Disability Benefits, Aggregate Economic Conditions, and Earnings

In How Do Economic Conditions Affect Earnings and Return to Disability Programs for Beneficiaries Whose Benefits Were Terminated? (NBER RDRC Paper NB22-03), Jeffrey Hemmeter, Kathleen Mullen, and Stephanie Rennane find that individuals whose benefits end due to medical improvement during an economic downturn earn less in the short run and are more likely to reapply for benefits within five years than those whose benefits end during stronger economic times.

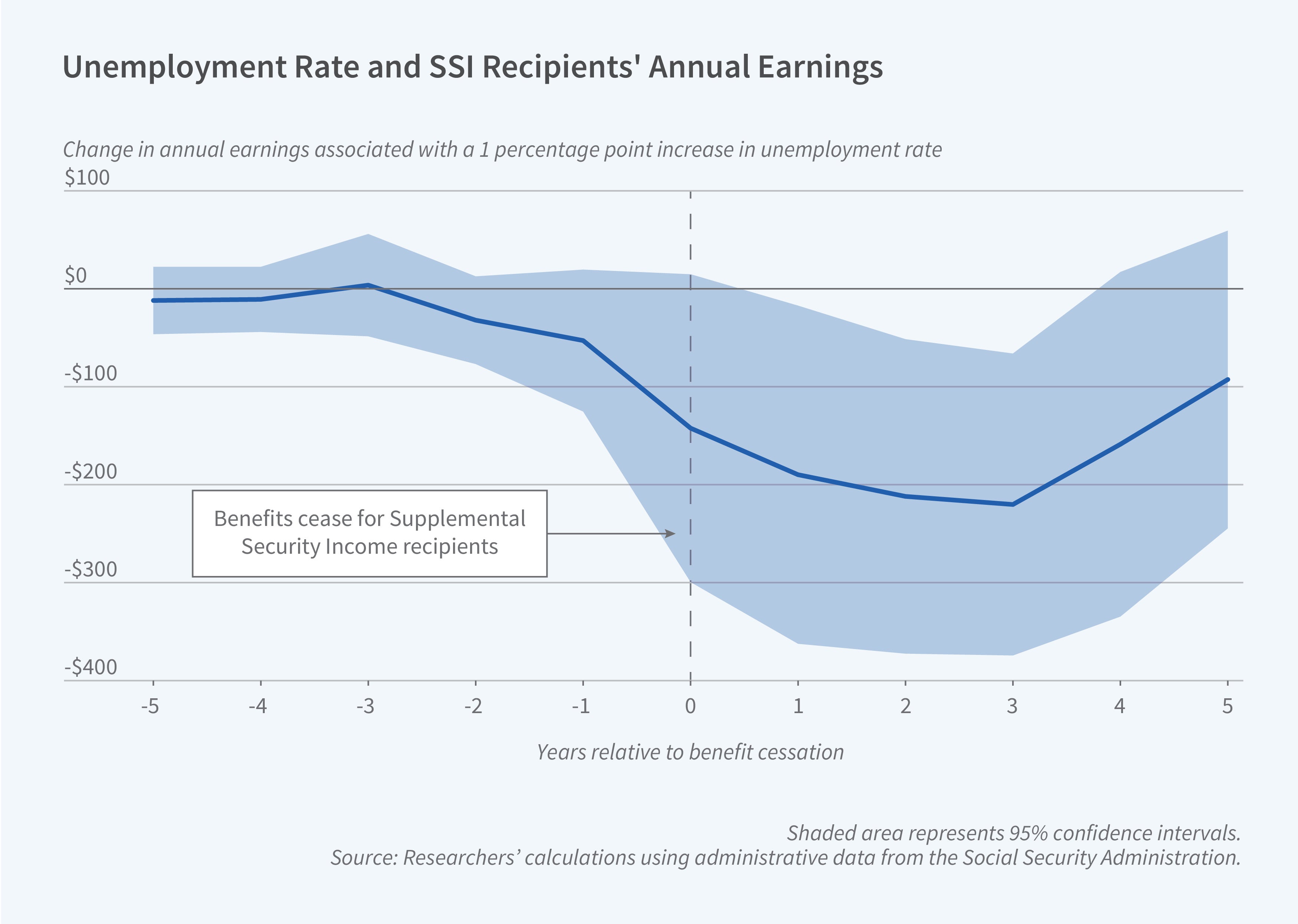

When disability insurance beneficiaries no longer receive benefits as a result of improved health, their earnings are sensitive to economic downturns.

The study, which draws on Social Security Administration records and monthly state unemployment statistics, includes any adult between ages 18 and 56 whose benefits were discontinued because of improved health during the years 2000 through 2015. The research compares individuals with similar medical, demographic, and work profiles but who lost benefits in different job climates.

Beneficiaries fall into three categories: those receiving Social Security Disability Insurance (SSDI), those receiving Supplemental Security Income (SSI), and those receiving both concurrently. To qualify for SSDI, recipients must have a work history.

Regardless of category, the earnings outcomes of former beneficiaries are affected by the economic conditions at the time they lose benefits. For former SSI-only recipients, a 1 percentage point increase in the jobless rate above the median at the time of benefit cessation reduces annual earnings by 4 percent — $200 — during the subsequent three years and increases the likelihood of reapplying to either SSI or SSDI in the next five years by about 1 percentage point.

For SSDI-only recipients, a 1 percentage point higher jobless rate is associated with an $800 cut in earnings in the first year after discontinuation of benefits. For concurrent recipients, the earnings shortfall is $500. For both SSDI and concurrent beneficiaries, losing benefits during a downturn is associated with a slightly greater likelihood of recurring benefit receipt within five years.

While the researchers are comfortable attributing the earnings effect to aggregate economic conditions for the SSI-only recipients, for the SSDI and concurrent beneficiaries, they raise a note of caution. The members of these groups whose benefits cease during downturns tend to have lower earnings before cessation than those who lost benefits when the economy was strong. One possible explanation for this finding is that the economic cycle affects the funding available for disability offices to review beneficiary eligibility; another is that workloads vary across Social Security Administration offices in different states and that local economic conditions affect these workloads.

For all three groups taken together, the earnings impact of economic conditions at the time of cessation fades away after five years.

— Steve Maas

The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the Federal Government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.