Estimates of Long-Term Yields from UK Housing Markets

The long-term yield of housing, or rent-to-price ratio, contains information about the expected long-term outlook of the economy. Estimating it is difficult, as transitory factors such as monetary policy, credit booms, short-run asset market bubbles, and capital adjustment costs can affect the dividends and realized capital gains that are often used in estimating asset yield movements. Structural approaches to estimating long-term yields are sometimes used, but are often imprecise and subject to model misspecification concerns.

In Dynamics of the Long Term Housing Yield: Evidence from Natural Experiments (NBER Working Paper 31760), Verónica Bäcker-Peral, Jonathon Hazell, and Atif R. Mian use publicly available data on leasehold extensions on properties in the United Kingdom to estimate the monthly long-term yield of housing. In the UK, 97 percent of apartments are leaseholds. Freeholders, who have a perpetual claim to the ownership of the property, issue long-duration leases that confer the right to occupy it. Lease terms are typically 90 years or more. Leaseholders can sell the lease to another occupant, or extend their leasehold after paying the freeholder the negotiated value of a leasehold extension. Leaseholds are typically extended when the current lease has 60 to 90 years left. Increasing the duration of a leasehold increases its market value because it provides the leaseholder with a longer span over which to live in the property or receive income from it.

Differences in property prices around leasehold extensions provide estimates of long-run yields.

There were 134,201 leasehold extensions from 2003 through the first part of 2023, covering about 5 percent of all UK apartments. Short leaseholds — 250 years or less — comprised 70 percent of the apartments studied. Thirty percent had remaining terms of 700 years or more.

The researchers assume that the service flow from a given property will grow similarly for extended leaseholds and shorter leaseholds on similar properties without extensions. Control group properties had similar average floor area and numbers of bedrooms. Rental prices were about 2 percent higher for extending properties, but extending properties were no more likely to be renovated than control properties, and their rents grew at the same rate. The researchers apply a discounted cash flow pricing equation to estimate the market’s expected long-term housing yield from the price difference for properties with extensions and a control group of properties without.

On average, when a leasehold was extended, its price increased by about 10 percent relative to the price of a leasehold on a similar property in the control group. The percentage increase in leasehold value from an extension was larger for properties with shorter leases before the extension. Leasehold values went up by more than 30 percent for properties with 40-year leases before extension that were extended by 90 years, and by only 5 percent for properties with 90-year leases before extension.

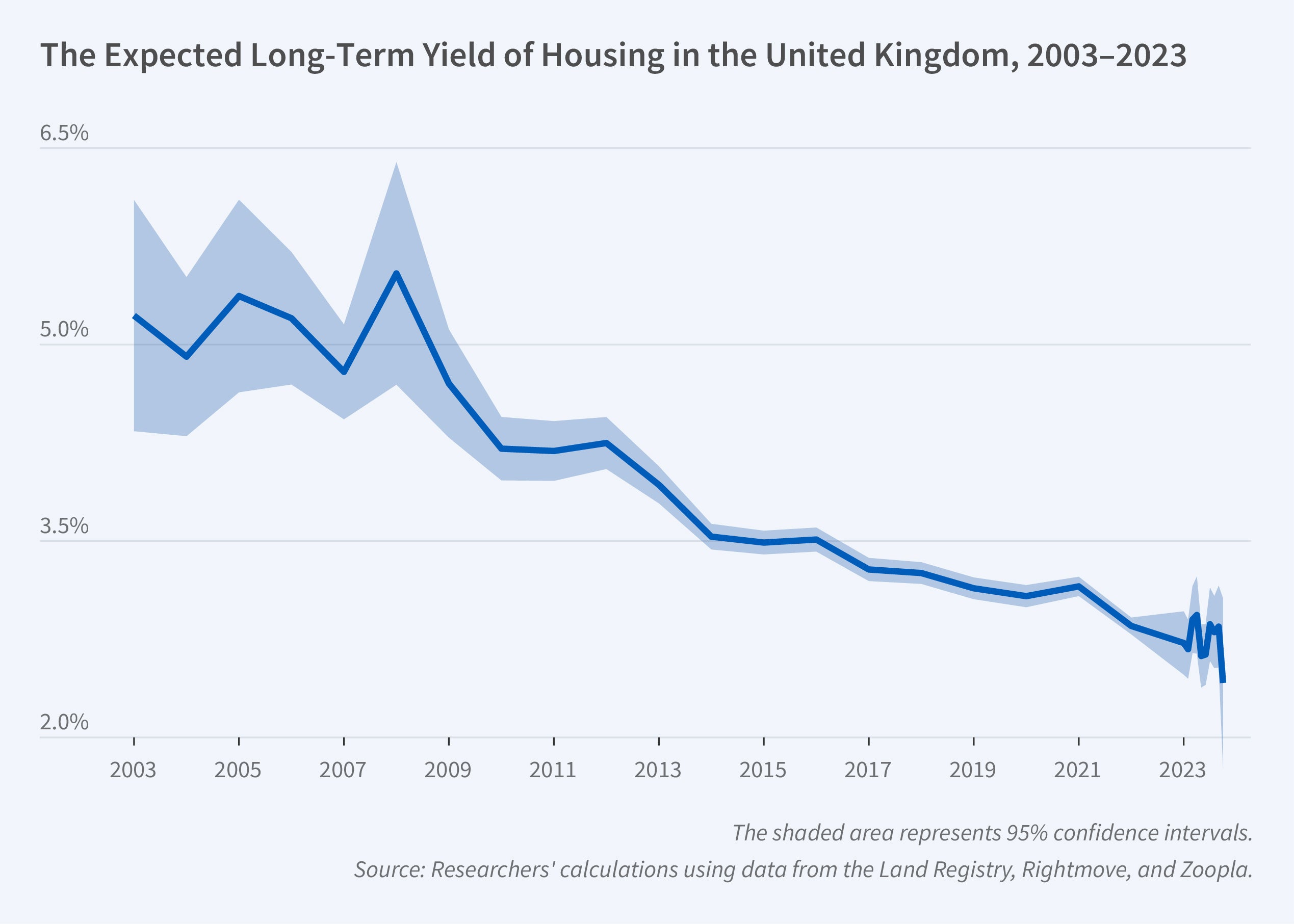

These price changes associated with leasehold extensions vary over time within the data sample and provide information on the variation in the long-term housing yield. The estimates suggest a value of around 5.2 percent between 2003 and 2006 that began to fall at the onset of the 2008 recession and reached a low of 2.8 percent in 2023. The decline is consistent with an observed decline in yields for several major asset classes across the globe during this period, suggesting it may have been driven by a common factor. The magnitude of the decline also encodes information about the elasticity of housing supply; when long-run safe interest rates fall, putting upward pressure on prices, elastic land supply will accommodate the growth in demand and mitigate the decline in long-term housing yields.

— Linda Gorman

This research was supported by the National Institutes of Health under Award Numbers R01AG053350 and R01AG073365.