Monetary Policy, Interest Rates, and Innovation Spending

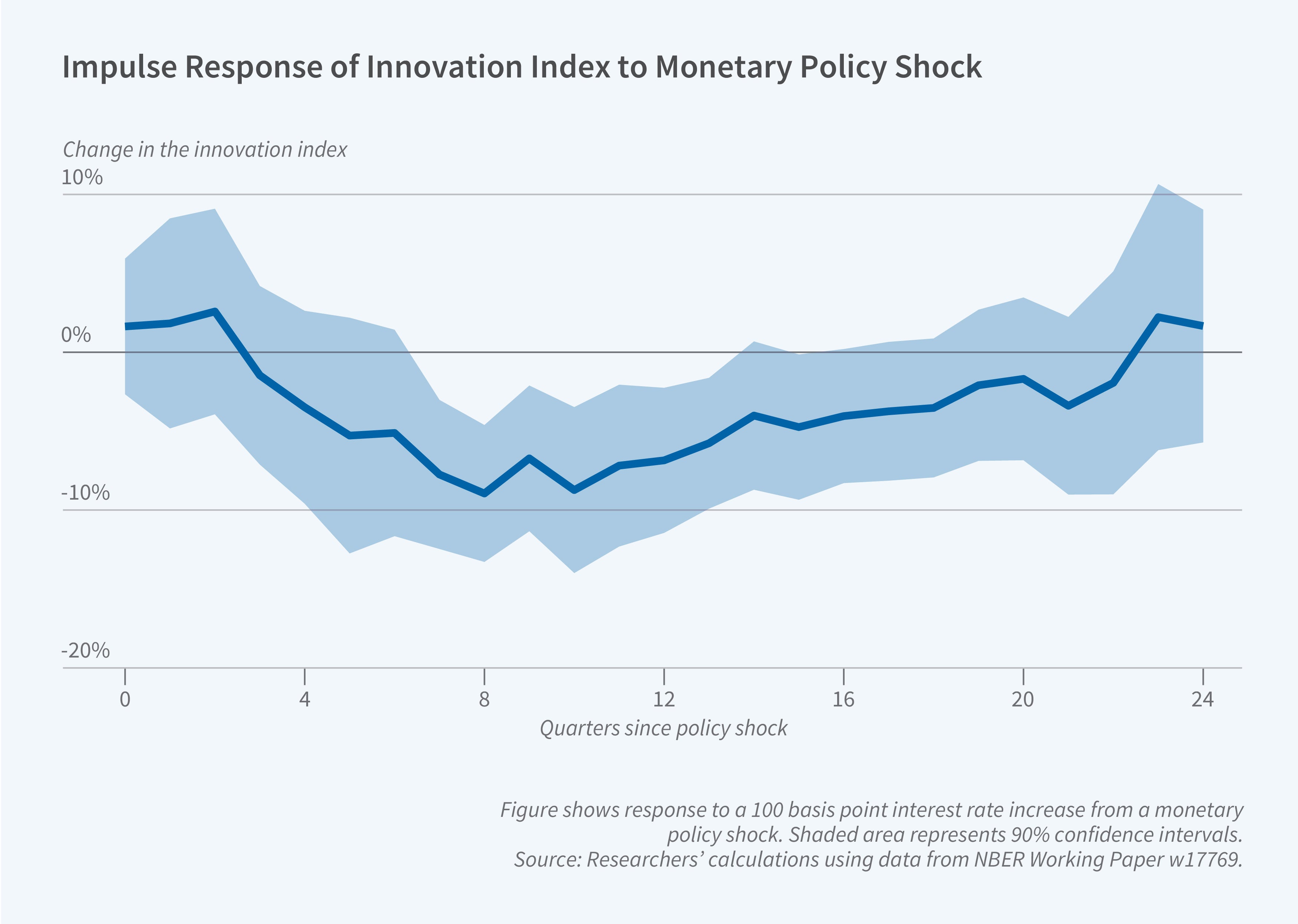

Analyzing monetary policy shifts over the 1969 to 2007 period, Yueran Ma and Kaspar Zimmermann find that a 1 percent increase in interest rates was associated with a 3 percent decline in R&D spending by US companies over the following three years. In Monetary Policy and Innovation (NBER Working Paper 31698), they also find that venture capital (VC) investment decreased by 25 percent in the one to three years following the rate hike. Finally, patent filings in key technologies and a widely used innovation index from previous work declined by 9 percent.

The researchers study several datasets to document these patterns. They look at aggregate investment in intellectual property products and R&D spending using data from the National Income and Product Accounts along with firm-level data from Compustat on R&D spending by US public companies. They track spending decisions by VC firms using the VentureXpert database and examine patents filed with the US Patent and Trademark Office for around 300 important technologies that have been frequently discussed in earnings calls over the past 20 years. When measuring monetary policy shocks, the researchers focus on interest rate changes that are not explained by current or forecasted economic conditions.

Interest rate increases are followed by protracted reductions in business

spending on research and development, venture capital investment, and patenting activities.

Interest rate increases can depress innovation through several mechanisms. The researchers focus on the reduction in aggregate demand and the tightening of financial conditions, which reduce the profits and the funding for investing in innovation. They find a larger decline in R&D spending at companies in cyclical industries, where demand is more sensitive to economic conditions. They also find that the decline of VC funding is present among early-stage startups, suggesting that tighter monetary policy leads investors to make fewer risky bets.

The researchers note that recent changes in interest rates and VC commitments are consistent with the pattern they observe over a much longer period. Since interest rates began to rise in 2022, VC investment has fallen by around 30 percent annually across most sectors.

— Emma Salomon

Yueran Ma acknowledges research support from the Macro Finance Research (MFR) Program at the University of Chicago and an NSF CAREER grant. Kaspar Zimmermann acknowledges research support from the Leibniz Institute for Financial Research SAFE.