Power Plant Acquisitions and Productivity

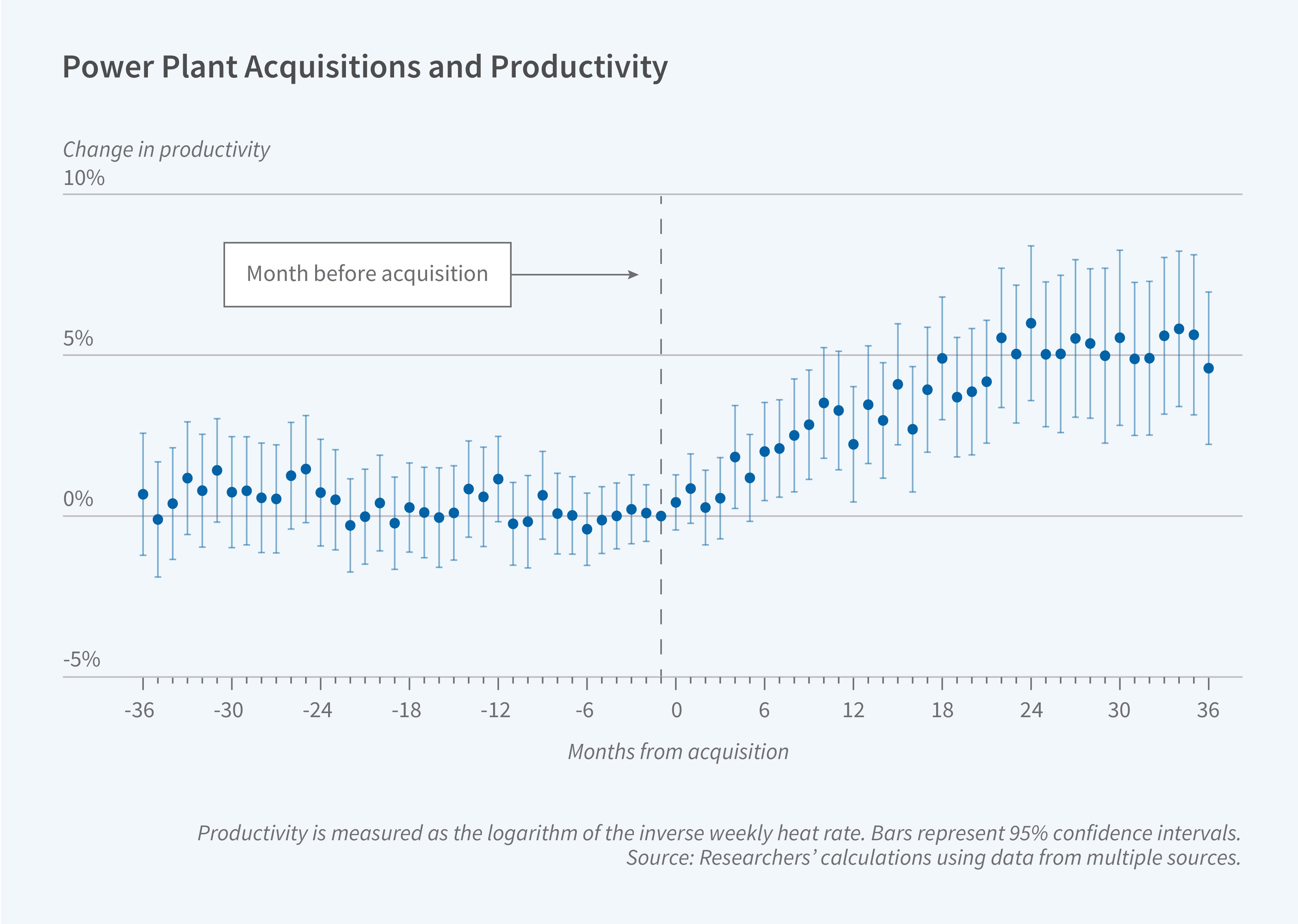

Finding empirical evidence on the productivity and competitive effects of firm mergers is a long-standing challenge. In Do Mergers and Acquisitions Improve Efficiency? Evidence from Power Plants (NBER Working Paper 32727), Mert Demirer and Ömer Karaduman find ownership changes for US electricity generators can increase efficiency by 2 to 5 percent, depending on the acquisition type. The efficiency increase begins around five months post-acquisition and stabilizes after 18 months.

With the deregulation of the US electric power industry in the 1990s, many states decoupled electricity generation from electricity transmission and distribution. Most electricity producers now receive market-based compensation rather than compensation based on regulated rate-of-return targets on capital investment and service costs. These generators are frequently bought and sold by the firms in the market, providing an opportunity to study efficiency changes after acquisitions.

Ownership changes for US electricity generators can increase efficiency by up to 5 percent.

Some key features of this industry allow researchers to overcome the well-known difficulties in the literature in quantifying merger efficiencies. The electricity industry has rich and high-frequency physical input-output data, making it possible to measure efficiency at extreme granularity. Moreover, electricity is a homogeneous product, eliminating potential quality changes that could confound the measurement of efficiency post-acquisition. Combining these characteristics with data on 505 transactions that involve 3,515 generator ownership changes provides an ideal environment to study the efficiency effects of mergers.

The researchers collect data from various sources for generators in the contiguous US in operation between January 2000 and March 2023. They combine hourly fuel input, electricity output, and various emissions data with important generator characteristics such as installation year and capacity. In addition, to understand the role of managers, they obtain information on plant managers’ backgrounds and education using a US Environmental Protection Agency database of plant representatives and LinkedIn profiles. Data on fossil fuel generator acquisitions were developed from various sources, including news articles, press releases, and data from GMI, a commercial dataset covering the US electricity sector.

The analysis relies on comparing the efficiency trends of acquired generators to comparable generators that have never been acquired. This comparison reveals an efficiency increase of 5 percent, but only under direct ownership changes, with no significant change when only the parent ownership changes. When the researchers look at the underlying mechanisms that generate efficiencies, they find that three-quarters of the efficiency gains occur through operational improvements inside the plant rather than additional capital investment. This suggests that acquirers transfer some best practices to their newly acquired generators.

The firm characteristics in the transactions also support this evidence. Acquirers are 1.7 percent more productive than the targets, and assets sold by the target firms underperform their other assets by 3 percent. These findings suggest acquisitions allocate assets to firms with both relative and absolute advantages in utilizing those assets, providing evidence for the allocative efficiency effects of acquisitions.

—Linda Gorman