Program Report: Corporate Finance, 2017

Narrowly interpreted, corporate finance is the study of the investment and financing policies of corporations. Because corporations are at the center of economic activity, the causes and consequences of corporate finance — and hence the research activities of the program — touch almost every aspect of micro- and macroeconomics, allowing the center of gravity to shift from the narrow concerns of corporate managers.

The NBER Program on Corporate Finance recently completed its 25th year. In his first program report, the founding director, Robert Vishny, described corporate finance as "institutionally oriented, with research often driven by issues of current importance" and the program's empirical studies as "motivated by relevant, applied theory."1 Back then, the takeover and restructuring wave of the late 1980s was salient; soon afterwards, in the mid-1990s, it was cross-country comparisons of legal systems, governance, enforcement, and financial development, often with implications for emerging institutions in the transitional economies of Eastern Europe and the former Soviet Union. The phenomena were studied with firm-level, market, and institutional data, and with then-novel empirical technologies. Notably, these included event studies and the quasi-experimental analysis of colonial legal origins. The applied theoretical lens was, for the most part, agency problems arising from the separation of ownership and control.

The influence of "issues of current importance" remains as apparent now as in the program's first report. The defining moment for corporate finance over the past decade has been the financial crisis of 2008. Broadly speaking, our program's research has found its greatest impact in exploring the role of credit cycles, the fragility of financial institutions, the behavior of households, and the associated macroeconomic consequences. A boom and bust in credit conditions, stretched bank balance sheets, and contagious defaults in the mortgage market were the proximate causes of the crisis, and the consequences were macroeconomic. So, credit markets, financial institutions, and household finance, including their macroeconomic and regulatory implications, are the current centers of activity among NBER researchers in corporate finance. Traditional topics of corporate investment and financing are receiving less attention. In some ways, this brings the program — which emerged from the NBER Financial Markets and Monetary Economics program, which was founded in the late 1970s and divided into Asset Pricing, Corporate Finance, and Monetary Economics in 1991 — back to its roots.

New empirical tools also have emerged. Techniques have been imported from labor economics and other fields. For example, NBER researchers exploit discontinuities in policy, which generate fruitful natural experiments, and design randomized controlled trials in partnership with firms, government agencies, and nongovernmental organizations. The rising demand for empirical rigor in identifying policy-relevant causal mechanisms has meant a microempirical shift, with the study of household financial products, for example, serving as an auspicious lamppost. At the same time, structural estimation of theoretical models is often used to tease out the macroeconomic implications of microempirical insights.

The program's empirical studies are grounded in a wider range of "relevant, applied theory." The seminal work of Merton Miller and Franco Modigliani, approaching its 60th anniversary, continues to be the organizing framework for understanding the market imperfections that allow finance to create or destroy value: whether in firms, as the authors originally intended, or more broadly in households, financial institutions, and the macroeconomy. Agency and information problems remain central imperfections, with a recent focus on conflicts of interest along the chain from savers to household borrowers; so do the costs of financial distress, fire sales, and the fragility of short-term financing, experienced on a systemic scale with the 2008 failure of Lehman Brothers.

In a new trend, affiliates of the program have become increasingly attentive to behavioral factors, frequently delving into the role of bias in households, managers, investors, and, ultimately, markets. Traditional theoretical lenses and new behavioral ones are at the forefront of research that could help mitigate the effect of the past crisis and inform macroprudential regulation for lowering the probability of a sequel. In that sense, the organizing frameworks and the research output of the NBER Program on Corporate Finance have proven robust, relevant, and sometimes central in fields that are outside the program's narrow mandate.

In particular, corporate finance has played a key role in enhancing traditional macro models, some of which were narrowly focused on a single policy instrument. Tweaking the federal funds rate without completely understanding its mechanism proved effective when the global economic engine required routine maintenance. But the economic breakdown of the financial crisis revealed limitations of the New Keynesian models. Without an explicit modeling of the financial sector, these models were less useful for restarting the engine. In contrast, the corporate finance toolkit proved essential in analyzing the alphabet soup of the Troubled Asset Relief Program (TARP), Quantitative Easing (QE), Home Affordable Refinance Program (HARP), and many other regulatory interventions.

This program report moves from small to large, from individuals to institutions to markets, and their influence on the macroeconomy. Regulation perhaps deserves a separate section, but I have opted instead to embed the discussion of regulatory analysis in context throughout. Each topic could fill an entire report, and there are far too many papers to mention. I will cite only a few recent NBER working papers in each area, with my sincere apologies to those I have missed, to earlier foundational work, and to related work outside of the program.

Individuals

The Corporate Finance program now places more emphasis on individual actors than it did in the past. These include household borrowers, who account for the majority of bank loans in the form of mortgages and credit card balances; household savers and investors, who provide bank and corporate funding; household financial advisers, who provide guidance; and, of course, corporate managers, but with a focus not just on their function in allocating capital, but also on their identities and beliefs.

