Offshoring, International Trade, and American Workers

In 1982, only one out of four employees of U.S. multinationals was located offshore, and over 90 percent of those employees were in industrial countries. By 2007, the share of offshore employment had reached 44 percent, and the majority of those jobs were in low-income countries. These trends in offshoring are mirrored in the statistics on international trade: over the past two decades imports from low-wage countries have more than doubled.1

Over this same time period, U.S. employment in the manufacturing sector fell sharply and income inequality increased. The downward trend in U.S. manufacturing employment began with the multinationals and coincided with their expansion offshore: between 1982 and 1999 U.S. based multinationals reduced employment domestically by 4 million workers. Our research is motivated by these parallel developments and seeks to understand the implications for American workers.

Are U.S. Based Multinationals Exporting Jobs?

This question has always been of interest to policymakers and is arguably more important now than ever before. Accordingly, there is no shortage of academic research on this topic.2 The problem is that the answer to the question seems to change depending on the study. Brainard and Riker3 find that labor employed by overseas affiliates substitutes at the margin for labor employed by parents at home, but they emphasize that the results differ depending on geographic location. In particular, they emphasize strong substitution between workers in developing countries, such as between workers in countries like Mexico and China. More recently, Desai, Foley, and Hines4 have shown that increases in employment abroad are positively correlated with employment at home. They interpret this as evidence that expansion abroad by U.S. based multinationals leads to job creation at home.

