Synthesizing Micro and Macro Evidence on the US Economy

The US economy has experienced a long expansion from the trough in June 2009 through the first half of 2019. The unemployment rate has dipped below 4 percent since April 2018, something that has happened only a few times in the last 50 years. At the same time, inflationary pressures have remained low, with relatively modest wage and price inflation rates. Two periods in the last half century also had these favorable macroeconomic conditions — the mid-1960s and the second half of the 1990s — but those were periods of robust productivity growth. In contrast, productivity growth has been relatively anemic since the Great Recession.1

Moreover, the evidence points to the productivity slowdown pre-dating the Great Recession. Given perceptions of rapid technological change from artificial intelligence, automation, and robotics, this has led some to argue that mismeasurement of productivity has increased over this period. While debate on this issue remains open, careful studies suggest that the slowdown shown in the measured productivity data from the early years of the 21st century is not primarily due to increased mismeasurement.2

Changes in the dynamics of productivity and growth at the micro level offer a deeper understanding of the macroeconomic patterns. In this summary, I review some of my research that explores these issues. This research reflects collaborative work with Kim Bayard, Cindy Cunningham, Steven Davis, Ryan Decker, Emin Dinlersoz, Tim Dunne, Jason Faberman, Lucia Foster, Cheryl Grim, Shawn Klimek, C.J. Krizan, Ron Jarmin, Javier Miranda, Scott Ohlmacher, Sabrina Pabilonia, John Stevens, Jay Stewart, and Zoltan Wolf. Many other researchers have been engaged in closely related research.

Declining Business Dynamism and Startups

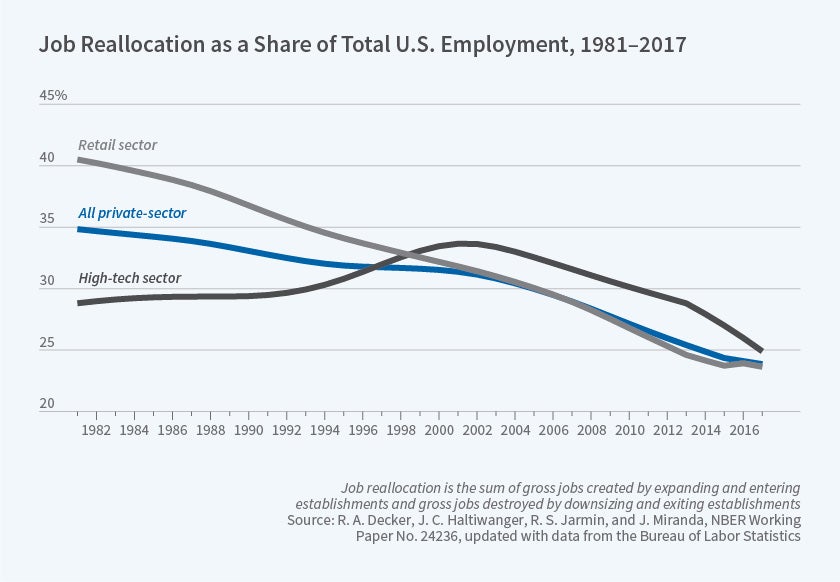

One of the most striking changes in the dynamics of US businesses is the decline in indicators of business dynamism and business startups, especially in the post-2000 period.3 These patterns emerge from analysis of longitudinal business databases developed at US statistical agencies from administrative data tracking establishments and their parent firms in the private, nonfarm sector. Figure 1 shows the trends in job reallocation at the economy-wide, private, nonfarm sector level and for two selected broad sectors, retail trade and high tech. The latter is a combination of the science-, technology-, engineering-, and mathematics-intensive sectors. These are series primarily computed from the Longitudinal Business Database at the Census Bureau, spliced with the closely related series from the Bureau of Labor Statistics' Business Employment Dynamics series.4

It is apparent from Figure 1 that the pace of job reallocation has declined over the last few decades, with an accelerated decline in the post-2000 period. Since 2000, there has been a ubiquitous decline in the pace of job reallocation across all sectors. Prior to 2000, the high-tech and retail trade sectors exhibit distinct differences in trends. The pace of job reallocation in the retail trade sector exhibits a pronounced decline since 1980, while job reallocation increased in the high-tech sector until 2000 but declined substantially after that.

