The Economics of Drug Development: Pricing and Innovation in a Changing Market

Pricing and competition in pharmaceutical markets is an area of great debate and controversy, much of which stems from the fact that patent protection allows firms to charge high prices for potentially life-saving treatments. In the absence of patents, other firms would be attracted by the large profits earned by incumbent firms and enter the market. Such entry would likely raise current period welfare by reducing prices and increasing access to valuable medications.

However, society enacts regulations that prohibit this entry in pharmaceuticals and other intellectual property-dependent markets, allowing high price-cost margins to exist for a period of time. Policymakers accept the reduced output from higher prices in order to provide appropriate incentives for firms to make large fixed-cost investments in new products. That is, there is an implicit trade-off in which some degree of current welfare is sacrificed in order to ensure strong incentives for future innovation.

A body of research supports this tradeoff, showing a robust relationship between expected profitability of pharmaceutical products and investment in research and development.1 The trade-off is not intended to be permanent. After a period of time, patented products are meant to face additional competition that decreases prices, either through the introduction of therapeutic substitutes that engage in "brand-brand" competition that has a moderate effect on prices, or from post-patent generic competition, which drives prices even lower. The degree and nature of the eventual competition is dictated by a combination of policies and market forces.

The parameters of the complicated tradeoff between static and dynamic efficiencies, such as the length and strength of patents, are intended to provide the incentives for an optimal amount of innovation. As a result, these parameters are inherently context-specific, and as the market for developing and selling pharmaceuticals changes, policymakers should reevaluate the fundamentals of the tradeoff. For example, factors that decrease the costs of developing products — such as less stringent clinical research requirements — or those that meaningfully increase potential revenues — such as large-scale increases in prescription drug coverage or the ability to develop products targeting particularly deadly diseases — could support shorter or weaker patent protection. In contrast, factors that increase the difficulty and/or length of the development process — such as targeting diseases where demonstrating efficacy is more difficult — would support stronger or longer patent protections.

Given the dependence of the development of pharmaceutical products on the existing body of scientific knowledge, scientific advancements likely will affect the optimality of the tradeoff between access today and innovation tomorrow. In partnership with various coauthors across a series of papers, I have investigated how changes in the development process of pharmaceuticals impact the economics of drug development, pricing, and innovation.

One strand of research examines changes in the ability of firms to create products targeting small and specific patient populations — products that are often paired with diagnostic tests indicating the product's likely efficacy in an individual. Broadly speaking, these types of drugs are part of the evolving world of precision medicine. The ability of firms to develop such products is more than simply a scientific advancement or curiosity. A pharmaceutical market involving products targeting small patient populations has vastly different economic fundamentals than those that prevailed when the parameters of our existing intellectual property system were developed. This mismatch between public policy and the current reality of drug development has implications for both optimal policy and firm strategies.

In a recent paper, Amitabh Chandra, Ariel Dora Stern, and I examine the degree to which the market is increasingly focusing on R&D activities related to precision medicines, and discuss the economic implications of such a shift in the product mixture.2 We first use data from the Cortellis Competitive Intelligence Clinical Trials Database (Cortellis), which is compiled by Clarivate (and formerly by Thomson Reuters) and contains all registered clinical trials from two dozen international clinical trial registries. Importantly for our purposes, these data contain detailed descriptions of the trials including the use and specific role of any biomarkers. At a high level, a biomarker is "a defined characteristic that is measured as an indicator of normal biological processes, pathogenic processes, or responses to an exposure or intervention, including therapeutic interventions," — that is, measurable features of a patient.3

