Childcare Subsidies and Parental Earnings

In the decade after their first child’s birth, Canadian mothers’ earnings decline by 25 percent relative to the earnings of fathers, Sencer Karademir, Jean-William P. Laliberté, and Stefan Staubli estimate. The unequal distribution of childcare responsibilities is a likely contributor to this gap, with 38 percent of women aged 24–35 providing over 30 hours of unpaid childcare per week compared to 11 percent of men.

In The Multigenerational Impact of Children and Childcare Policies (NBER Working Paper 32204), the researchers examine how formal childcare subsidies affect the labor market effects of childbirth. Using data from the Intergenerational Income Database, they consider new parents who were born between 1963 and 1985, as well as potential grandparents who were between the ages of 40 and 85 between the years 1981 and 2016. They find that the arrival of a child raises the likelihood that parents and grandparents live in the same area, consistent with families valuing grandparental proximity for informal childcare. The birth of a grandchild leads to an 8 percent reduction in employment and a 16 percent decline in earnings for grandmothers, and a 6 percent reduction in employment and a 15 percent drop in earnings for grandfathers after 10 years.

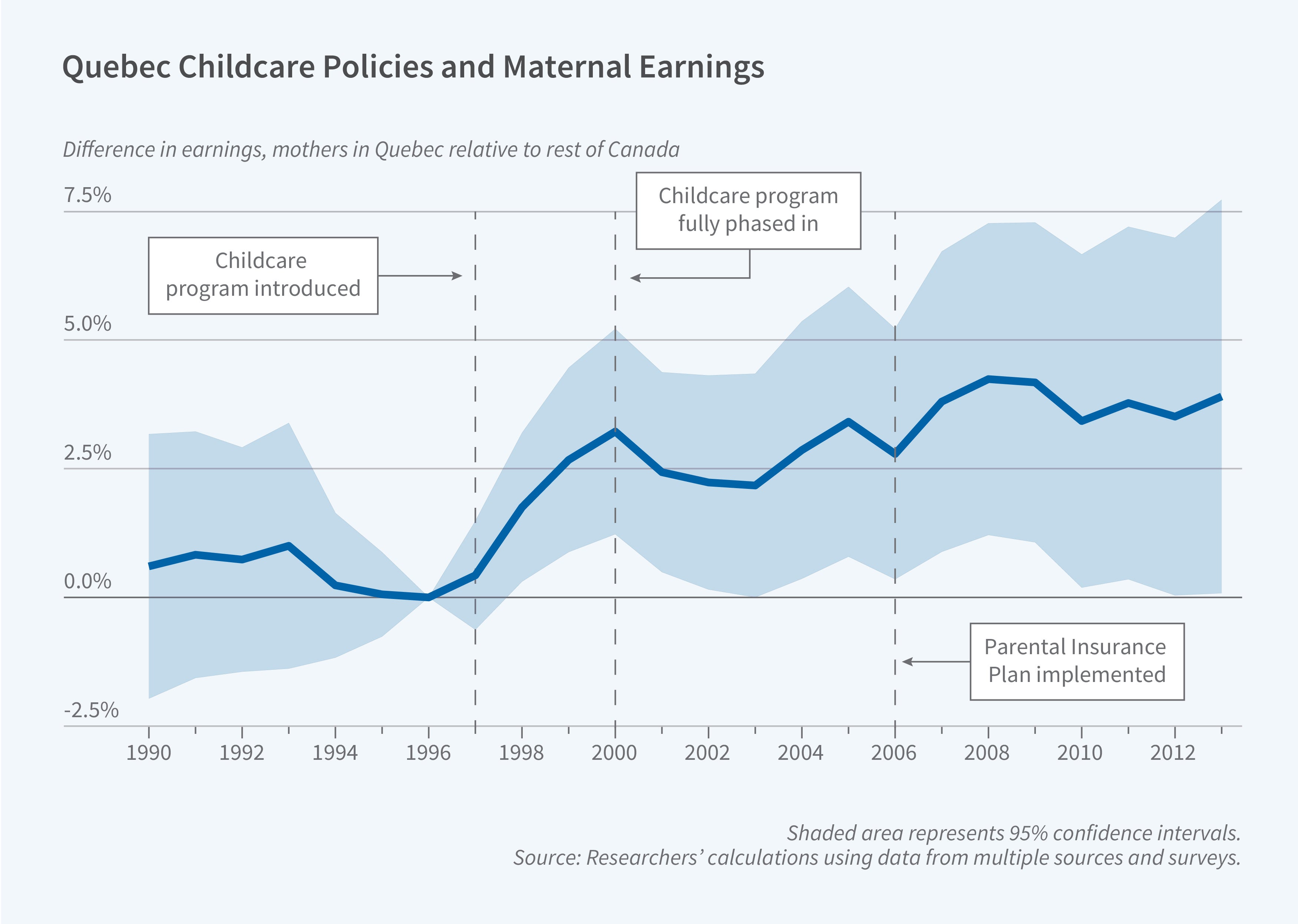

In Canada, the earnings decline following first childbirths is larger for mothers than for fathers, but formal childcare subsidies in Quebec attenuate this disparity.

The earnings effect of first children is negatively correlated between mothers and grandmothers. A 6 percent larger decline in the earnings of a grandmother is associated with a 9 percent reduction in the earnings decline (a smaller decline) for the mother, suggesting that parental and grandparental care are substitutes.

Areas with greater formal childcare usage have smaller motherhood penalties. Doubling the share of families claiming childcare expenses from 25 percent to 50 percent is associated with an 11 percent smaller reduction in earnings and a 7 percent smaller drop in employment.

To estimate the impact of childcare subsidies, the researchers leverage the introduction of Quebec’s universal childcare program in September 1997, which limited parental childcare expenses to $5 a day. The program was phased in to cover all children who were under the age of five by September 2000. Using National Longitudinal Survey of Children and Youth data, the researchers estimate that between 14 and 20 percent of families switched from parental or grandparental care to formal care due to the Quebec childcare program. The share of families mainly relying on a relative for childcare decreased by between 3 and 4 percentage points.

Between 2000 and 2005, maternal earnings and employment increased by 2.5 percent in Quebec relative to the rest of Canada. Relative to mothers in Quebec during the 1982–1996 period, mothers covered by this program displayed a 4 percentage point higher employment rate a decade after childbirth. Earnings increased by 3.3 percent. Grandmothers’ employment increased by about 2 percent but grandmothers’ average earnings declined, consistent with formal childcare substituting for intensive informal care provided by relatives while complementing low-intensity care.

— Leonardo Vasquez

Financial support from the Social Sciences and Humanities Research Council of Canada is gratefully acknowledged.