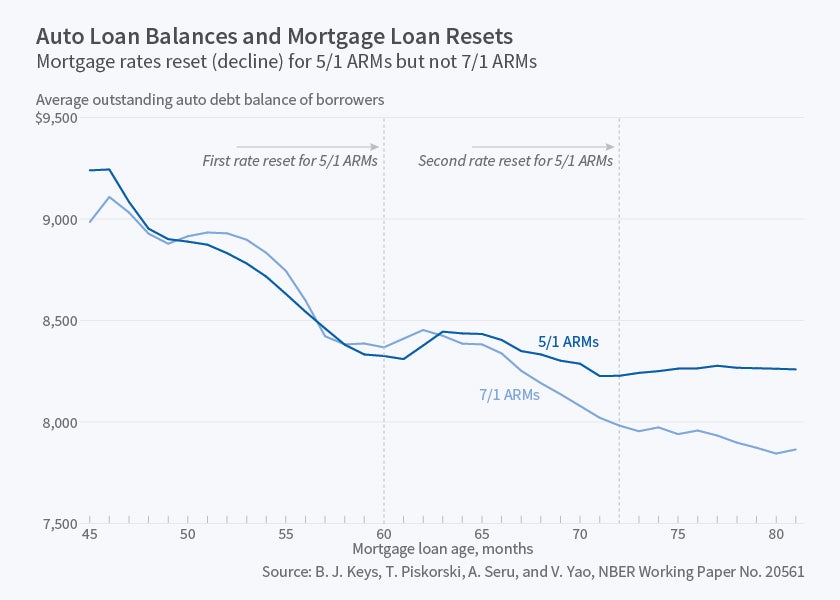

Starting with borrowers, Hong Ru and Antoinette Schoar show how credit card companies use a combination of salient teaser interest rates and back-end fees located in the fine print to design solicitations to appeal to unsophisticated households.2 Ex ante contract design of this type can have ex post consequences: Benjamin Keys, Tomasz Piskorski, Amit Seru, and Vincent Yao show how households respond to resets in adjustable mortgage rates, with the newfound liquidity lowering default, increasing new car consumption financed with auto debt, as shown in Figure 1, and, for credit-constrained households, reducing high-cost credit card debt.3 This suggests a channel for transmission of monetary policy.

Moving to savers, Adriano Rampini and S. Viswanathan develop a theory of household risk management that helps to explain why poorer households bear the brunt of macroeconomic fluctuations, and perhaps also helps explain their demand for safe securities.4 Safety may be in the eye of the beholder: Nicola Gennaioli, Andrei Shleifer, and Vishny; and Pedro Bordalo, Gennaioli, and Shleifer, emphasize the possibility that savers and investors neglect subtle risks, leading to the manufacture and sale of securities that load up on subtle, unappreciated risks, deliver the illusion of safety, and eventually undermine the stability of the financial system as previously neglected risks are revealed.5 Consistent with risk neglect, Jeffrey Wurgler and I; Rüdiger Fahlenbrach, Robert Prilmeier, and René Stulz; as well as Matthew Baron and Wei Xiong find that higher risk and less well-capitalized banks with faster loan growth earn lower average returns.6

Households also invest in risky securities. Here, the salience of past returns replaces apparent safety and risk neglect. Bordalo, Gennaioli, and Shleifer7 develop a model built on Daniel Kahneman and Amos Tversky's8 representativeness heuristic to illustrate how investors extrapolate recent history. Itzhak Ben-David, Justin Birru, and Viktor Prokopenya,9 in retail foreign exchange markets, and Robin Greenwood and Shleifer,10 in investor expectations data, provide corroborating evidence. Investors increase risk-taking in response to their own past performance, despite the fact that past performance is not predictive: Surveys of investor expectations are both positively correlated with past returns and negatively correlated with future returns and ex ante proxies for future returns, such as the dividend-price ratio. Extrapolative expectations are a plausible driver of credit- and equity-market-driven business cycles.

In principle, financial advisers should help unsophisticated households navigate borrowing, saving, and investing decisions. However, Sendhil Mullainathan, Markus Noeth, and Schoar show that advisers tend not to de-bias their clients; instead they endorse return-chasing behavior and steer clients toward funds with high fees.11 Mark Egan, Gregor Matvos, and Seru go further, documenting a high rate of misconduct among financial advisers.12 Even when fired from their institutions, sanctioned advisers are reemployed at high rates by firms that disproportionately serve unsophisticated retail clients.

The lack of sound professional advice points to the potential importance of financial literacy education; decision support with mandated presentation of relevant facts and figures; libertarian paternalism with carefully chosen defaults; and direct regulatory intervention through consumer financial protection.

The benefits of literacy training have been hard to show empirically. Bruce Carlin and David Robinson emphasize the complementary importance of decision support and literacy in experimental data.13 Relatedly, Sumit Agarwal, Souphala Chomsisengphet, Neale Mahoney, and Johannes Stroebel show positive effects of displaying the cumulative interest savings of early payment of credit card balances.14 The four researchers show that the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act reduced borrowing costs by placing regulatory limits on credit card fees. In spite of concerns that lower fees would be offset by higher interest expenses or reduced access to credit, the regulation appears to have had no observable downside, consistent with low fee salience and limited competition in the market for credit card services.

The data on corporate managers' micro decisions is often less rich. In principle, managers should have more training, experience, and feedback to bring to bear in corporate finance and investment. On the one hand, a household makes comparatively few decisions to finance a home or apply for a credit card. On the other hand, the promotion of successful managers may itself select for biases like overconfidence. Ben-David, John Graham, and Campbell Harvey compute a direct measure of manager overconfidence from survey data: Realized market returns fall within managers' forecast confidence intervals far too infrequently to be consistent with correct ex ante calibration.15 Beyond the surveys, we can infer potential bias from corporate behavior. Greenwood and Samuel Hanson provide evidence of extrapolation in shipbuilding, where prices and procurement vary too strongly with current earnings, given their historical rates of mean reversion and the high degree of competition in the transport sector.16 Kelly Shue and Richard Townsend find anchoring in the number of options granted.17 Yihui Pan, Tracy Wang, and Michael Weisbach find that new CEOs shed poorly performing assets on arrival, showing their predecessors' aversion to realizing losses.18 Misbehavior appears to be contagious in work by Christopher Parsons, Johan Sulaeman, and Sheridan Titman, showing that rates of financial misconduct rise with the misconduct rates of nearby peers.19 Overconfidence, extrapolation, loss aversion, peer effects, norms, and anchoring suggest managerial microfoundations for macroeconomic fluctuations and trends in CEO pay.

Manager personality and experience also loom large. For example, Paul Gompers, William Gornall, Steven Kaplan, and Ilya Strebulaev find that venture capitalists weigh a firm's management team quality more heavily than its product and technology.20 Perhaps this is because CEO personality, as measured in structured surveys, predicts operating performance, as shown by Ian Gow, Kaplan, David Larcker, and Anastasia Zakolyukina.21 There are also apparent links between military service and corporate finance,22 with a connection to conservative policies, lower investment, lower fraud, and performance in downturns.23 Schoar and Luo Zuo also emphasize the formative effects of macroeconomic conditions when CEOs enter the labor market.24

Whether these traits are optimally matched to corporate circumstances is harder to prove. Boards that chose CEOs with military experience, for example, may have needs for which this experience is particularly valuable. Carola Frydman and Dirk Jenter provide a contemporary survey paper on the question of whether the assignment of managers to assets comes from organizational power or an efficient and competitive market for CEO labor.25 It is hard for traditional corporate finance to keep up with the standards for the identification of causality made possible by vast databases on household financial decision making.

