How Did the Great Recession Affect the Disability Insurance Program?

The U.S. Social Security Disability Insurance (DI) program is designed to insure workers against earnings losses arising from a severe and long-lasting disability. Previous research suggests that about 40 percent of DI applicants have at least some ability to work. For those in this group, the decision to apply for DI benefits may be sensitive to economic conditions. If partially disabled individuals have a suitable job (perhaps one that accommodates their disability), they may work; however, if they lose their job, they may turn to the DI program.

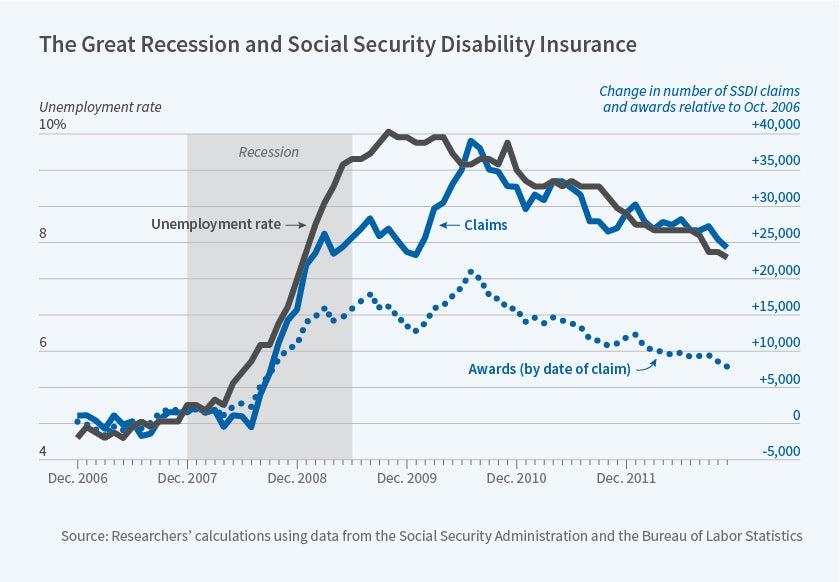

During the Great Recession, which began in late 2007, the U.S. unemployment rate rose from 5.0 to 10.0 percent. The loss of millions of jobs during this period is likely to have affected DI applications and awards. Researchers Nicole Maestas, Kathleen Mullen, and Alexander Strand explore this question in their recent study, The Effect of Economic Conditions on the Disability Insurance Program: Evidence from the Great Recession (NBER Working Paper 25338).

The authors begin by noting that DI applications rose in lockstep with the national unemployment rate during the Great Recession, as did DI awards (measured by date of claim). Yet as striking as these coincident trends are, causal inference is complicated by secular trends in claims and allowances resulting from the aging of the population and changing administrative practices of the Social Security Administration.

To address potential confounding from these trends, the authors use variation in the timing and severity of the recession across U.S. states, essentially asking if DI applications and awards rose more in states with larger increases in unemployment. The authors analyze over 10 million DI applications that were filed between October 2006 and December 2012. Their data allow them to observe outcomes for all claims, including appeals of denied claims that occurred by September 2016.

The authors' analysis of this data yields several key findings. First, the Great Recession led 1.4 million former workers to apply for DI benefits during 2008-2012. Among this group, nearly 1 million were induced to apply by the recession and otherwise would not have applied, while the remainder would have applied at a later date but accelerated the timing of their claim due to the recession. The 1 million induced applicants represent nearly 12 percent of all claims filed during this period.

These recession-related claims resulted in more than one-half million new DI awards, with over 400,000 going to those who would not otherwise have entered the DI program and the rest going to people who would have entered the program anyway at a later date. The awards to induced applicants represent nearly 9 percent of all new awards during this period.

Induced applicants were less severely impaired than the average applicant, as evidenced by their lower final allowance rate (42 percent, versus 54 percent for all applicants). More than 6 in 10 induced applicants had difficult-to-verify diagnoses such as musculoskeletal and mental diagnoses, while fewer than 1 in 10 had severe, automatically qualifying impairments such as chronic kidney disease.

Perhaps not surprisingly, induced applicants were more likely to receive an initial denial than other applicants. But once denied, they were more likely to file an appeal, and much more likely to be awarded benefits on appeal – 53 percent of this group was awarded benefits via appellate decision, versus only 37 percent for all new beneficiaries during this era.

Finally, the authors estimate that these recession-induced awards will result in an additional $56 billion in DI benefits over the lifetime of the beneficiaries, or $97 billion including Medicare costs. There was also an estimated $3 billion increase in administrative costs to process the additional applications.

The authors conclude, "the impact of the Great Recession [on the DI program] is economically significant. In terms of human capital, over 400,000 workers were awarded benefits who would not otherwise have entered the program. Because working above SGA [substantial gainful activity level, currently $1,220 (nonblind) or $2,040 (blind)] after program entry is rare, this corresponds to a near-permanent decline in productive capacity. In terms of the fiscal health of the U.S. disability insurance system, both contemporaneous and future SSDI program costs increased significantly."

The authors acknowledge funding from the U.S. Social Security Administration through grant #1 DRC12000002-04 to the NBER as part of the SSA Disability Research Consortium, and from the National Institute on Aging (1R01AG056239).