National Bureau of Economic Research

Latest from the NBER

Jay Bhattacharya Tapped to Lead National Institutes of Health

news article

In early April, following his Senate confirmation, Jay Bhattacharya, a Professor of Medicine at the Stanford Medical School, became the 18th Director of the National Institutes of Health (NIH). The NIH, with a budget of $47 billion in 2024, is the largest federal funder of medical research on the causes, treatments for, and cures of diseases. Bhattacharya holds both an MD and PhD in economics from Stanford University, and he has studied a range of issues in health economics, demography, and the economics of innovation. He was appointed as a Faculty Research Fellow in the NBER Health Care (now the Economics of Health) program in 2002 and…

Kristin Forbes Joins Business Cycle Dating Committee

news article

Kristin Forbes, a Research Associate in the International Finance and Macroeconomics and Monetary Economics programs and the Jerome and Dorothy Lemelson Professor of Management and Global Economics at MIT’s Sloan School of Management, has joined the Business Cycle Dating Committee (BCDC). Forbes is an expert on monetary policy, exchange rates, capital flows, and financial regulation who has also served in a number of important public policy roles, including as a member of the Monetary Policy Committee at the Bank of England, a member of the White House Council of Economic Advisers, and as a deputy assistant secretary at the US Department of the Treasury. Members of the BCDC are appointed by the NBER President with approval of the BCDC committee chair…

A research summary from the monthly NBER Digest

What Drives Stock Price Fluctuations? Expected Cash Flows Versus Expected Returns

