Measuring the Effects of Consumer Bankruptcy Protection

People whose petitions were approved had higher earnings, lower mortality rates, more employment, and fewer home foreclosures.

In recent years, nearly one in ten American households has filed for bankruptcy, and yet it has long been unclear whether bankruptcy protection actually benefits debtors. In Debt Relief and Debtor Outcomes: Measuring the Effects of Consumer Bankruptcy Protection (NBER Working Paper No. 20520), Will Dobbie and Jae Song use a new dataset linking 500,000 bankruptcy filings to tax records from the Social Security Administration and foreclosure records to estimate the effect of bankruptcy on subsequent earnings, mortality, and home foreclosure. Their study focuses on the Chapter 13 form of bankruptcy, which allows individual debtors to keep most of their assets in exchange for a partial repayment of debt.

The researchers also consider the key role of the assigned bankruptcy judge, who decides all matters connected to a bankruptcy request, including whether or not to dismiss the filing. Dobbie and Song use differences in the probability that a judge dismisses a filing to estimate the causal impact of bankruptcy protection. They also note that more lenient judges may confirm repayment plans that are more generous to debtors or that are less feasible.

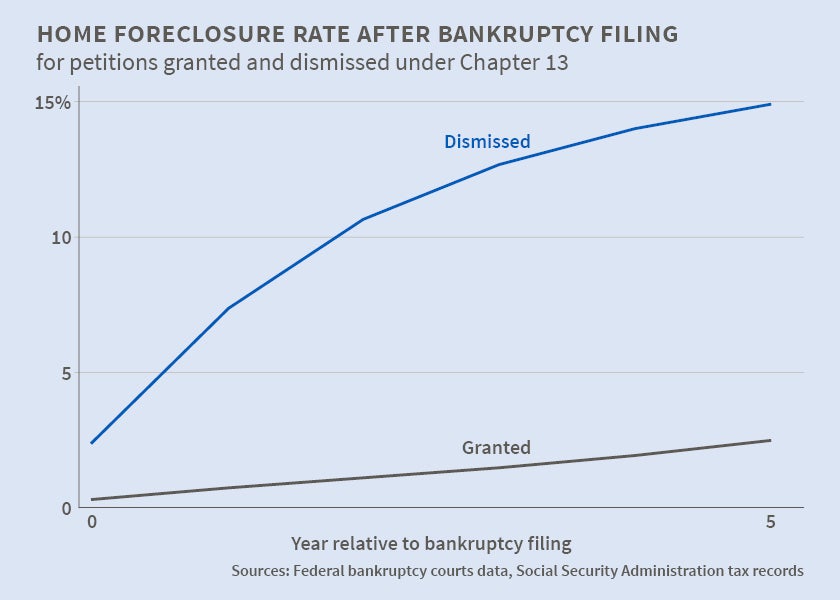

Using differences in judges' leniency as a variable for bankruptcy protection, Dobbie and Song find that Chapter 13 bankruptcy protection does in fact benefit debtors. Over the first five post-filing years, debtors who receive Chapter 13 protection report annual earnings that exceed the earnings of those who do not receive protection by $5,562, or 25.1 percent of their earnings in the pre-filing period. The difference in employment rates is 6.8 percentage points, and five-year mortality is 1.2 percentage points lower -- a 30 percent differential -- for those who receive protection. The difference in the five-year home foreclosure rates is 19.1 percentage points. The analysts note that the estimated impacts come from deterioration of outcomes among dismissed filers, not gains by filers who are granted protection. Filers who are granted protection have similar pre- and post-filing earnings. In contrast, dismissed filers experience large and persistent drops in earnings.

Dobbie and Song say their evidence is consistent with the hypothesis that the results are driven by increased incentive to work and increased economic stability following the receipt of bankruptcy protection. They add that these results are significant in view of the continuing debate surrounding the use of debt relief and mortgage modification to stimulate the economy. Dobbie and Song suggest moreover that the restrictions on bankruptcy filing introduced by the 2005 Bankruptcy Abuse Prevention and Consumer Protection Act may have important adverse consequences on debtors.

-- Matt Nesvisky