Institutions

Leaving aside the individuals involved, corporate finance is concerned with the sources and uses of funds. This suggests a natural delineation: Banks or firms raise money, accounting for the components of fundraising on the right side of their balance sheets, and invest the proceeds, accounting for the components of investment on the left side. The 2008 financial crisis has concentrated research efforts of the Corporate Finance program on banks and the less regulated, but functionally similar, shadow banking system. Banks are special because their defining source of funds is ultrasafe deposits and because their defining uses of funds are, for practical and regulatory reasons, much safer than the investments of industrial firms. They specialize in maximally diversified portfolios of loans, which are expected to produce a stable cash flow and are often collateralized by specific and transferable assets that can be quickly converted into cash in the event of default. As an illustration of the power of collateral and the bank lending channel, Thomas Chaney, David Sraer, and David Thesmar show a high propensity of firms to invest following the price appreciation of their real estate holdings, a traditional form of collateral for lenders.26

On the right or funding side of the balance sheet, Gary Gorton argues that financial history is marked by the continual search for truly safe assets, which are prized for their ability to avoid adverse selection, eliminate costly information production, and hence provide a means for the exchange of goods and services.27 Thus, any risk in banks' assets is optimally opaque, avoiding mark-to-market pricing: to work as money, short-term bank liabilities must trade at par. The essential feature of banks in this view is their transforming risky assets into safer, more useful ones. Gorton, Stefan Lewellen, and Andrew Metrick find that the percentage of all assets that is safe has remained stable, suggesting limits on their overall production.28 The creation of safe assets has shifted, though, toward the shadow banking system, suggesting a functional view of risk transformation and the substitution of money market mutual funds for deposit-taking banks. Meanwhile, Harry DeAngelo and Stulz emphasize banks' central role in liquidity production as a driver of high leverage ratios; they conclude that stringent capital requirements for regulated banks have fueled the growth of the shadow banking system.29

By this logic, the essential positive feature of deposits and other ultrasafe assets is that they require no monitoring. This makes things simple for depositors. A behavioral version developed by Gennaioli, Shleifer, and Vishny says that investors, for the most part, consider assets that pay in most states of the world to be ultrasafe, neglecting tail risks and obviating monitoring.30 This helps banks. Hanson, Shleifer, Jeremy Stein, and Vishny argue that banks are able to invest more patiently in fixed income assets because the stability of their deposit funding helps them endure transitory price volatility. 31

At the same time, the essential negative feature of deposits and other ultrasafe assets is that they elicit no private monitoring. Securities deemed ultrasafe are by their nature a low-cost source of finance, and invite ex post risk-shifting. Oliver Hart and Luigi Zingales argue that regulation is needed to limit private sector creation of safe assets that are close substitutes for money.32 Zhiguo He and Asaf Manela 33 analyze limited information and rumors about bank solvency, while Gorton and Guillermo Ordoñez 34 and Viral Acharya, Douglas Gale, and Tanju Yorulmazer35 argue that private parties will underinvest in information production, leading to credit booms, crises, freezes, and fragility that comes from runs. Deposit insurance and regulation help, but they lead non-core liabilities to be indicators of vulnerability, according to Joon-Ho Hahm, Hyun Song Shin, and Kwanho Shin.36 In light of excessive private incentives to create ultrasafe deposits and securities, Stein argues for monetary policy as a tool to limit their negative externalities. In this sense, the bank lending channel is an alternative to traditional models of monetary policy, which emphasize sticky prices.37

With a distinctive access to low-cost deposits and short-term funding, banks and shadow banks view equity as the more costly form of finance, pushing bank leverage ratios to much higher levels than those of industrial firms. For example, Acharya, Philipp Schnabl, and Gustavo Suarez show how banks used conduits to skirt capital requirements, moving assets off their balance sheets without a complete transfer of risk.38 Ivo Welch39 and Mathias Hoeyer, Wurgler, and I40 emphasize a complementary channel of high-cost bank equity that comes from the mispricing of safe, low-leverage, and bond-like firms in the equity market. These private incentives again provide a rationale for regulation, this time of bank capital. However, Agarwal, David Lucca, Seru, and Francesco Trebbi show how the capture of state regulators, whose revenues depend on the size of the banks they regulate, abetted reductions in risk-weighted capital ratios.41

On the left or investing side of the balance sheet, demand deposits and concomitant fragility mean that banks must hold some portion of their assets in ultraliquid securities. By analogy, Sergey Chernenko and Aditya Sunderam show how open-end equity mutual funds, like banks, use cash management to accommodate liquidity demands even when the underlying securities are illiquid.42 But, private incentives are once again limited. Douglas Diamond and Anil Kashyap argue that because their depositors have imperfect information, banks, left to their own devices, do not hold enough liquid assets to survive runs.43

While the creation of ultrasafe liabilities is the key function on the liability side of the banking system's balance sheet, screening and monitoring a diverse pool of risky borrowers is the key function on the asset side. Konstantin Milbradt and Martin Oehmke point to an interdependence between financing and investing horizons, suggesting that banks might hold short-duration loan portfolios, even when their highest return investments are long-term, as a result of financial frictions that grow with loan maturity.44 A critical question is whether banks price loans appropriately, given a borrower's risk and the bank's ability to absorb losses without resorting to government intervention and support. In traditional banks, Antonio Falato and David Scharfstein show that pressure coming from public equity markets to increase current stock price through short-term earnings causes banks to increase risk.45 In shadow banks, Marcin Kacperczyk and Schnabl find that risk-taking by money market funds is higher when the fund sponsor does not provide an implicit guarantee.46 Agarwal and Ben-David find that when bankers are encouraged to generate revenue through loan prospecting versus screening, risk also rises.47 Even with new commu-nications technology, banking deregulation, and consolidation, banking often remains local. Distance matters in Scharfstein and Sunderam, where concentrated local banking markets do not fully pass on reductions in yields on mortgage-backed securities to their customers.48 Itamar Drechsler, Alexi Savov, and Schnabl examine the macroeconomic implications of concentration in banking for monetary policy: Interest rate spreads increase as interest rates rise, reflecting bank market power and shifting deposits into higher yielding instruments.49

