Bond Markets Pay Attention to Countries’ Political Leanings

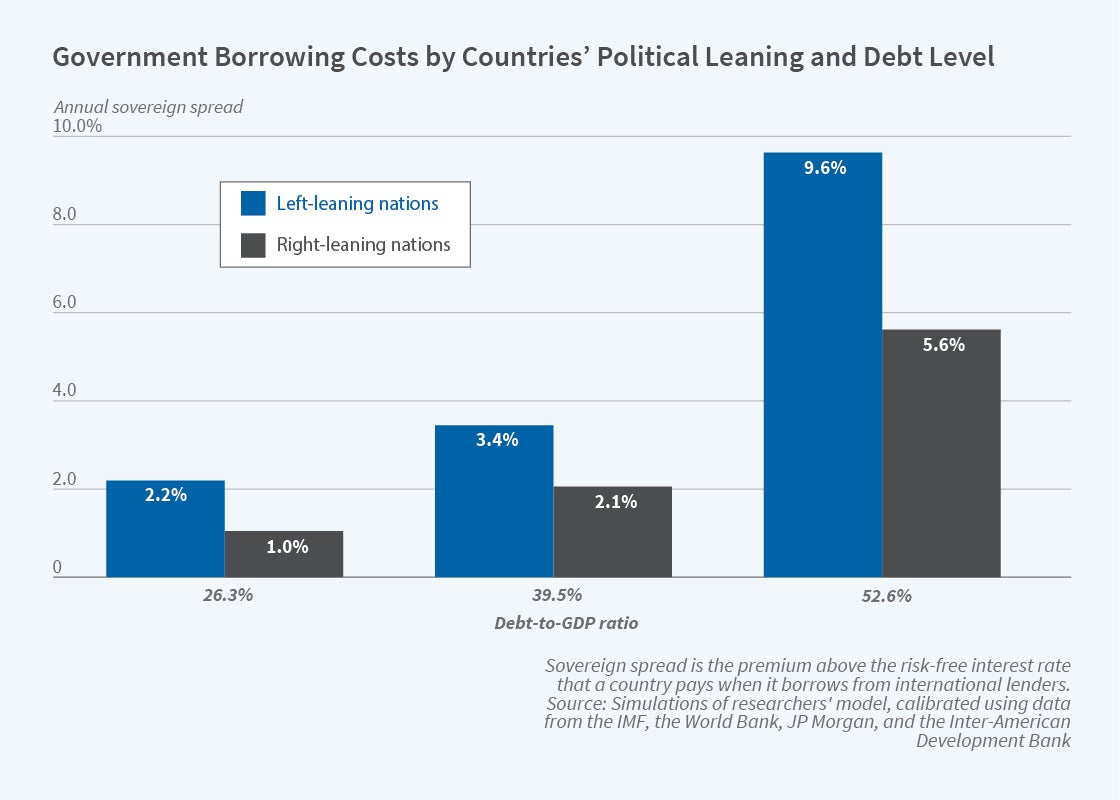

Countries that are more likely to elect left-leaning governments face higher borrowing costs, on average, in global capital markets.

Some nations are more likely to elect left-leaning central governments than others. In Sovereign Spreads and the Political Leaning of Nations (NBER Working Paper 29197), Ionut Cotoc, Alok Johri, and César Sosa-Padilla investigate the relationship between a country’s political composition and the interest rate on its sovereign debt, and develop a quantitative model to explain their empirical results.

The researchers analyze data from 56 countries over the period 1975 to 2020, including information from the International Monetary Fund and the World Bank on national debt levels, government spending, private consumption, trade balances, and interest rates on national debt repayment. The political affiliation of national governments is calculated from the Inter-American Development Bank’s Database of Political Institutions.

Two empirical regularities emerge from the data on borrowing costs. First, countries with a higher propensity to elect left-wing governments pay, on average, higher interest rates on their national debt. For example, a 50 percent increase in the propensity to elect left-wing governments is associated with an increase in spreads of between 80 and 115 basis points. Second, countries with a higher average ratio of debt to GDP also pay higher interest rates. A 1 percentage point increase in a nation’s debt, relative to its GDP, raises its borrowing cost by an average of 5.5 basis points.

The researchers explore the link between government spending and the reelection chances of incumbent leaders from left- and right-leaning parties. They find that a 1 percent increase in the ratio of government spending to national income increases a left-leaning government’s re-election probability by about 0.95 percentage points. For a right-leaning government, however, the effect of a comparable increase in government spending is smaller: 0.72 percentage points. Thus, left-wing governments gain more electoral support per unit of increase in public spending than right-wing governments.

The study focuses on each government’s decision of whether to repay its debt or to default. All else equal, a government’s incentive to default increases with its debt level and decreases with national income. While increased public spending generates more electoral support in both left-leaning and right-leaning political systems, in the former the greater increase in electoral support for a given increase in public spending provides governments with a greater incentive to spend. Left-leaning electorates are more likely to vote to replace governments that adopt fiscal austerity measures in order to repay debt during economic downturns. The researchers find that "this cost encourages defaults and discourages fiscal austerity while increasing the likelihood of electing left policymakers." These factors give left-wing governments an incentive to spend more and make them more likely to engage in procyclical fiscal policy (increasing spending relatively more in good times and cutting it relatively less in bad times).

Simulations from the quantitative model, calibrated to the historical experience, suggest that household welfare is higher in nations with right-leaning electorates because lower default incentives lead to less frequent defaults and lower borrowing costs for the national government, and because lower government spending leaves more room for more highly valued private consumption.

—Linda Gorman