The Economics of Fair Trade

Fair Trade certification, a labeling initiative that offers better terms to producers and helps them to organize, aims to offer ethically minded consumers the opportunity to help lift producers in developing countries out of poverty. In a series of recent papers, I have examined the causes and consequences of Fair Trade certification.1

The appeal of this initiative is reflected in the impressive growth of Fair Trade-certified imports over the past two decades. Since Fair Trade's inception in 1997, sales of its certified products have grown exponentially. In 2016, when data are last available, there were over 1,400 Fair Trade-certified producer organizations worldwide representing more than 1.6 million Fair Trade-certified farmers and workers in 73 countries across 19 product categories.

This growth appears to be driven by socially motivated demand by Western consumers who are willing to pay more for coffee that is produced in a manner consistent with Fair Trade certification. A number of recent studies focusing on coffee provide convincing evidence that the demand for Fair Trade-certified products is significantly higher and less price-sensitive than for conventional products.2

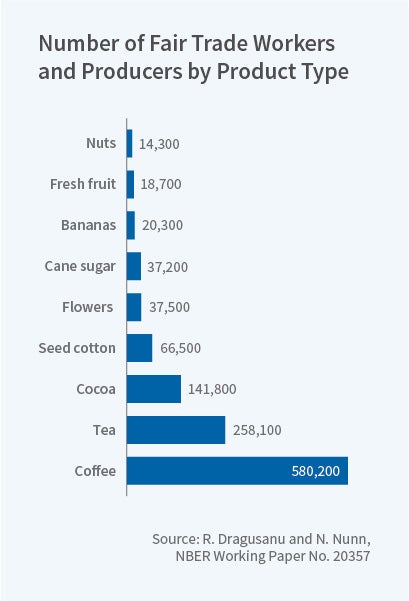

Among the products that have Fair Trade certification, coffee is the largest product category. A comparison of coffee with other products in terms of the number of producers that fall under the certification is shown in Figure 1. Fair Trade accounts for 48 percent of all Fair Trade farmers and for 46 percent of total premiums paid.3 Given this, my research has tended to focus on this sector.

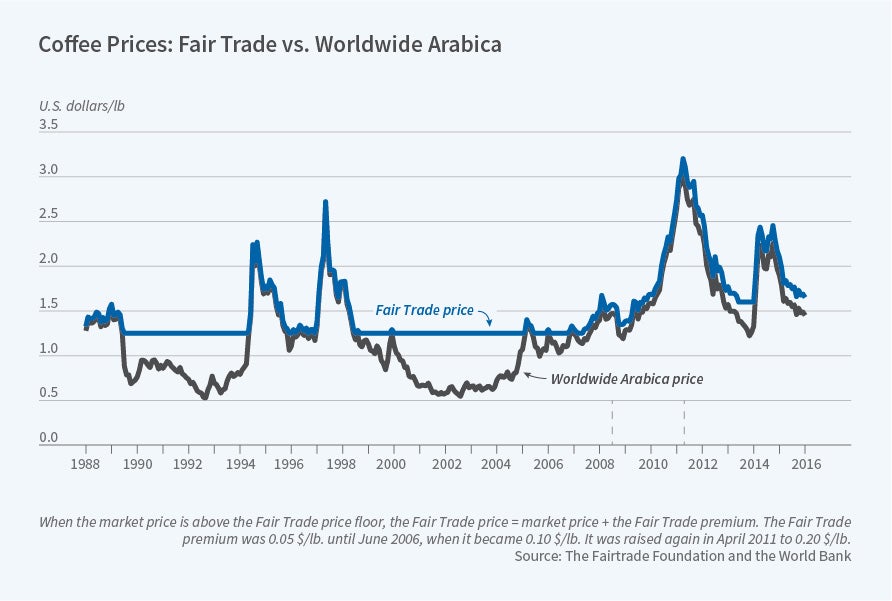

Fair Trade uses two primary mechanisms in an attempt to achieve its goal of improving the lives of farmers in developing countries. The first is a guaranteed minimum price to be paid if the product is sold as Fair Trade. This is meant to cover the average costs of sustainable production and to provide a guarantee that reduces the risk faced by coffee growers. The second is a price premium paid to producers. This premium is in addition to the sales price and must be set aside and invested in projects that improve the quality of life of producers and their communities. The specifics of how the premium is used must be reached in a democratic manner by the producers themselves.

The relationship between the sum of the minimum price and price premium — the guaranteed amount that Fair Trade-certified producers receive if their products are sold as Fair Trade — and the market price is shown in Figure 2 for coffee. From the figure it is clear that the market price for coffee has historically been volatile and that, for significant periods of time, the market price has been below the Fair Trade price.