article

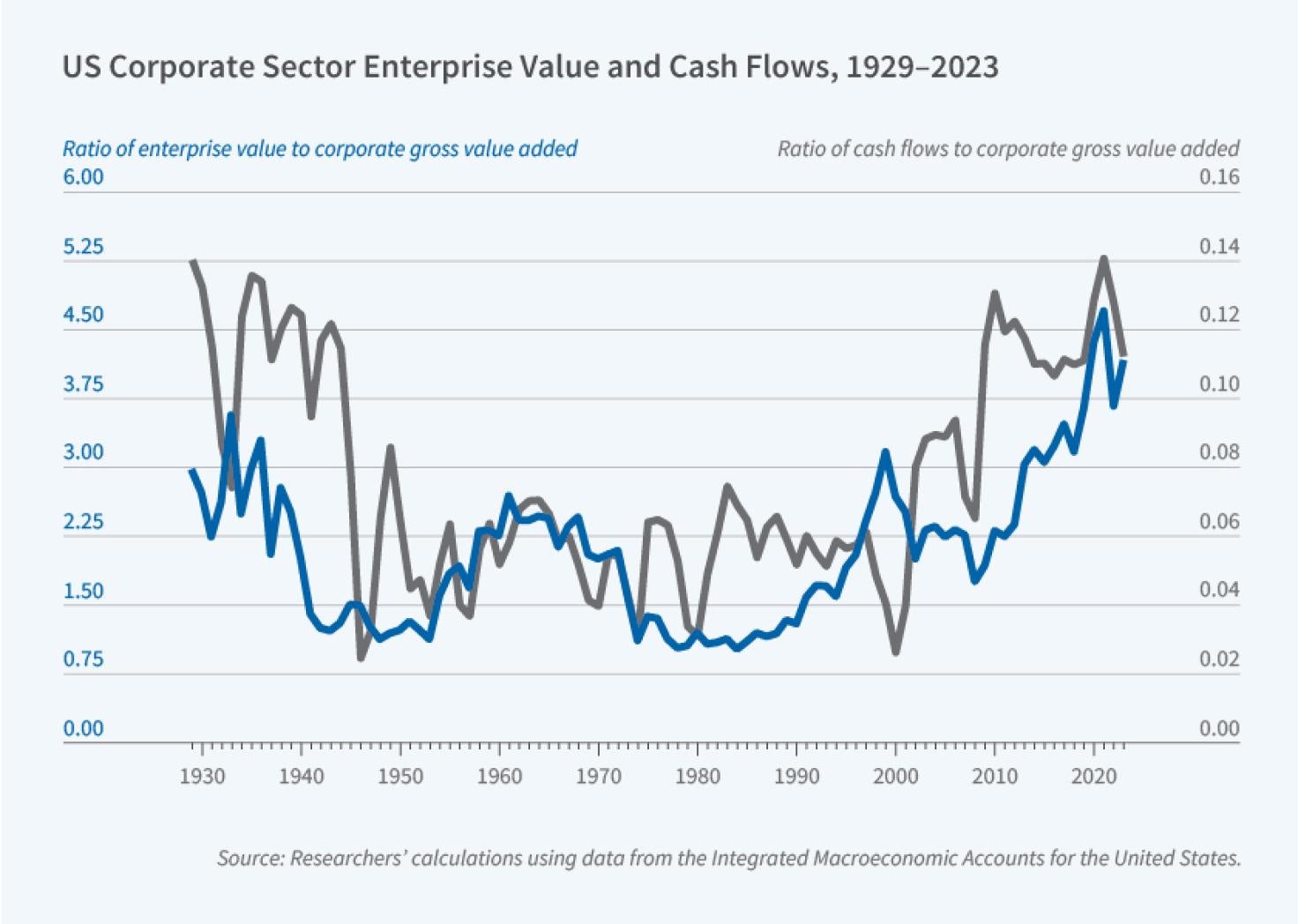

One leading view in finance is that the high volatility of the stock market valuations of US corporations is driven by large fluctuations in expected returns. However, if expected returns are so volatile, why is the capital stock of the same US corporations relatively stable? In Reconciling Macroeconomics and Finance for the US Corporate Sector: 1929 to Present (NBER Working Paper 33459), researchers Andrew Atkeson, Jonathan Heathcote, and Fabrizio Perri seek to reconcile these seemingly discordant...