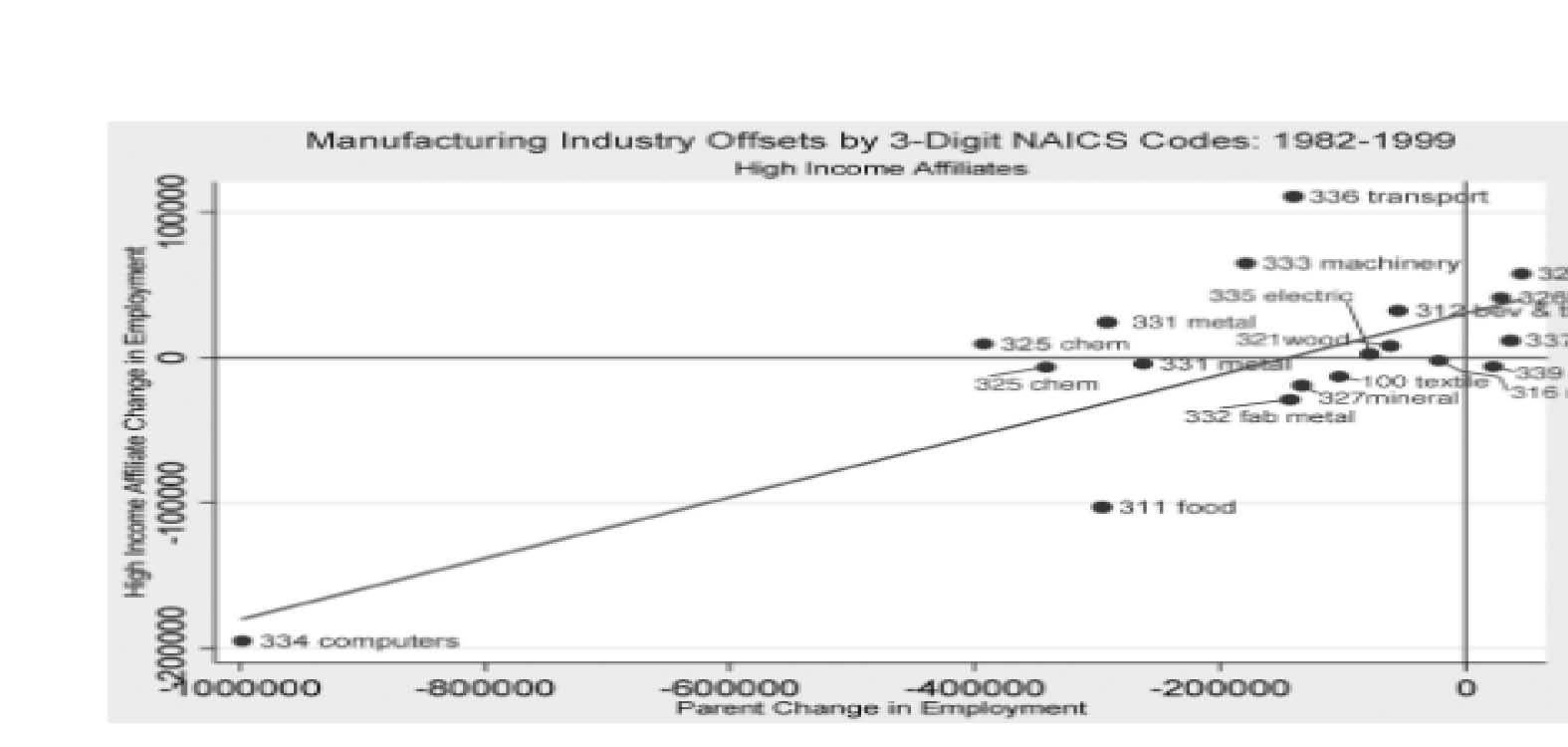

Our research examines this seemingly contradictory evidence in an attempt to bring closure to this debate. We begin by establishing that the relationship between multinational employment at home and abroad changes depending on the location of U.S. multinational activity .5 We show that for affiliates in high-income countries, there is a positive correlation between employment at home and abroad, suggesting that foreign employment of U.S. multinationals may be complementary to domestic employment (Figure 1). However, we also establish that this positive correlation between employment in the United States and employment in high income locations is driven by a contraction in employment in both locations, not by employment growth.

