Recessions and Retirement: How Stock Market and Labor Market Fluctuations Affect Older Workers

The sharp drop in equity values at the beginning of the recent financial crisis led to widespread concern about the effect of the crisis on retirement security. With defined contribution pension plans largely having replaced defined benefit plans for U.S. workers,1 millions of individuals experienced deep declines in the value of their retirement savings. It was widely predicted that workers would delay retirement to make up for these losses, as newspaper headlines proclaimed "Economic Crisis Scrambles Retirement Math" and "Will You Retire? New Economic Realities Keep More Americans in the Workforce Longer."

The effect of the sharp rise in the unemployment rate on retirement was a less-publicized element of the crisis. Relative to earlier periods, workers who lost jobs experienced longer spells of unemployment and had a lower probability of finding new jobs.2 Older workers who experienced job loss and difficulty finding work may have retired earlier than planned. Indeed, the Social Security Administration reported in 2009 that new retired worker benefit claims rose by 10 percent more than expected during 2008 and officials surmised that the weak economy was the cause.3

The potential effects of the crisis on retirement are more complex than suggested by the headlines. In a series of studies, we have investigated the effect of stock and labor market fluctuations on retirement decisions and retiree well-being in the United States. This summary reviews our exploration of whether retirement rates are higher when stock markets or labor markets are weak. We also describe our analyses of whether recessions have long-term impacts on retiree income and health.

Does the Stock Market Affect Retirement?

In order for stock market fluctuations to affect retirement decisions, several conditions must be met. First, since equity investors presumably expect a positive rate of return and understand that daily prices are volatile, there must be asset price movements representing larger- or smaller-than-expected returns. Second, workers must have enough stock assets that these price changes constitute meaningful wealth shocks. Third, retirement rates must be sensitive to fluctuations in wealth.

The stock market has experienced unusual equity returns over the past two decades, with two boom-bust cycles, culminating in the dot-com crash of 2000–2002 and the more recent financial crisis. Whether workers have substantial equity investments is a different matter. In one analysis, we report that 58 percent of U.S. households with a head aged 55 to 64 held stock assets in 2007, just before the recent crisis.4 The most common form of ownership is through retirement accounts (50 percent of households), though some households own stocks directly (21 percent) or in mutual funds outside of retirement accounts (14 percent). Median stock assets are $78,000 among stockholders. Asset ownership and values are strongly correlated with education. Some 78 percent of households headed by a college graduate own stock, and the median holding is $125,000, while just 21 percent of households headed by high school dropouts hold stock, with a median holding of $10,000. Overall, nearly six in 10 of near-retirement-age households have less than $25,000 in stock assets and only one in eight have assets over $250,000.

