Credit Booms Forecast Sub-Par Performance of Equities

Market leverage has historically predicted one-year-ahead stock returns better than measures of stock market momentum, and almost as well as measures of value.

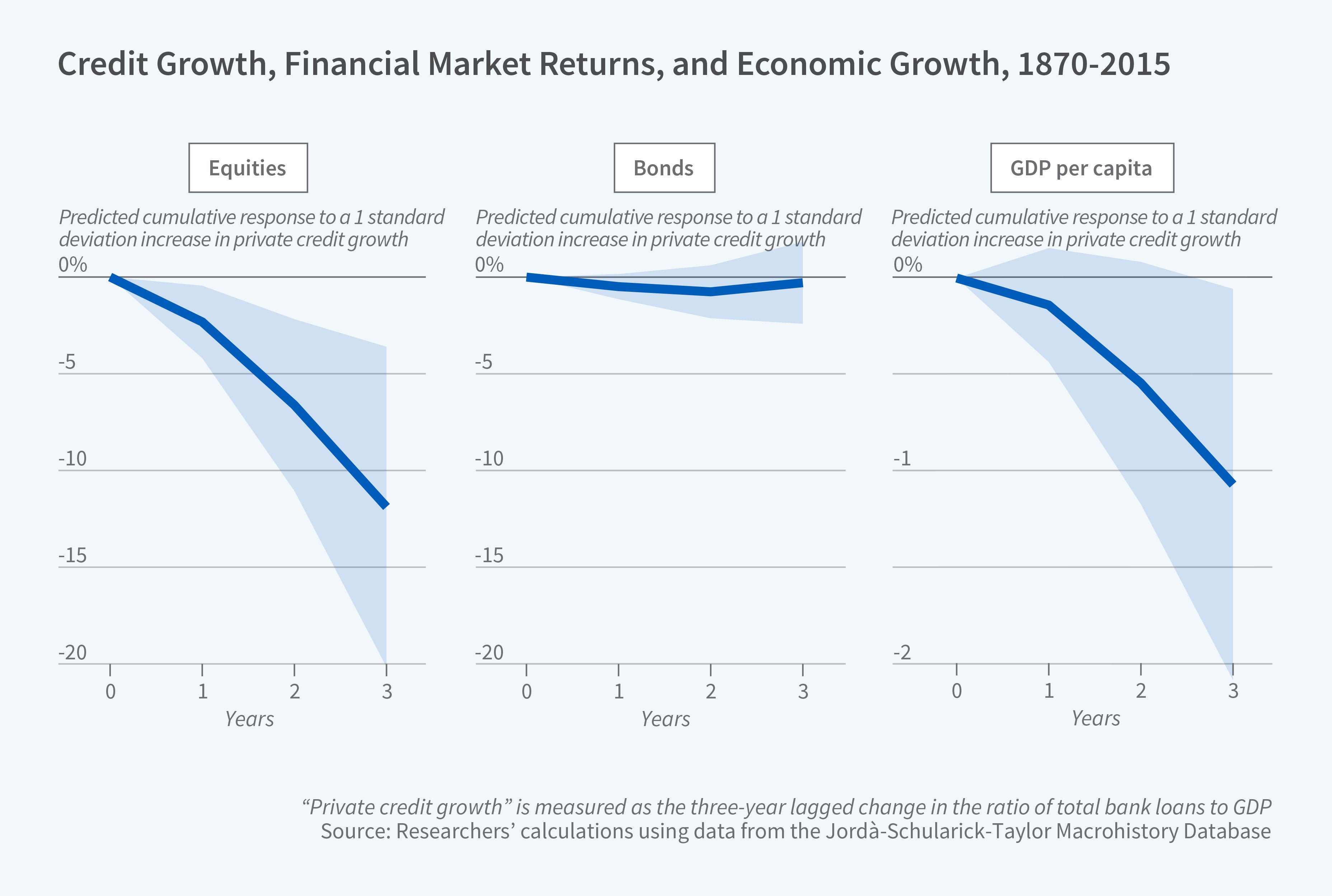

Rapid growth in credit, which has been linked to slower economic growth and even economic downturns, is also a predictor of below-average equity returns. In The Leverage Factor: Credit Cycles and Asset Returns (NBER Working Paper 26435) , Josh Davis and Alan M. Taylor study returns in 14 advanced economies over the period 1870 to 2015. They conclude that credit booms are followed, on average, by unusually low returns to equities, both in absolute terms and relative to bonds.

The researchers focus on the lagged three-year change in the ratio of total bank loans to GDP in each country as their measure of credit availability, and they grade each year, for each country, as high or low based on this metric. They measure stock returns using a broad-based stock index for each country, and they compute bond returns using returns on bonds with roughly 10 years to maturity.

In the postwar era, the researchers find, the average return to stocks in their sample of countries was 8.9 percent. When lagged growth in the credit-to-GDP ratio was below the median — that is, in periods without credit booms — the return averaged 11.6 percent. But when the credit growth ratio was high, returns the following year averaged only 6.8 percent. When the postwar data are pooled with the earlier historical data, the results point to the same conclusion: Credit booms are associated with lower stock returns. Credit booms are also associated with lower absolute returns on bonds, but the effects are much smaller than those for stock returns.

The researchers test the robustness of their results by controlling for other variables that may predict stock returns, such as market momentum — a measure of whether recent stock returns have been positive — and value, the ratio of stock prices to determinants of fundamental value such as dividends or earnings. Adding the controls does not eliminate the predictive power of the backward-looking credit growth variable.

To test how useful this finding could be for stockholders, the researchers built model portfolios for each country using the postwar data. They varied the portfolio allocation between stocks and bonds depending on the leverage measure and the other predictive measures they considered. They found that the Sharpe ratio — the ratio of the average additional return associated with adjusting portfolio weights to the additional risk generated by this strategy — for the leverage factor alone was 0.78, better than the analogous measure of 0.70 for momentum but not quite as high as 0.82 for value. A portfolio adjustment rule that uses all three variables — credit booms, momentum, and value — generates a Sharpe ratio of 0.94. The researchers conclude that credit growth signals can be a useful input for a tactical asset allocation strategy.

— Laurent Belsie