Housing Wealth Fluctuations Affect Seniors' Health Care Choices

Home equity run-ups due to house price increases raise use of paid home health care and unpaid informal care, but don't affect utilization of nursing home care.

The daunting costs of long-term health care pose a challenge for senior citizens. Half of adults who live to the age of 65 will require long-term care services at some point. For those who need such care, the average annual cost of these services rings in at $133,700 in 2015 dollars. For a small subset of the population, 5 percent of men and 12 percent of women, the total lifetime cost of long-term care will exceed $250,000. Medicaid covers about 35 percent of these costs; elderly individuals and their fami-lies bear about half the cost of long-term care.

In Access to Long-Term Care After a Wealth Shock (NBER Working Paper No. 23781), Joan Costa Font, Richard Frank, and Katherine Swartz look at how changes in wealth, specifically housing wealth, affect decision-making around the use of three types of long-term care services: paid home health care services, unpaid informal care, and nursing home care. Housing wealth is a particularly relevant metric for this question because it constitutes the largest source of savings for most Americans, particularly older Americans. Housing assets represent 67 percent of the median per capita net worth of adults over the age of 66, and home equity is the primary self-funding mechanism for those who require long-term care.

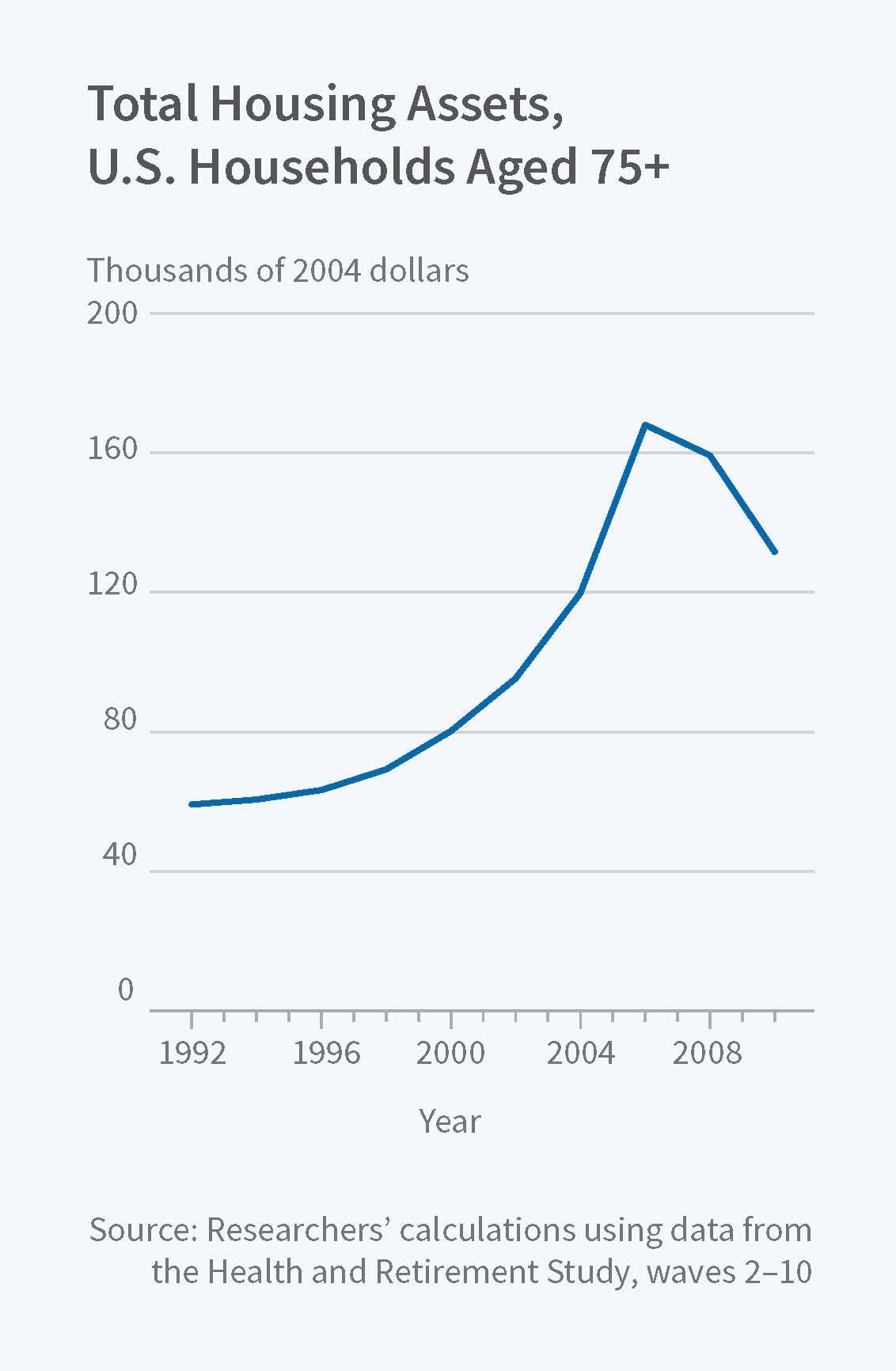

Using data from the Health and Retirement Study and the Federal Housing Finance Agency, the researchers analyze how variations in housing prices from 1996 through 2010 affected utilization of long-term care services. The time period represents a particularly turbulent period in the housing market. Between 1998 and 2006, housing prices (and thus housing wealth) rose significantly. In subsequent years it fell sharply, dropping by more than 20 percent on average between 2006 and 2010.

The researchers find that positive shocks to house prices significantly increase homeowners' use of both paid home health care and unpaid informal care. They do not find any effect on utilization of nursing home care. Specifically, a $3,149 increase in wealth increases the probability that a homeowner will use paid home health care services by 0.25 percentage points. A positive wealth shock of this magnitude is also associated with a 3 to 4 percent increase in the probability that a homeowner will use unpaid, informal care. In contrast, renters in the researchers' sample did not change long-term care service usage patterns in response to changing local housing prices. This finding supports the researchers' hypothesis that housing wealth is tapped to finance long-term care services.

— Dwyer Gunn