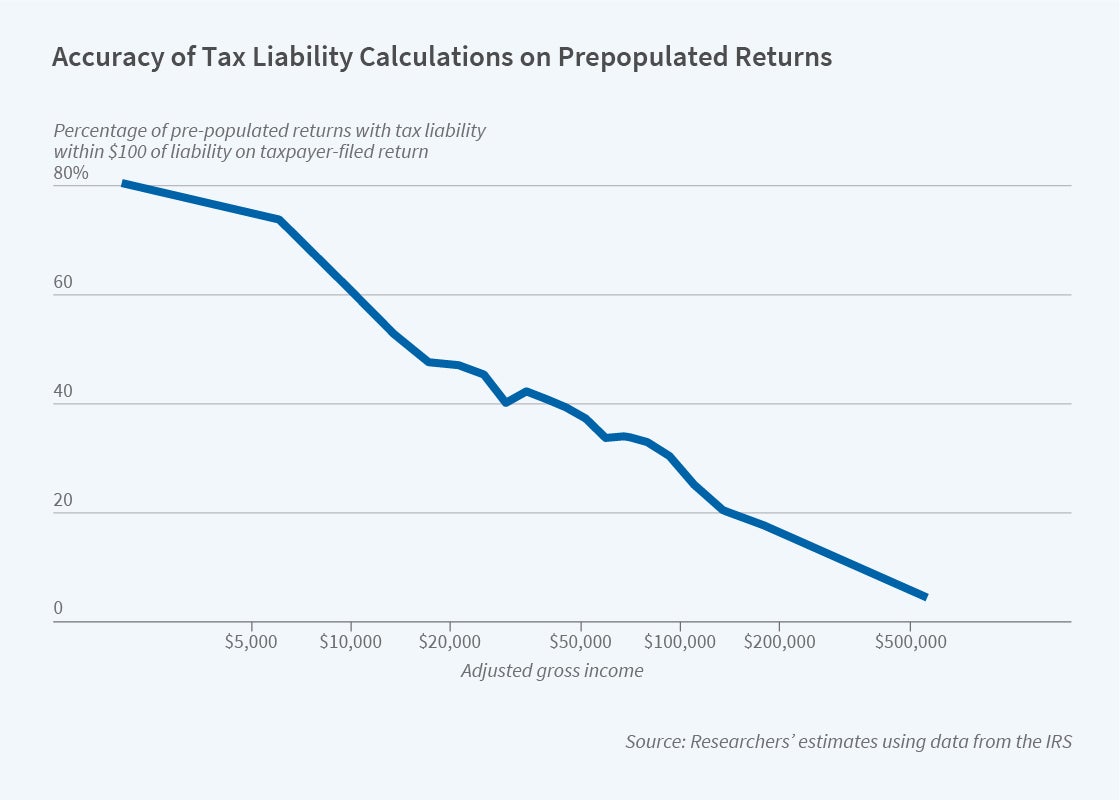

They measure the degree of agreement between the prepopulated and actual tax returns in two ways. Their first definition of agreement is that the actual tax return does not include any nontrivial income, deductions, or credits that do not appear on the prepopulated return. This metric yields an upper bound on the degree of agreement. Their second definition, which yields a lower bound, requires that the tax liability on the prepopulated return fall within $100 of that on the actual tax return. Using these two metrics, the researchers conclude that prepopulating returns would be accurate for between 62 and 73 million returns, or 41 to 48 percent of filers.

Prepopulation is particularly accurate for taxpayers who are single, lack dependents, have no credits or deductions, and whose only income is wages of less than $100,000. Around one-fifth of tax filers fit this description. The accuracy rate for this group is between 78 and 82 percent. Accuracy rates vary with adjusted gross income (AGI). For those with AGI in the bottom 15 percent of tax filers, below about $10,000, the two measures of accuracy are 61 and 80 percent. For those at the 65th percentile of AGI, around $60,000, accuracy rates are between 34 and 51 percent, and for those with AGI in the top 5 percent accuracy is lower still, between 10 and 30 percent. The decline in the accuracy rates for higher-income taxpayers is driven largely by increasing rates of itemized deductions, which cause a divergence between prepopulated and actual returns.

Among taxpayers who would have had an accurately prepopulated return, almost 45 percent used a paid preparer when filing. Even for those for whom the IRS could not fully complete a return, prepopulation could still yield significant time savings. Among the 52 to 59 percent of taxpayers with inaccurately prepopulated returns, the majority would need to make only one change — such as reporting self-employment income or deductions — or complete one additional schedule.

Prepopulation would affect nonfilers, those who did not need to file a tax return, as well as those who do. Of the 46.3 million taxpayer units that did not have a filing obligation based on income in 2019, 17 percent (8 million) were entitled to a refund. These refunds averaged $387. On the other hand, the researchers identify 8.8 million nonfilers who had a filing obligation. Fifty-five percent of this group (4.9 million) would have owed additional taxes if they had filed a return.

— Brett M. Rhyne