Encouraging Private Capital to Invest in Solving Social Problems

Initiatives to mitigate societal challenges have historically been financed primarily with public and philanthropic resources. In Blended Finance (NBER Working Paper 32287), Caroline Flammer, Thomas Giroux, and Geoffrey Heal examine World Bank initiatives to attract private investors to support projects that create societal value but are perceived to have low prospective profitability or high potential risk of failure. They focus on the International Finance Corporation (IFC), the private-sector branch of the World Bank, which strives to promote sustainable development through its commercial investments.

With ‘blended financing,’ philanthropic and public funders serve as catalyst for private investors to take on projects they would otherwise reject as too risky or unprofitable.

Public and philanthropic capital absorbs risks and provides subsidies which can take a number of forms, including loans at below-market rates, first-loss guarantees, performance-based incentives, and hedges against currency fluctuations. In one example, the IFC provided 40 percent of the financing at below-market rates for a €100 million project promoting sustainable cocoa farming in Côte d’Ivoire. The remaining funds were provided by other lenders at market rates.

The study analyzes 173 projects supported by the IFC between 2018 and 2023. For each, the IFC calculated the degree of concessionality as the subsidy from the blending (taking into account all blending provisions), expressed as a percentage of the project cost. About half the projects were in Africa, with the remainder in a range of other locations.

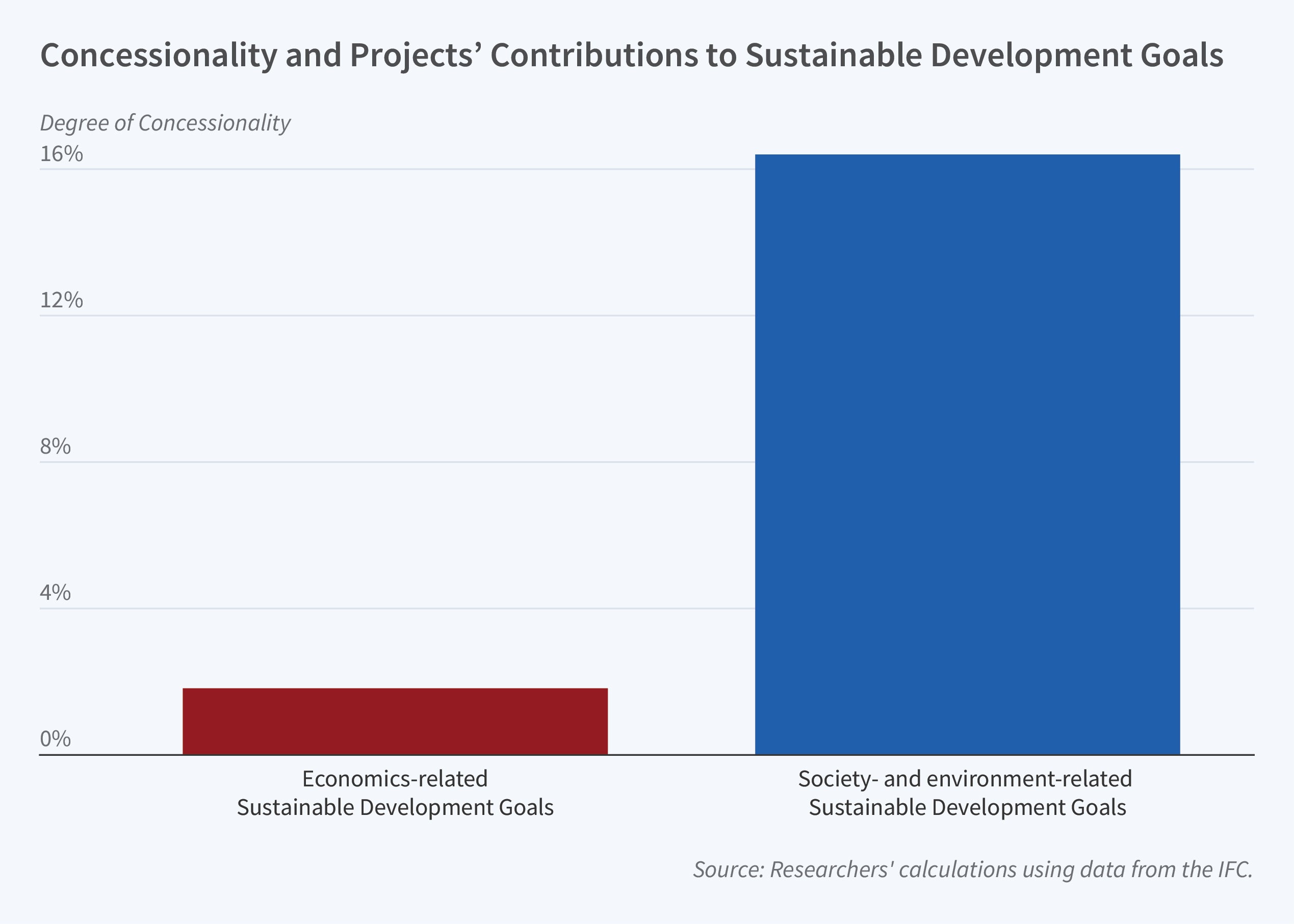

The researchers examine the correlation between a project’s degree of concessionality and its potential impact on various United Nations Sustainable Development Goals. The average number of sustainable goals advanced by the projects in the data sample was 3.52, of which 2.53 were societal or environmental. These measures of sustainability impact are based on projections, not achievements, because many of the projects were still underway at the time of the study. The researchers find that the degree of concessionality depends primarily on a project’s anticipated environmental and societal impact as opposed to the project’s economic impact. Moreover, the degree of concessionality is higher when a project is being undertaken in a country with higher political risk and a more opaque business environment. In such settings, the IFC’s support is more likely to include risk-management provisions on top of financial incentives.

Blended finance has the potential to crowd in more private capital. Yet, the researchers also caution that more work is needed to understand the effectiveness and system-level implications of blended finance.

— Steve Maas