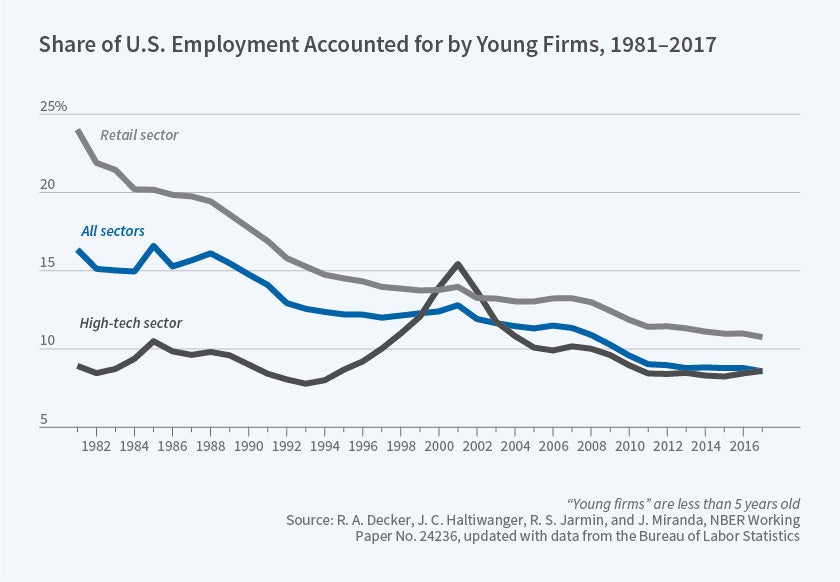

A closely related phenomenon is the change in firm startup rates. The share of activity at young firms has declined over the last few decades, as shown in Figure 2. The pattern of changes in young firm activity closely mimics that of job reallocation. Young firms are more volatile; about 30 percent of the overall decline in job reallocation is accounted for by a shift in the age distribution toward older rather than younger firms.

Implications for Productivity?

The declines in both startups and reallocation potentially are related to the aggregate decline in productivity. Young firms disproportionately contribute to job creation, innovation, and productivity growth.5 More generally, empirical evidence supports the view that medium-term reallocation flows are an important source of medium-term productivity growth. This also resonates with Schumpeterian theories of creative destruction that see reallocation as critical for innovation and growth. Increasing barriers to entry and reallocation stifle growth, according to these theories.

Alternatively, changes in the structure of businesses induced by changing technology and globalization may account for the declines in both young firm activity and job reallocation without having adverse implications for productivity and growth. For example, the retail trade sector has undergone productivity-enhancing structural change that has been accompanied by a decline in the pace of entry and reallocation.6 In this sector, there has been a pronounced shift away from single-establishment firms toward large national and multinational chains. Information and Communications Technology and globalization have enabled large, multinational chains to develop global supply chains and efficient distribution networks. Establishments of large, national chains are both more productive and stable than single- establishment firms. This structural change accounts for a large fraction of the productivity growth in retail trade over recent decades.

Both of these alternative perspectives could be at work accounting for some fraction of the decline in reallocation and startups, but with different implications for economic growth. Sorting out these alternative perspectives is an active area of research. The evidence suggests that the relative importance of these alternatives varies over time and sectors. Multiple mechanisms and directions of causality are likely at work. Industries in the high-tech sector with extraordinary bursts of productivity growth in the late 1990s and early 2000s exhibited a systematic pattern of entry, followed by productivity dispersion and a shakeout period.7 A burst of entry in a narrowly defined industry in high tech first led to a period of rising productivity dispersion and, if anything, a decline in productivity growth. Following this period of experimentation, a shakeout occurred, with more productive young firms growing and exhibiting rapid within-firm productivity growth and less productive firms contracting and exiting. Only several years after the surge of entry in a narrowly defined industry did productivity growth increase. These patterns in the high-tech sector are consistent with the view that entry plays a critical role in innovation and productivity growth in some sectors.

Differences between retail trade and high tech show up in other dimensions of firm dynamics, arguing against a one-size-fits-all explanation of the declining pace of startups and reallocation. Before 2000, young firms in the high-tech sector exhibit a pronounced right skewness in the growth rate distribution — indicating the presence of some extreme outlier firms with very high growth rates.8 These patterns are consistent with high-growth young firms playing a critical role in economic growth. However, during the post-2000 decline in entry and reallocation, the right skewness in high tech declines substantially. This decline is associated with a decline in the number of high-growth young firms in high tech and is consistent with the observed declines in IPOs in this sector over this period. In contrast, young firms in the retail trade sector exhibit no right skewness either before or after 2000.