Despite the rapid growth and pervasiveness of Fair Trade products, well-identified evidence of the effects of Fair Trade certification remains scarce. The question remains: Does Fair Trade accomplish its intended goals? Does it really work? My recent study with Raluca Dragusanu attempts to answer this question by estimating the effects of Fair Trade certification within the coffee sector in Costa Rica.4

The primary issue one faces when attempting to identify the causal effects of Fair Trade is that certification is endogenous. For example, mills may become certified when they also obtain a lucrative long-term contract from a large buyer like Starbucks. To gain a better understanding of the nature of selection into certification, in August 2012 we interviewed several Fair Trade-certified coffee cooperatives to collect information on the factors that lead co-ops to become Fair Trade-certified. Importantly, and perhaps surprisingly, we learned that the reasons for selection appear to be ambiguous or even negative. In theory, positive selection could arise, since those with the greatest capacity to adopt Fair Trade are also capable in other dimensions of business. However, in reality, the most common narrative during our interviews was that Fair Trade was something that producers resorted to only if they had difficulty selling their coffee otherwise.

The study examines the universe of coffee mills in Costa Rica, observed annually over a sixteen-year period, 1999–2014. The analysis accounts for time-invariant differences across mills, as well as mill-invariant differences across years. Despite accounting for these factors, it is still possible that selection into certification results in misleading estimates of the causal effect of Fair Trade certification. Thus, the estimation strategy also exploits the fact that the expected benefits that accrue because of Fair Trade certification varied significantly during our sample period. This is true both because of variation in the market price of conventional coffee and in the price paid for Fair Trade-certified coffee due to changes in the Fair Trade minimum price and price premium. This generates time variation in the price difference between Fair Trade and conventional coffee, which the study also exploits.

The estimates indicate that when the price floor is binding, Fair Trade-certified producers sell their products at higher prices and earn more revenues. Thus, Fair Trade does have some effect. However, we also find that the effect of Fair Trade is limited to only a fraction of the market: not all coffee that is eligible to be sold as Fair Trade can actually be sold as Fair Trade by Fair Trade-certified farmers.5 The magnitude of our estimates is consistent with this fact. Taken at face value, they indicate that only 12 percent of Fair Trade-eligible coffee was sold as Fair Trade over our sample period. Put differently, we find that if the effective price benefit to Fair Trade certification — the difference between the Fair Trade and conventional prices — increases by 1 cent, the average price benefit received by Fair Trade-certified mills is only 0.12 cents.

We then turn to upstream effects and estimate the effects of Fair Trade certification on intermediaries, farmers, and farm employees. We link Fair Trade certification to these individuals, observed in household survey data, by constructing a measure of the share of exports in a canton (an administrative region in Costa Rica) and year that is from Fair Trade-certified producers.

Since one of the explicit goals of Fair Trade is to set aside funds for community projects, it is possible that households not directly involved in coffee production, but living in the same canton, may also benefit from an increase in Fair Trade certification. Thus, our analysis checks for the presence of spillovers by examining the effects of Fair Trade certification on all households in a canton, including those not employed in the coffee sector.

We find no evidence of positive spillover effects from Fair Trade certification to households in the canton not working in the coffee sector. For those working within the coffee sector, we find sizeable, highly uneven benefits.