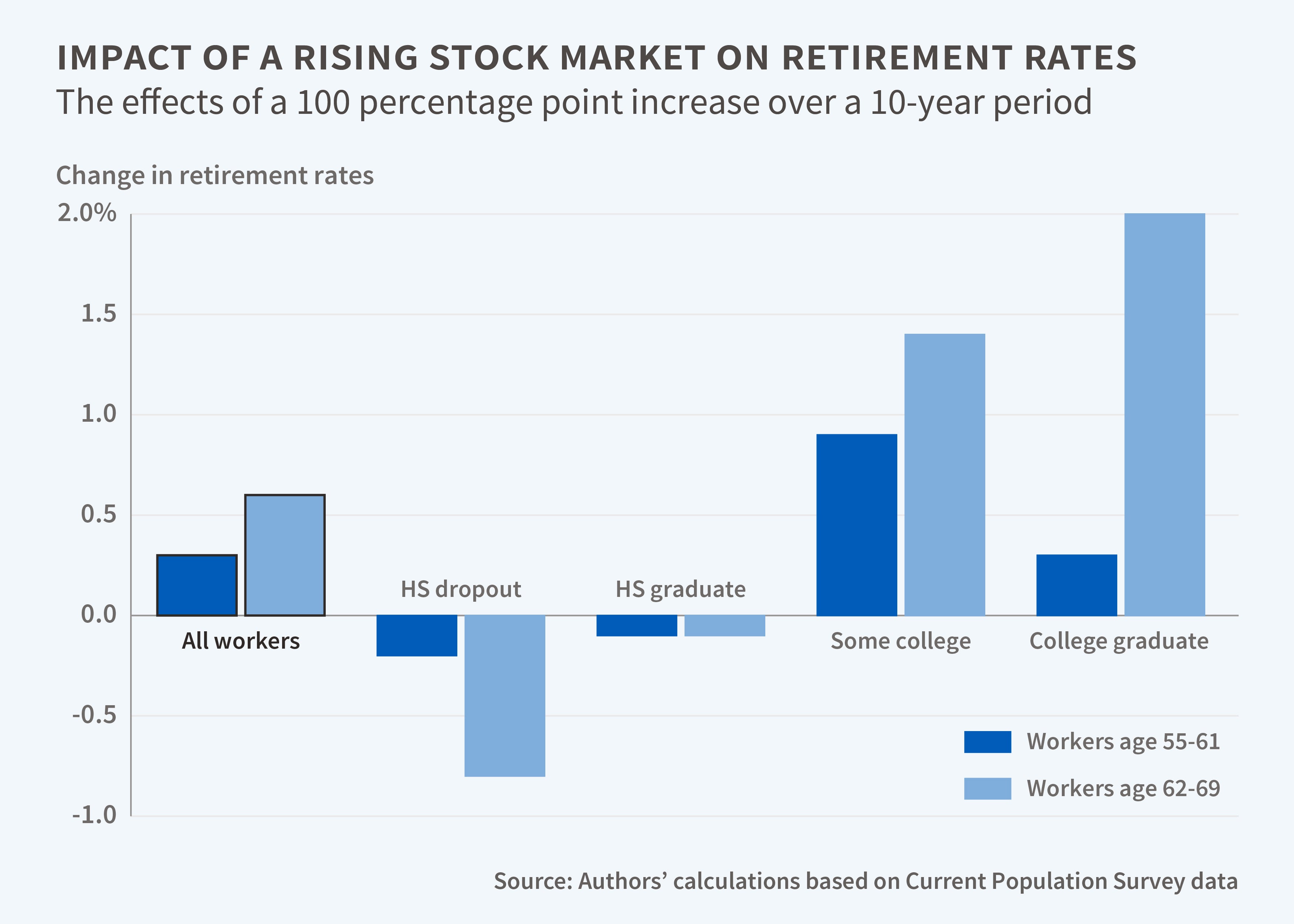

If workers respond to financial wealth shocks, the stark differences in stock ownership by education suggest that the impact of stock market returns on retirement will vary by education. We asked whether college graduates between the ages of 55 and 70 are more sensitive to short-term (single year) stock market fluctuations when making retirement decisions than less educated individuals.5 When we analyzed data from the Current Population Survey, 1980–2002, and the Health and Retirement Study, 1992–2002, we found no evidence of this. This could be due to the small number of individuals who experienced large, unexpected wealth gains or losses during this period, or to the wealth effect being relatively small. We subsequently revisited this question with more years of data and were able to identify circumstances in which retirement behavior is responsive to stock market fluctuations.6 Specifically, we found that long-term market fluctuations, as measured by the percent change in the S&P 500 Index over a five- or 10-year period, affect the retirement decisions of college-educated workers aged 62 to 69. [See Figure 1] We found no statistically significant effect of short-term fluctuations on retirement behavior, nor any effect of market fluctuations on younger workers or workers with less education. The magnitude of the response is economically meaningful — a one-standard-deviation (77 percentage point) increase in the 10-year return increases the retirement rate of college graduates by 1.5 points, or 12 percent relative to the mean.

Overall, the empirical findings suggest that while there are workers whose retirements are slowed or accelerated when they experience unexpected changes in stock market returns, the number of workers who experience substantial wealth shocks is relatively small and the magnitude of the aggregate retirement response is likely modest. Therefore, it is unlikely that changes in labor force participation in the overall population that coincide with stock market upswings or downturns are retirement responses to the market.

Does the Labor Market Affect Retirement?

The Great Recession has equaled or surpassed recessions of the 1970s and 1980s in terms of the steep rise in unemployment and slow pace of recovery. While it seems logical that such an event could affect retirement behavior, the extensive retirement literature offers surprisingly little guidance on this point. We have explored whether retirement is cyclically sensitive, using 25 years of Current Population Survey data.7 Unlike an analysis of the stock market, a study of the labor market can take advantage of differences in market conditions across geographic locations as well as time. We use standard panel data methods to account for longstanding differences across states and national trends over time in retirement behavior, essentially asking whether workers retire earlier when the labor market is weaker in their geographic area after all other differences are taken into account.

