e-Commerce and the Pricing Behavior of Traditional Retailers

The frequency of price changes at multi-channel retailers has increased, particularly in sectors with high levels of online competition.

As online retailers such as Amazon have increased the frequency with which they adjust prices, perhaps due to their use of dynamic pricing algorithms, traditional retailers are following suit. In More Amazon Effects: Online Competition and Pricing Behaviors (NBER Working Paper 25138), Alberto Cavallo analyzes data on retail prices for both multi-channel retailers — those that sell online and in brick-and-mortar stores — and Amazon. He finds that the frequency of price changes at multi-channel retailers increased from 15 percent per month in 2008–10 to almost 30 percent in 2014–17.

The change in the frequency of price changes was greater in sectors in which online retailers are especially competitive, such as electronics, and weaker in sectors such as food and non-alcoholic beverages. The period of time over which prices remained stable in the food and beverages sector, for example, started falling in 2015, around the time that Amazon started competing aggressively in this sector.

To identify a causal link between online competition and multi-channel retailer pricing behavior, the study also examines a smaller subsample of products sold on Walmart's website between 2016 and 2018. Price durations were about 20 percent shorter for Walmart products that were easily found on Amazon. This was most pronounced in the clothing and footwear sector, where Amazon and Walmart compete aggressively. The findings "are consistent with intense online competition, characterized by the use of algorithmic or 'dynamic' pricing strategies and the constant monitoring of competitors' prices," Cavallo writes.

He also examines retailer pricing practices for identical goods sold at multiple locations. In general, online retailers tend to charge consumers the same price for a given product in all locations. To assess whether this practice influences the pricing strategies of multi-channel retailers, he compares prices across multiple zip codes for Amazon and three large multi-channel retailers — Walmart, Safeway, and Best Buy. For Amazon, prices across zip codes are identical 91 percent of the time. For the three multi-channel retailers, they are the same 78 percent of the time. Almost all of the geographic pricing variation occurs in the food and beverages category. Prices for electronics have nearly uniform pricing for all three retailers. Walmart products that are easily found on Amazon are more likely to be uniformly priced, which suggests that competition from online retailers is leading traditional retailers to adopt more uniform pricing across locations.

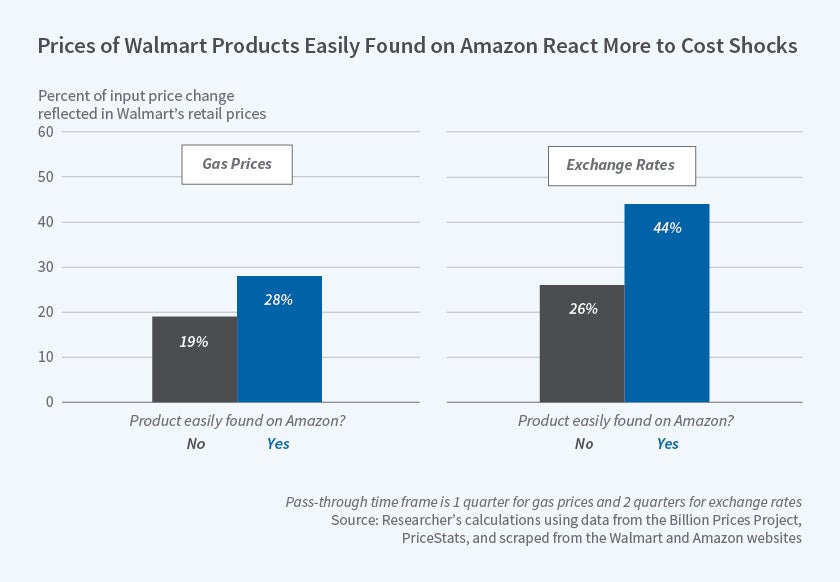

Cavallo argues that the combination of higher frequency price changes and uniform pricing is affecting the way traditional retailers respond to nationwide economic shocks such as fluctuations in gasoline prices and nominal exchange rates. For exchange rate shocks, the pass-through at Walmart is 26 percent for goods that are not easily found on Amazon, and 44 percent for those that are. For gasoline price movements, the analogous magnitudes are 19 and 28 percent. Using a larger sample of retailers, Cavallo finds that both the short- and long-run effect of exchange rates on online price indices have increased over time, especially in sectors such as electronics with more competition from online retailers. This evidence "suggests that online competition is making U.S. retail prices far more sensitive to exchange rates than in the past," the researcher concludes. More generally, the acceleration in the rate at which retail prices react to macroeconomic shocks may affect the dynamics of economy-wide inflation.

— Dwyer Gunn