Markets

The banking system has always been somewhat transactional, preserving high-cost equity capital by originating loans and underwriting securities of various types, with the goal of transferring ownership to non-bank market participants through securitization, syndication, and public offerings. The ability to sell assets insulates the broader economy from the health of the banking system. For example, Tobias Adrian, Paolo Colla, and Shin show that bonds made up much of the shortfall in bank lending during the 2008 financial crisis.50 But bond and equity markets can themselves be sources of fluctuations, and the process of transferring assets from banks is fragile. Asset fire sales were a source of contagion in the crisis.51 Natural and informed buyers were also stressed and unable to absorb the sales of bank assets, creating a downward spiral in prices and bank capital when measured at fire sale prices. This is the source of bank vulnerability in Greenwood, Augustin Landier, and Thesmar.52

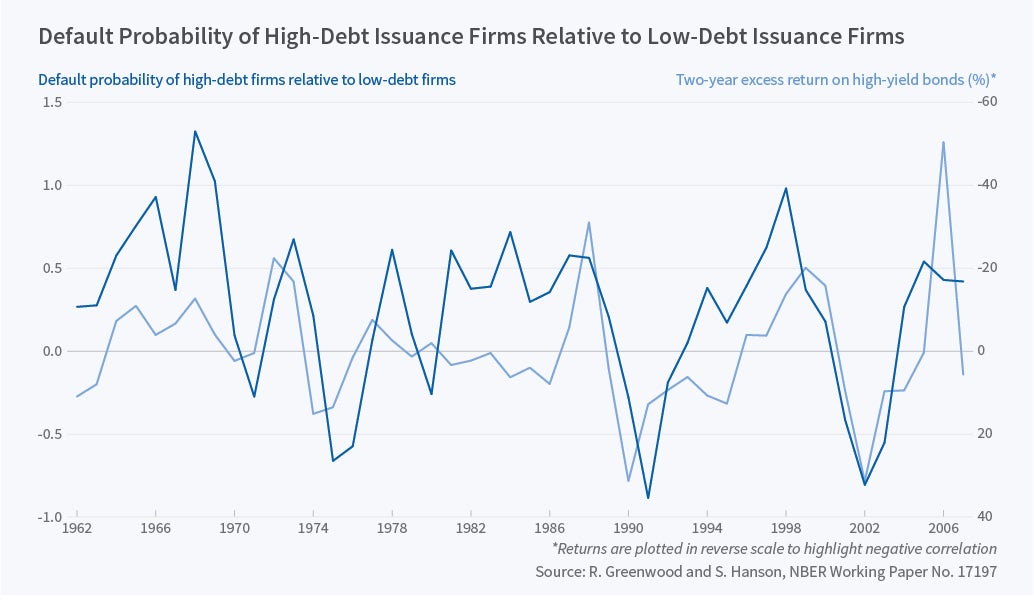

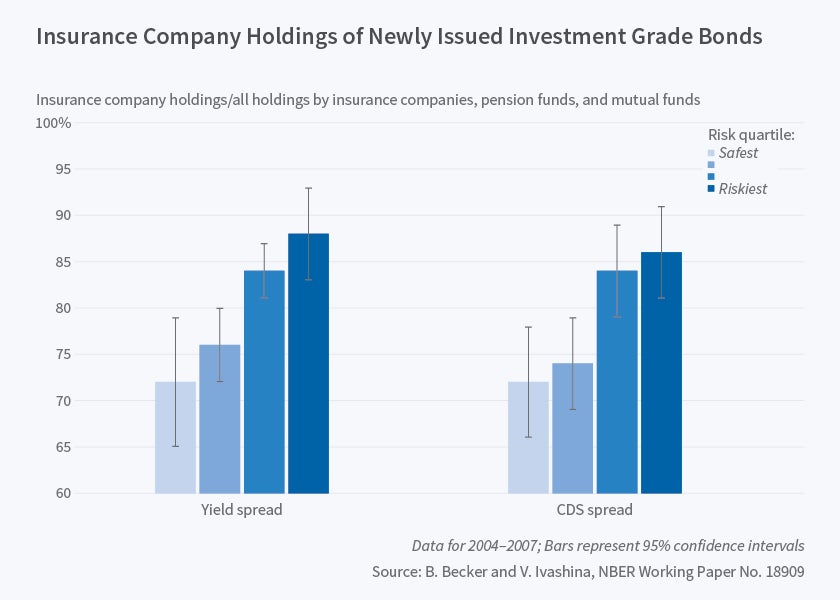

Along with a shift in focus from industrial firms to banks, researchers have turned their attention from equity to credit markets. A variety of factors appears to capture credit market sentiment: the share of low-quality issuers;53 the ratio of bank loans to bonds in corporate capital structure;54 intermediary leverage;55 growth in credit that is delinked from productivity;56 and insurance companies reaching for yield, holding the highest yielding issuers within any credit rating category.57 Figures 2a and 2b show two examples. David López-Salido, Stein, and Egon Zakrajšek argue that credit market sentiment predicts a decline in economic activity with a lag, suggesting that policy makers might use these measures of asset prices alongside the traditional objectives of price stability and employment in dictating monetary policy.58