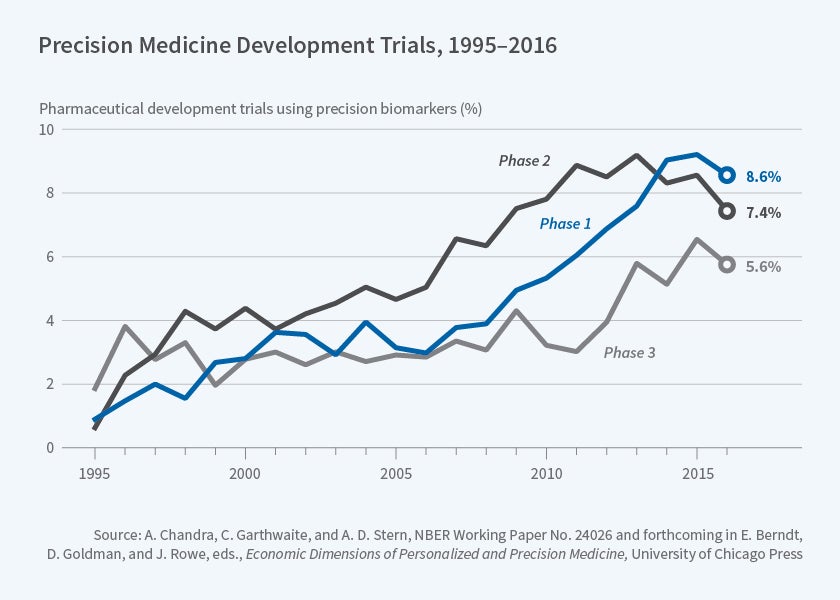

Biomarkers can serve a variety of purposes in a clinical trial. Some, but not all, of these purposes may relate to precision medicine. For example, a biomarker can be included to measure the toxicity of a product across an entire population; this is valuable, but isn't especially relevant to targeting. When considering the economic evolution of the pharmaceutical market, we are primarily interested in trials that employ biomarkers for the purpose of identifying patient populations that are more (or less) likely to respond to particular medications. We therefore exploit additional information on the role of the biomarker in a trial to identify those related to products that we define as "likely precision medicines" (LPMs). Figure 1 depicts the growth in trials for these LPMs over time and shows an increase in their use across all phases of clinical development. In particular, there has been a marked increase in Phase I trials for LPMs in recent years.

The increasing percentage of LPMs in pharmaceutical development has clear economic ramifications. In particular, the ability to create these products changes optimal pricing policies, decisions about which drugs to prioritize in the development process, and the structure of existing government research and development incentives.

One area in which these scientific developments affect the market involves a firm's investment decision for products targeting small patient populations. Historically, there have been limited incentives for pharmaceutical firms to develop products targeting conditions afflicting relatively small numbers of patients. Since the fixed costs of research and development are broadly unrelated to the size of the potential pool of patients, firms generally find it difficult to invest profitably in products that create large amounts of value per patient but treat relatively few individuals.

Recognizing this fact, many developed countries have implemented policies that provide additional incentives for products targeting small patient populations. In the United States, these policies took the form of the Orphan Drug Act (ODA), which provides both research and development tax credits, and allows extended periods of market exclusivity for firms developing products aimed at conditions afflicting fewer than 200,000 patients. These two policies are intended to shift the optimal investment threshold for firms. Passed in 1983, the ODA originally relied on firms demonstrating a lack of economic viability for a product, rather than a strict population limit. The 200,000-patient limit was added in 1984 and, according to the Department of Health and Human Services, was arbitrarily based on the prevalence of narcolepsy and multiple sclerosis. The decision to pick those conditions, which established the patient population threshold, was influenced by the then-existing technology and associated fixed costs for drug development.