The post-2000 period also exhibits a decline in the responsiveness of firms to productivity shocks and an accompanying rise in the dispersion of productivity across firms within industries.9 These patterns are more robustly measured in the manufacturing sector, where total factor productivity can be measured, but also hold in nonmanufacturing sectors when calculated using firm-level revenue productivity measures. The declining responsiveness is consistent with an increase in adjustment frictions, broadly interpreted to include any impediment to resources being allocated to their highest valued use. This decline in responsiveness acts as a drag on aggregate (sectoral level) productivity growth. An active area of research seeks to uncover the source of these changes in responsiveness accompanied by rising productivity dispersion.10

Interactions with the Cycle: Was the Great Recession Different?

The post-2000 acceleration of the decline in job reallocation and startups begins before the Great Recession, but the latter yields interactions with the cycle that are distinct from prior downturns. Young firms are especially sensitive to financial conditions, which makes them exhibit more cyclical behavior than their mature counterparts. The financial crisis yielded an especially sharp decline in the share of young firm activity, as is evident in Figure 2. The collapse in housing prices and the decline in bank lending to young firms during the Great Recession account for almost all of the sharp decline in young firm activity.11

The Great Recession was also distinctive in that the relationship between firm growth and productivity shocks weakened substantially during this period. The decline in responsiveness of firms to differences in productivity predates the recession but the financial collapse dampened responsiveness further. During this period, heterogeneity in firm outcomes became less associated with economic fundamentals.12

Looking Forward

The pace of job reallocation, the business startup rate, and the associated share of young firm activity have exhibited pronounced changes in the last few decades. Patterns differ by sector and time period, but since 2000 the decline in these indicators of business dynamism and entrepreneurship has accelerated. The long-run decline in these indicators in retail trade is a stark reminder that a high pace of reallocation, business startups, and share of young firm activity are not inherently associated with more robust economic performance. However, theory and evidence suggest that frictions or distortions that inhibit entry and reallocation can be a drag on innovation and productivity. Moreover, a surge of entry, a high pace of reallocation, and productivity dispersion often accompany the development of new products and processes. Distinguishing between episodes when changes in reallocation and entry reflect benign versus detrimental channels is an area of active research.

Great progress has been made at the US statistical agencies in developing public domain statistics tracking business dynamism and entry. The underlying administrative datasets, some containing longitudinal firm-level data and others similar data at the establishment level within firms, have become active sources of ongoing research, including much of the research discussed in this summary. These databases, which cover the universe of US businesses, have also been integrated with a host of external data as well as survey data at the statistical agencies. The resulting combined datasets have yielded a number of new insights.13 I have been actively engaged in collaborating on the development of these databases, and it is heartening to see their active use both as micro databases for research and as public domain databases for use by both researchers and policy analysts.

