Economic Impact of Hospital Acquisitions

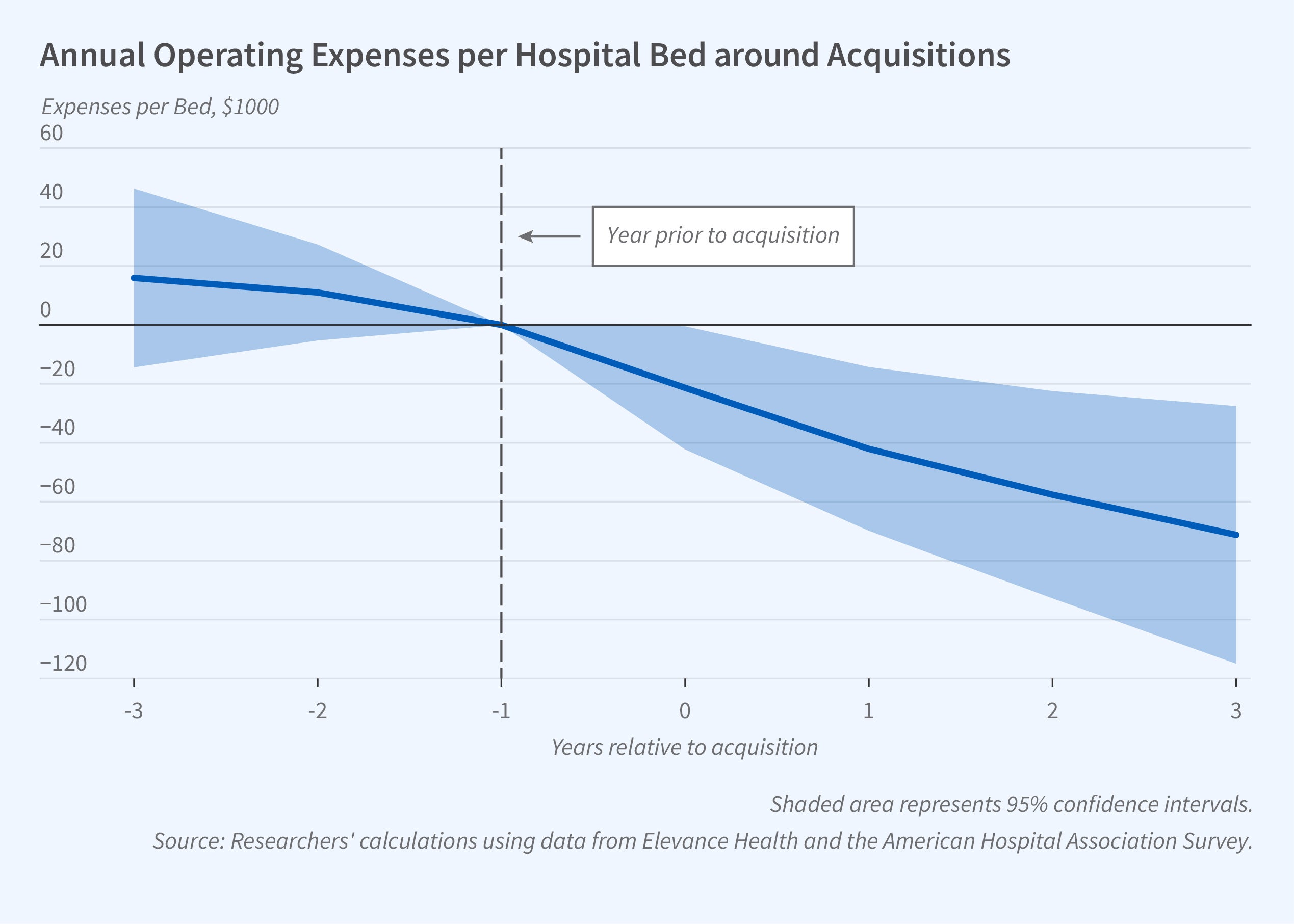

The share of US hospital bed capacity owned by multi-unit hospital systems increased from 58 to 81 percent between 2000 and 2020. In The Corporatization of Independent Hospitals (NBER Working Paper 31776), Elena Andreyeva, Atul Gupta, Catherine E. Ishitani, Małgorzata Sylwestrzak, and Benjamin Ukert study changes in hospital costs and pricing at 101 independent hospitals that were acquired by hospital systems in the 20 states in which Elevance Health provides employer-sponsored and individual plans and Medicare Advantage coverage. They analyze transaction prices paid for individual inpatient stays, Medicare fee-for-service claims, and all-payer New York state hospital discharges. They find that after an acquisition, hospital operating profit rose by about $60,000 per bed per year. Much of this increase — about $48,000 — was from reductions in personnel expenses and capital and financing costs. Inpatient revenues also rose about 6 percent within three years of acquisition.

When an independent hospital is acquired by a for-profit hospital system, the subsequent drop in annual operating costs per bed is $94,000 larger than if the acquirer is a nonprofit organization.

The average acquired hospital had 230 beds and about 10,000 admissions per year. By comparison, the average acquiring system had 3,900 beds, 17 hospitals, and about 177,000 annual admissions. Acquired hospitals with lower-than-median prices and number of beds had larger increases in prices across all service lines. Price increases were larger when the acquired hospital and at least one hospital owned by the acquiring system were in the same Dartmouth Atlas hospital referral region. The researchers find that prices for inpatient treatment of commercially insured patients also increased by about 6 percent when one system sold a hospital to another system, leading them to suggest that the price increase following system acquisitions may be related to increases in market power.

Average operating expenses in the acquired hospitals were about $1 million per bed per year. Payroll expenses accounted for just over half of the total, while depreciation and interest expenses accounted for about 7 percent. Acquired hospitals reduced payroll spending by 6 percent, about 0.29 full-time employees or $23,534 per bed. A majority, 61 percent, of the reductions in staff spending occurred among personnel in overhead or support functions such as employee benefits, general and administrative functions, maintenance, pharmacy, and medical records.

For-profit hospital systems pared operating costs the most, generating reductions that were $94,000 per bed larger than those of nonprofit systems. Larger acquiring systems generated larger declines in operating costs. Acquiring systems of above-median hospital system size generated per-bed operating cost declines that were $80,000 larger than those of acquiring systems with below-median hospital system size. In contrast, when a system-owned hospital was sold to another system, there was no decline in personnel expenses per bed.

Patient satisfaction scores and mortality rates were not affected by hospital acquisitions. The researchers do not find any evidence that the system improved the quality of care, and identify some evidence of decline. After acquisition, the average 90-day readmission rate increased by 3 percentage points for commercially insured cardiac care patients. Medicare data show that readmissions for patients with non-deferrable conditions increased by 0.57 percentage points.

— Linda Gorman