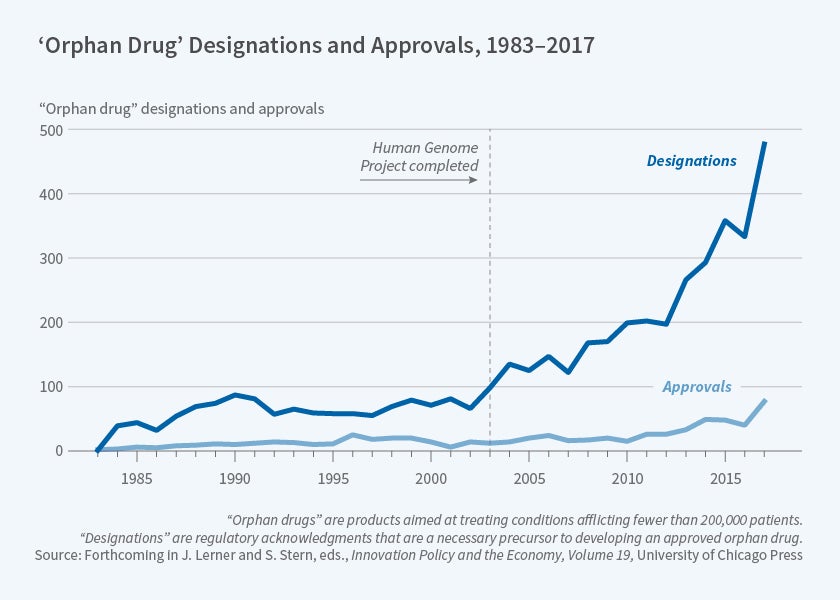

In the 35 years since the passage of the ODA, advances in technology related to biomarkers, as well as developments in the understanding of the human genome, have changed the cost structure for firms developing products targeting small patient populations. Benjamin Berger, Nicholas Bagley, Chandra, Stern, and I examine the market for orphan drugs and the implications of changes in the ability of firms to develop these types of products.4 Orphan designations are a formal regulatory acknowledgement that a firm is attempting to develop a drug for a rare disease and is a necessary precursor to developing an approved orphan drug. In recent years, as Figure 2 illustrates, there has been a marked increase in the number of these designations — with a rapid increase in the United States broadly following the completion of the Human Genome Project.

The rapid increase in clinical trial activity for precision products and the number of products receiving orphan designations should change the nature of pricing and competition in these markets. Precision medicines and orphan products have, on average, higher prices than other medications. As we discuss in our joint work, and as Stern, Chandra, and Brian Alexander explain in an additional paper, these high prices are the result of a selection effect of products brought to market rather than a special pricing rule for orphan diseases.5 For example, given the small patient population, firms will only bring to market products that generate large amounts of value for individuals with those conditions. For such products, the potential value created leads to an expected price and resulting profits that justify the research and development investments. Thus, in equilibrium, prices are higher for orphan drugs that firms choose to bring to market than for other drugs.

While the high prices for orphan drugs may represent an equilibrium based on the investment decisions of firms, as for other drugs, these high prices are only intended to exist while the product is under patent protection. For traditional, small-molecule drugs, the United States has long provided the policy framework to support a robust system of generic competition. While the United States still lacks a truly competitive post-patent market for complex biologic products (i.e. biosimilars), for small-molecule products the expiration of a patent is normally followed by generic entry and large price decreases. However, as technology allows for drug developers to target increasingly smaller patient populations, the future prospects for this competitive system are limited.

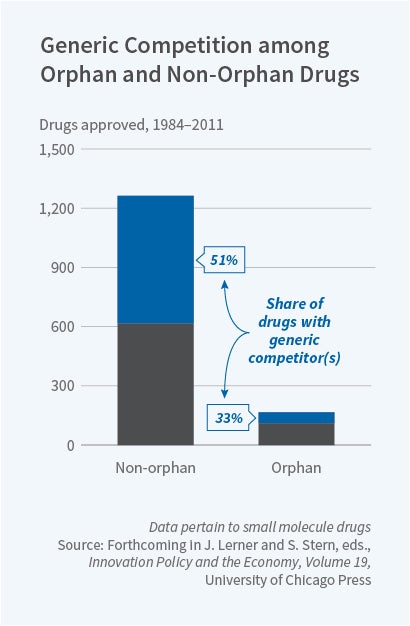

The attractiveness of any market from the perspective of a new entrant is a function of the expected profitability of entry. For products targeting exceptionally small patient populations, the fixed costs of entry and the likelihood of intense post-entry price competition mean that a new entrant is unlikely to earn profits. This means that in the markets for some drugs targeted at small populations, a generic firm will never emerge — regardless of how high a price-cost margin the incumbent firm is able to charge. Evidence of this phenomenon can be seen in the nature of generic competition across orphan and non-orphan products in Figure 3. Approximately 50 percent of small-molecule non-orphan drug products have faced generic competition in the form of a competitor firm filing an abbreviated new drug application (ANDA) — a necessary regulatory step for a firm to produce a generic product. In contrast, only 33 percent of small-molecule orphan products have ever had an ANDA filed against them.