There has been less focus on equity markets, which were not the epicenter of the 2008 crisis. One area of emphasis has been corporate governance and investor activism. In some sense the successful private equity model described in Steven Davis, John Haltiwanger, Ron Jarmin, Josh Lerner, and Javier Miranda59 and Robert Harris, Tim Jenkinson, and Kaplan,60 for example, has been imported into public equity markets, in a reprise of the 1980s. Lucian Bebchuk, Alon Brav, and Wei Jiang61 and Brav, Jiang, Song Ma, and Xuan Tian62 find analogous long-run benefits of activism in public markets, while Craig Doidge, Andrew Karolyi, and Stulz63 show that a new wave of acquisitions has thinned the ranks of publicly listed firms. Even without activism, Philip Bond, Alex Edmans, and Itay Goldstein point to positive feedback effects from equity markets: Movements in stock price inform real decision making, and are in part self-fulfilling.64

The Macroeconomy

The program has become both more focused on individuals, as described above, and more macroeconomic. Papers routinely consider the general equilibrium conclusions of their microempirical estimates. For examples, see: Xavier Giroud and Joshua Rauh65 for the effect of state-level taxation; Agarwal, Gene Amromin, Chomsisengphet, Piskorski, Seru, and Yao66 for the effect of mandated loan modification; and Giroud and Holger Mueller 67 for the effect of firm balance sheets on aggregate employment. Broadly speaking, research has emphasized two related amplifying mechanisms for the 2008 crisis: the effect of household balance sheets on consumption, and the bank-lending channel.

Household balance sheets were arguably the ground zero of the crisis. Mian and Sufi have suggested that the effect of the housing boom and bust on household balance sheets was responsible for the sharp rise and fall in consumption surrounding the financial crisis.68 Prior to the crisis, lower-income ZIP codes responded aggressively to increases in house prices and the decoupling of credit and income growth, converting price changes to spending through borrowing. In these areas, the gap between income growth reported on mortgage applications and ZIP code income growth points to the loosening of credit standards as causal. The low-income areas that experienced more loan growth fared worse during the crisis, especially in nontradeable goods and services. Specific household amplifiers include the impact of mortgage finance through the conforming limit69 and the impact of auto lending as a result of the collapse of securitization.70

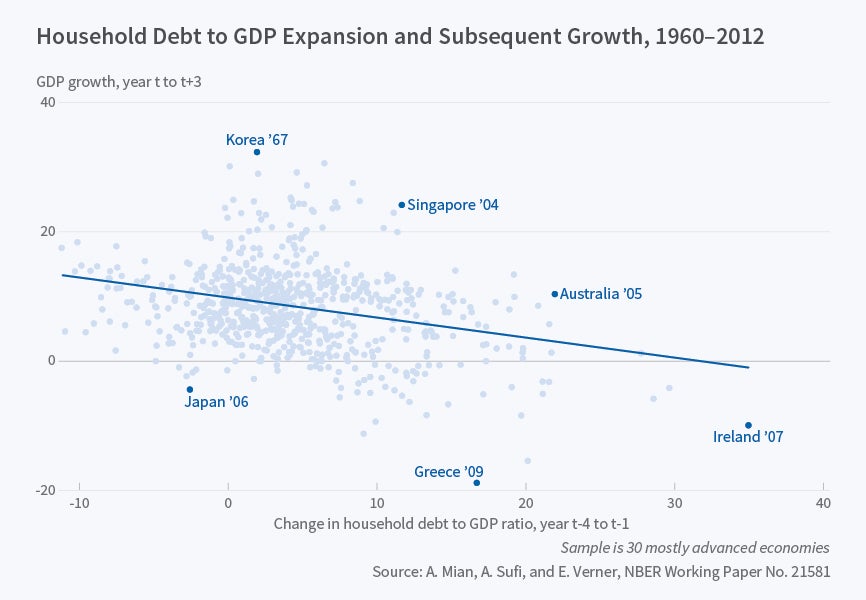

The labor market suffered in tandem with consumption. Corporate Finance researchers have increasingly considered employment as an outcome variable, alongside corporate finance and investment. For example, Jennifer Brown and David Matsa find that depressed housing markets lower household mobility and job-search activity.71 Relatedly, Kyle Herkenhoff, Gordon Phillips, and Ethan Cohen-Cole find an inefficient reallocation of labor in tight credit markets.72 Together, these papers suggest weak household balance sheets can be a driver of business cycles. Mian, Sufi, and Emil Verner show a broader link in the time series and across countries between the ratio of household debt to GDP and subsequent reductions in growth and employment, as shown in Figure 3.73

Cumulatively, this highly influential research, which documents a causal link from credit cycles to household balance sheets to consumption and employment, has made corporate finance central to macroeconomics. Taking issue with this pure supply-side narrative, Christopher Foote, Lara Loewenstein, and Paul Willen74 and Manuel Adelino, Schoar, and Felipe Severino75 point to the large contemporaneous growth in bad loans made to higher income and traditionally credit-worthy households. Rather than suggesting loose credit for lower income households as the critical mechanism, these papers point to a widespread loan-demand narrative as equally plausible.

As household solvency deteriorated, so too did the solvency of banks that lent to them, with consequences for the bank-lending channel and their client corporations. Small firms were hit harder than larger firms. Efraim Benmelech, Nittai Bergman, Anna Milanez, and Vladimir Mukharlyamov emphasize local contagion in firm bankruptcies, using data on retail centers.76 International trade was hit harder than domestic consumption. Implicitly then, bank finance plays a disproportionate role in these locations. For example, collateral is especially important for smaller firms;77 trade credit is easily stressed in cross-border transactions.78 Shocks can also propagate through the bank branch network as shown in Erik Gilje, Elena Loutskina, and Philip Strahan.79 Patrick Bolton, Xavier Freixas, Leonardo Gambacorta, and Paolo Emilio Mistrulli argue that relationship banking played a mitigating role for larger firms.80 Relationship banks may charge a premium in good times but they extended credit at favorable terms during the downturn. Murillo Campello, Erasmo Giambona, Graham, and Harvey81 point to credit lines and Michael Roberts82 points to renegotiation in allowing firms and banks to weather the crisis.