High Income Affiliates

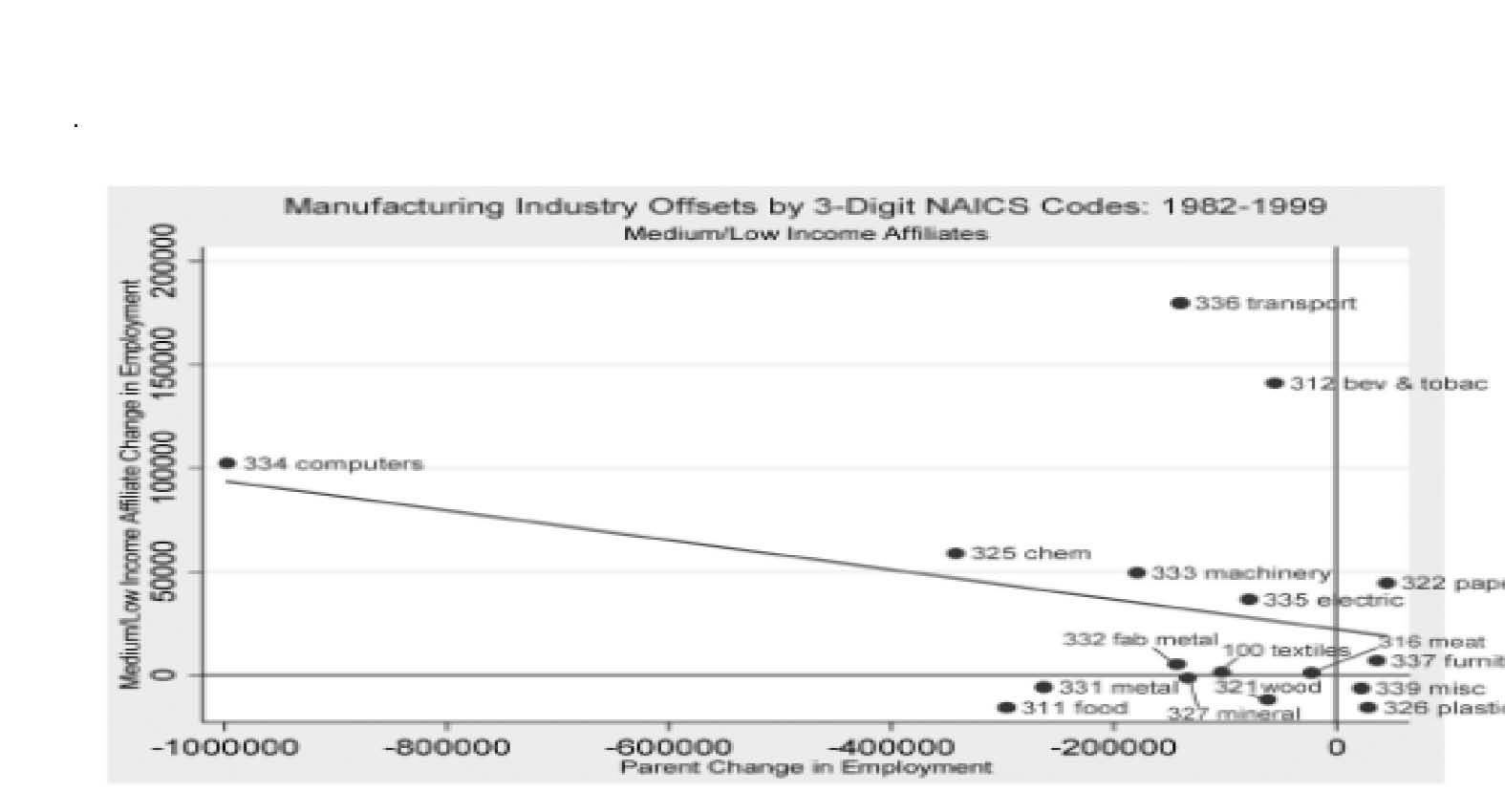

For firms that operate in developing countries, however, employment contractions in the United States are matched by affiliate employment growth in low income locations. As shown in Figure 2, workers in low income countries appear to be substitutes for U.S. workers in several highly visible industries, including computers, electronics, and transportation.

Medium/Low Income Affiliates

We can explain these apparently conflicting results by distinguishing between the different motives for foreign investment.6 Markusen and Maskus 7 show how different incentives for foreign investment lead to different organizational structures, which should produce different degrees of substitution between employment at home and abroad. Horizontal multinationals (H-FDI), defined as firms that produce the same products in different locations, are primarily motivated to locate abroad by trade costs. For H-FDI, investment abroad substitutes for parent exports, and foreign-affiliate employment should substitute for home employment. Vertically integrated enterprises (V-FDI) are motivated to locate different components of production in different locations by factor price differences. For V-FDI, sourcing different stages of production elsewhere can be complementary to employment growth at home. Another theoretical framework that emphasizes "trade in tasks" has been developed by Grossman and Rossi-Hansberg: they show that falling costs of offshoring specific tasks can be associated with higher wages at home. 8

Our research design allows us to answer the following question: what is the foreign wage elasticity of demand for American workers, and to what extent does it depend on the motivation for foreign direct investment? We use confidential firm-level data on U.S.-based multinationals from the U.S. Bureau of Economic Analysis combined with international wage data. We allow different degrees of substitution (or complementarity) depending on the motive for offshoring and whether offshoring takes place in high-or low-income affiliate locations. We differentiate between the motives for offshoring using the following measures of vertical integration between parents and their affiliates: imports from foreign affiliates; exports for further processing; exports for resale; and export platform offshoring. At the same time, we control for other confounding changes, such as other factor price changes, demand shocks, and technological change.

Overall, we find that affiliate employment in low-income countries substitutes for domestic employment: a 10 percentage point reduction in wages in low-income countries is associated with a 1 percent reduction in U.S. parent employment. However, for vertically integrated multinationals that split up the production process and export significant amounts to low-income coun¬tries for further processing, foreign wage reductions are associated with an increase in domestic employment.

During our sample period, offshoring still was not a primary driver of aggregate employment changes in U.S. manufacturing. After decomposing the 17-percentage-point decline in U.S. manufacturing employment at home and assigning different causal factors to the decline, we find that the usual suspects account for only a tiny fraction of the observed decline. Greater import penetration accounts for 2 percentage points; lower and falling real wages in low-income countries where U.S. companies expanded their offshore operations only account for 2.4 percentage points of the reduction in U.S. manufacturing employment. We show that 12 percentage points out of the 17-percentage-point decline in U.S. employment can be attributed to the falling cost of capital. As the price of investment goods fell relative to wages, companies replaced people with machines.

Interpreting the Results on Multinational Employment Abroad

Our results indicate that whether the offshoring of jobs by U.S. multinationals leads to a decline in U.S. based employment depends on both the location of the investment abroad and the motive for the investment. In general, the expansion of employment in low-income countries has been associated with a contraction in employment in the United States and in high-income countries. However, when American workers and workers in low-income countries perform different tasks, the expansion of multinational employment abroad can lead to increases in domestic employment. Taken together, these results go a long way toward explaining why previous researchers have found seemingly contradictory results. Still, a number of important questions remain unanswered.