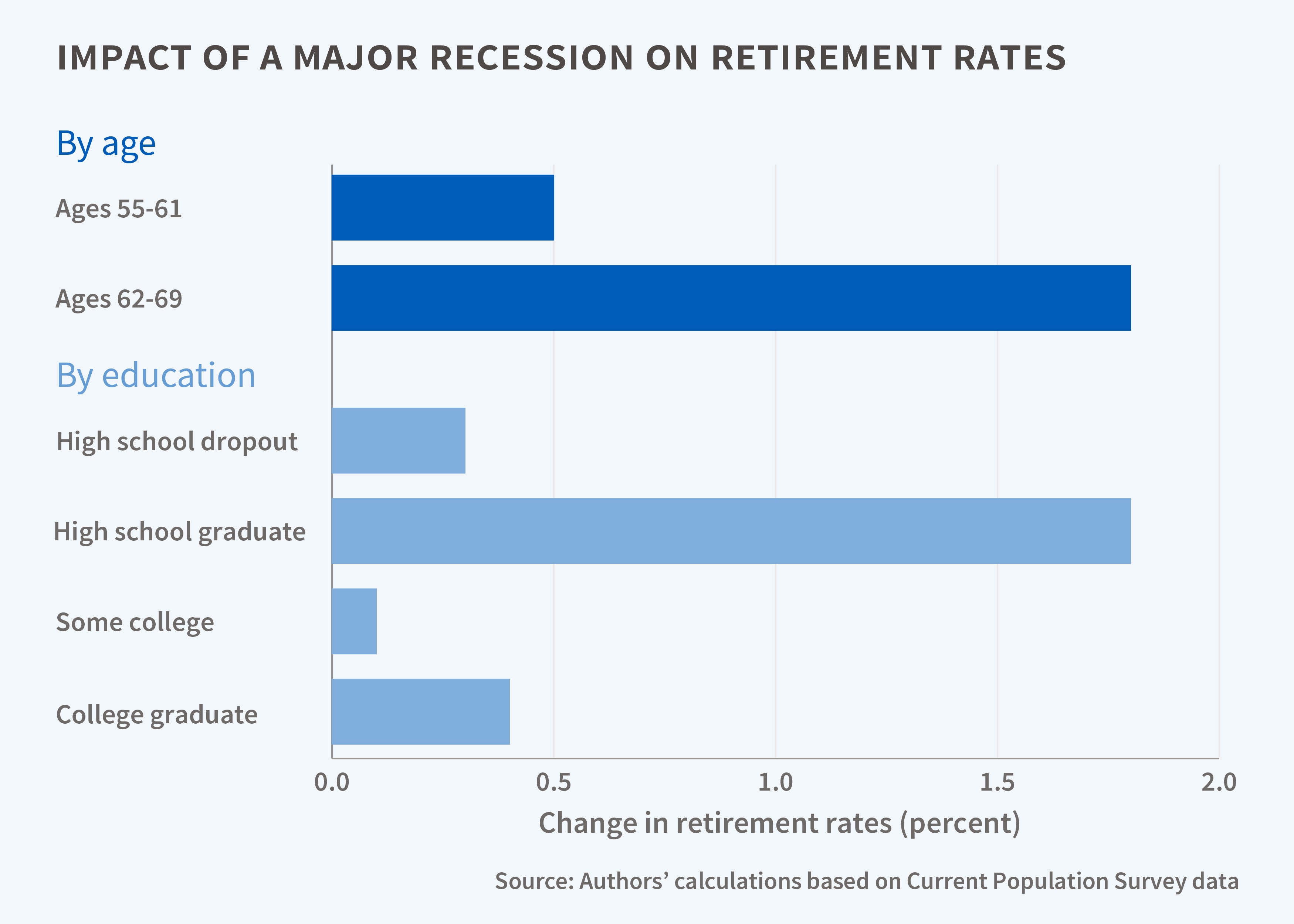

Our central finding is that retirement is cyclically sensitive — five-point increase in the unemployment rate raises the probability of retirement by about one percentage point, or eight percent relative to the mean annual retirement rate of 13 percent. Moreover, the labor supply response to unemployment emerges at age 61, as workers approach the Social Security early retirement age of 62; retirement is not cyclical for workers age 55 to 60.

In subsequent work, we explore how the cyclicality of retirement varies with education.8 We find that workers with a high school degree experience the largest effect — a five point increase in the unemployment rate raises their probability of retirement by 1.8 percentage points, or nearly 20 percent relative to the mean. [See Figure 2] The effects for other education groups are positive but not statistically significant. In explaining these results, we surmise that high school dropouts may be most likely to lose a job during a recession, but also are likely to retire at early ages regardless of market conditions due to poor health and the inability to continue working at physically demanding jobs, while more skilled workers may have a relatively low risk of unemployment during a recession. We think that "high school graduates may have the right combination of desire to continue working along with a higher risk of unemployment and difficulty in finding new work, so a recession may lead many of them to retire involuntarily." 9 In short, the results suggest that retirement is cyclically sensitive, particularly for less-educated workers over the age of 61.

Do Stock and Labor Markets Affect Retiree Well-Being?