From the NBER Bulletin on Health

Policy Changes and Pharmaceutical Innovation Combine to Increase Naloxone Access

article

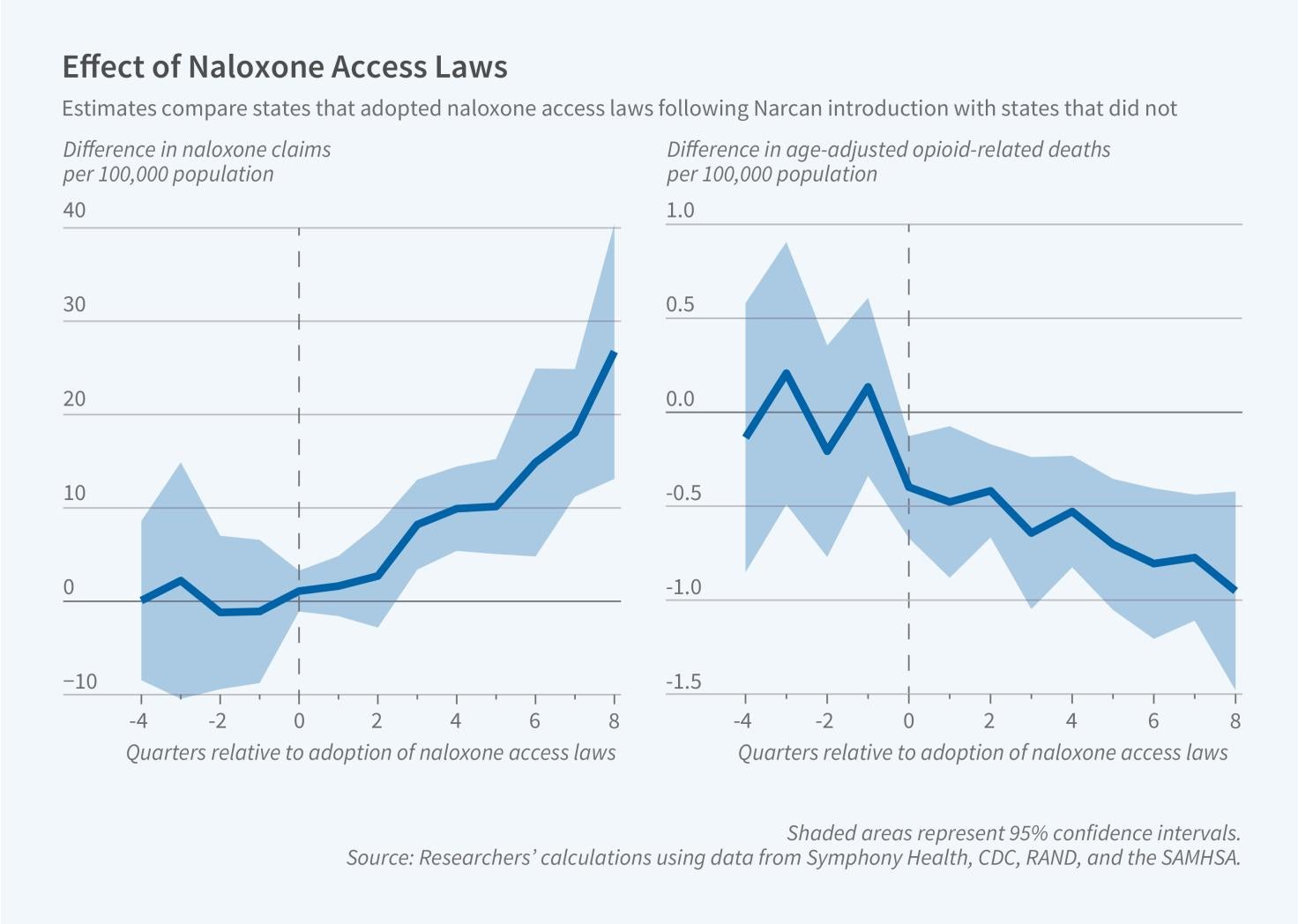

Naloxone, which reverses the effects of an opioid overdose, is a critical tool for responding to the opioid crisis. However, prior to the 2010s, two barriers hindered its widespread distribution and use in the United States. One was legal access: Naloxone required a prescription from a healthcare provider. Another was that naloxone was administered by injection and therefore required training for proper use.

In 2010, Illinois became the first state to adopt a dispensing naloxone access law (NAL) that permitted individuals to obtain naloxone directly from pharmacists, eliminating the need for an individual prescription. By 2015, another 35 states had implemented dispensing NALs. These policy initiatives were complemented by the introduction of Narcan, the first FDA-approved naloxone nasal spray, in 2016. This new…

