Universal Pre-K Access and Parental Earnings

In recent decades, cities, states, and the federal government have expanded funding for universal pre-kindergarten (UPK) programs. These programs are large and free. The policy logic underlying UPK expansion is that many parents may lack access to or underinvest in pre-kindergarten childcare and that the educational benefits for children and expanded labor market opportunities for parents combine to outweigh the costs of public provision.

In Parents’ Earnings and the Returns to Universal Pre-Kindergarten (NBER Working Paper 33038), John Eric Humphries, Christopher Neilson, Xiaoyang Ye, and Seth D. Zimmerman study whether UPK raises parents’ earnings. The researchers examine UPK in the New Haven Public Schools (NHPS), which have offered full-day public pre-kindergarten to three- and four-year-olds since the late 1990s. New Haven’s pre-K students are selected through a lottery system, allowing the researchers to compare outcomes between students who are selected for the free, all-day program and those who are not. The researchers link 20 years of NHPS pre-K lottery enrollment information with data on parental earnings and student achievement.

Access to pre-kindergarten programs increases average parental earnings by over $5,400 per year.

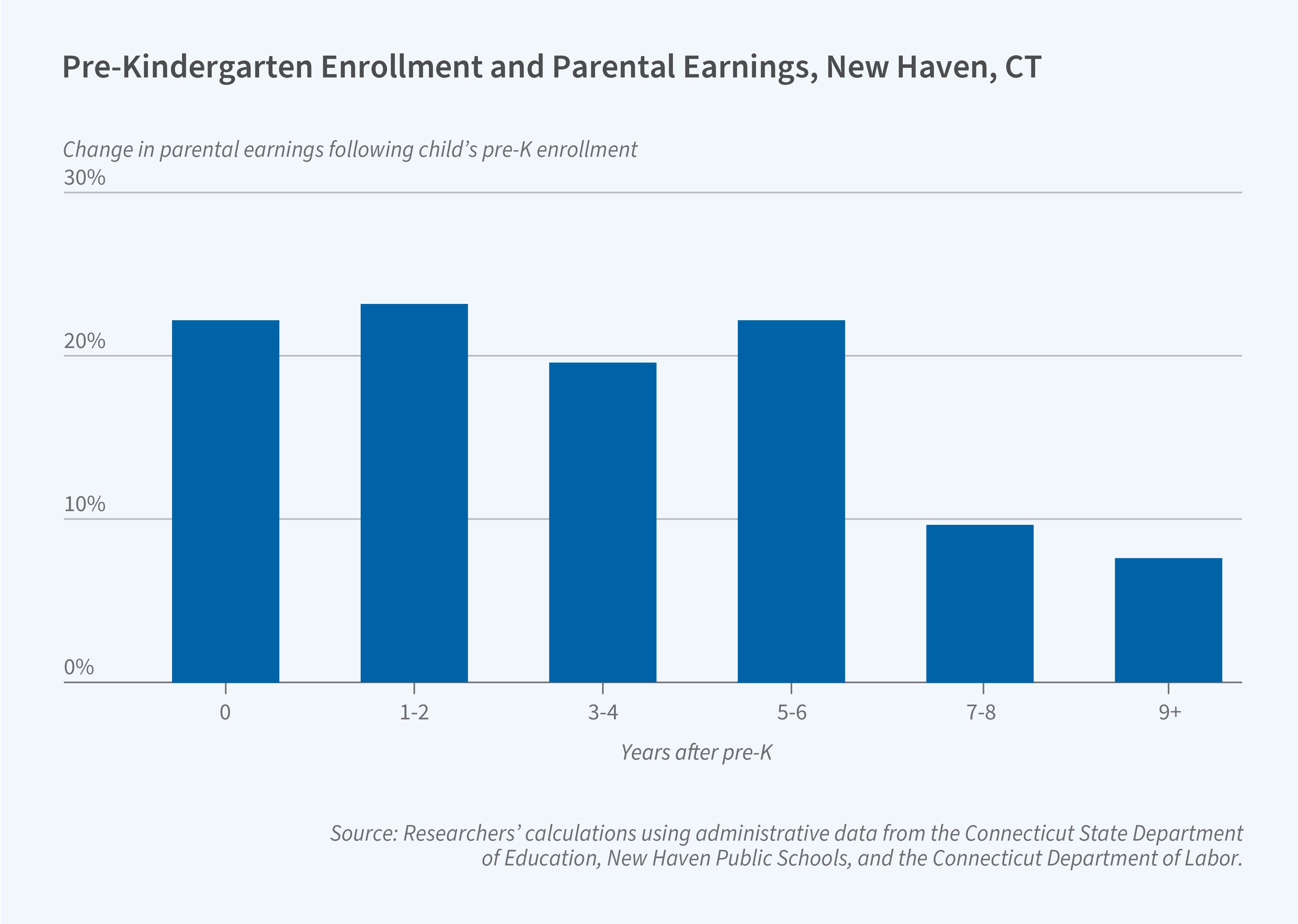

Enrolling a child in the NHPS UPK program raises parents’ average earnings by $5,461 per year, or 21.7 percent, during the one- or two-year period when the child is of pre-kindergarten age. These gains coincide with increases in hours worked: UPK enrollment allows parents to work 12.8 more hours per week in the year following enrollment.

Parents’ earnings remain higher for at least the next six years. These gains are not driven by increased labor supply alone. The effects on hours worked fall towards zero after the pre-kindergarten period and effects on labor force participation are modest both during and after pre-kindergarten. This suggests that the long-run labor market effects of UPK may be attributable to returns to experience or job continuity, as UPK allows parents to maintain their career paths, keep consistent work hours, and possibly work more effectively.

The researchers find that UPK enrollment does not raise the fraction of children in childcare, as nearly all students selected for UPK substitute away from another childcare option. There is, however, a large effect on hours of childcare. Children who “win” the UPK lottery receive an average of 11.3 more hours of childcare coverage per week. This is because NHPS UPK programs offered a 10-hour day for most of the study period, supplementing a 6.5-hour academic day with before- and aftercare, similar to extended-day programs in other cities.

The researchers find little evidence that UPK affects children’s academic performance or behavior in the medium run. They find no statistically significant effects on test scores, attendance, or grade retention between kindergarten and the eighth grade.

The study suggests high returns to public investment in free, all-day early childhood care since gains in parental earnings offset the program’s cost. On average, each $1 of net government costs yields $10 in benefits to families. These findings suggest the return to UPK is higher than that of many other active labor market policies.

— Abigail Hiller

This research received financial support from the Tobin Center for Economic Policy. Researcher Christopher Neilson discloses that he is the CEO of and has a financial stake in TetherEd, a firm that provides school choice support services to school systems, including to the New Haven public schools. Researcher Seth D. Zimmerman discloses that he holds a volunteer position as a member of the Connecticut State Board of Education and that he has a financial stake in TetherEd.