Inflation’s Impact on Social Security Disability Program Beneficiaries

Social Security Disability (SSD) program beneficiaries, like other consumers, have been negatively affected by inflation over the past several years. In a survey from June of 2023, more than half (59 percent) of SSD program beneficiaries reported higher prices for the disability-related goods and services they need to purchase, and more than one-quarter reported reducing food spending to cover disability-related costs, Zachary Morris and Stephanie Rennane found in Examining the Impact of Inflation on the Economic Security of Disability Program Beneficiaries (NBER RDRC Paper NB23-08).

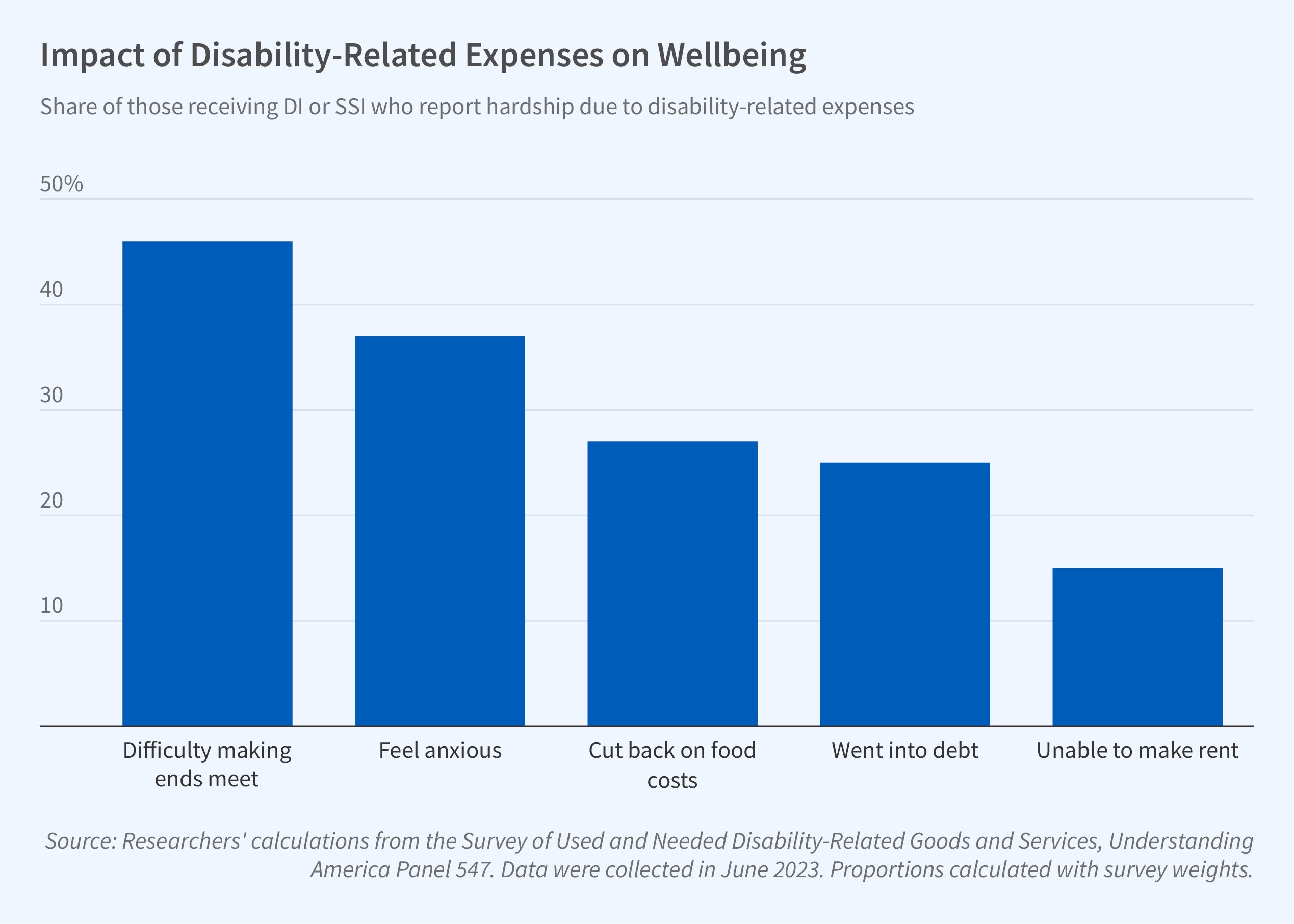

Using new survey data, the researchers found that 82 percent of beneficiaries reported out-of-pocket expenses related to their disability, with average annual spending of $4,412 and median spending of $384 as of June 2023. Fifty-nine percent of beneficiaries reported higher spending on disability-related goods and services compared to two years earlier. In response to these rising costs, 25 percent of beneficiaries indicated they went into debt; 43 percent found recent COLA adjustments insufficient to maintain their standard of living.

Medical expenses make up 15 percent of disability program beneficiaries’ spending, more than twice that of the average consumer.

To build their dataset, the researchers developed a novel survey tool that was fielded to the Understanding America Study (UAS), a nationally representative internet survey panel administered by the University of Southern California. Over 400 survey respondents were recipients of either Social Security Disability Insurance or Supplemental Security Income (together, SSD beneficiaries).

The survey asked beneficiaries about extra disability-related spending in 10 categories: mobility, assistive technologies, vision, hearing, personal assistance, interior home modifications, exterior home modifications, health services, health goods, and miscellaneous additional expenditures. The researchers then modified spending weights from the Consumer Price Index-W (CPI-W) to account for these extra disability-related costs and compared spending patterns to those of the average CPI-W consumer. The CPI-W, the average consumer price index for urban wage earners and clerical workers, is used as the basis for inflation-related cost-of-living adjustments to federal programs, including disability benefits.

The market basket of goods purchased by SSD beneficiaries differed significantly from that of the average consumer. Over 15 percent of SSD beneficiaries’ expenditures were for medical expenses, compared to only 7 percent for the average consumer. This reflected both higher-than-average medical care spending and specific high-cost items like wheelchairs, assistive technologies, and hearing aids. Home modifications were also a source of higher spending and contributed to the large difference between average and median expenses. SSD beneficiaries spent more on food, general expenses, medical expenses, and transportation costs than the average consumer.

The researchers explored whether cost-of-living increases to disability benefits should be based on a disability-specific measure of spending which places a higher weight on medical costs. They noted that the federal government already calculates a similar measure, the CPI-E, of the consumer spending of the elderly, although this metric is not presently used to calculate changes to benefit programs. Another policy that could mitigate the effects of inflation on disability program beneficiaries is raising the share of prescription and over-the-counter medication costs covered by disability-related insurance programs. This approach would offer a more targeted option to reduce out-of-pocket costs for disability program beneficiaries in a category with higher-than-average spending.

— Emma Salomon

The research reported herein was performed pursuant to grant RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA, any agency of the Federal Government, or NBER. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.