Finally, we turn to the question of whether market fluctuations have long-term effects on retiree well-being. Here our focus is on labor market conditions, as the stock market has rebounded from its 2009 low to values near or above pre-crash levels, while the weakness in the labor market has been extensive and persistent. A spell of late-career unemployment can have long-term consequences for an individual even after the labor market rebounds. If an individual fails to find new employment, he or she may claim Social Security benefits when first available at age 62, potentially years earlier than planned. As benefits are subject to actuarial adjustment, earlier claiming results in permanently lower monthly income.

We use data from the American Community Survey to look at the relationship between the labor market conditions around the time of 62-year-olds' retirements and those individuals' income in their 70s.10 As in earlier work, we essentially treat labor market conditions at retirement as a random draw, asking whether individuals who approach retirement during a recession have lower retiree income than other individuals, after controlling for state, year, and age effects. We find that experiencing a recession in the years leading up to retirement lowers retiree income. The finding is stronger for Social Security income, for less-educated workers, and for labor market conditions experienced at or after age 62.

Of course, income is not the only important measure of well-being. With coauthor Robin McKnight, we examined the impact of labor market conditions around the time of retirement on longevity.11 Individuals who experience a late-career layoff may face years of reduced employment and earnings before retiring when they reach Social Security eligibility. They may also experience lost health insurance and reduced access to health care until reaching age 65, when Medicare becomes available. Using 30 years of data from the National Vital Statistics System, we find that experiencing a recession in one's late 50s leads to a reduction in longevity. We also establish that reduced employment, insurance coverage, and health care access are plausible mechanisms for this effect.

Conclusion

Market fluctuations affect retirement, but the story is nuanced — weaker long-term stock returns lead more-skilled workers to delay retirement, while higher unemployment rates lead less-skilled workers to retire earlier. In one study, we estimated that if the unusual stock and labor market conditions experienced during the most recent downturn were to gradually return to normal over a five-year period, there would be a net increase in retirements of about 120,000, or 1.2 percent relative to the estimated 10 million workers retiring during this period.12 In fact, the stock market has rebounded more quickly and the labor market more slowly, so the actual net increase in retirements is likely larger. Moreover, it is less-skilled workers who bear the brunt of the labor market effects of the crisis, and there appear to be negative long-term effects of late-career unemployment on income and health for these individuals. While the recent crisis focused public attention on retirement security in an age of defined contribution pension plans, it seems clear that the difficulties facing individuals who approach retirement at a time when the labor market is weak merit greater public attention.

Endnotes

J. Poterba, S. Venti, and D. Wise, "The Changing Landscape of Pensions in the United States," NBER Working Paper 13381, October 2007.

H. Farber, "Job Loss in the Great Recession: Historical Perspective from the Displaced Worker Survey, 1984–2010," NBER Working Paper 17040, May 2011.

S. C. Goss, Applications for Social Security Retirement Worker Benefits in Fiscal Year 2009, Washington, D.C.: Social Security Administration, Office of the Chief Actuary, 2009.

C. Coile and P. Levine, Reconsidering Retirement: How Losses and Layoffs Affect Older Workers, Washington D.C.: Brookings Institution Press, 2010.

C. Coile and P. Levine, "Bulls, Bears, and Retirement Behavior," NBER Working Paper 10779, September 2004, and Industrial and Labor Relations Review, 59(3), 2006, pp. 408–29.

C. Coile and P. Levine, "The Market Crash and Mass Layoffs: How the Current Economic Crisis May Affect Retirement," NBER Working Paper 15395, October 2009, and The B.E. Press Journal of Economic Analysis and Policy, 11(1), ISSN(Online) 1935–1682, 2011.

C. Coile and P. Levine, "Labor Market Shocks and Retirement: Do Government Programs Matter?" NBER Working Paper 12559, October 2006, and Journal of Public Economics, 91(10), 2007, pp. 1902–19.

C. Coile and P. Levine, "The Market Crash and Mass Layoffs: How the Current Economic Crisis May Affect Retirement," NBER Working Paper 15395, October 2009, and The B.E. Press Journal of Economic Analysis and Policy, 11(1), ISSN (Online) Article 22, 2011.

C. Coile and P. Levine, Reconsidering Retirement: How Losses and Layoffs Affect Older Workers, Washington, D.C.: Brookings Institution Press, 2010.

C. Coile and P. Levine, "Recessions, Reeling Markets, and Retiree Well-Being," NBER Working Paper 16066, June 2010, and American Economic Review: Papers & Proceedings, 101(3), 2011, pp. 23–28, (published as "Recessions, Retirement, and Social Security.")

C. Coile, P. Levine, and R. McKnight, "Recessions, Older Workers, and Longevity: How Long Are Recessions Good for Your Health?" NBER Working Paper 18361, September 2012, and American Economic Journal: Economic Policy, 6(3), 2014, pp. 92–119.