Future Directions

Recent history shows both the usefulness and adaptability of the empirical and theoretical toolkits of corporate finance. Undoubtedly, the bank-lending channel will continue to be an area of focus because of the availability of rich data on households, the quasi-experimental nature of government interventions in the financial system, and the salience and size of the macroeconomic effects of the financial crisis. However, the imperatives may soon shift with events, and may well move back to core topics such as the financing and governance of industrial firms; innovation, entrepreneurial finance, and productivity; and international trade, finance, and comparative financial systems.

There will also surely be new areas of inquiry. Studies of the rising share of finance in the global economy and the disruptive forces of emerging financial technology firms, such as Thomas Philippon83 and Jennie Bai, Philippon, and Savov84 may be leading indicators of what lies ahead.

Endnotes

R. Vishny, "Program Report: Corporate Finance," NBER Reporter, Winter, 1994-5, pp. 1-4

H. Ru and A. Schoar, "Do Credit Card Companies Screen for Behavioral Biases?" NBER Working Paper 22360, June 2016.

B. Keys, T. Piskorski, A. Seru, and V. Yao, "Mortgage Rates, Household Balance Sheets, and the Real Economy," NBER Working Paper 20561, October 2014.

A. Rampini and S. Viswanathan, "Household Risk Management," NBER Working Paper 22293, May 2016.

N. Gennaioli, A. Shleifer, and R. Vishny, "Neglected Risks, Financial Innovation, and Financial Fragility," NBER Working Paper 16068, June 2010, and Journal of Financial Economics, 104 (3), 2012, pp. 452-68; and P. Bordalo, N. Gennaioli, and A. Shleifer, "Salience Theory of Choice Under Risk," NBER Working Paper 16387, September 2010.

M. Baker and J. Wurgler, "Do Strict Capital Requirements Raise the Cost of Capital? Banking Regulation and the Low Risk Anomaly," NBER Working Paper 19018, May 2013; R. Fahlenbrach, R. Prilmeier, and R. Stulz, "Why Does Fast Loan Growth Predict Poor Performance for Banks?" NBER Working Paper 22089, March 2016; and M. Baron and W. Xiong, "Credit Expansion and Neglected Crash Risk," NBER Working Paper 22695, September 2016.

P. Bordalo, N. Gennaioli, and A. Shleifer, "Diagnostic Expectations and Credit Cycles," NBER Working Paper 22266, May 2016.

D. Kahneman and A. Tversky, "Subjective Probability: A Judgment of Representativeness," Cognitive Psychology, 3 (3), 1972, pp. 430-54; D. Kahneman, Thinking: Fast and Slow, New York, New York: Farrar, Straus, and Giroux, 2011; A. Tversky and D. Kahneman, "Judgment under Uncertainty: Heuristics and Biases," Science, 27 (185), 1974, 1124-31; and A. Tversky and D. Kahneman, "Extensional versus Intuitive Reasoning: the Conjunction Fallacy in Probability Judgment," Psychological Review, 90 (4), 1983, pp. 293-315.

I. Ben-David, J. Birru, and V. Prokopenya, "Uninformative Feedback and Risk Taking: Evidence from Retail Forex Trading," NBER Working Paper 22146, April 2016.

R. Greenwood and A. Shleifer, "Expectations of Returns and Expected Returns," NBER Working Paper 18686, January 2013, and The Review of Financial Studies, 27 (3), 2014, pp. 714-46.

S. Mullainathan, M. Noeth, and A. Schoar, "The Market for Financial Advice: An Audit Study," NBER Working Paper 17929, March 2012.

M. Egan, G. Matvos, and A. Seru, "The Market for Financial Adviser Misconduct," NBER Working Paper 22050, February 2016.

B. Carlin and D. Robinson, "What Does Financial Literacy Training Teach Us?" NBER Working Paper 16271, August 2010, and The Journal of Economic Education, 43 (3), 2012, pp. 235-47.

S. Agarwal, S. Chomsisengphet, N. Mahoney, and J. Stroebel, "Regulating Consumer Financial Products: Evidence from Credit Cards," NBER Working Paper 19484, September 2013, and The Quarterly Journal of Economics, 130 (1), 2015, pp. 111-64.

I. Ben-David, J. Graham, and C. Harvey, "Managerial Miscalibration," NBER Working Paper 16215, July 2010, and The Quarterly Journal of Economics, 128 (4), pp. 1547-84.

R. Greenwood and S. Hanson, "Waves in Ship Prices and Investment," NBER Working Paper 19246, July 2013, and The Quarterly Journal of Economics, 130 (1), 2015, pp. 55-109.

K. Shue and R. Townsend, "Growth through Rigidity: An Explanation for the Rise in CEO Pay," NBER Working Paper 21975, February 2016.

Y. Pan, T. Wang, and M. Weisbach, "CEO Investment Cycles," NBER Working Paper 19330, August 2013.

C. Parsons, J. Sulaeman, and S. Titman, "The Geography of Financial Misconduct," NBER Working Paper 20347, July 2014.

J P. Gompers, W. Gornall, S. Kaplan, and I. Strebulaev, "How Do Venture Capitalists Make Decisions?" NBER Working Paper 22587, September 2016.

I. Gow, S. Kaplan, D. Larcker, and A. Zakolyukina, "CEO Personality and Firm Policies," NBER Working Paper 22435, July 2016.

U. Malmendier, G. Tate, and J. Yan, "Overconfidence and Early-life Experiences: The Impact of Managerial Traits on Corporate Financial Policies," NBER Working Paper 15659, January 2010, and The Journal of Finance, 66 (5), pp. 1687-733. ↩

E. Benmelech and C. Frydman, "Military CEOs," NBER Working Paper 19782, January 2014, and Journal of Financial Economics, 117 (1), 2015, pp. 43-59.

A. Schoar and L. Zuo, "Shaped by Booms and Busts: How the Economy Impacts CEO Careers and Management Styles," NBER Working Paper 17590, November 2011.

C. Frydman and D. Jenter, "CEO Compensation," NBER Working Paper 16585, December 2010, and Annual Review of Financial Economics, 2 (1), 2010, pp. 75-102.