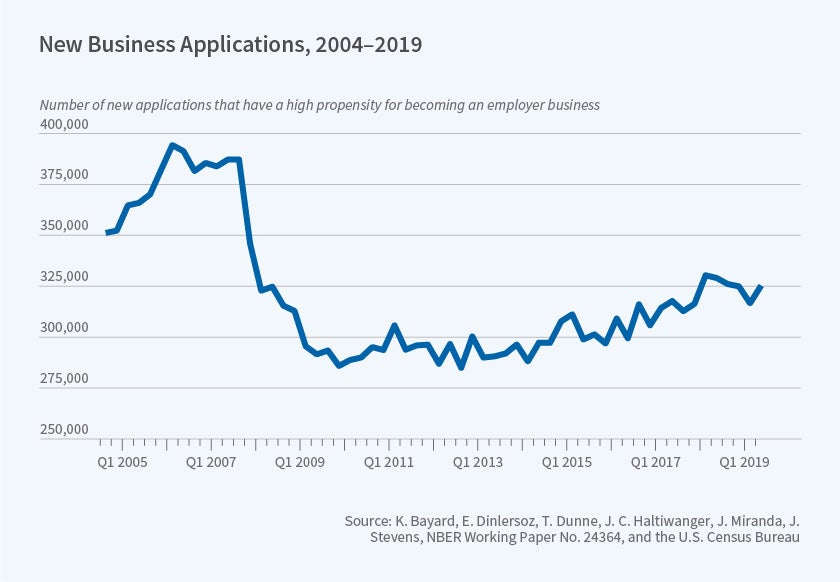

One challenge is that the underlying micro administrative data on businesses are typically not sufficiently timely to generate economic indicators on the current health of the economy. The Business Formation Statistics (BFS) are an important exception; I helped develop them with collaborators from the research community, the Federal Reserve Board, and the Census Bureau.14 BFS are based on the real-time flow of applications for new employer identification numbers that the Census Bureau receives on an ongoing basis. The potential of the BFS, illustrating new applications that have a high propensity for becoming employer businesses, is shown in Figure 3. This data series, along with other new statistical measures, is now released within a couple of weeks of the end of the most recent quarter at national and state levels. More disaggregated series at sub-state and sector levels can also be constructed. Figure 3 shows that the patterns highlighted in Figure 2 persisted through the second quarter of 2019. High-propensity applications for new businesses in 2019:2 were still 6 percent below the pre-Great Recession levels. The research summarized here suggests that real-time measures of the pace of reallocation and entry can provide useful indicators for assessing the state of the US economy.

Endnotes

“Productivity and Potential Output Before, During, and After the Great Recession,” Fernald J. NBER Macroeconomics Annual 2014, 29, pp. 1–51, and Federal Reserve Bank of San Francisco total factor productivity data.

“Challenges to Mismeasurement Explanations for the U.S. Productivity Slowdown,” Syverson C. NBER Working Paper 21974, February 2016.

“Labor Market Fluidity and Economic Performance,” Davis S, Haltiwanger J. NBER Working Paper 20479, revised December 2014, and presented as “Re-Evaluating Labor Market Dynamics,” at annual economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, WY, August 21–23, 2014.

“Changing Business Dynamism and Productivity: Shocks vs. Responsiveness,” Decker R, Haltiwanger J, Jarmin R, Miranda J. NBER Working Paper 24236, February 2018.

“Who Creates Jobs? Small vs. Large vs. Young,” Haltiwanger J, Jarmin R, Miranda J. NBER Working Paper 16300, revised November 2012, and Review of Economics and Statistics 95(2), March 2013, pp. 347–361. “The Role of Entrepreneurship in U.S. Job Creation and Economic Dynamism,” Decker R, Haltiwanger J, Jarmin R, Miranda J. Journal of Economic Perspectives 28(3), Summer 2014, pp. 3–24.

“Market Selection, Reallocation, and Restructuring in the US Retail Trade Sector in the 1990s,” Foster L, Haltiwanger J, Krizan CJ. Review of Economics and Statistics 88(4), November 2006, pp. 748–758. See also “The Evolution of National Chains: How We Got Here,” Foster L, Haltiwanger J, Klimek S, Krizan CJ, Ohlmacher S, in Handbook of the Economics of Retailing and Distribution, Basker E, editor, pp. 7–37. Cheltenham, UK: Edward Elgar Publishing, 2016.

“Innovation, Productivity Dispersion, and Productivity Growth,” Foster L, Grim C, Haltiwanger J, Wolf Z. NBER Working Paper 24420, revised September 2018, and forthcoming in Measuring and Accounting for Innovation in the 21st Century, Corrado C, Miranda J, Haskel J, Sichel D, editors. Chicago: University of Chicago Press.

“Where Has All the Skewness Gone? The Decline in High-Growth (Young) Firms in the US ,” Decker R, Haltiwanger J, Jarmin R, Miranda J. NBER Working Paper 21776, revised January 2016, and European Economic Review 86, July 2016, pp. 4–23.

An experimental new data product with statistics on productivity dispersion by 4-digit NAICS is being released jointly later this year by the Bureau of Labor Statistics and the Census Bureau. The methodology for this measure, along with a beta release (https://www2.census.gov/ces/disp/), was presented at the NBER Summer Institute in the NBER/CRIW group in July 2019. The team developing this product included Cindy Cunningham, Lucia Foster, Cheryl Grim, Sabrina Pabilonia, Jay Stewart, Zoltan Wolf, and me.

“Dynamism Diminished: The Role of Housing Prices and Credit Conditions,” Davis S, Haltiwanger J. NBER Working Paper 25466, January 2019.

“Reallocation in the Great Recession: Cleansing or Not?” Foster L, Grim C, Haltiwanger J. NBER Working Paper 20427, August 2014, and Journal of Labor Economics 34(1), January 2016, pp. S293–S331.

See, e.g., “The Establishment-Level Behavior of Vacancies and Hiring,” Davis S, Faberman RJ, Haltiwanger J. NBER Working Paper 16265, revised August 2012, and Quarterly Journal of Economics 128(2), 2013, pp. 581–622.

“Early Stage Business Formation: An Analysis of Applications for Employer Identification Numbers,” Bayard K, Dinlersoz E, Dunne T, Haltiwanger J, Miranda J, Stevens J. NBER Working Paper 24364, March 2018.