Retail Investors Reach for Income when Interest Rates Fall

A one percentage point drop in the federal funds rate is associated, over the following three years, with a 5 percent increase in the inflows to stock mutual funds with high income yields.

Standard theories in financial economics hold that investors should be indifferent to whether income accrues from dividends or from capital gains as long as there are no tax differences and capital markets are frictionless. The actual behavior of retail investors appears to be inconsistent with this prediction. In Monetary Policy and Reaching for Income (NBER Working Paper 25344), Kent Daniel, Lorenzo Garlappi, and Kairong Xiao show that some retail investors have a demand for income streams like those provided by the interest payments on bonds and the dividends on corporate stocks. When interest rates fall, they adjust their portfolios to include a higher fraction of stocks that pay high dividends.

The researchers study how household portfolios adjust in the aftermath of federal funds rate changes.

They analyze individual portfolio holdings at a large discount broker over the period 1991-96 for 19,394 households. They merge portfolio data with the Center for Research in Security Prices (CRSP) stock database, and determine income and pricing for the stocks in each individual portfolio. The average dividend yield of the stocks in the sample was 2.1 percent. "High income yield" stocks were those with dividend yields above the 90th percentile, or 5.7 percent.

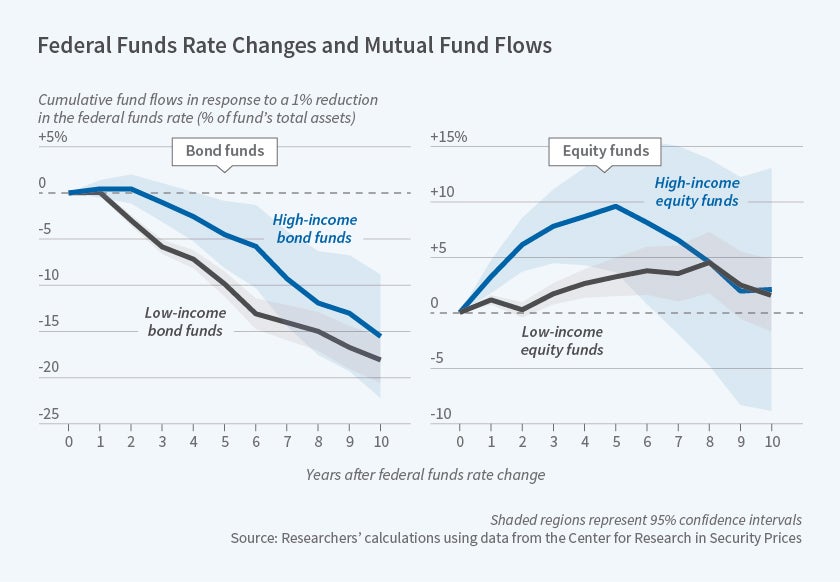

The study also uses the CRSP Survivor-Bias-Free U.S. Mutual Fund Database, which provides mutual fund income yields, asset flows, returns, size, expenses, and volatility from January 1991 to December 2016, to analyze rotations of fund flows following a decrease in the federal funds rate. The average yield of equity mutual funds was 1.3 percent and the yield at the 90th percentile was 2.8 percent.

In the six months after a 1 percentage point drop in the federal funds rate associated with accommodative monetary policy, households raise the share of their portfolio in stocks paying high dividends by 0.95 percentage points. Over the following three years, the researchers find a 5.2 percentage point increase in inflows to equity mutual funds with high income yields. These results suggest that an accommodative monetary policy may reduce portfolio diversification and increase the value of high dividend stocks relative to low dividend stocks.

To disentangle monetary policy changes from other economic changes, the researchers compare changes in holdings of individual stocks by households in different Metropolitan Statistical Areas. They find that demand for dividends was negatively related to local area bank deposit rates, suggesting that local bank deposit rates "provide a more accurate measure of available sources of income for local investors than the Fed Funds rate."

The researchers suggest that reaching for income can be an optimal investment strategy if investors try to discipline themselves by restricting their spending to the income from their portfolios. It appears that the investors who reach for income are disproportionately those with low labor income, such as retirees.

— Linda Gorman