From the NBER Reporter: Research, program, and conference summaries

Program Report: Corporate Finance

article

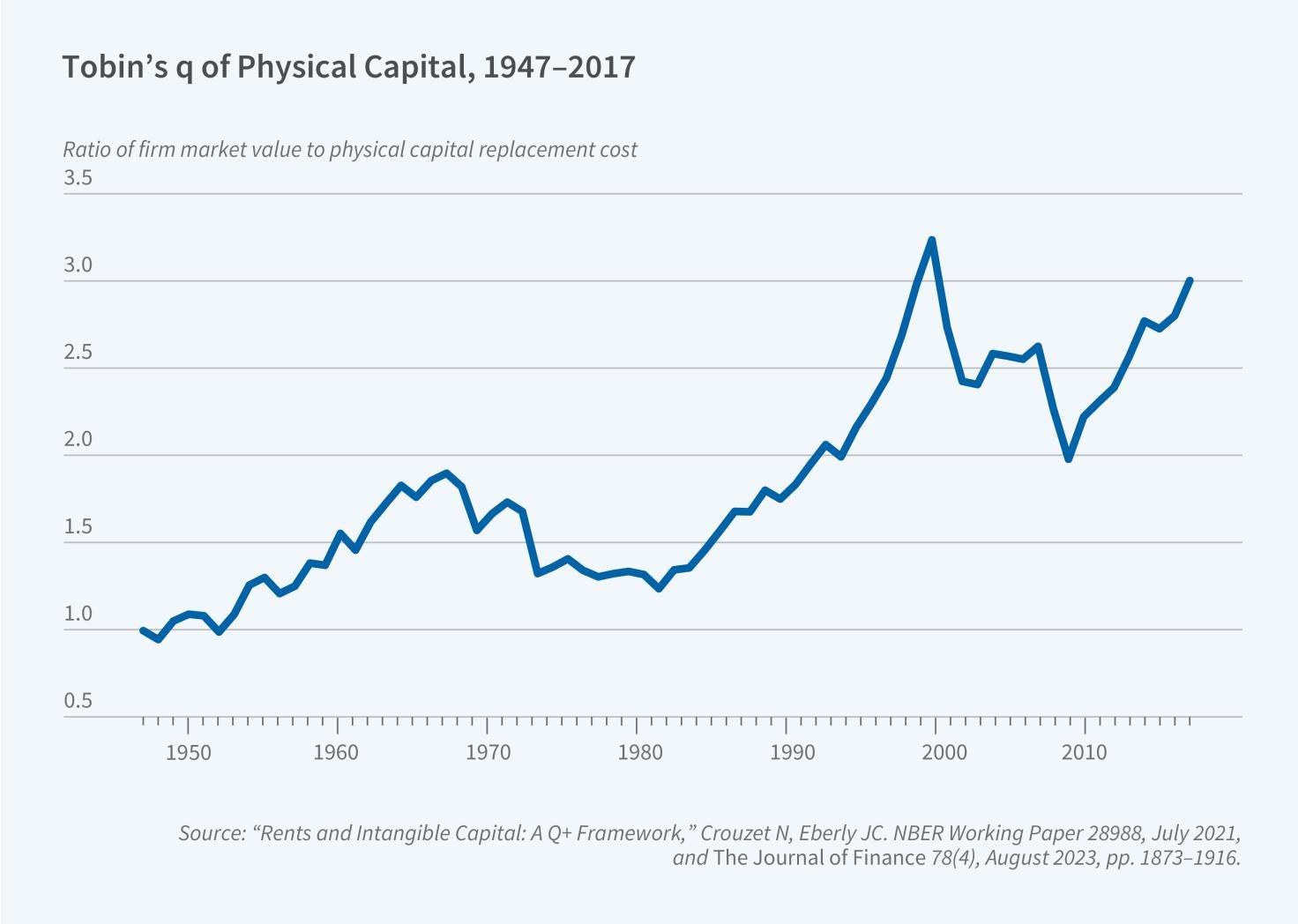

The NBER Corporate Finance Program has been a leading research forum in the field since it was established in 1991. Corporate finance questions intersect with many areas of finance and economics, including macrofinance, asset pricing, financial intermediation, and organizational economics. This breadth of topics is reflected in the work presented at the Corporate Finance program meetings. The importance of the field has been widely recognized in academia and is evidenced by the 2022 Nobel Memorial Prize in Economic Sciences for Ben Bernanke, Douglas Diamond, and Philip Dybvig’s work on banking and intermediation. In this report, we cannot do justice to the entire field, but we must select a few topics that have been addressed in a number of recent NBER Working Papers or in presentations at...