First, in the absence of a counterfactual, it is impossible to know whether the jobs lost to offshoring were part of a survival strategy. If relocating jobs offshore enabled firms to stay afloat, then it might be the case that even more jobs would have been lost if the multinational had not offshored jobs. We find some evidence that offshoring is associated with a higher probability of firm survival, but this effect is dwarfed by the effect of firm size on survival rates. Establishing a credible counterfactual is likely to be highly problematic because multinational firms are different from other firms along several dimensions.

Further, there are two important questions that we cannot address with the BEA data, but which could be addressed with data from the Current Population Survey (CPS). First, with only the BEA data we cannot say anything about the relationship between offshoring and wages because the firms in the sample report only aggregate wages -- individual characteristics are not included. Second, to the extent that offshoring has an impact on domestic employment, it will have general equilibrium effects that cannot be detected by focusing solely on U.S. based multinationals and their employees. We explore these issues with our co-authors Avi Ebenstein and Shannon Phillips. 9

Economy-wide Trends in Employment, Wages and Inequality

Using data from the CPS, we show that between 1982 and 2002, total manufacturing employment fell from 22 to 17 million, with rapid declines at the beginning of the 1980s and in recent years. However, the effects were uneven across different types of workers. For workers without a college degree, there were significant declines in manufacturing employment over the entire period. The opposite was true for workers with a college degree. Within manufacturing, the labor force has become increasingly well educated, as college graduates replace workers with high school degrees.

Wage trends mirror the shifts in employment. While wages fell for the least educated workers, they increased for workers with at least some years of college. The biggest wage gains were for manufacturing workers with an advanced degree. The decline in wages for high school dropouts and the steep wage increases at the upper end of the income distribution indicate a sharp increase in wage inequality.

Are Trade and Offshoring Responsible for Growing Wage Inequality?

As we note in our work with John McLaren10 , there are a variety of mechanisms through which trade and offshoring are likely to affect wages and inequality. We focus on one such mechanism: the impact of trade and offshoring on the movement of workers across sectors and occupations. To the extent that trade leads workers to switch industries (for example from manufacturing to services) or occupations (for example from machine tool operator to burger flipper), studies that focus on the impact of trade liberalization on within-sector inequality miss an important part of the story.

By merging data from the CPS with data on trade and offshoring, we show that the effects of trade and offshoring on wages across industries within manufacturing are tiny and sometimes positive. These results are in line with earlier work on trade and wages that focuses exclusively on the manufacturing sector. However, when we redefine the analysis at the occupation level, we find large, significant, and primarily negative effects of import competition and offshoring on U.S. wages. These results are consistent with recent empirical work demonstrating the importance of occupational tenure and downplaying the importance of tenure within a particular industry for a worker's wages.

We then examine the mechanisms behind the contrast between the small positive wage effects of globalization within manufacturing and the relatively large negative wage effects we observe at the occupational level. We begin by showing that trade and offshoring are associated with a contraction in the manufacturing workforce. Then, using a large panel of CPS workers who are matched across surveys, we demonstrate that workers who switch industries within manufacturing experience almost no decline in wages. However, when workers relocate to the service sector, they experience a significant wage loss. The negative wage impact is particularly large among displaced workers who also switch occupations. We estimate wage losses of 2-to-4 percent among workers leaving manufacturing and an additional 4-to-11 percent wage loss among workers who also switch occupations. These effects are most pronounced for workers who perform routine tasks. This downward pressure on wages because of import competition and offshoring has been overlooked since it operates between and not within sectors.

This provides compelling evidence that the negative consequence of trade on workers is mediated through a reallocation of labor across sectors and into different occupations. While many models of trade posit that workers can move in a costless manner to new jobs in the face of pressure from foreign labor, we identify large and significant wage declines among workers forced to leave manufacturing, and the wage decline is particularly pronounced for those who are forced to switch occupations.

Finally, we find that the negative effect of international trade on U.S. wages was more pronounced in the 1990s than in earlier decades. Moreover, the negative impact of offshoring to low-wage countries on both U.S. wages and employment only became important in the 1990s. The wages of older workers appear to have been disproportionately hurt by offshoring activities.

Implications for American Workers

The trends in offshoring and international trade that we have described are likely to accelerate. China currently employs around 120 million people in the manufacturing sector and, although some reports indicate that wages are rising in China, those wages are still only a tiny fraction of wages in the United States. Moreover, China is expanding its manufacturing base to low-wage countries across the globe through a series of overseas economic zones11 . The implication for American workers is that in order to regain ground, they will need to find jobs outside of manufacturing where wages are comparable to those in manufacturing.