T. Chaney, D. Sraer, and D. Thesmar, "The Collateral Channel: How Real Estate Shocks Affect Corporate Investment," NBER Working Paper 16060, June 2010, and American Economic Review, 102 (6), 2012, pp. 2381-409.

G. Gorton, "The Development of Opacity in U.S. Banking," NBER Working Paper 19540, October 2013; G. Gorton, "The History and Economics of Safe Assets," NBER Working Paper 22210, April 2016.

G. Gorton, S. Lewellen, and A. Metrick, "The Safe-Asset Share," NBER Working Paper 17777, January 2012, and American Economic Review, 102 (3), 2012, pp. 101-6.

H. DeAngelo and R. Stulz, "Why High Leverage is Optimal for Banks," NBER Working Paper 19139, June 2013.

N. Gennaioli, A. Shleifer, and R. Vishny, "A Model of Shadow Banking," NBER Working Paper 17115, June 2011, and The Journal of Finance, 68 (4), 2013, pp. 1331-63.

S. Hanson, A. Shleifer, J. Stein, and R. Vishny, "Banks as Patient Fixed-Income Investors," NBER Working Paper 20288, July 2014, and Journal of Financial Economics, 117 (3), 2015, pp. 449-69.

O. Hart and L. Zingales, "Inefficient Provision of Liquidity," NBER Working Paper 17299, August 2011.

Z. He and A. Manela, "Information Acquisition in Rumor Based Bank Runs," NBER Working Paper 18513, November 2012, and The Journal of Finance, 71 (3), 2016, pp. 1113-58.

G. Gorton and G. Ordoñez, "Collateral Crises," NBER Working Paper 17771, January 2012, and American Economic Review, 104 (2), pp. 343-78.

V. Acharya, D. Gale, and T. Yorulmazer, "Rollover Risk and Market Freezes," NBER Working Paper 15674, January 2010, and The Journal of Finance, 66 (4), 2011, pp. 1177-209.

J. Hahm, H. S. Shin, and K. Shin, "Non-Core Bank Liabilities and Financial Vulnerability," NBER Working Paper 18428, September 2012, and Journal of Money, Credit and Banking, 45 (8), 2013, pp. 3-36.

J. Stein, "Monetary Policy as Financial-Stability Regulation," NBER Working Paper 16883, March 2011, and The Quarterly Journal of Economics, 127 (1), 2012, pp. 57-95.

V. Acharya, P. Schnabl, and G. Suarez, "Securitization without Risk Transfer," NBER Working Paper 15730, February 2010, and Journal of Financial Economics, 107 (3), 2010, pp. 515-36.

I. Welch, "Levered Returns," NBER Working Paper 22150, April 2016.

M. Baker, M. Hoeyer, and J. Wurgler, "The Risk Anomaly Tradeoff of Leverage," NBER Working Paper 22116, March 2016.

S. Agarwal, D. Lucca, A. Seru, and F. Trebbi, "Inconsistent Regulators: Evidence From Banking," NBER Working Paper 17736, January 2012, and The Quarterly Journal of Economics, 129 (2), 2012, pp. 889-938.

S. Chernenko and A. Sunderam, "Liquidity Transformation in Asset Management: Evidence from the Cash Holdings of Mutual Funds," NBER Working Paper 22391, July 2016.

D. Diamond and A. Kashyap, "Liquidity Requirements, Liquidity Choice, and Financial Stability," NBER Working Paper 22053, March 2016.

K. Milbradt and M. Oehmke, "Maturity Rationing and Collective Short-Termism," NBER Working Paper 19946, February 2014, and Journal of Financial Economics, 118 (3), 2015, pp. 553-70.

A. Falato and D. Scharfstein, "The Stock Market and Bank Risk-Taking," NBER Working Paper 22689, September 2016.

M. Kacperczyk and P. Schnabl, "Implicit Guarantees and Risk Taking: Evidence from Money Market Funds," NBER Working Paper 17321, August 2011.

S. Agarwal and I. Ben-David, "Loan Prospecting and the Loss of Soft Information," NBER Working Paper 19945, February 2014.

D. Scharfstein and A. Sunderam, "Concentration in Mortgage Lending, Refinancing Activity and Mortgage Rates," NBER Working Paper 19156, June 2013.

I. Drechsler, A. Savov, and P. Schnabl, "The Deposits Channel of Monetary Policy," NBER Working Paper 22152, April 2016.

T. Adrian, P. Colla, and H. S. Shin, "Which Financial Frictions? Parsing the Evidence from the Financial Crisis of 2007-9," NBER Working Paper 18335, August 2012, and in D. Acemoglu, J. Parker, and M. Woodford, eds., NBER Macroeconomics Annual 2012, Volume 27, Chicago, Illinois: University of Chicago Press, 2013, pp. 159-214.

A. Shleifer and R. Vishny, "Fire Sales in Finance and Macroeconomics," NBER Working Paper 16642, December 2010, and Journal of Economic Perspectives, 25 (1), 2011, pp. 29-48.

R. Greenwood, A. Landier, and D. Thesmar, "Vulnerable Banks," NBER Working Paper 18537, November 2012, and Journal of Financial Economics, 115(3), 2015, pp. 471-85.

R. Greenwood and S. Hanson, "Issuer Quality and the Credit Cycle," NBER Working Paper 17197, July 2011, and The Review of Financial Studies, 26 (6), 2013, pp. 1483-525.

B. Becker and V. Ivashina, "Cyclicality of Credit Supply: Firm Level Evidence," NBER Working Paper 17392, September 2011, and Journal of Monetary Economics, 62, 2014, pp. 76-93.

T. Adrian and H. Shin, "Procyclical Leverage and Value-at-Risk," NBER Working Paper 18943, April 2013, and The Review of Financial Studies, 27 (2), 2014, pp. 373-403.

G. Gorton and G. Ordoñez, "Good Booms, Bad Booms," NBER Working Paper 22008, February 2016.

B. Becker and V. Ivashina, "Reaching for Yield in the Bond Market," NBER Working Paper 18909, March 2013.

D. López-Salido, J. Stein, and E. Zakrajšek, "Credit-Market Sentiment and the Business Cycle," NBER Working Paper 21879, January 2016.