From the NBER Bulletin on Entrepreneurship

Immigrant Entrepreneurship in the US

article

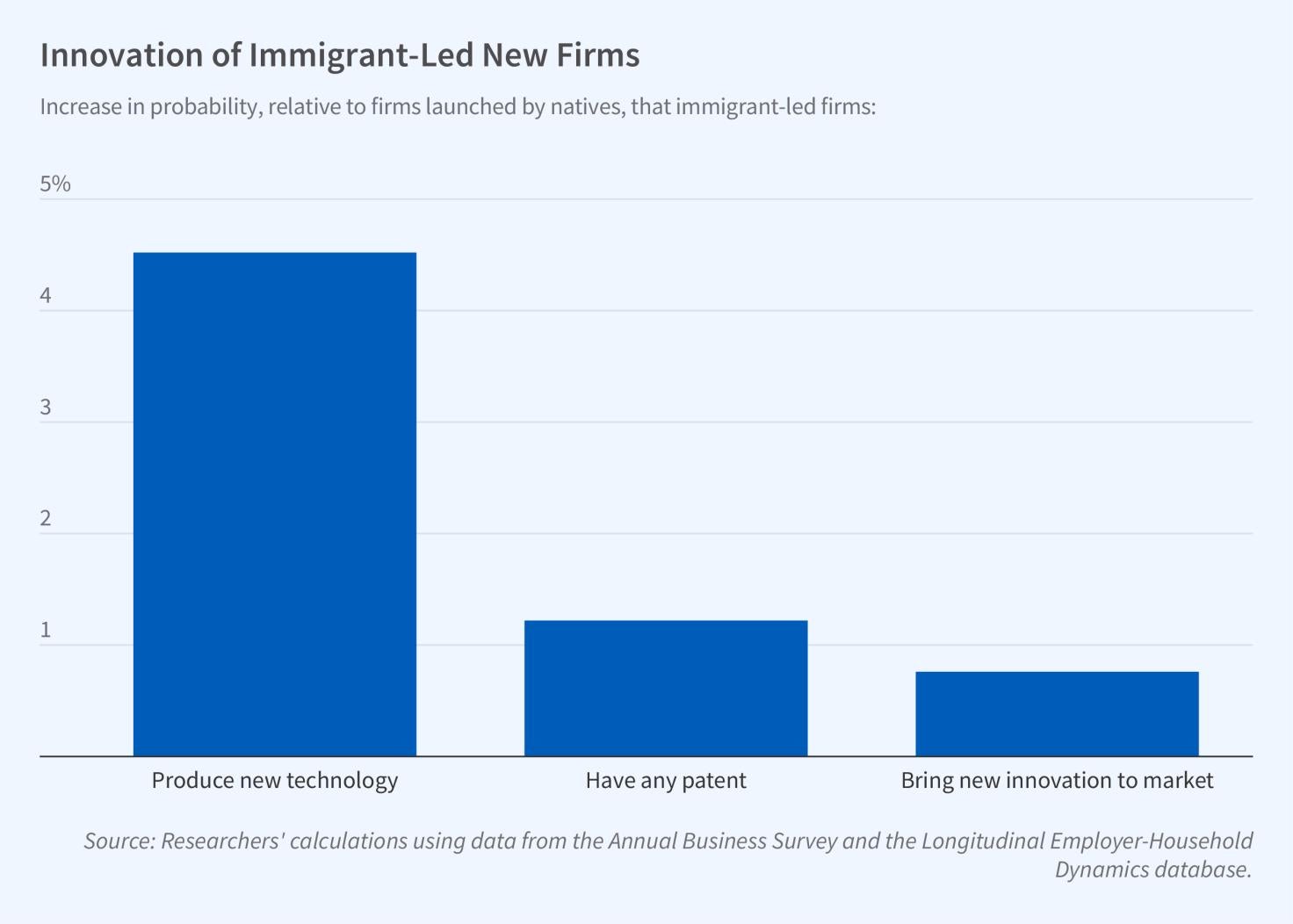

Immigrants to the US are more entrepreneurial than the native population and overrepresented among high-growth startups and venture-backed tech firms. In Immigrant Entrepreneurship: New Estimates and a Research Agenda (NBER Working Paper 32400), Saheel Chodavadia, Sari Pekkala Kerr, William Kerr, and Louis Maiden use business surveys and administrative employment records to provide new evidence on the prevalence and predictors of immigrant...

Featured Working Papers

Firm effects explain 20 percent of the variation in early career wage growth and the sorting of women to slower-growth firms accounts for a fifth of the gender gap in career wage growth, with larger effects for women who have a child within five years of entering work, according to David Card, Francesco Devicienti, Mariacristina Rossi, and Andrea Weber.

When Medicare capped per-patient physical therapy coverage, with exceptions for those with documented medical need, Ashvin Gandhi and Maggie Shi find that spending fell by 8 percent with no evident reduction in patient health.

Allowing for capital adjustment increases estimates of the cost of a trade war, according to David Baqaee and Hannes Malmberg. They find that a trade war lowers US consumption by 0.6 percent in a model that does not allow for capital adjustment, but by 2.6 percent in a model that does.

Records on 380,000 mortgage borrowers during the Great Recession show that receiving a mortgage modification increased the homeownership rate a decade later by 19 percentage points, and raised housing equity by $83,000, according to Heidi Artigue, Patrick Bayer, Fernando V. Ferreira, and Stephen Ross.

The American Economic Association Mentoring Program for underrepresented minority groups in economics improved the likelihood that mentees would hold tenure-track or tenured positions by 19.7 percentage points, but did not affect publication outcomes, according to Francisca M. Antman, Sheng Qu, Trevon D. Logan, and Bruce A. Weinberg.

In the News

Recent citations of NBER research in the media

_______________________________________

Research Projects

Conferences

Books & Chapters

Through a partnership with the University of Chicago Press, the NBER publishes the proceedings of four annual conferences as well as other research studies associated with NBER-based research projects.

Videos

Recordings of presentations, keynote addresses, and panel discussions at NBER conferences are available on the Videos page.