This is a tall order. As McMillan and Rodrik12 point out, the type of structural change that characterizes the U.S. economy and many other parts of the world reduces economic growth. And when growth slows down, so does job creation. This focus on structural change as an important determinant of economic growth also has been addressed by World Bank Chief Economist Justin Lin13 .

This state of affairs has led some economists, including one of us, to reconsider the role of industrial policy. Harrison and Rodriguez-Clare14 discuss "soft" industrial policies that focus on strengthening the educational system, investing in infrastructure, and promoting collaboration with industry associations, and compare such policies with "hard" industrial policies that shift relative prices. Aghion, Dewatripont, Du, Harrison, and Legros15 demonstrate that industrial policy which preserves competition is most likely to improve performance.

1. Survey of Current Business, various articles.

2. Due to space constraints, we cannot list all of the relevant papers here. For reviews of this literature, see A. Harrison and M. McMillan, "Outsourcing Jobs? Multinationals and U.S. Employment", NBER Working Paper No. 12372, July 2006, and "Offshoring Jobs? Multinationals and U.S. Manufacturing Employment", The Review of Economics and Statistics, Vol. 93, No. 3, August 2011, pp. 857-75.

3. L. Brainard and D. Riker, "Are U.S. Multinationals Exporting U.S. Jobs?" NBER Working Paper No. 5958, March 1997.

4. F. Foley, M.Desai, and J. Hines Jr. "Domestic Effects of the Foreign Activities of U.S. Multinationals", American Economic Journal: Economic Policy, No. 1, February 2009, pp.181-203.

5. A. Harrison and M. McMillan, "Dispelling Some Myths about Offshoring", eAcademy of Management Perspectives, Vol. 20, No. 4, November 2006, pp. 6-22, and A. Harrison, M. McMillan, and C. Null, "U.S. Multinational Activity Abroad and U.S. Jobs: Substitutes or Complements?", Journal of Industrial Relations, Vol. 45, No. 2, 2007, pp. 347-65.

6. A. Harrison and M. McMillan, "Outsourcing Jobs? Multinationals and U.S. Employment", and "Offshoring Jobs? Multinationals and U.S. Manufacturing Employment".

7. J. Markusen and K. Maskus, "General-Equilibrium Approaches to the Multinational Firm: A Review of Theory and Evidence," NBER Working Paper No. 8334, June 2001.

8. G. Grossman and E. Rossi-Hansberg, "Trading Tasks: A Simple Theory of Offshoring", NBER Working Paper 12721, December 2006.

9. A. Ebenstein, A. Harrison, M. McMillan, and S. Phillips, "Estimating the Impact of Trade and Offshoring on American Workers Using the Current Population Surveys." NBER Working Paper 15107, June 2009.

10. A. Harrison, J. McLaren, and M. McMillan, "Recent Findings on Trade and Inequality", NBER Working Paper 16425, September 2010, and "Recent Perspectives on Trade and Inequality", Annual Review of Economics, Vol. 3: pp. 261-89, September 2011.

11. D. Brautigam and T. Xiaoyang, "Going Global in Groups: Analyzing China's New Overseas Economic Zones", IFPRI Working Paper, 2011.

12. M. McMillan and D. Rodrik, "Globalization, Structural Change and Productivity Growth", NBER Working Paper No. 17143, June 2011. Results for the United States are not shown in this paper. In more recent work, McMillan shows that 1997-2007 was a period of growth-reducing structural change for the United States.

13. J. Lin, "Should Industrial Policy in Developing Countries Conform to Comparative Advantage or Defy It? A Debate between Justin Lin and Ha-Joon Chang", Development Policy Review, 27(5), 2009, pp. 483-502.

14. A. Harrison and A. Rodriguez-Clare, "Trade, Foreign Investment, and Industrial Policy for Developing Countries," NBER Working Paper No. 15261, August 2009, and Handbook of Development Economics, Volume 5, D. Rodrik and M. Rosenzweig eds., North Holland, 2010, pp. 4039-214.

15. P. Aghion, M. Dewatripont, L. Du, A. Harrison, and P. Legros, "Industrial Policy and Competition," Working Paper, June 2011.