S. Davis, J. Haltiwanger, R. Jarmin, J. Lerner, and J. Miranda, "Private Equity and Employment," NBER Working Paper 17399, September 2011.

R. Harris, T. Jenkinson, and S. Kaplan, "Private Equity Performance: What Do We Know?" NBER Working Paper 17874, February 2012, and The Journal of Finance, 69 (5), 2014, pp. 1851-82.

L. Bebchuk, A. Brav, and W. Jiang, "The Long-Term Effects of Hedge Fund Activism," NBER Working Paper 21227, June 2015.

A. Brav, W. Jiang, S. Ma, and X. Tian, "How Does Hedge Fund Activism Reshape Corporate Innovation?" NBER Working Paper 22273, May 2016.

C. Doidge, A. Karolyi, and R. Stulz, "The U.S. Listing Gap," NBER Working Paper 21181, May 2015.

P. Bond, A. Edmans, and I. Goldstein, "The Real Effects of Financial Markets," NBER Working Paper 17719, December 2011, and Annual Review of Financial Economics, 4 (1), 2012, pp. 339-60.

X. Giroud and J. Rauh, "State Taxation and the Reallocation of Business Activity: Evidence from Establishment-Level Data," NBER Working Paper 21534, September 2015.

S. Agarwal, G. Amromin, S. Chomsisengphet, T. Piskorski, A. Seru, and V. Yao, "Mortgage Refinancing, Consumer Spending, and Competition: Evidence from the Home Affordable Refinancing Program," NBER Working Paper 21512, August 2015.

X. Giroud and H. Mueller, "Firm Leverage and Unemployment during the Great Recession," NBER Working Paper 21076, April 2015.

A. Mian and A. Sufi, "Household Leverage and the Recession of 2007 to 2009," NBER Working Paper 15896, April 2010, and IMF Economic Review, 58(1), 2010, pp. 74-117; A. Mian and A. Sufi, "What Explains High Unemployment? The Aggregate Demand Channel," NBER Working Paper 17830, February 2012; A. Mian and A. Sufi, "House Price Gains and U.S. Household Spending from 2002 to 2006," NBER Working Paper 20152, May 2014; and A. Mian and A. Sufi, "Fraudulent Income Overstatement on Mortgage Applications during the Credit Expansion of 2002 to 2005," NBER Working Paper 20947, February 2015.

M. Adelino, A. Schoar, and F. Severino, "Credit Supply and House Prices: Evidence from Mortgage Market Segmentation," NBER Working Paper 17832, February 2012.

E. Benmelech, R. Meisenzahl, and R. Ramcharan, "The Real Effects of Liquidity during the Financial Crisis: Evidence from Automobiles," NBER Working Paper 22148, April 2016.

J. Brown and D. Matsa, "Locked in by Leverage: Job Search during the Housing Crisis," NBER Working Paper 22929, December 2016.

K. Herkenhoff, G. Phillips, and E. Cohen-Cole, "How Credit Constraints Impact Job Finding Rates, Sorting, and Aggregate Output," NBER Working Paper 22274, May 2016.

A. Mian, A. Sufi, and E. Verner, "Household Debt and Business Cycles Worldwide," NBER Working Paper 21581, September 2015.

C. Foote, L. Loewenstein, and P. Willen, "Cross-Sectional Patterns of Mortgage Debt during the Housing Boom: Evidence and Implications," NBER Working Paper 22985, December 2016.

M. Adelino, A. Schoar, and F. Severino, "Loan Originations and Defaults in the Mortgage Crisis: The Role of the Middle Class," NBER Working Paper 20848, January 2015, and The Review of Financial Studies, 29 (7), 2016, pp. 1635-70; and M. Adelino, A. Schoar, and F. Severino, "Loan Originations and Defaults in the Mortgage Crisis: Further Evidence," NBER Working Paper 21320, July 2015.

E. Benmelech, N. Bergman, A. Milanez, and V. Mukharlyamov, "The Agglomeration of Bankruptcy," NBER Working Paper 20254, June 2014.

M. Adelino, A. Schoar, and F. Severino, "House Prices, Collateral, and Self-Employment," NBER Working Paper 18868, March 2013, and Journal of Financial Economics, 117 (2), 2015, pp. 288-306.

P. Antràs and C. Foley, "Poultry in Motion: A Study of International Trade Finance Practices," NBER Working Paper 17091, May 2011, and Journal of Political Economy, 123 (4), 2015, pp. 853-901; and C. Foley and K. Manova, "International Trade, Multinational Activity, and Corporate Finance," NBER Working Paper 20634, October 2014, and Annual Review of Economics, 7 (1), 2015, pp. 119-46.

E. Gilje, E. Loutskina, and P. Strahan, "Exporting Liquidity: Branch Banking and Financial Integration," NBER Working Paper 19403, September 2013, and The Journal of Finance, 71 (3), 2016, pp. 1159-84.

P. Bolton, X. Freixas, L. Gambacorta, and P. Mistrulli, "Relationship and Transaction Lending in a Crisis," NBER Working Paper 19467, September 2013.

M. Campello, E. Giambona, J. Graham, and C. Harvey, "Liquidity Management and Corporate Investment during a Financial Crisis," NBER Working Paper 16309, August 2010, and The Review of Financial Studies, 24 (6), pp. 1944-79.

M. Roberts, "The Role of Dynamic Renegotiation and Asymmetric Information in Financial Contracting," NBER Working Paper 20484, September 2014.

T. Philippon, "Has the U.S. Finance Industry Become Less Efficient? On the Theory and Measurement of Financial Intermediation," NBER Working Paper 18077, May 2012, and American Economic Review, 105 (4), 2015, pp. 1408-38; and T. Philippon, "The FinTech Opportunity," NBER Working Paper 22476, August 2016.

J. Bai, T. Philippon, and A. Savov, "Have Financial Markets Become More Informative?" NBER Working Paper 19728, December 2013.