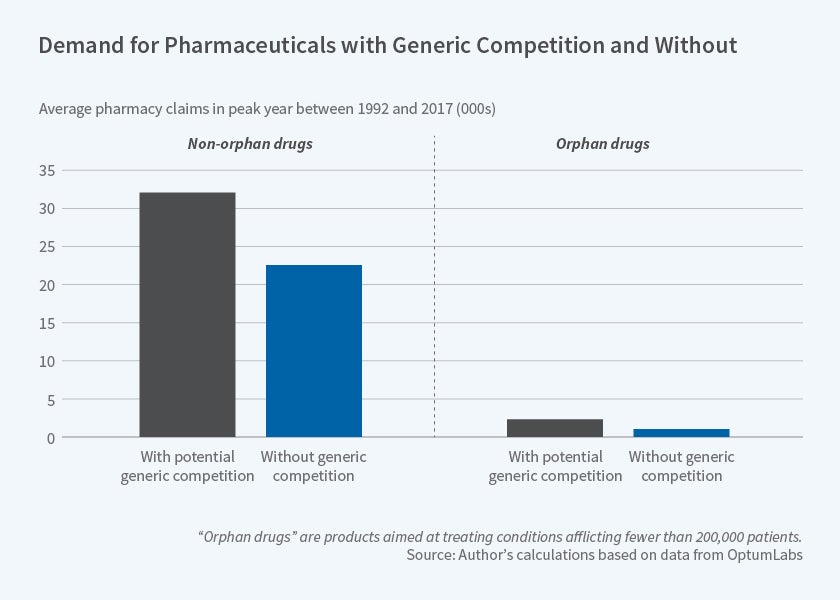

Figure 4, on the next page, demonstrates the role of market size in determining future competition. It shows the average peak demand in pharmacy claims data for orphan and non-orphan products based on the presence of an ANDA. These data come from OptumLabs and comprise all retail and mail-order pharmacy claims and inpatient and outpatient medical claims filed by United Healthcare beneficiaries between 1992 and 2017. The table demonstrates the importance of market size in determining competition. Products that never receive an ANDA have meaningfully smaller peak demand compared with those that face some form of generic competition.

The lack of generic competition emerging to compete with branded products losing patent protection is currently limited to a relatively small number of drugs that target very small patient markets. However, as more and more firms develop precision medicines, the lack of generic entry in small drug markets could become a greater threat to future price competition across the entire market. Consider, for example, the case of Kalydeco (ivacaftor), which is a treatment for a subset of cystic fibrosis patients who also have a particular set of mutations. The likely patient population is estimated at between 2,000 and 3,000, and the drug costs several hundred thousand dollars per year. Despite the high prices, the small patient population means that it is unlikely that additional firms will attempt to target patients currently treated with Kalydeco.

Profit-maximizing firms understand the benefits of potentially long-lived profits from products targeting these smaller patient populations. As a result, it may be optimal for firms to shift their attention away from products that create meaningful value for large patient populations but where future competition may quickly allow patients to capture that value. For example, Vertex (the manufacturer of Kalydeco) is developing several additional products that target cystic fibrosis patients with mutations — each of which will likely face little competition from generics or therapeutic substitutes. Future work should examine the degree to which firms are shifting research away from the larger market products that are more likely to receive meaningful competition in favor of these smaller markets that might offer larger and more long-lived profits.

Beyond simply extending the time period during which firms face little or no competition, an increasing ability to develop products aimed at small patient populations could change a firm's optimal pricing strategy. If firms can more accurately predict a drug's ex ante efficacy — as is true for many precision medicines — they could develop more complicated pricing policies that allow them to capture more of the value they create. This is particularly true if a product can be used to treat multiple conditions with varying efficacy across these conditions. In these settings, firms may be interested in charging prices based on the indication-specific value created; this is often called indication-based pricing. Such a pricing system is promoted by many policy activists who believe that charging prices based on a product's indication-specific value will lower prices and reduce pharmaceutical profits.6 However, a system allowing firms to charge different prices based on a consumer's value and willingness to pay for a product presents the ideal conditions for price discrimination.

To understand the way in which indication-based pricing allows firms to price-discriminate, consider how pharmaceutical firms set prices for products that can be used to treat multiple conditions. For all drugs, prices are set based on negotiations between pharmaceutical firms and payers/pharmacy benefit managers. In most cases, a firm's optimal price is limited by the value a product creates, because an insurer must pass along the cost to patients via premiums.7 If pharmaceutical manufacturers set a high price relative to the value created for a specific indication, payers will implement utilization management programs that limit access to the product. For products treating multiple conditions, this ability for payers to restrict access requires pharmaceutical manufacturers to consider which segments of the market it will attempt to serve.