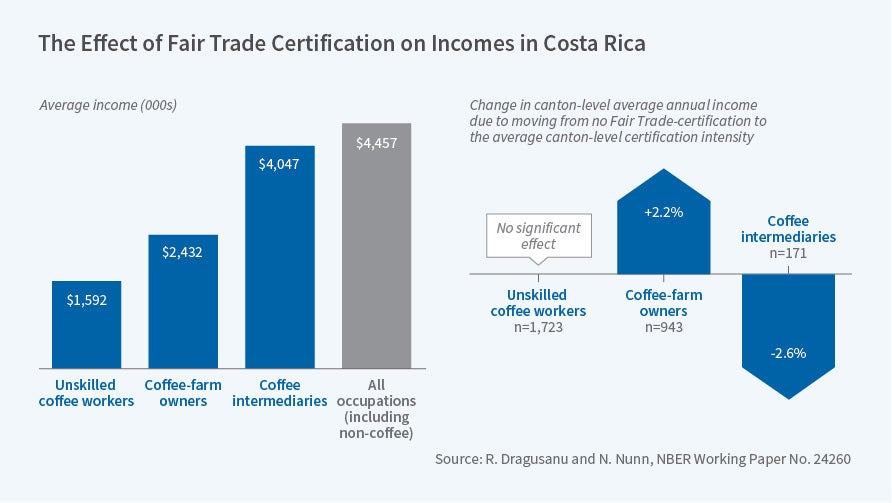

Within the coffee sector, we separately estimate the effects of Fair Trade on the incomes of three groups. The first is skilled coffee growers, who are primarily farm owners and are 33 percent of those working in the coffee sector. The second is unskilled workers, such as coffee pickers and farm laborers. This is the largest group, accounting for 61 percent of those working in the sector. The third is non-farm occupations in the coffee sector, primarily intermediaries and their employees who are responsible for transportation, storage, and sales. This group accounts for 6 percent of those working in the sector. The size and average annual income of each group in our sample are summarized in Figure 3. The figure also summarizes the estimated effects for each group.

We find large positive income effects for farm owners. An increase from zero to the mean Fair Trade-certification intensity is associated with a 2.2 percent increase in average income. Given that this group is one-third of those working in the coffee sector, this is a sizeable benefit that affects a large number of individuals. However, we also find that for unskilled workers, the poorest and largest group within the coffee sector, there is no evidence of a positive effect of Fair Trade on incomes. The estimated effects for this group are small and statistically insignificant. Lastly, we find that the small group of intermediaries in nonfarm occupations is hurt significantly by Fair Trade. For this group, the same increase in Fair Trade intensity is associated with a 2.6 percent decline in average incomes. Since intermediaries have incomes that are approximately 40 percent higher than those of farm owners, a consequence of Fair Trade is that it decreases income inequality within the coffee sector by transferring rents from higher-income intermediaries to lower-income farm owners.

According to our estimates, about 10 percent of the gains to farm owners are likely due to the losses to intermediaries, while the remaining 90 percent of the gains are explained by the minimum price of Fair Trade-certified coffee. The magnitudes of our estimated effects line up very closely with expected benefits to Fair Trade, based on actual sales by Fair Trade-certified producers, the difference between the world price and the Fair Trade price guarantee, and the number of coffee producers, workers, and intermediaries in Costa Rica during our sample period.

Motivated by the fact that within Costa Rica, cooperatives commonly use Fair Trade premiums for building schools, purchasing materials, and providing scholarships, we also examine the effect of Fair Trade certification on education, as measured by the enrollment of school-aged children. However, we find no evidence of positive effects of Fair Trade on schooling. The one education effect of Fair Trade that we do find is adverse: For the children of intermediaries, Fair Trade certification is associated with a 7.3 percentage-point decrease in the probability of high school enrollment. These effects are likely due to the large negative income effects that we find for coffee intermediaries.

In the end, our household estimates paint a mixed picture. Fair Trade appears to have helped farm owners, increasing their incomes. Part of these gains (approximately 10 percent) appears to arise from a transfer of rents from intermediaries. This is likely due to the creation of farmer cooperatives that perform many of the activities that intermediaries would otherwise perform. As a consequence, Fair Trade is also associated with a significant reduction in the incomes of intermediaries in the coffee sector. By these metrics, Fair Trade appears to be accomplishing some of its stated goals. The relatively impoverished coffee farmers gain at the expense of the wealthier coffee intermediaries. However, we also find that the poorest and largest group within the coffee sector — unskilled workers — does not gain at all from Fair Trade. In addition, we find no evidence of positive spillovers of benefits to those in the local community who work outside of the coffee sector.

Endnotes

R. Dragusanu, D. Giovannucci, and N. Nunn, "The Economics of Fair Trade," NBER Working Paper No. 20357, July 2014, and Journal of Economic Perspectives, 28(3), 2014, pp. 217–36.

C. Arnot, P. Boxall, and S. Cash, "Do Ethical Consumers Care About Price? A Revealed Preference Analysis of Fair Trade Coffee Purchases," Canadian Journal of Agricultural Economics, 54(4), 2006, pp. 555–65; M. Hiscox, M. Broukhim, and C. Litwin, "Consumer Demand for Fair Trade: New Evidence from a Field Experiment using eBay Auctions of Fresh- Roasted Coffee," 2011. Mimeo, Harvard University; and J. Hainmueller, M. Hiscox, and S. Sequeira, "Consumer Demand for Fair Trade: Evidence from a Multistore Field Experiment," Review of Economics and Statistics, 97(2), 2015, pp. 242–56.

R. Dragusanu and N. Nunn,"The Effects of Fair Trade Certification: Evidence from Coffee Producers in Costa Rica," NBER Working Paper No. 24260, January 2018.