The Effect of Disability Programs on Financial Outcomes

Over six percent of working age adults in the U.S. receive disability benefits through the Disability Insurance (DI) or Supplemental Security Income (SSI) programs. These programs benefit workers by insuring them against the risk of experiencing a long-term disability and the associated loss of earnings. However, these programs may also distort decisions about work and human capital investment.

Although the labor supply effects of U.S. disability programs have been studied extensively, there is relatively little evidence on the programs' potential benefits. This gap motivates a new paper by researchers Manasi Deshpande, Tal Gross, and Yalun Su, Disability and Distress: The Effect of Disability Programs on Financial Outcomes (NBER Working Paper 25642).

The authors study bankruptcy, foreclosure, and eviction, events that occur infrequently but are associated with large declines in consumption. They undertake an ambitious data linkage that involves matching Social Security Administration data for millions of DI applicants to court data on bankruptcy filings, county-level foreclosure and deed records, and evictions records.

They first show that DI applicants experience more financial distress than the general population and also apply for benefits after a period of increasing financial distress, potentially caused by deteriorating health. Financial distress declines after the disability decision for successful applicants but also (to a lesser extent) for denied applicants. Measuring the role of DI in these improving outcomes is challenging – the experience of rejected applicants may not be a good indication of how successful applicants would have fared without DI, since successful applicants are typically less healthy.

To address this challenge, the authors use age-based variation in DI eligibility — namely, that evaluators can use more lenient standards for those above age 50 and age 55 when assessing whether applicants deemed unable to do their previous job are able to do another kind of work. DI allowance rates rise at these ages, as those just above these age thresholds are more likely to be awarded benefits than are similar applicants below the thresholds. The authors are able to assess the effect of DI receipt on financial outcomes by focusing on differences in receipt that arise solely from being on one side or the other of these age cutoffs.

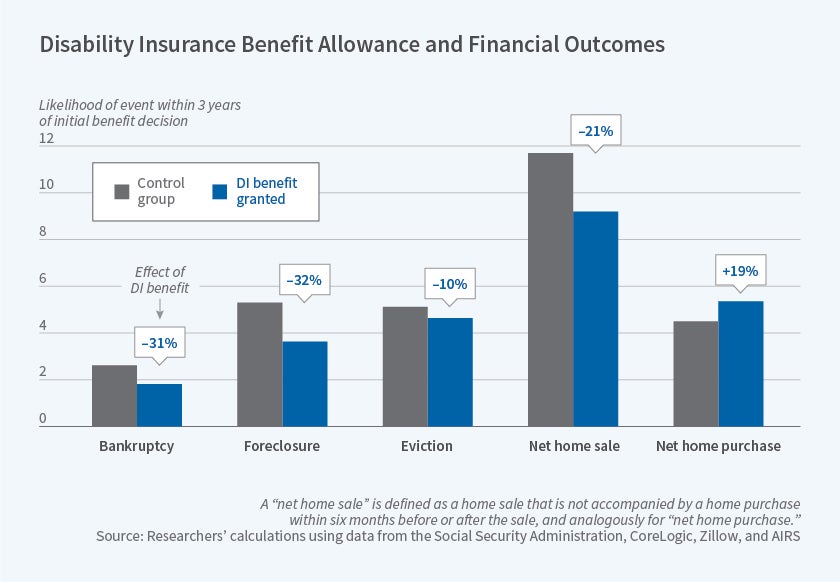

Turning to the main results, the authors find that DI receipt is associated with a 31 percent decline in bankruptcy, a 32 percent decline in foreclosure, and a 10 percent decline in eviction. DI receipt also reduces the probability of selling a home without buying a new home ("net home sale") and raises the probability of moving into home ownership ("net home purchase").

Exploring the mechanisms for these findings, the authors find little evidence that they are driven by an increase in credit access or demand or by a change in the incentives to enter bankruptcy or repay debts. Rather, "the most likely channel is the wealth channel: allowance onto disability programs increases applicants' wealth and thus they become solvent. Newly allowed applicants can meet their financial obligations, and this wealth leads to a decrease in bankruptcies, foreclosures, and home sales."

The authors conclude, "the estimates suggest that disability programs confer large welfare gains to recipients and to third parties," including spillovers to neighboring homeowners whose property values rise due to the decline in foreclosures. "Determining the optimal generosity of disability programs requires weighing these benefits against the moral-hazard costs of these programs," such as reduced labor supply, the authors write. Finally, the findings suggest that processing DI applications more quickly could avert a substantial amount of financial distress, though doing so involves higher administrative costs and could change the composition of the applicant pool.

This research was supported by the U.S. Social Security Administration through grant #5 DRC12000002-06 to the National Bureau of Economic Research as part of the SSA Disability Research Consortium.