Public Beliefs about Inflation

In People’s Understanding of Inflation (NBER Working Paper 32497), Alberto Binetti, Francesco Nuzzi, and Stefanie Stantcheva present new survey results on the American public’s views on inflation. The survey collected information about individuals’ demographics, income, news sources, and voting habits as well as their opinions on the causes and distributional results of inflation. The survey was conducted between March and May 2024 using the Lucid internet platform. The sample was constructed to mirror the US population in 2022.

On average, respondents categorized inflation’s effects as unambiguously negative, saying it was worse than unemployment and ranking it as a more important policy priority than healthcare, growth, and unemployment. They did not view managing inflation as requiring trade-offs such as reduced economic activity or increased unemployment. They identified government policy actions, higher production costs resulting from the COVID-19 pandemic, rising oil prices, and supply chain disruptions as major drivers of recent inflation. The most important harm from inflation, identified by 35 percent of respondents, was the increased complexity of daily household decisions.

Americans dislike inflation and have diverse opinions, correlated with political affiliation, on its causes and solutions.

The researchers also asked a series of qualitative questions about the relationship between inflation and economic activity. Nearly one-third of survey respondents thought inflation was more likely to emerge in a boom than in a recession, and about the same share thought that policies designed to reduce unemployment might increase inflation. Only 10 percent of survey participants associated inflation with a good economy, while 62 percent thought that reducing inflation requires reducing government debt.

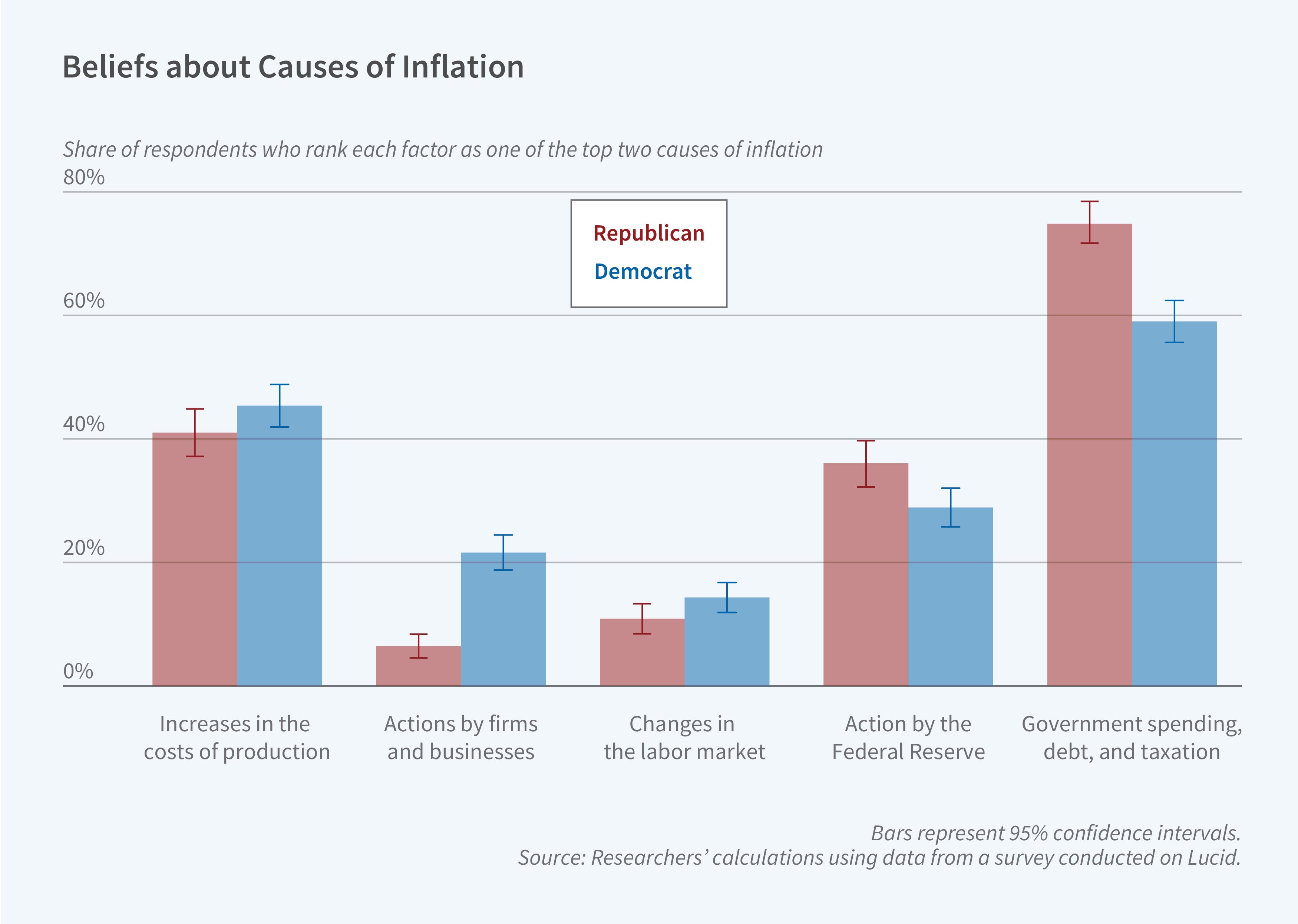

The perceived causes of inflation differed across political party registration and news sources but not across income levels. Republicans were more likely to view inflation negatively and to attribute it to the government. Democrats tended to blame business for inflation and to associate adverse distributional effects with it. Republicans and Fox News viewers were less likely than Democrats and CNN viewers to blame firms and businesses for inflation.

With regard to policy actions, many respondents held views that diverged from standard textbook prescriptions. Fifty percent of respondents supported decreasing interest rates to fight inflation and 60 percent (70 percent of Democrats and 52 percent of Republicans) supported reducing government debt by increasing taxes on high incomes. Decreasing the money supply was supported by 30 percent of respondents.

—Linda Gorman

This project was approved by instituitional review board at Harvard University (IRB24-0213). The researchers acknowledge support from the Chae Macroeconomic Policy Fund.