International Holdings and Hedging of USD-Denominated Assets

Foreign investors’ demand for US dollar (USD) denominated securities and their currency hedging activities are important for analyzing international capital flows, exchange rates, and the dollar’s global dominance. In Dollar Asset Holdings and Hedging Around the Globe (NBER Working Paper 32453), Wenxin Du and Amy W. Huber combine information from a range of disparate data sources — industry filings, company reports, and national statistics from many nations — to provide new insights on these issues. They study seven groups of foreign institutional investors: insurance companies, pension funds, mutual funds, banks, hedge funds, nonfinancial corporations, and official institutions like central banks.

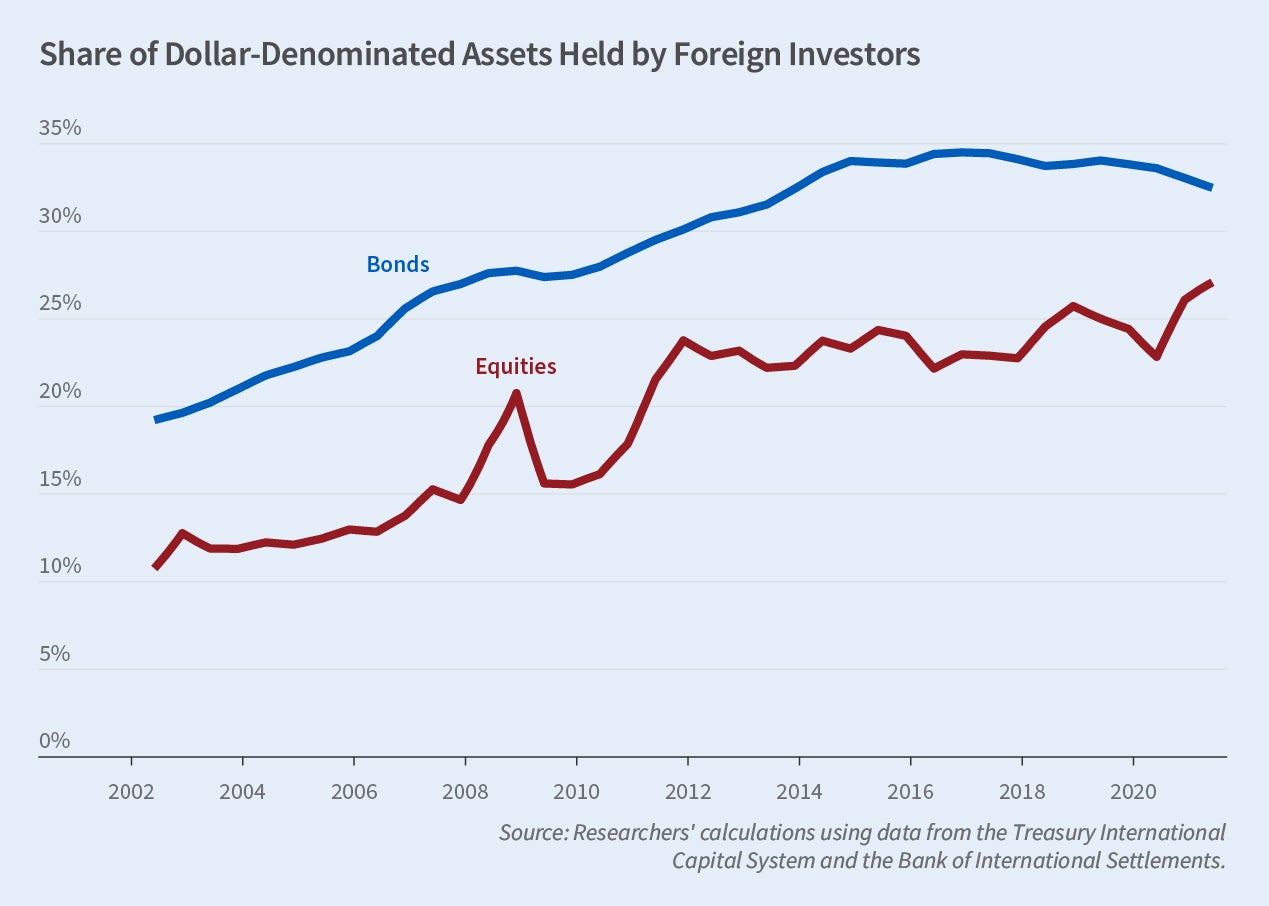

Foreign investors have tilted their portfolios toward dollar-denominated assets over the last two decades.

The researchers document a sixfold increase in nominal foreign holdings of USD-denominated securities, from $5.5 trillion in 2002 to $33.4 trillion in 2021. This growth reflects foreign investors shifting their portfolios toward USD assets relative to those denominated in domestic and other foreign currencies, not just an increase in the value of foreigners’ total portfolio holdings.

They also find an increase, particularly after the 2007–09 financial crisis, in the degree to which foreign mutual funds, insurance companies, and pension funds hedge their foreign exchange (FX) exposure to the dollar. The “hedge ratio,” the share of dollar asset exposure that foreign investors hedge, rose by around 15 percentage points despite an increase in hedging costs as a result of pricing dislocations in currency markets.

Although there is notable cross-country variation, collective FX hedging demand from insurance companies, pension funds, and mutual funds exceeded $2 trillion in 2019. The global banking sector supplied only around $333 billion in net USD FX hedging in that year, underscoring the role of nonbank financial institutions in facilitating the transfer of currency risk exposures.

The researchers compare the observed degree of currency hedging with the predictions of a standard model of hedging demand by an investor who divides her portfolio between a local risk-free asset and a riskier USD-denominated asset with the objective of maximizing expected returns subject to a given level of risk. Assuming that the expected return on dollar-denominated assets has risen over time, this framework can account for the time series pattern of rising USD asset ownership. It is not very successful, however, in explaining the cross-country variation in the degree of dollar exposure hedging.

The researchers note that varying liquidity needs across currencies, which are driven by interest rate differentials, may influence FX hedging practices to a greater extent than the analysis of risk-return trade-offs predicts. In particular, they document a negative relationship between currency-specific FX hedging demand and pricing dislocations in FX derivatives markets, which they attribute to constrained financial intermediaries facing balance sheet segmentation.

— Emma Salomon

This research was funded in part by the Fama-Miller Center for Research in Finance at the University of Chicago Booth School of Business.