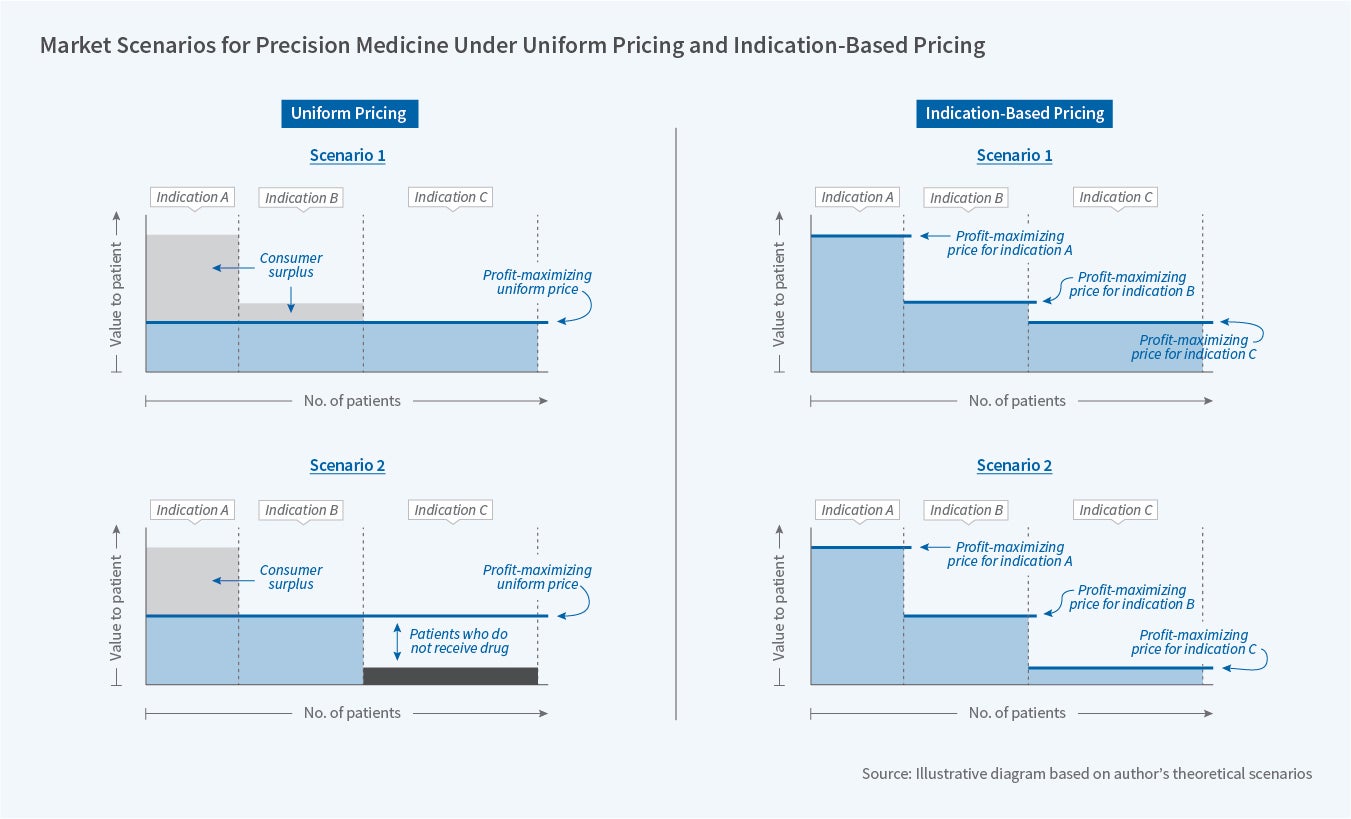

The pricing decisions of firms for different markets is summarized in Figure 5.8 Panel A contains a depiction of optimal pricing decisions for firms under the existing uniform pricing system for a product that treats three indications with differing efficacy. Under Scenario 1, patients with Indication C receive the least relative value of all patients. However, given the large size of this population, and the broadly high value they receive, a pharmaceutical manufacturer finds it optimal to set a price that causes insurers to allow these patients to access the medication. This relatively low price allows patients with Indications A and B to enjoy a relatively large amount of consumer surplus. In contrast, in Scenario 2 of Panel A, patients who have Indication C receive such a small amount of value from the product that the pharmaceutical firm finds it optimal to set a price that causes the insurer to limit these patients from accessing the drug. This decreases output and results in some of the consumer surplus from Indication B patients now being captured by the firm.

Now consider the situation where a pharmaceutical manufacturer could charge multiple prices. For ease of discussion, Panel B presents a simplified version of this for the two scenarios discussed above, where firms are able to price at the maximum willingness to pay for each indication and consumers don't respond to a higher price through reduced utilization. In this case, the ability to charge multiple prices means that firms are able to capture far more surplus than they could under a uniform pricing system.

After considering this simple example, it becomes hard to imagine how implementing indication-based pricing would result in reduced pharmaceutical profits or lower average prices. However, the welfare implications of indication-based pricing remain decidedly unclear. If the number of markets similar to Scenario 2 is large, then instituting indication-based pricing could be output-expanding. However, if most markets resemble Scenario 1, the primary effect of an indication-based pricing scheme would be to transfer value to firms. Again, the welfare implications of this transfer are unclear. Greater expected profits from such a system could increase the amount of innovation, as products that previously would not have generated sufficient profits to justify development are now worth more in expectation. However, the higher prices for each indication could reduce output — particularly if patients are exposed to meaningful cost-sharing based on the price of the product. The potential scope for these welfare losses increases if each indication is quite small and therefore unlikely to attract competition after patent expiration.

In summary, the economics of the pharmaceutical market are shaped in part by the scientific research and development process. As a result, changes in the nature and type of medications that can be developed can ripple through the entire system, impacting firms' innovation incentives, competition in pharmaceutical markets, and public and private drug spending. These changes can affect the optimal nature of decisions regarding the protection of intellectual property, as well as pricing strategies implemented by firms that themselves will dictate the welfare generated in these markets.

Far more work is needed to understand the economic factors affecting firms in this area. For example, we know that changes in profitability can affect investments in innovation, but we know little about the quality of that innovation. In a recent paper, David Dranove, Manuel I. Hermosilla, and I find little evidence that truly novel products are affected by marginal changes to profitability, but this relationship warrants further study.9 In addition, little is known about the current incentives for firms to develop new biomarkers — particularly those that could decrease market size by providing more information about the optimal use of existing products.10

Endnotes

D. Acemoglu and J. Linn, "Market Size in Innovation: Theory and Evidence From the Pharmaceutical Industry," NBER Working Paper 10038, October 2003, and The Quarterly Journal of Economics, 119(3), 2004, pp. 1049–90; A. Finkelstein, "Health Policy and Technological Change: Evidence from the Vaccine Industry," NBER Working Paper 9460, January 2003, and published as "Static and Dynamic Effects of Health Policy: Evidence from the Vaccine Industry," The Quarterly Journal of Economics, 119(2), 2004, pp. 527–64; M. Blume-Kohout and N. Sood, "The Impact of Medicare Part D on Pharmaceutical R&D," NBER Working Paper 13857, March 2008, and published as "Market Size and Innovation: Effects of Medicare Part D on Pharmaceutical Research and Development," Journal of Public Economics, 2013, 97, pp. 327–36; P. DuBois, O. Mouzon, F. Scott-Morton, and P. Seabright, "Market Size and Pharmaceutical Innovation," The RAND Journal of Economics, 46(4), 2015, pp. 844–71.

A. Chandra, C. Garthwaite, and A. Stern, "Characterizing the Drug Development Pipeline for Precision Medicines," chapter in forthcoming book, E. Berndt, D. Goldman, and J. Rowe, eds., Economic Dimensions of Personalized and Precision Medicine, University of Chicago Press.

S. Amur, "Biomarker Terminology: Speaking the Same Language," available at https://fda.report/media/102547/BIOMARKER-TERMINOLOGY--SPEAKING-THE-SAME-LANGUAGE.pdf ↩

N. Bagley, B. Berger, A. Chandra, C. Garthwaite, and A. Stern, "The Orphan Drug Act at 35: Observations and an Outlook for the 21st Century," forthcoming, NBER Innovation Policy and the Economy, Vol. 19.

P. Bach, "Indication-Specific Pricing for Cancer Drugs," Journal of the American Medical Association, 312(16), 2014, pp. 1629–30.

Though in some markets, firms are able to exploit forced bundling in insurance contracts to charge prices that exceed the value created by the products. D. Besanko, D. Dranove, and C. Garthwaite, "Insurance and the High Prices of Pharmaceuticals," NBER Working Paper 22353, June 2016.

A. Chandra and C. Garthwaite, "The Economics of Indication-Based Drug Pricing," New England Journal of Medicine, 377(2), 2017, pp. 103–6.

D. Dranove, C. Garthwaite, and M. Hermosilla, "Pharmaceutical Profits and the Social Value of Innovation," NBER Working Paper 20212, June 2014.